Mobile Payment Market Research, 2034

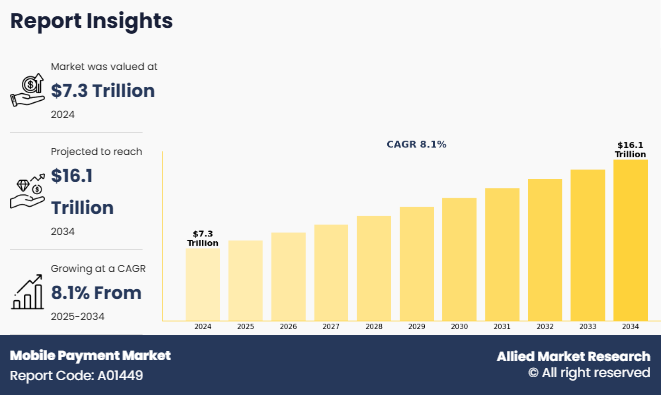

The global mobile payment market was valued at $7,280.2 billion in 2024, and is projected to reach $16,142.0 billion by 2034, growing at a CAGR of 8.1% from 2025 to 2034.

Mobile payments refer to using mobile devices such as smartphones or tablets to perform financial transactions, replacing the need for cash or physical cards. These digital transactions offer a convenient, secure, and efficient way to send or receive money, pay for goods and services, or manage finances. Mobile payments are used in various scenarios, including person-to-person (P2P) transfers, business-to-consumer (B2C) purchases, and business-to-business (B2B) transactions. Technologies such as Near-Field Communication (NFC), QR codes, and mobile payment apps such as Apple Pay, Google Pay, and PayPal power these transactions. Key benefits include enhanced convenience, security through encryption and biometric authentication, improved accessibility for underserved populations, and faster, more cost-effective transactions. Common examples include using mobile wallets such as Apple Pay or Google Pay, banking apps for payments, or using apps like PayPal for online transactions.

Key Takeaways:

- By End User, the personal segment held the largest share in the mobile payment market for 2024.

- By Transaction Mode, the mobile web payments segment held the largest share in the mobile payment market for 2024.

- Region-wise, Asia-Pacific held the largest market share in 2024. However, LAMEA is expected to witness the highest CAGR during the forecast period.

Factors such as the increase in the penetration of smartphones and expansion of the e-commerce sector positively impact the growth of the mobile payment market. In addition, the implementation of various government initiatives, such as the promotion of cashless transactions and development of digital infrastructure, is expected to fuel the mobile payment market growth during the forecast period. Furthermore, the surge in the adoption of artificial intelligence-based applications in payments, fraud detection, and personalized financial services is providing lucrative opportunities for the growth of the mobile payment market size during the forecast period. Moreover, the growing demand for enhanced customer experience, along with the growing demand from millennials and Gen Z consumers, creates lucrative opportunities for growth of the mobile payment market.

Moreover, the surge in the implementation of mobile point-of-sale (POS) systems to accept digital payments by retailers, enabling faster and more convenient transactions, positively impacts the growth of the market. However, security and privacy concerns, along with resistance to adopting new technologies, are expected to hamper market growth. On the other hand, the rising demand for advanced security solutions such as biometrics, tokenization, and AI-driven fraud detection is anticipated to drive market expansion. In addition, the continuous advancements in payment technologies and the increasing penetration of smartphones and internet connectivity are expected to create remunerative opportunities for the expansion during the mobile payment market forecast period.

Segment Review

The mobile payment market is segmented into end-user, transaction mode, and region. On the basis of end-user, the market is divided into personal and business. By transaction mode, the market is classified into mobile web payments, near-field communication, SMS direct carrier billing, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of transaction mode, the global mobile payment market share was dominated by the near-field communication segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the rapid deployment of NFC-enabled point-of-sale (POS) terminals, government initiatives promoting cashless economies, and rising consumer demand for seamless, secure payment experience. In addition, there is a growing trend in the adoption of smartphones and wearable devices equipped with NFC technology, making contactless payments more accessible and widespread. However, the mobile web payments segment is expected to experience the highest growth during the forecast period. This segment is experiencing increase in smartphone penetration, rising internet accessibility, and the global shift toward cashless transactions.

