Mobile Phone Insurance Market Overview

The global mobile phone insurance market was valued at $24.6 billion in 2020, and is projected to reach $74.5 billion by 2030, growing at a CAGR of 11.8% from 2021 to 2030. Growing smartphone adoption, high device repair/replacement costs, increasing mobile thefts, rising consumer awareness, expanding e-commerce, and availability of value-added insurance services contribute to the growth of the market.

Market Dynamics & Insights

- The mobile phone insurance industry in North America held the largest market share in 2020.

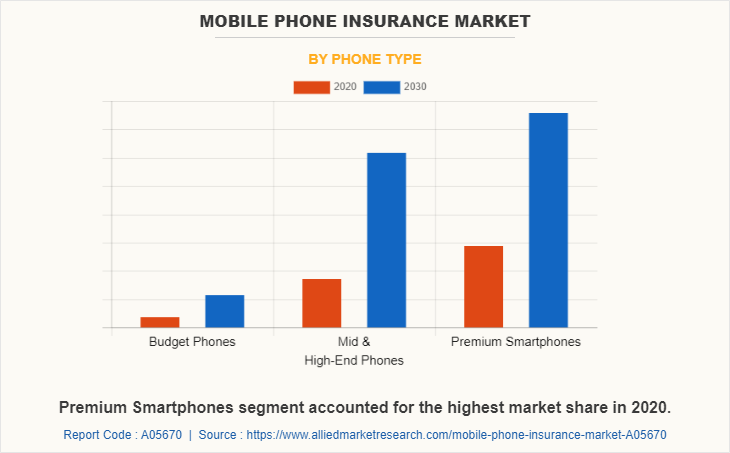

- By phone type, the premium smartphone segment held the largest market share in 2020.

- By coverage type, the physical damage segment held the largest market share in 2020.

- By application, the personal segment held the largest market share in 2020.

Market Size & Future Outlook

- 2020 Market Size: $24.6 Billion

- 2030 Projected Market Size: $74.5 Billion

- CAGR (2021-2030): 11.8%

- North America: dominated the market in 2020

- Asia-Pacific: Fastest growing market

What is Meant by Mobile Phone Insurance

Mobile phone insurance is called service contract, which provides component fix repair service for phones sold by retailers, and service providers. It often provides additional coverage of phones such as unauthorized usage, malicious damage, e-wallet payments, or theft. Mobile phone insurance also covers the cost and inconvenience of mechanical and electrical failures.

Factors such as increase in incidents of accidental damage, phone thefts, virus infection, & device malfunction, and surge in adoption of high quality smartphones are some of the major factors, which drive the market growth. In addition, high replacement cost of various parts of mobile phones boost mobile phone insurance market growth. However, decline in sale of mobile phones is a major restraint that hinders the growth of the mobile phone insurance market. On the contrary, surge in demand for innovative products is expected to boost the mobile phone insurance market growth in the future.

The report focuses on growth prospects, restraints, and trends of the global mobile phone insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the mobile phone insurance industry.

Mobile Phone Insurance Market Segment Review

The global mobile phone insurance market is segmented on the basis of phone type, sales channel, coverage type, end user, and region. By phone type, it is segmented into budget phones, mid & high-end phones, and premium smartphones. On the basis of sales channel, it is divided into retail and online. Based on coverage type, it is segregated into physical damage, internal component failure, theft & loss protection, and others. By end user, the mobile phone insurance market is divided into business and individuals. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of phone type, the premium smartphones segment dominated the mobile phone insurance market share in 2020, and is expected to maintain its dominance in the upcoming years owing to growing need to provide enhance security to this phones as premium phones are more prone to technical and physical damages, which lead to huge losses.

Region wise, the mobile phone insurance market was dominated by North America in 2020, and is expected to retain its position during the forecast period. The major factors that drive the growth of the mobile phone insurance market in this region include 60% consumers prefer mobile phone insurance, while 62% are active users of mobile phone insurance in the country.

