Mobile Imaging Market Research, 2030

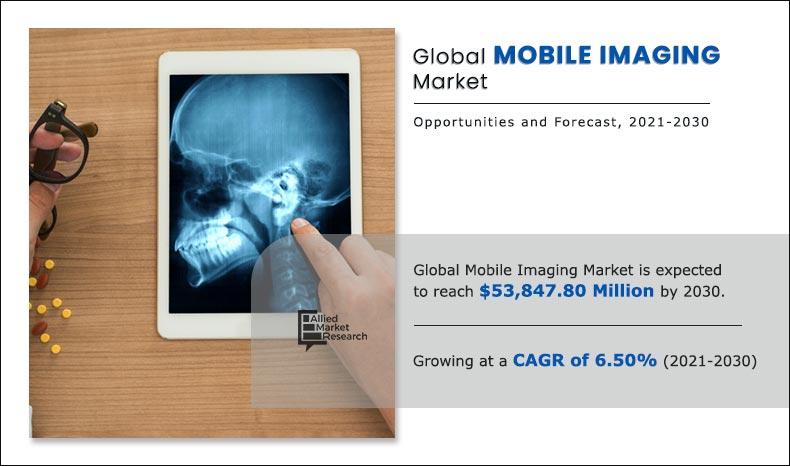

The global mobile imaging market size was valued at $29,389.4 million in 2020 and is projected to reach $53,847.8 million by 2030 registering a CAGR of 6.50% from 2021 to 2030. Alarming surge in prevalence of chronic diseases such as cancer, neurological disorders, and cardiovascular diseases due to increase in alcohol consumption, unhealthy eating habits, smoking, and sedentary lifestyle is expected to propel the growth of the mobile imaging services market. According to Globocan, an estimated 19.3 million new cancer cases and almost 10.0 million cancer deaths occurred worldwide in 2020. Mobile imaging services help care providers perform many kinds of vital screenings by using various imaging technologies such as X-ray, electrocardiography (EKG), and ultrasound.

Market Introduction and Definition

Mobile imaging refers to the use of portable imaging devices to capture and transmit diagnostic images in real-time, typically in medical settings. These mobile systems enable healthcare professionals to perform imaging procedures, such as X-rays, ultrasounds, CT scans, and MRIs, directly at the patient's location. Mobile imaging offers significant advantages in terms of flexibility, convenience, and speed, particularly for patients in remote or underserved areas, emergency situations, or those with limited mobility. It also helps reduce the need for patients to travel to centralized imaging centers, improving access to care. Mobile imaging devices are increasingly integrated with digital technology for enhanced image quality, remote consultations, and efficient data storage.

Key Takeaways

- Depending on service type, the X-ray held largest share in the global market in 2020.

- On the basis of patient type, the adult segment acquired the largest share in 2020 and is expected to remain dominant throughout the forecast period.

- By facility, the hospitals & clinics dominated the global market in 2020 and is anticipated to continue this trend during the forecast period.

- By region, North America dominated the market in 2022 and is expected to grow during the forecast period.

Market Dynamics

The mobile imaging market has experienced significant growth due to various drivers that are reshaping the healthcare landscape. One of the primary drivers is the increasing demand for accessibility and convenience in healthcare. As healthcare needs evolve, there is a growing emphasis on providing timely medical services, especially in remote or underserved areas. Mobile imaging devices, such as portable X-ray machines, ultrasounds, and CT scanners, provide immediate diagnostic results, improving the speed and quality of care in emergency and out-of-hospital settings. These devices help overcome barriers such as the lack of specialized imaging centers, making diagnostic imaging more widely accessible and efficient, particularly in rural areas, during medical emergencies, or in home healthcare scenarios.

Another key driver is the rising prevalence of chronic diseases globally. Conditions such as cardiovascular diseases, diabetes, and musculoskeletal disorders require continuous monitoring and regular imaging to manage and track their progression. Mobile imaging is especially valuable in these situations as it allows for ongoing surveillance of chronic conditions without requiring patients to visit healthcare facilities frequently. The growing aging population is also a factor contributing to the increased demand for mobile imaging solutions. Elderly patients often face mobility issues, making it difficult for them to travel to traditional imaging centers. Mobile imaging devices help provide diagnostic solutions at home or in nursing facilities, ensuring timely interventions and reducing hospital visits, which are crucial for managing health effectively in aging populations.

