mHealth Market Research, 2032

The global mhealth market size was valued at $70.7 billion in 2022 and is projected to reach $370.7 billion by 2032, growing at a CAGR of 18% from 2023 to 2032. Mobile health (mHealth) is a term used to describe the practice of using mobile devices for healthcare purposes. It encompasses a wide range of mobile health apps and services that leverage mobile technology to improve health outcomes, enhance healthcare delivery, and empower individuals to take control of their own health. There are various types of mHealth devices such as blood glucose meters, blood pressure monitors, pulse oximetry, neurological monitors, cardiac monitors, and others that are used for monitoring health. Various mHealth services include prevention services, diagnostic services, monitoring services, and others, which are provided by healthcare professionals. mHealth has gained significant attention and popularity due to the widespread use and accessibility of mobile devices.

Market Dynamics

The growth of the mhealth market size is driven by rise in prevalence of chronic cardiac diseases such as heart attack, hypertension, and stroke, which further increase the demand for mHealth devices to monitor the heart health of patients who often experience symptoms related to their heart irregularities, such as palpitations, dizziness, or fainting spells. For instance, according to the Centers for Disease Control and Prevention (CDC) 2022 report, about 20.1 million adults aged 20 and older were suffering from coronary artery disease in 2020.

In addition, mobile health applications (mHealth apps) and connected devices enable individuals with diabetes to monitor their blood glucose levels. Therefore, increase in incidence of diabetes is expected to boost the growth of the mHealth market share. For instance, according to the International Diabetic Federation, in 2021, around 90 million people were suffering from diabetes in southeast Asia. This number is estimated to reach 113 million by 2030 and 151 million by 2045.

Furthermore, rise in geriatric population along with chronic diseases is expected to drive the mHealth market growth. For instance, according to the United Nations Report on “World Population Ageing,” published in December 2020, globally, there were 727 million people aged 65 years or above in 2020. According to International Diabetes Federation (IDF) Diabetes Atlas, 9th edition 2020, the prevalence of diabetes among the global elderly population aged above 65 years was about 135.6 million. Thus, rise in geriatric population is expected to drive growth during the mHealth market forecast. Moreover, increase in utilization of advanced healthcare devices and technologies, such as mHealth and wearable devices to enhance efficiency, is the major factor for the growth of the mHealth market share.

What is the Impact of 2023 Recession on Mobile Health (mHealth) Market?

Recessions can impact venture capital and investment activity. For instance, according to a comprehensive new study by the World Bank, published in September 2022, as central banks globally simultaneously hike interest rates in response to inflation, the world may be edging toward a global recession in 2023 and a string of financial crises in emerging market and developing economies that would do them lasting harm.

According to this report, Central banks globally have been raising interest rates this year with a degree of synchronicity not seen over the past five decades, a trend that is likely to continue well into next year. Higher interest rates can discourage investors and venture capitalists from allocating funds to the mHealth market. High interest rates make borrowing more expensive, which can limit the availability of capital for mHealth companies. Startups and smaller businesses in the mHealth sector, which often rely on loans or investments to fund their operations and expansion, may face challenges in obtaining affordable financing. This can hinder their ability to invest in R&D, product innovation, and market expansion.

Thus, the recession is expected to temporarily impact the growth and investment in the mHealth market, while the long-term potential for mHealth remains insignificant. The rise in prevalence of heart diseases, diabetes, rise in demand for remote patient monitoring, and increased patient engagement are trends that can continue to drive the adoption of mHealth technologies, even in challenging economic times. Such trends are expected to bring a high growth rate during the mHealth market forecast period.

mHealth Market Segmental Overview

The mHealth market is segmented on the basis of type, application, stakeholder, and region. By type, the market is classified into mHealth devices and mHealth services. The mHealth devices segment is further categorized into blood glucose meter, blood pressure monitors, pulse oximetry, neurological monitors, cardiac monitors, apnea & sleep monitors, wearable fitness sensor device & heart rate meters, and others. The mHealth service segment is further categorized into prevention services, diagnostic services, monitoring services, treatment services, and wellness & healthcare system strengthening solutions. By application, the mHealth market classified into cardiovascular, diabetes, respiratory, neurology, and others. By stakeholder, the mHealth market is divided into mobile operators, device vendors, healthcare providers, and mHealth apps & content players. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