The report analyzes the profiles of key players operating in the global mobile phone insurance market such as Apple Inc., ASSURANT, INC., Asurion, AT&T Intellectual Property, Aviva, bolttech, Chubb, Digital Care sp. z o.o., Servify, Singtel, and U Mobile Sdn Bhd. These players have adopted various strategies to increase their mobile phone insurance market penetration and strengthen their position in the global mobile phone insurance market.

Market landscape and trends

The mobile phone insurance market has grown significantly in recent years, owing to the increasing popularity and widespread adoption of smartphones. Mobile phone insurance is the coverage and protection plans provided by insurance companies to protect mobile devices against theft, damage, loss, and other risks. Insurance firms, mobile network operators (MNOs), smartphone makers, and third-party insurance providers are common players in the mobile phone insurance sector or mobile phone insurance domain. Furthermore, mobile phone insurance companies provide extensive coverage alternatives that go beyond typical policies. These may include accidental damage, liquid damage, theft, loss, unauthorized use, and even coverage for accessories. To differentiate their offerings, several insurers offer value-added services such as data backup, device tracking, and technical help. In addition, mobile phone insurance companies frequently engage with mobile network operators and smartphone manufacturers to provide insurance policies to customers at the point of purchase.

Furthermore, the influence of technology in determining the mobile phone insurance business is considerable. Telematics, artificial intelligence (AI), and data analytics are being used by insurers to expedite policy administration, claims processing, and fraud detection. These technologies contribute to improved overall client experience as well as operational efficiency and mobile phone insurance adoption. These collaborations enable seamless integration of insurance services into the purchasing process, making it easier for consumers to obtain coverage for their equipment. Therefore, these are some of the major market trends of mobile phone insurance market.

Government Initiatives

Governments frequently pass consumer protection legislation to protect the interests of mobile phone customers. Insurance coverage, warranties, and protection against fraudulent actions may be included in these statutes. Such regulations seek to ensure that consumers are treated fairly and receive proper compensation in the event that their mobile phones are damaged, stolen, or lost. Furthermore, the insurance sector, including mobile phone insurance, is governed by regulatory frameworks established by governments. These frameworks often outline the laws, procedures, and licensing criteria for insurance companies. They seek to ensure the insurance market's dependability, transparency, and stability, benefiting consumers and insurance businesses. In addition, governments and insurance firms are expected to collaborate to provide mobile phone insurance as an optional add-on service. This collaboration could entail negotiating favorable terms, assuring affordability, and increasing customer awareness. Such initiatives may make insurance coverage more accessible to mobile phone users.

Moreover, governments may conduct public awareness efforts to educate mobile phone users about the value of insurance coverage and the various options available. These advertisements can reduce the risks of mobile phone usages, such as loss, theft, and unintentional damage, as well as the advantages of having insurance protection, to encourage people to purchase mobile phone insurance..

What are the Top Impacting Factors in Mobile Phone Insurance Market

Surge in adoption of high quality smartphones

Rise in demand for mobile phone insurance on accidents, such as mechanical breakdown, accidental damage of phones or malicious & liquid damage, theft, and unauthorized usage, creates pressure on insurance companies to invest and develop such products that have less proliferation, high coverage, and provide financial security in the form of new refurbished phones. In recent years, there has been an increase in the number of accidents, in terms of accidental damage from handling and loss protection, which resulted in an increase in the need for mobile phone insurance. For instance, in the U.S., a study conducted by ASSURANT, INC., a global mobile phone insurance provider, stated that in 2019, around 34% consumers purchased mobile phone insurance for more than two years for their mobile devices. Hence, these aforementioned factors are expected to boost the cell phone insurance market growth in the future.

Decline in sales of mobile phones

Mobile phones is one of the major category under consumer electronics, which largely purchases mobile phone insurance coverage in the market. However, demand for mobile phone insurance has also declined, with decline in sales of mobile phones since recent years. Moreover, consumer experiences and adoption of mobile phones remain a primary concern, which needs to be addressed by balancing the sales of mobile phones and its alternative uses in the mobile phone insurance market. Furthermore, unit shipment for mobile phones have been on the decline globally, therefore, these factors limit the growth of mobile phones premium in the market.