The technological advancements in mobile imaging equipment are another driver of market growth. Innovations in digital imaging, miniaturization of imaging systems, and improved image quality have made mobile imaging more accurate, reliable, and efficient. With the integration of wireless technology and cloud-based platforms, mobile imaging devices can now transmit diagnostic images in real-time to specialists, facilitating remote consultations and reducing the time it takes to make critical medical decisions. These advancements make mobile imaging solutions not only more practical but also more accurate, thus encouraging widespread adoption among healthcare professionals and patients alike.

However, the mobile imaging market does face certain restraints that may slow its growth. One of the main challenges is the high cost associated with mobile imaging equipment. These devices, while highly effective, require significant capital investment from healthcare providers, especially smaller hospitals and clinics. The cost of purchasing and maintaining mobile imaging devices can be a barrier, particularly in developing regions or areas with limited healthcare budgets. The need for specialized training for healthcare professionals to operate advanced mobile imaging systems further adds to the overall expense, limiting the widespread adoption of these devices in certain markets.

Another restraint is the regulatory and compliance challenges in mobile imaging. In many regions, strict regulations govern the use of medical devices, particularly imaging technologies. These regulations ensure patient safety; however, they often delay the introduction of new mobile imaging products in the market. The process of obtaining necessary certifications, approvals, and compliance with local health regulations can be time-consuming and costly for manufacturers. This regulatory burden can slow the pace of innovation and adoption in certain regions, limiting market growth.

Despite these challenges, the mobile imaging market presents significant opportunities, particularly in the home healthcare sector. The increasing preference for home-based care, especially among the aging population and individuals with chronic conditions, is a major opportunity for mobile imaging solutions. With advancements in portable imaging technologies, patients can now receive diagnostic imaging at home, reducing the need for hospital visits and improving the overall patient experience. Home healthcare services benefit from mobile imaging’s ability to provide timely results and enhance patient care, making it a key area of growth for the industry. As home healthcare continues to expand, the demand for mobile imaging is expected to rise, presenting new revenue streams and market opportunities for manufacturers.

Segments Overview

The mobile imaging market is segmented into service type, patient type, facility, and region to provide a detailed assessment of the market. By service type, the market is divided into X-ray, CT scan, ultrasound, MRI, mammography, nuclear imaging, and others (PET scan and fluoroscopy). On the basis of patient type, it is categorized into adult and pediatric. Depending on the facility, it is segregated into hospitals & clinics, home healthcare, and others. Others again segmented into ambulatory imaging centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service Type

The X-ray segment dominated the mobile imaging market share in 2020. This is attributed to its widespread use in diagnostic imaging for detecting fractures, infections, and diseases like cancer. X-ray technology is cost-effective, readily available, and provides quick results, making it a preferred choice in medical facilities and emergency situations.

However, the mammography segment is expected to witness considerable growth during the forecast period, owing to the increasing prevalence of breast cancer and the growing emphasis on early detection. Advancements in digital mammography, improved screening guidelines, and greater awareness about breast health boost demand for mammography services.

By Service Type

X-Ray segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By Patient Type

The adult segment dominated the market share in 2020, owing to the higher prevalence of chronic diseases, such as cardiovascular conditions, cancer, and musculoskeletal disorders, among adults. In addition, the increasing number of routine diagnostic imaging procedures for health monitoring and early detection of diseases in adults contributed to the segment's strong market presence.

However, the pediatric segment is expected to witness considerable growth during the forecast period, owing to the rising awareness of early diagnosis and treatment of pediatric diseases. Advances in imaging technology tailored for children, along with increasing demand for non-invasive diagnostic tools for conditions like congenital heart disease and tumors, are driving this growth.

By Patient Type

Adult segment is projected as one of the most lucrative segment.

By Facility

The Hospitals & Clinics segment held the largest mobile imaging market share in 2022, owing to the high demand for mobile imaging solutions in healthcare settings. These facilities require quick, on-site imaging for diagnostics, emergency care, and patient monitoring. Mobile imaging helps hospitals and clinics reduce patient wait times, enhance diagnostic accuracy, and improve overall workflow efficiency, making it an essential tool for modern healthcare delivery.

However, the Home Healthcare segment is expected to witness considerable growth during the forecast period, owing to the increasing demand for at-home care, especially for elderly and chronically ill patients. Mobile imaging devices offer convenience, reduce hospital visits, and provide timely diagnostic solutions in the comfort of patients' homes, improving care accessibility and efficiency.

