Modified Starch Market Size & Insights:

The global modified starch market size was valued at $9.0 billion in 2022, and is projected to reach $14.4 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032.

Introduction

Starch is a natural carbohydrate commonly found in food such as potatoes, corn, rice, and wheat. It serves as an essential energy source and plays a pivotal role in the food industry due to its thickening, stabilizing, and gelling properties. However, native starches have limitations when subjected to conditions like high heat, acidity, or shear during processing. To overcome these drawbacks, starches are often chemically, physically, or enzymatically altered, resulting in what is known as modified starch. Modified starch is extensively used in the food and beverage sector, where it serves multiple roles such as thickening, gelling, stabilizing, and emulsifying agents. It also helps improve texture, enhance mouthfeel, and prevent syneresis (water separation) in processed food.

In pharmaceuticals, modified starch plays a critical role as an excipient—an inactive substance that serves as the vehicle for a drug or other active ingredient. It is widely utilized in tablet manufacturing due to its binding, disintegrating, and coating properties. The paper industry uses large quantities of modified starch as a surface sizing agent and binder to enhance paper strength and quality. It improves the physical properties of paper such as printability, surface smoothness, and water resistance.

Key Takeaways:

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

The modified starch market is fragmented in nature among prominent companies such as ADM, AGRANA Beteiligungs-AG, AVEBE U.A., Cargill, Incorporated, EMSLAND GROUP GmbH and Co. KG, Ingredion Incorporated., Roquette Freres, Royal Ingredients Group, and Tate and Lyle PLC.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

Latest trends in global modified starch market such as undergoing R&D activities, public policies, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 2,500 modified starch-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global modified starch market

Market Dynamics

The growing processed food industry is expected to drive the growth of the modified starch market. Modified starch functions as a thickener, stabilizer, binder, and emulsifier, helping to maintain consistency, improve mouthfeel, and extend shelf life in processed foods. Its ability to perform well under various processing conditions—such as high temperature, shear, and pH changes makes it ideal for use in a wide range of formulations including soups, sauces, bakery items, dairy products, and instant meals. In May 2025, the U.S. Health Secretary announced that the National Institutes of Health (NIH) and the Food and Drug Administration (FDA) would prioritize research into ultra-processed food, sugars, and food additives, reflecting growing concerns over their health impacts. Modified starch plays a crucial role in achieving these goals by enhancing the texture, appearance, and stability of food products, even during extended storage or under challenging processing conditions like freeze-thaw cycles. In May 2025, Kraft Heinz announced a $3 billion investment to upgrade its 30 U.S. manufacturing plants, aiming to enhance operational efficiency and support long-term food production amid economic uncertainties and tariffs.

However, the availability of alternative materials is expected to restrain the growth of the modified starch market. The availability of alternative ingredients, particularly hydrocolloids such as guar gum, xanthan gum, pectin, and locust bean gum, poses a notable restraint on the growth of the modified starch market. These alternatives often provide similar or superior functionalities, including thickening, gelling, stabilizing, and emulsifying properties. In some applications, especially those requiring specific viscosities, pH stability, or dietary attributes, hydrocolloids can outperform modified starch in both effectiveness and efficiency. The modified starch market also faces significant competition from other thickening and stabilizing agents, such as gums (e.g., guar gum, xanthan gum), cellulose derivatives, and synthetic polymers. This competition can limit the adoption of modified starch, especially in regions or industries where alternatives are more cost-effective or provide superior functional properties

Moreover, growth in gluten-free and functional food is expected to provide lucrative opportunities in the modified starch market. As more consumers become aware of gluten intolerance, celiac disease, and the perceived health benefits of gluten-free diets, food manufacturers are increasingly reformulating their products to meet these needs. Modified starches act as texture enhancers, helping to replicate the structural functions typically provided by gluten. They improve the volume, softness, and chewiness of gluten-free baked products such as breads, muffins, and cookies. Additionally, they enhance moisture retention and shelf stability, addressing common issues like dryness and crumbling that often affect gluten-free goods. In March 2025, Quiznos, the renowned sandwich chain known for its high-quality meats and cheeses, freshly sliced in-house daily and expertly toasted, announced the launch of new gluten-smart options across its U.S. locations. As part of this expansion, the brand introduced a limited time offering, the Buffalo Chicken Club, featuring a spicy mayonnaise infused with Frank’s RedHot sauce, bacon, provolone cheese, tomatoes, and lettuce. The gluten-free bread is available for all sandwiches in regular and large sizes, with varying additional charges by location.