By region, Asia-Pacific dominated the market share in 2024 for the mobile payment market. This is due to the high smartphone penetration, rapid urbanization, and government-led initiatives promoting cashless transactions, driving the demand for mobile payment and contributing significantly to the region’s market growth. However, LAMEA is expected to experience the fastest growth during the forecast period. The region is experiencing an increase in internet connectivity and adoption of digital financial services, presenting numerous opportunities for mobile wallet providers, fintech startups, and telecommunication companies, which is expected to support the growth of the mobile payment market in the region.

Competition Analysis

The report analyzes the profiles of key players operating in the mobile payment market are Mastercard Incorporated., Google LLC, JPMorgan Chase & Co, PayPal Holdings, Inc., Samsung Electronics Co., Ltd., Apple Inc., VISA, INC., One 97 Communications Ltd, Boku Inc., WeChat Pay Hong Kong Limited, Moneris Solutions Corporation, N26 Bank SE, Adyen N.V., Vodafone Group Plc., Klarna Bank AB, Monzo Bank Limited, Stripe, Inc., Block, Inc., One MobiKwik Systems Ltd., and Alipay. These players have adopted various strategies to increase their market penetration and strengthen their position in the mobile payment industry.

Recent Developments in the Mobile Payment Market

In May 2025, Apple expanded its Tap to Pay on iPhone feature to eight more European countries, including Belgium, Croatia, Cyprus, Denmark, Greece, Iceland, Luxembourg, and Malta. This feature allows merchants to accept in-person contactless payments including Apple Pay, contactless credit/debit cards, and other digital wallets, directly on the iPhones without needing extra hardware. The move supports small and medium-sized businesses by offering a flexible, secure, and cost-effective mobile payment solution, further strengthening Apple’s presence in the mobile payments market.

In May 2024, Paytm, owned by One97 Communications Ltd., launched a new ad campaign to promote its core payment solutions, reaffirming its commitment to digital payments. The campaign highlights key features such as UPI money transfers, Scan and Pay, the Made-in-India Soundbox, Paytm UPI Lite wallet, and Credit Card on UPI. Through a series of ad films, Paytm showcases how these tools simplify everyday transactions for users and merchants. The initiative also reflects Paytm’s strategy to boost engagement and recover its payment GMV, with UPI now contributing up to 85% of its total payment volume.

In July 2023, Adyen launched Tap to Pay on Android, allowing merchants to accept contactless card payments directly on mobile devices without needing additional hardware. Initially launched in the United States and Singapore, this feature supports payments via credit/debit cards and mobile wallets like Google Pay. It simplifies point-of-sale operations for businesses, especially small merchants, by turning smartphones into payment terminals, enhancing flexibility and reducing costs.

Top Impacting Factors

Driver

Increasing penetration of smartphones

The increase in penetration of smartphones, supported by advancements in mobile internet connectivity and affordable data plans, is a significant factor driving the growth of the mobile payment market. Rise in the penetration of smartphone has led to increase in the adoption of digital wallets such as Apple Pay, Google Pay, Paytm, and Alipay. These apps offer convenient, secure, and fast payment options, making them attractive alternatives to traditional methods, thus driving the growth of the market. In addition, the surge in the improvements in mobile internet connectivity, including the widespread availability of 4G and the rollout of 5G networks, allowing for fast and real-time transactions, fuels the growth of the mobile payment market. Furthermore, smartphones are equipped with advanced security features such as biometric authentication (fingerprint and facial recognition) and secure element technologies, which play a crucial role in building user trust in mobile payment systems. These innovations help ensure that transactions are safe and protected, reducing the risk of fraud and unauthorized access, thus supporting in the expansion of the mobile payment market.