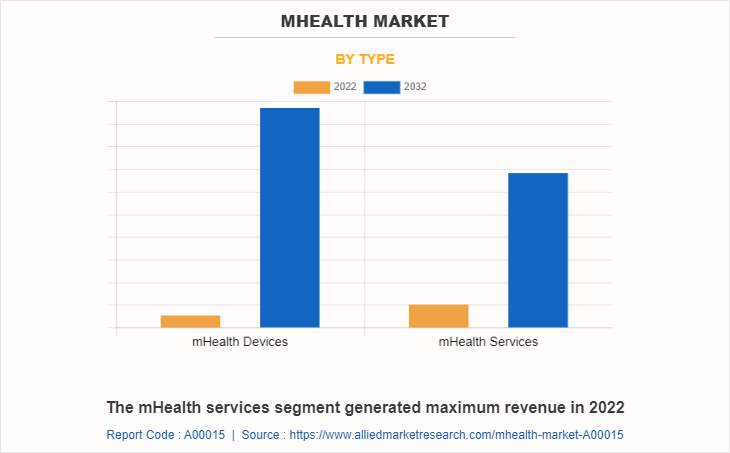

By Type

The mHealth services segment generated maximum revenue in 2022, owing to a higher number of people using mHealth services for the management of diabetes and heart diseases and the wider availability of mHealth service providers. The mHealth devices segment is expected to witness the highest CAGR during the forecast period, owing to rise in demand for mHealth devices and rise in R&D activities related to mHealth devices.

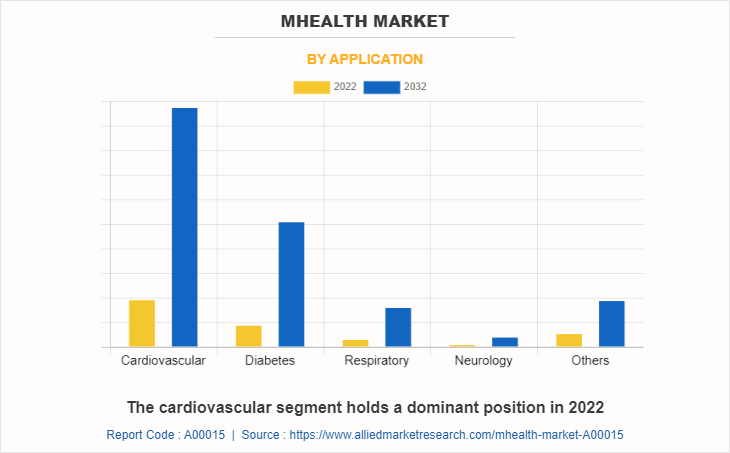

By Application

The cardiovascular segment generated maximum revenue in 2022, owing to rise in prevalence of cardiovascular diseases, which require monitoring of the condition of the patient for prevention and better treatment. The diabetes segment is expected to witness the highest CAGR during the mHealth market analysis, owing to rise in demand for glucose monitoring devices, high number of service provider for the management of diabetes and rise in awareness regarding the use of glucose monitoring devices at home in developing countries such as China, and India.