Segments Overview:

The modified starch market is segmented on the basis of raw material, type, function, application, and region. On the basis of raw material, the market is categorized into maize, cassava, potato, wheat, and others. On the basis of type, it is divided into cationic starch, etherified starch, esterified starch, resistant starch, and pre-gelatinized. On the basis of function, it is classified into thickeners, stabilizers, binders, emulsifiers, and others. By application, the market is segregated into food & beverages, animal feed, paper-making, weaving textiles, pharmaceuticals, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

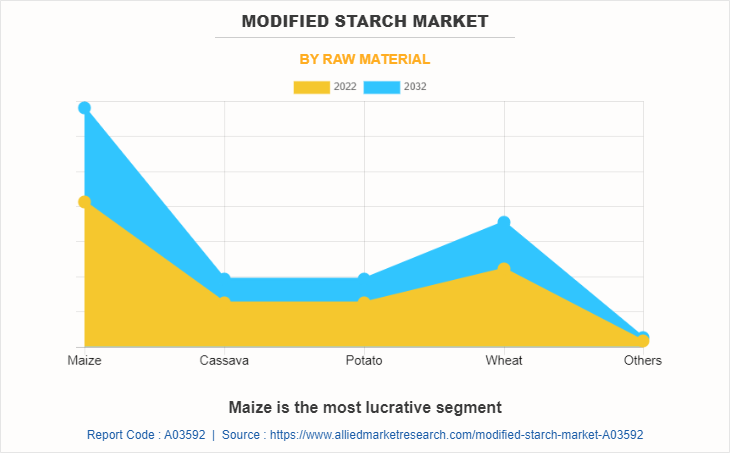

Modified Starch Market by Raw Material

In 2022, the maize segment was the largest revenue generator and is anticipated to grow at a CAGR of 5.2% during the forecast period. In the food industry, modified maize starch is extensively utilized for its thickening, stabilizing, and emulsifying capabilities. It is commonly found in products like sauces, gravies, soups, and dressings, where it provides consistent texture and prevents separation during storage. In October 2024, China relaxed its export restrictions on maize starch, aiming to enhance exports and leverage its substantial manufacturing capacity, which includes an estimated annual production of 24 million tons of maize starch. As per the Volza, between October 2023 and September 2024, India emerged as the largest importer of modified maize starch, accounting for 23% of global imports during this period.

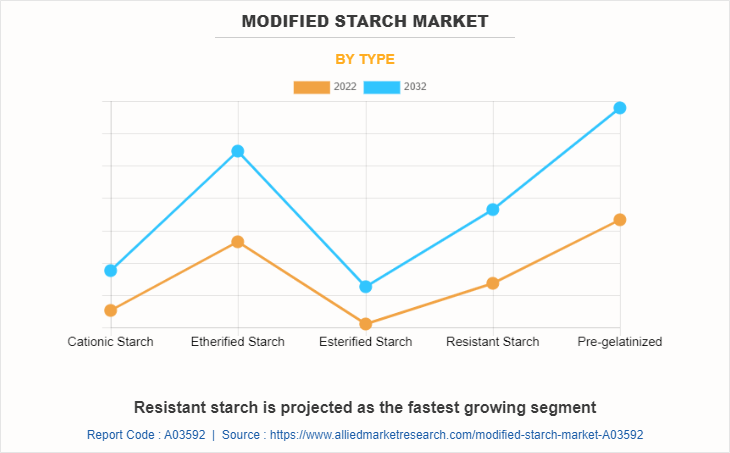

Modified Starch Market by Type

In 2022, the pre-gelatinized segment was the largest revenue generator and is anticipated to grow at a CAGR of 5.1% during the forecast period. The integration of modified starches into pregelatinized starch production enhances the functional properties of the starch, making it more versatile and efficient across multiple industries. By tailoring the modifications, manufacturers can produce starches that meet specific requirements, improving product quality and performance. In the pharmaceutical industry, modified pregelatinized starches serve as excipients in tablet formulations. They function as binders, disintegrants, and controlled-release agents, ensuring uniformity and controlled release of active pharmaceutical ingredients. Their cold-water solubility and stability under various conditions make them suitable for use in pharmaceutical applications.

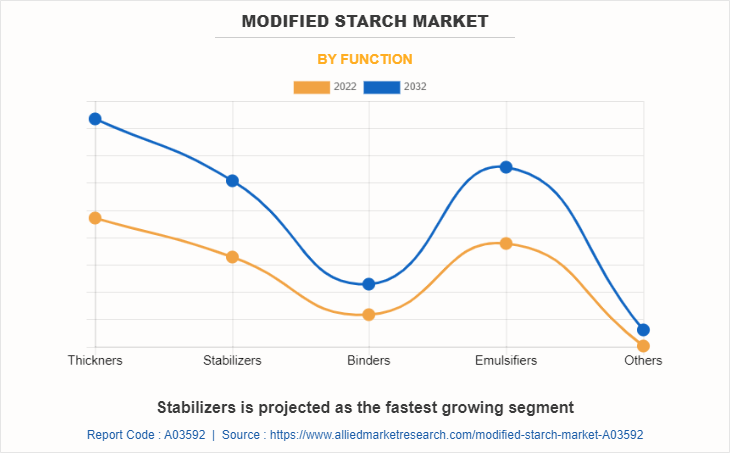

Modified Starch Market by Function

In 2022, the thickeners segment was the largest revenue generator and is anticipated to grow at a CAGR of 5.0% during the forecast period. Modified starches are extensively utilized in the food industry as thickeners due to their enhanced functional properties, which are achieved through physical, chemical, or enzymatic modifications of native starches. These modifications tailor the starch's characteristics to meet specific processing and product requirements, offering advantages over unmodified starches. They serve as thickeners in items such as sauces, soups, gravies, puddings, pie fillings, and dressings. Their ability to maintain consistency under varying temperatures and pH levels makes them invaluable in both hot and cold applications. For instance, pregelatinized starches, which can thicken without heat, are used in instant desserts and ready-to-eat meals, ensuring smooth texture without clumping.

