The global mobility on demand market was valued at $552.9 billion in 2021, and is projected to reach $1,694.7 billion by 2031, growing at a CAGR of 11.8% from 2022 to 2031.

Mobility on Demand (MOD) is an integrated mobility solution that combines traditional public transportation with private enterprise options into a single mobility service. It is generally attributed to traveler-focused service, which puts more weight on personal choice, trip satisfaction, and the efficient delivery of services. Mobility on demand is especially valuable in helping address transportation challenges in urban areas (to reduce congestion caused by single-occupancy vehicles), transit deserts, and a replacement for fixed routes during off-peak hours. It can also help bridge gaps in first mile/last mile, corporate transportation, paratransit/dial-a-ride, and university shuttle services.

Currently, the developing requirement for individual mobility in the stir of rising urbanization and the significant rise in the preference for carpool and bike pool services among regular office commuters is the primary factor contributing toward the growth of the ride-hailing and ride-sharing services, thereby propelling the mobility on demand market during the forecast period. For instance, in March 2021, Europcar Mobility Group announced the extension of its partnership with ECO Rent a Car in India and Shouqi Car Rental in China, which were popular car rental services in India and China, respectively. This allowed Europcar to benefit from the massive inflow of customers across India and China.

The factors such as proactive government initiatives for smart cities, rise in venture capital and strategic investments, and adoption of e-bikes in the sharing fleet supplement the growth of the mobility on demand market. However, low rate of internet penetration in developing regions and resistance from local transport services, coupled with varying government regulations in different countries are the factors expected to hamper the growth of the market. In addition, emergence of eco-friendly electric cab services and adoption of car rental management software creates market opportunities for the key players operating in the mobility on demand industry.