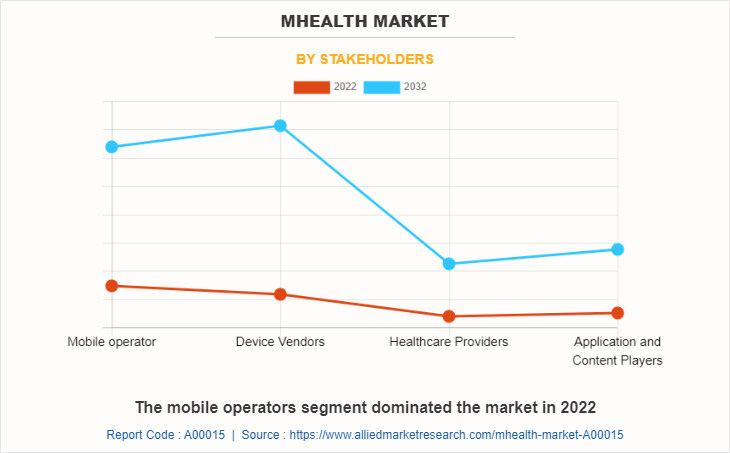

By Stakeholder

The mobile operators segment dominated the market in 2022, owing to provide secure end-to-end healthcare services and content-based wellness information services (SMS subscription service); support to mobile telemedicine (data, voice, text, imaging, or video functions of a mobile device). However, the device vendors segment is expected to witness the highest CAGR during the forecast period, owing to increase in demand for mHealth devices from healthcare providers for delivery of treatment & diagnostics services and increase in number of device vendors in market.

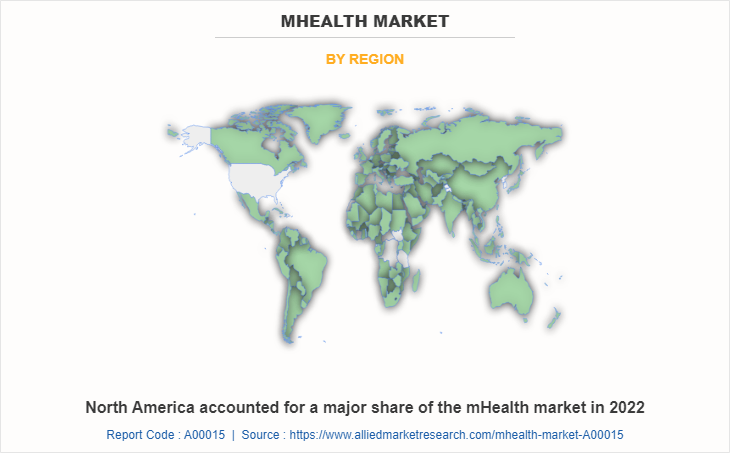

By Region

North America accounted for a major share of the mHealth market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Boston Scientific Corporation, Dexcom, Inc., Fitbit, Inc. (Google), and WellDoc, availability of advanced healthcare facilities, and high healthcare expenditure from government organizations in the region drive the growth of the market.

Furthermore, the availability of advanced healthcare system, increase in cases of heart failure; development of novel mHealth device, and availability of newly launched products in the region fosters the growth of the market. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the mHealth market during the forecast period. The presence of key players, high number of patient suffering from diabetes, high purchasing power, high adoption rate of mHealth devices & services, and the significant increase in capital income in developed countries boost the growth of the mHealth market in North America.

Asia-Pacific is expected to grow at the highest rate during the forecast period, owing to rise in cases of hypertension, increase in awareness regarding the use of mHealth devices & services, and increase in purchasing power of populated countries, such as China and India.

Furthermore, the mHealth market growth in the region is attributable to factors such as technological advancements in mHealth devices, increase in per capita spending, rise in medical tourism, and surge in number of people suffering from diabetes. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,411,778,724 population in 2020 and India as the second most populated country having 1,380,004,385 population in 2020. Therefore, rise in population along with longer life expectancy is expected to drive the growth of the market in Asia-Pacific during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the mHealth market, such as Boston Scientific Corporation, DexCom, Inc., FITBIT, INC. (Google), Koninklijke Philips N.V., Medtronic plc, Omada Health, Omron Corporation, SAMSUNG ELECTRONICS CO., LTD., Teladoc Health, Inc., and Welldoc, Inc. are provided in the report.

What are the Recent Developments in mHealth Market?

There are some important players in the market such as DexCom, Inc., Koninklijke Philips N.V., Medtronic plc, Omada Health, Omron Corporation, and others, who have adopted agreement, acquisition, product approval, and product launch as their key developmental strategies to improve their product portfolio.