Furthermore, the rise of e-commerce and on-demand services has led to the emergence of mobile-first consumer behavior, where smartphones serve as the primary tool for browsing, purchasing, and paying for products and services. Smartphones also support various payment methods like NFC and QR code scanning, providing flexibility and convenience for users. In addition, smartphones enable cost-effective point-of-sale solutions for small and medium-sized businesses, helping businesses run app-based loyalty programs that encourage repeat purchases, enhance customer engagement, and drive market growth. For instance, in January 2025, IDEMIA launched a new smartphone-based enrollment solution for its F.CODE biometric payment cards, aiming to make fingerprint registration faster and more user-friendly. This innovation uses a battery-less USB-C dongle that connects the biometric card to a smartphone, compatible with both iOS and Android, allowing users to complete the enrollment process directly through their bank’s app. The biometric data remains securely stored on the card and never leaves it, ensuring privacy. This advancement enhances convenience and security, enabling contactless payments authenticated by fingerprint without a PIN or transaction limit, thus accelerating the growth of the mobile payment market.

Restraints

Security & privacy concerns

The major challenge for the growth of the mobile payment market is the security and privacy concerns associated with data breaches, unauthorized access, and insufficient regulatory compliance, which undermine consumer trust and hinder widespread adoption. Despite advancements in encryption and authentication technologies, consumers and businesses are increasingly concerned regarding the potential risks associated with digital financial transactions, particularly when sensitive personal and financial data is involved. Mobile payment systems rely heavily on internet connectivity, cloud services, and third-party applications, which inherently expose them to threats such as data breaches, phishing attacks, identity theft, and malware infections, impeding the growth of the mobile payment market. Rising incidents of cybercrime targeting mobile wallets and digital banking apps have sparked concern, prompting increased awareness among potential users, particularly in regions where cybersecurity measures are weaker or digital literacy is limited. Furthermore, lack of transparency in data handling practices by payment service providers exacerbates trust issues. In addition, inconsistent security protocols across different platforms, coupled with varying levels of digital literacy among users, further amplify the risks. Moreover, the integration of mobile payments with third-party apps and services introduces new privacy challenges, as data sharing between entities may not always be transparent or fully consented to by users, thus hindering consumer confidence and potentially slowing growth of the mobile payment market. To address these challenges, stakeholders need stronger cybersecurity, clearer data transparency, and consistent regulations. Educating users and standardizing security can build trust, while collaboration between governments and providers will help to create favorable environment for the growth of the mobile payment market.

Opportunity

Rapid advancements in payment technologies

The mobile payment market outlook shows strong growth potential, driven by the rapid advancement of payment technologies that are reshaping digital commerce. Innovations such as Near Field Communication (NFC), biometric authentication, QR code systems, and blockchain-based transactions are transforming how consumers and businesses handle financial exchanges. These technologies enhance transaction speed, security, and convenience, fostering greater consumer trust and wider adoption of mobile payment solutions.Smartphones are integrating features such as AI-driven fraud detection, multi-factor authentication, and enhanced biometric systems, significantly improving the trustworthiness and efficiency of eWallet platforms.. These advancements not only streamline the payment experience but also reduce risks, addressing key concerns around security and privacy, which are the core elements of M-commerce Payments.

Moreover, the rise of digital wallets, super apps, and embedded finance is creating a more seamless ecosystem for mobile transactions. Fintech companies and traditional financial institutions are leveraging APIs and cloud-based infrastructure to scale mobile payment offerings rapidly. This technological momentum provides lucrative mobile payment market opportunity for expansion, especially in emerging economies where mobile penetration is high, but banking infrastructure is limited. Businesses that embrace and innovate within this fast-evolving landscape stand to gain a competitive edge, capture new user segments, and drive the future of cashless economies. For instance, in April 2025, Mastercard launched Agent Pay, a groundbreaking agentic payments technology designed to integrate with AI agents and transform digital commerce. This solution enables smarter, more secure, and personalized payment experiences by using Agentic Tokens, which build on Mastercard’s existing tokenization infrastructure. Agent Pay allows AI agents to make purchases, manage subscriptions, and handle transactions on behalf of users, enhancing both consumer and business interactions in the age of AI. This is expected to boost adoption of AI-driven financial services by reducing friction, enabling autonomous payments, and simplifying transactions through secure, intelligent automation, thereby propelling the growth of the mobile payment market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile payment market analysis from 2024 to 2034 to identify the prevailing mobile payment market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the mobile payment market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global mobile payment industry.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global mobile payment market trends, key players, market segments, application areas, and market growth strategies.