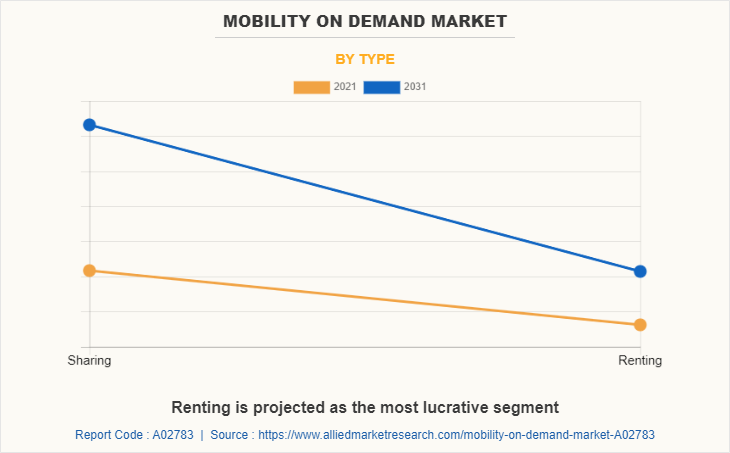

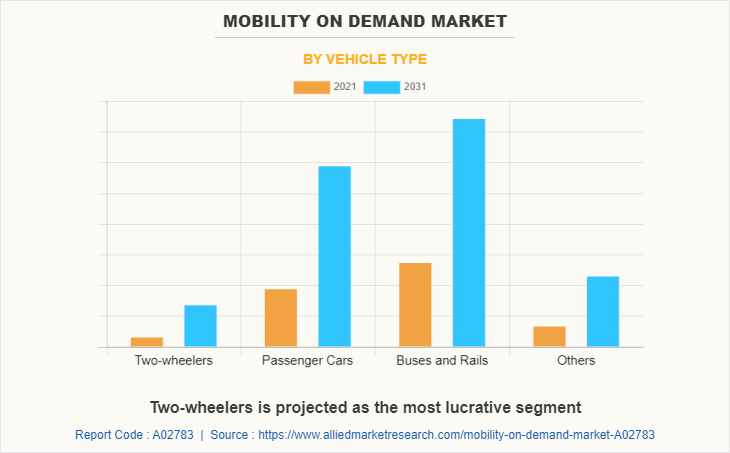

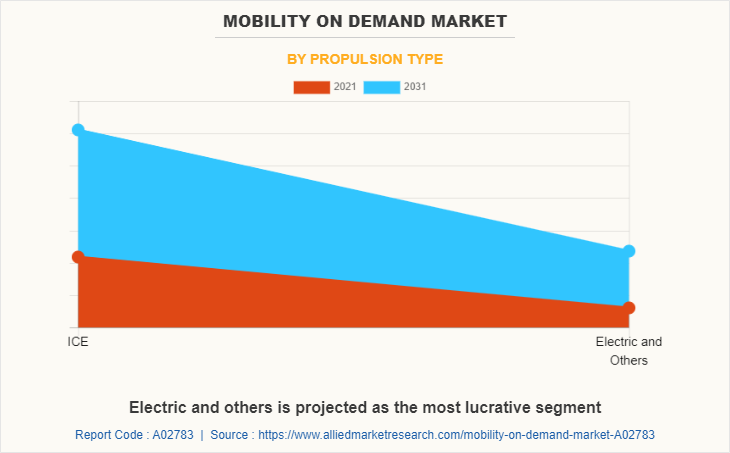

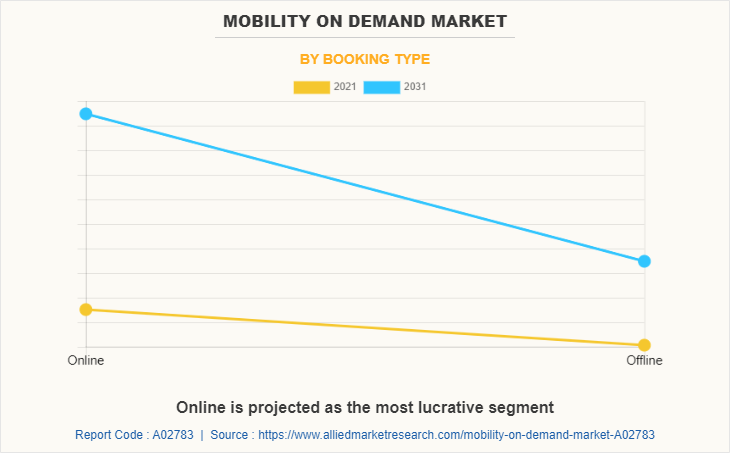

The mobility on demand market is segmented into type, vehicle type, propulsion type, booking type, commute type, and region. By type, the market is divided into sharing and renting. By vehicle type, it is fragmented into two-wheelers, passenger cars, buses and rails, and others. By propulsion type, it is categorized into internal combustion engine (ICE) and electric and others. By booking type, it is further classified into online and offline. By commute type, it is fragmented into intracity and intercity. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the mobility on demand market are Aptiv, BMW AG, Cabify España S.L.U., Car2go NA, LLC, Cityscoot, Europcar Mobility Group, Ford Motor Company, General Motors, Gett, The Hertz Corporation, Intel Corporation, IBM, Lyft, Inc., Robert Bosch GmbH, Toyota Motor Corporation, Uber Technologies Inc., and Yulu Bikes Pvt Ltd.

Proactive government initiatives for smart cities

Smart city technologies are the key to boosting recovery and building resilience to future shocks, while also driving efficiencies and improving quality of life. Currently, the world is standing at the cusp of change with revolutionary technologies like blockchain and AI enhancing industries, the focus of which has now also shifted onto radicalizing the mobility sector. Transportation today accounts for close to 19% of the world’s energy consumption. Meanwhile, several government initiatives have been made for implementing the concept of shared mobility across the globe. This has led to the growth of the global mobility on demand market. For instance, in 2019, in Japan, the Ministry of Economy, Trade, and Industry (MEIT) and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) jointly created the smart mobility challenge subsidy program, thereby generating revenue of $27.6 million for the smart mobility challenge subsidy program. Similar investments and subsidy programs have been implemented by different governments across the globe, which also led to the growth of the global mobility on demand market.

Adoption of e-bikes in the sharing fleet

The demand for e-bikes is increasing across the globe owing to their fast & flexible operations and zero carbon emissions. In addition, rise in consumer inclination toward the usage of e-bikes as cost-effective & eco-friendly transport solution is adding up to bike sharing expansion. Moreover, an e-bike is the more-preferred option, as it better fulfills the requirement for higher speed in short-distance commuting, when compared to a pedal operated bike. Features such as higher speed, more convenience, effortless driving, and variable motor power as per the road conditions make e-bikes more preferred for sharing purposes.

Furthermore, the governments across the globe are taking several initiatives to promote usage of e-bike. For instance, majority of the governments across the globe is looking forward to convert fuel vehicles into electric vehicles to tackle the environmental issues. Also, several bike sharing providers have started focusing on expanding their fleet of e-bikes to sustain the growing competition in the mobility on demand market which is expected to drive the market growth.

Low rate of internet penetration in developing regions

Generally, mobility service requires three parties for their operation, i.e., driver, riders, and service providers. All the processes such as matching rider with driver, fare estimation & calculation, ride payment, and reputation management, are done by using smartphones with the mandatory internet connectivity. Some countries such as Eritrea, Burundi, Chad, Somalia, and others, have a low penetration of internet that threaten the growth of the smart mobility market in these areas.

Further, the driver must have an active internet connection to identify the exact service provider location of companies. Therefore, this low penetration of the internet hampers the mobility on demand market.