By Region

The mobile imaging industry is analyzed across North America, Europe, Asia-Pacific, LAMEA. North America dominated the market share in 2020. This was attributed to increase in demand for digitization in healthcare organizations, rise in prevalence of chronic diseases, rise in awareness about mobile imaging technologies in diagnosis of various diseases, surge in demand of better healthcare facilities, increase in healthcare expenditure, and improved healthcare infrastructure in the region.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to the expanding healthcare infrastructure, growing population, and rising prevalence of chronic diseases. In addition, increasing healthcare expenditure, advancements in medical technologies, and the growing demand for accessible healthcare services, especially in rural and remote areas, are driving the adoption of mobile imaging solutions across countries in the region.

By Region

North America is expected to experience growth at the highest rate, registering a CAGR of 5.50 % during the forecast period.

Competitive Analysis

Agilent Technologies, Inc., Becton Dickinson and Company, bioMérieux SA, have adopted acquisition as key developmental strategies to improve the product portfolio of the mobile imaging market. For instance, In July 2019, Atlantic Medical Imaging Inc. acquired Center for Diagnostic Imaging which offers MRI, CT, PET, ultrasound, and X-ray.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile imaging market analysis from 2020 to 2030 to identify the prevailing mobile imaging market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobile imaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional and global mobile imaging market trends, key players, market segments, application areas, and mobile imaging market growth strategies.

Analyst Review

Mobile imaging technology is primarily used in the diagnosis of diseases by providing detailed images of the body. Mobile imaging has various innovative applications in areas such as cardiology, neurology, and women’s health. Mobile imaging services offer direct X-ray, electrocardiogram (EKG), and ultrasound services to medical facilities and residential and private sectors. The approach is cheaper and faster as compared to conventional and in-house imaging services. Mobile imaging technology helps create visual representations of the interior parts of the body so that medical practitioners can analyze organs and tissues to determine if invasive or noninvasive medical interventions are required. Medical imaging in healthcare consists of tests such as magnetic resonance imaging (MRI), computed tomography (CT scans), ultrasounds, positron emission tomography (PET scans) and X-rays.

Increase in prevalence of chronic diseases coupled with awareness toward early diagnosis of diseases, emergence of COVID-19 pandemic outbreak, strategic collaborations & acquisitions of key players, and significant development in digital radiology boost growth of the market. Furthermore, high growth potential exhibited by emerging markets create a lucrative opportunity for manufacturers to invest in the near future. However, high maintenance requirement, low flexibility of moving the mobile imaging units, and shortage of skilled radiologists are some factors, which are expected to hinder growth of the market.

The X-ray segment is expected to remain dominant during the forecast period, owing to factor such as growing demand for mobile X-ray systems, growth in the number of hospitals and diagnostic centers, advances in digital technology, painless and non-invasive procedures, low prices as compared to other modalities, increase in the aging population, and the rise in incidence of injuries and diseases. North America are expected to offer lucrative opportunities to the market during the forecast period, increase in demand for digitization in healthcare organizations, rise in prevalence of chronic diseases, surge in awareness about mobile imaging technologies in the diagnosis of various diseases, increase in demand of better healthcare facilities, rise in healthcare expenditure, and improved healthcare infrastructure in the region.

Mobile imaging is the technique of creating visual representations of the interior of a body for clinical analysis and medical intervention, as well as visual representation of the function of some organs or tissues (physiology).

The total market value of mobile imaging market is $29389.4 million in 2020.

The primary use of mobile imaging technology is in the diagnosis of illnesses by giving comprehensive pictures of the body.

The market value of mobile imaging market in 2021 is $30623.8 million.

The base year is 2020 in mobile imaging market

Top companies such as Accurate Imaging Inc., Alliance Healthcare Services, Atlantic Medical Imaging Inc., Cobalt Health, Front Mobile Imaging, Inhealth Group Limited, Interim Diagnostic Imaging Inc., Insights Health Services Corp., RadNet Inc., Trident USA Health Services a high market position in 2020.

X-ray segment is the most influencing segment owing to owing to the growing demand for mobile X-ray systems, retrofit upgrade kits, growth in the number of hospitals and diagnostic centers, advances in digital technology, painless and non-invasive procedures, low prices as compared to other modalities, increase in the aging population, and the rising incidence of injuries and diseases.

Increase in prevalence of chronic diseases coupled with awareness towards early diagnosis of diseases, emergence of COVID-19 pandemic outbreak, strategic collaborations and acquisitions of key players, and significant development in digital radiology boost growth of the market.

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing to economic development and adoption of mobile imaging services in low emerging economies

The forcast period for mobile imaging market is 2021 to 2030

Loading Table Of Content...