- Recent Acquisition in the Mobile Health Market

In January 2021, Royal Philips announced that it has signed an agreement to acquire Capsule Technologies, Inc., a leading provider of medical device integration and data technologies for hospitals and healthcare organizations. Capsule’s Medical Device Information Platform, comprised of device integration, vital signs monitoring, and clinical surveillance services, connects almost all existing medical devices and EMRs in hospitals through a vendor-neutral system.

- Recent Agreement in the mHealth Market

In March 2023, Astellas Pharma Inc. announced that it has entered into an agreement (“the Agreement”) with Roche Diabetes Care Japan Co., Ltd. for the development and commercialization of Roche Diabetes Care’s world-renowned Accu-Chek Guide Me blood glucose monitoring system with advanced accuracy as a combined medical product with BlueStar.

- Recent Collaboration in the mHealth Market

In June 2021, Royal Philips and Cognizant, a world-leading professional services firm, announced a new collaboration to develop end-to-end digital health solutions that will enable healthcare organizations and life sciences companies to improve patient care and accelerate clinical trials. The strategic alliance brings together Philips HealthSuite, a cloud-based platform, and Cognizant’s digital engineering expertise to deliver and maintain leading-edge digital health solutions at scale, providing advanced connectivity and using big data to create actionable insights.

In February 2021, Welldoc, Inc. and Eli Lilly and Company announced a collaboration and licensing agreement to integrate Welldoc's software into Lilly's connected insulin solutions, currently in development. Under the terms of the agreement, Lilly and Welldoc are expected to collaborate to create a new version of the BlueStar insulin management solution that integrates insulin dosing data for several Lilly insulins. Lilly is anticipated to commercialize the pen platform, which will include the new app and Lilly's connected insulin pen solutions.

- Recent Merger in the mHealth Industry

In October 2020, Teladoc Health announced that it has completed its merger with Livongo. The milestone marks the completion of the most significant blending of capabilities and talent in the history of digital health. By joining the market leaders in virtual care and applied health signals, the combined company becomes the only consumer and healthcare provider partner to span a person’s entire health journey.

- Recent Partnership in the mHealth Market

In April 2023, Conifer Health Solutions, a leading provider of value-based care that helps its client organizations manage their medical spend, and Welldoc, announced a partnership to launch Conifer Connect, a personalized digital health app designed to help members manage their daily health while strengthening connections with their personal health nurse (PHN).

In November 2022, OMRON Healthcare announced partnership with CardioSignal to innovate early cardiovascular disease detection and remote patient monitoring at scale. As a first result of the collaboration, CardioSignal mobile health apps integrated into OMRON connect to detect signs of atrial fibrillation. Users simply lie down and place the mobile phone in the center of the chest. Measurement starts automatically and the user receives a notification of the possibility of atrial fibrillation. This service is available in OMRON Connect.

In October 2022, CCS, a leading provider of clinical solutions and home-delivered medical supplies for those living with chronic conditions has announced a new technology partnership with Welldoc and ZeOmega to expand its established LivingConnected solution. This new, proprietary approach to managing chronic conditions will help improve patient outcomes and reduce costs of care for employer groups and health plan customers by integrating clinical device and care utilization data.

- Recent Product Approval in the mHealth Industry

In August 2022, DexCom, Inc. announced that the FDA has cleared the next-generation Dexcom G7 Continuous Glucose Monitoring (CGM) System for people with all Types of diabetes for ages two years and older. With an overall mean absolute relative difference (MARD) of 8.2%, Dexcom G7 is the most accurate CGM cleared by the FDA, which is clinically proven to lower A1C, reduce hyper- and hypoglycemia and increase time in range.

In May 2020, Medtronic plc announced the U.S. Food and Drug Administration (FDA) approval for the Android version of its Guardian Connect continuous glucose monitoring (CGM) system. The Guardian Connect system is a standalone CGM system that alerts patients of potential high or low sensor glucose events up to 60 minutes in advance and provides confidence to people living with diabetes who worry about fluctuating glucose levels and dangerous low glucose events.