Mobile Payment Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 16.1 trillion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 254 |

| By End User |

|

| By Transaction Mode |

|

| By Region |

|

| Key Market Players | One MobiKwik Systems Ltd., N26 Bank SE, WeChat Pay Hong Kong Limited, Adyen N.V., Moneris Solutions Corporation, VISA, INC., Apple Inc., Block, Inc., Boku Inc., Monzo Bank Limited, Samsung Electronics Co., Ltd., Alipay, JPMorgan Chase & Co, PayPal Holdings, Inc., Klarna Bank AB, Google LLC, Vodafone Group Plc., One 97 Communications Ltd, Stripe, Inc., Mastercard Incorporated. |

Analyst Review

The mobile payment market is witnessing significant growth, fueled by rising consumer demand for fast, secure, and contactless payment solutions. This shift is largely driven by increase in adoption of smartphones, expansion of e-commerce, and surge in preference for cashless transactions. The market is expanding across various sectors as businesses integrate mobile payment options to enhance customer experience, streamline operations, and boost sales. In addition, advancements in mobile wallet technology, biometric authentication, and real-time transaction capabilities are enhancing convenience and security for users. The mobile payment market is well-positioned for sustained growth in the upcoming years as digital ecosystems continue to evolve, and financial institutions, retailers, and fintech companies invest heavily in innovation.

Furthermore, technological advancements in digital payment solutions, mobile wallets, and e-commerce platforms are significantly driving the growth of the mobile payment market. Modern mobile payment systems offer features such as contactless transactions, biometric authentication, seamless integration with loyalty and rewards programs, and real-time spending tracking. These innovations enhance convenience, speed, and security for both consumers and businesses, making mobile payments a preferred choice across retail, hospitality, transportation, and more. The rise of fintech and payment tech startups, along with increase in collaboration between retailers, digital platforms, and financial institutions, is enabling the development of more secure, user-friendly, and versatile mobile payment solutions. Adoption is expanding rapidly across global markets as consumer demand for cashless, flexible, and on-the-go payment options continues to accelerate.

Moreover, supportive government initiatives and evolving regulatory frameworks aimed at promoting digital payments and financial inclusion are significantly boosting the growth of the mobile payment market. Policies encouraging cashless transactions, tax benefits for digital adoption, and the establishment of fintech innovation hubs are creating a favorable environment for mobile payment solutions. In many regions, public-private partnerships are advancing the development of secure, inclusive, and user-friendly mobile payment platforms. However, challenges such as cybersecurity risks, lack of interoperability, and disparities in digital infrastructure continue to hinder widespread adoption. Additionally, varying levels of consumer awareness, trust, and digital literacy can impact market penetration. Despite these hurdles, the mobile payment market is expected to grow steadily, especially in emerging economies, driven by the rising demand for fast, flexible, and contactless payment experiences.

The mobile payment market is expected to witness notable growth due to rise in penetration of smartphones and expansion of e-commerce sector and online retail.

The mobile payment market is projected to reach $16,142.0 billion by 2034.

The mobile payment market is estimated to grow at a CAGR of 8.1% from 2025 to 2034.

The key players profiled in the report include Mastercard Incorporated., Google LLC, JPMorgan Chase & Co, PayPal Holdings, Inc., Samsung Electronics Co., Ltd., Apple Inc., VISA, INC., One 97 Communications Ltd, Boku Inc., WeChat Pay Hong Kong Limited, Moneris Solutions Corporation, N26 Bank SE, Adyen N.V., Vodafone Group Plc., Klarna Bank AB, Monzo Bank Limited, Stripe, Inc., Block, Inc., One MobiKwik Systems Ltd., and Alipay.

The key growth strategies of mobile payment market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...