Emergence of eco-friendly electric cab services

Players operating in the mobility on demand market are focusing on minimizing carbon footprint of their business operations by adding electric cars to their taxi fleet. In addition, shift in consumer preference toward using sustainable mobility solutions for routine commute further supports use of electric cab services. Moreover, factors such as rise in government initiatives for adoption of electric vehicles, increase in demand for emission-free vehicles, and stringent government regulations on carbon di-oxide (CO2) emission accelerate adoption of electric vehicles in alternate transportation services. Furthermore, various market players are collaborating with automobile manufacturers to expand their taxi fleet of electric cars for mobility sharing or renting purposes. For instance, in February 2022, The Hertz Corporation partnered with UFODRIVE, self-service electric vehicle rental company and eMobility service provider in Europe. This partnership allowed Hertz to grow its fleet of electric vehicles and to offer the best rental and recharging experience for leisure and business customers around the world. Therefore, adoption of electric cab services in mobility on demand services offers lucrative growth opportunities for the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobility on demand market analysis from 2021 to 2031 to identify the prevailing mobility on demand market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobility on demand market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mobility on demand market trends, key players, market segments, application areas, and market growth strategies.

Mobility on Demand Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1694.7 billion |

| Growth Rate | CAGR of 11.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 341 |

| By Type |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Booking Type |

|

| By Commute Type |

|

| By Region |

|

| Key Market Players | Orix Corporation, Robert Bosch GmbH, Bayerische Motoren Werke AG (BMW AG), Tomtom NV, General Motors Company, Hertz Corporation, Intel Corporation, Cabify, Delphi Automotive PLC, Europcar Mobility Group, Toyota Motor Corporation, International Business Machines Corp. (IBM), Uber Technologies, Inc., Ford Motor Company, Lyft, Inc., Gett, Car2Go |

Analyst Review

This section provides the opinions of various top-level CXOs in the global mobility on demand market. The increasing focus on reduction & control of high air pollution levels due to heavy vehicular traffic is creating the need for alternative transportation forms, driving mobility on demand market value globally. Consumer preferences in North American and European countries are shifting from old vehicular transport to various other mobility choices, leading to the demand for flexible travel options. Moreover, the mobility on demand industry is witnessing popularity owing to the emphasis on public & private transportation options that allow shared usage & multimodal integration.

Furthermore, several government initiatives have been made to implement the concept of shared mobility globally. This has led to the growth of the global mobility on demand market. For instance, in 2019, in Japan, the Ministry of Economy, Trade, and Industry (MEIT) and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) jointly created the innovative mobility challenge subsidy program, thereby generating revenue of $27.6 million for the innovative mobility challenge subsidy program. In addition, several service providers offer various facilities, offers, and discounts, such as monthly passes on the shared ride, to reduce the expenses of daily commuters. For instance, in August 2019, Lyft Inc. brand Citi Bike partnered with the public library systems in Brooklyn, Manhattan, and Quyeens to offer one month of free Citi bike rides for NYCHA residents and SNAP recipients. Moreover, customers got access to unlimited 45-minute rides during these 30 days. Members had a choice to continue their membership afterward, paying just $5 a month, by simply taking a Citi Bike trip.

The market growth is supplemented by factors such as proactive government initiatives for smart cities, rise in venture capital and strategic investments, and adoption of e-bikes in the sharing fleet supplement the growth of the mobility on demand market. However, low rate of internet penetration in developing regions and resistance from local transport services, coupled with varying government regulations in different countries are the factors expected to hamper the growth of the mobility on demand market. In addition, emergence of eco-friendly electric cab services and adoption of car rental management software creates market opportunities for the key players operating in the mobility on demand market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to increasing vehicle purchasing & ownership costs due to the launch of technically advanced passenger cars and growing focus of business enterprises on providing better employee transportation services.

The leading players operating in the mobility on demand market are Aptiv, BMW AG, Cabify España S.L.U., Car2go NA, LLC, Cityscoot, Europcar Mobility Group, Ford Motor Company, General Motors, Gett, The Hertz Corporation, Intel Corporation, IBM, Lyft, Inc., Robert Bosch GmbH, Toyota Motor Corporation, Uber Technologies Inc., and Yulu Bikes Pvt Ltd.

The global mobility on demand market was valued at $552.9 billion in 2021, and is projected to reach $1,694.65 billion by 2031, registering a CAGR of 11.8% from 2022 to 2031

Asia-Pacific is the largest regional market for mobility on demand

Booking of two-wheelers and passenger cars is the leading application of mobility on demand market

Increased online bookings are the upcoming trends of mobility on demand market in the world

Loading Table Of Content...