- Recent Product Launch in the mHealth Market

In April 2022, DexCom, Inc. announced that the Dexcom G7 Continuous Glucose Monitoring (CGM) System is now available for people with diabetes for age two years and older in the UK, Ireland, Germany, Austria and Hong Kong, marking the first major milestone in the availability of the revolutionary new technology. The company is also working quickly to introduce G7 in New Zealand and South Africa in the weeks ahead, with additional markets planned soon after.

In August 2021, Samsung Electronics Co., Ltd. announced the launch of Galaxy Watch4 and Galaxy Watch4 Classic in India. Galaxy Watch4 series has started a new era of smartwatch innovation to drive holistic health and wellness. They are the first smartwatches to feature the new Wear OS Powered by Samsung, built jointly with Google, and are equipped with One UI Watch, Samsung’s most intuitive user interface yet.

In April 2021, Omada Health Inc. launched two additional tools intended to help people with chronic conditions receive targeted care and to lower their out-of-pocket costs. One tool is a physician-guided care program with a virtual cardiometabolic clinic for patients with hypertension and diabetes. The other is a musculoskeletal, or MSK, program that relies on computer vision instead of wearables to track patients' movements.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mhealth market analysis from 2022 to 2032 to identify the prevailing mhealth market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mhealth market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mhealth market trends, key players, market segments, application areas, and market growth strategies.

mHealth Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 370.7 billion |

| Growth Rate | CAGR of 18% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By Stakeholders |

|

| By Region |

|

| Key Market Players | Fitbit, Omada Health, DexCom, Inc., SAMSUNG ELECTRONICS CO., LTD., Boston Scientific Corporation, Omron Corporation., Welldoc, Inc, Medtronic plc, Koninklijke Philips N.V., Teladoc Health, Inc. |

Analyst Review

According to the insights of the CXOs, the mHealth market is poised to grow at a notable pace due to rise in prevalence of chronic heart diseases such as heart attack, myocardial infarction, and stroke, which further increase the demand for mHealth devices & services to monitor for patients.

As per the perspectives of CXOs, the factors that fuel the growth of the global mHealth market include the profound impact of the use of mobile phones in the healthcare sector. Furthermore, experts of key companies believe that mHealth has the potential to make healthcare innovative, accessible, and affordable. However, it requires a strong wireless network and robust IT infrastructure to handle several devices at the same time. Healthcare firms and service providers are expected to leverage technologies in the most effective way. The key reason behind the growth of mHealth can be attributed to factors such as surge in adoption of smartphones and tablets. These smartphones are widely being used for the patient’s data collection, ongoing condition monitoring, proper communication with healthcare service providers, access to healthcare information, and others. The other major factors that contribute toward the growth of the market include surge in prevalence of chronic diseases such as diabetes and blood pressure, which require constant monitoring for better management of the condition. However, lack of technology and scarcity of effective technological interventions are the major challenges faced by the mHealth market.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to high adoption of mHealth devices & services, availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth owing to increase in arrythmia, diabetes hypertension, cases, high unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

The mHealth market was valued at $70,695.15 million in 2022.

Technological advancements in medical devices, increase in the number of patients suffering from chronic heart diseases, which further increase the demand for mHealth devices for monitoring heart disease patients, and rise in prevalence of diabetes are the upcoming trends of mHealth Market in the world.

The cardiovascular is the leading application of mHealth Market.

North America is the largest regional market for mHealth.

The mHealth market is estimated to reach $370,663.20 million by 2032.

The forecast period for mHealth Market is 2023 to 2032.

DexCom, Inc.;Koninklijke Philips N.V.; Teladoc Health, Inc.; Omron Corporation; Medtronic plc are the top companies to hold the market share in mHealth.

Yes, competitive analysis is included in mHealth Market.

Loading Table Of Content...

Loading Research Methodology...