Surge in demand for innovative products

Various mobile phone companies across the globe are introducing new strategies to improve their mobile phone insurance market value and surge their revenue as well as enhance their customer experience. Some of the mobile phone insurance companies are providing applications and other technologically advanced services to their customers to keep their customer safe from the pandemic situation. For instance, according to Asurion survey, on May 25, 2021 the number of phone mishaps increased more than usual owing to vacations and summer activities. Therefore, such new advanced services have become a major trend in the mobile phone insurance industry, which, is expected provide a lucrative opportunity for mobile phone insurance providers in the upcoming years.

Report Coverage & Deliverables

Regional Insights

North America is anticipated to account for a mobile phone insurance size of 33.7% by 2030. The regional market growth can be attributed to the presence of a large number of mobile phone insurance providers and the rising incidences of crimes committed using smartphones in Canada and the U.S. According to the Bureau of Justice Assistance, on average, more than one million smartphones are stolen in the U.S. every year. Furthermore, the availability of insurance plans that offer additional protection for software malfunctioning and replacement of stolen devices is expected to fuel the regional market growth over the forecast period.

Solution Insights

Mobile phone insurance market offers solutions like accidental damage coverage, theft and loss protection, and extended warranties to safeguard devices. Additionally, policies may include liquid damage protection, international coverage, and device replacement services to meet diverse user needs and ensure comprehensive protection.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations to augment their market share. For instance, in January 2023, Cox Mobile, a Cox Communications mobile phone service, collaborated with Asurion to provide device protection and trade-in services to its wireless customers. Customers of Cox Mobile can now protect their smartphones from accidental damage, theft, and loss.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile phone insurance market size analysis from 2020 to 2030 to identify the prevailing mobile phone insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobile phone insurance market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global mobile phone insurance market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mobile phone insurance market trends, key players, market segments, application areas, and market growth strategies.

Mobile Phone Insurance Market Report Highlights

| Aspects | Details |

| By Phone Type |

|

| By Sales Channel |

|

| By Coverage Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Digital Care sp. z o.o., Apple Inc., Singtel, ASSURANT, INC., Bolttech, Asurion, Aviva, Servify, U Mobile Sdn Bhd, AT&T Intellectual Property, Chubb |

Analyst Review

Mobile phone insurance provides coverage from multiple types of products & brands, ranging from appliances to electronics, wearables, computer equipment, and others. In addition, manufacturers tend to deal with limited product & brand set to provide an insurance as the licensing & credentialing requirements largely differ from other insurance coverage. Furthermore, mobile phone insurance is designed to provide additional protection for end user mobiles. However, consumers face several challenges while dealing with mobile insurance. For instance, retailers that do not repair in the store, generally sell mobile insurance, which are third-party policies. Therefore, though consumers buy the insurance from retailers, another company handles the claim processes

North America is the leading region across the world in terms of market share owing to rise in incidences of crimes related to smartphones and presence of key players of the market which in turn drives the growth of the market. Furthermore, developing countries such as India, Hong Kong, Indonesia is expected to grow at the fastest rate, owing to increase in awareness related to the significant advantage of mobile phone insurance among the population, which in turn drives the growth of the market. In addition, rise in awareness and additional savings by the people of these boosts the adoption of the mobile insurance. Some of the key players profiled in the report include Apple Inc., ASSURANT, INC., Asurion, AT&T Intellectual Property, Aviva, bolttech, Chubb, Digital Care sp. z o.o., Servify, Singtel, and U Mobile Sdn Bhd. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Mobile Phone Insurance Market is estimated to grow at a CAGR of 11.8% from 2021 to 2030.

The Mobile Phone Insurance Market is projected to reach $74.5 billion by 2030.

Factors such as increase in incident of accidental damage, phone thefts, virus infection, and device malfunction, along with surge in adoption of high quality smartphones drives the growth of the Mobile Phone Insurance market .

The key players profiled in the report include Apple Inc., ASSURANT, INC., Asurion, AT&T Intellectual Property, Aviva, bolttech, Chubb, Digital Care sp. z o.o., Servify, Singtel, and U Mobile Sdn Bhd.

The key growth strategies of Mobile Phone Insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...