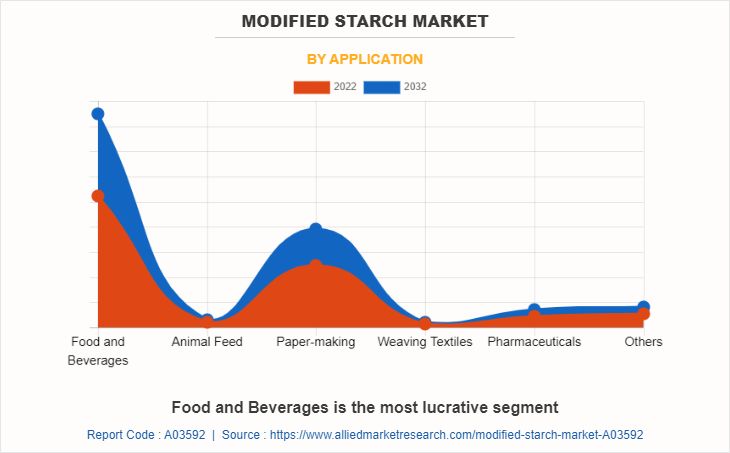

Modified Starch Market by Application

By application, the food and beverages segment dominated the global market in 2022 and is anticipated to grow at a CAGR of 5.0% during the forecast period. Modified starches serve as effective thickeners and stabilizers in a variety of food products. They are commonly used in sauces, soups, gravies, puddings, and pie fillings to achieve desired viscosities and prevent separation during storage and heating. For instance, phosphated distarch phosphate (E1413) is employed in frozen gravies and pie fillings for its freeze-thaw stability. In 2025, Cargill introduced a cold-swelling modified starch for dairy-based and plant-based yogurt formulations in 2025, improving texture and stability by 28% without requiring additional gums or stabilizers.

Modified Starch Market by Region

The Asia-Pacific modified starch market size accounted for 37.3% of modified starch market share in 2022 and is projected to grow at the highest CAGR of 5.3% during the forecast period. In the Asia-Pacific region, the food and beverage sector is the primary consumer of modified starches. Countries like China and India have witnessed a surge in processed and convenience food consumption, driving the demand for modified starches. These starches enhance texture, improve shelf life, and provide stability to products such as sauces, soups, and instant noodles. The growing preference for ready-to-eat meals and snacks further propels the market. In September 2022, Ingredion inaugurated a cutting-edge manufacturing facility in Shandong, China, significantly enhancing its starch production capacity and capabilities in the region. Additionally, in November 2022, the company completed one-third of its $160 million capital investment aimed at expanding capacity for modified and clean label specialty starches globally. Moreover, In October 2024, China relaxed its export prohibition on maize starch, signaling improved market confidence and a more positive economic outlook. This decision is expected to enhance China's exports of maize starch, which had been limited since late 2021 due to concerns over domestic availability.

Competitive Analysis

The global modified starch market profiles leading players that include ADM, AGRANA Beteiligungs-AG, AVEBE U.A., Cargill, Incorporated, EMSLAND GROUP GmbH and Co. KG, Ingredion Incorporated., Roquette Freres, Royal Ingredients Group, Tate and Lyle PLC, and Tereos.

Moreover, other key players in the market that are not profiled in the report includes Grain Processing Corp., KMC, Roquette Freres, Archer Daniels, Everest Starch, Pars Koosheh Pardaz Co., SPAC Starch Products Ltd., Tongaat Hulett Starch, Eurodona Food Ingredients GmbH, and others. The global modified starch market report provides in-depth competitive analysis and profiles of these major players.

In May 2022, ADM announced a significant expansion of its starch production at the Marshall, Minnesota facility to meet increasing demand from food, beverage, and industrial sectors. This move supports the growth of ADM's BioSolutions platform, which focuses on sustainable, plant-based products.

In November 2022, Ingredion announced that it had completed one-third of its $160 million capital investment to expand capacity for modified and clean-label specialty starches across its global supply chain. This includes opening a state-of-the-art manufacturing facility in Shandong, China, which more than doubles its starch production capacity in the country.

Recent Key Developments in Modified Starch Market:

In April 2024, Roquette Pharma Solutions expanded its LYCAGEL® range with a new hydroxypropyl pea starch excipient, supporting sustainable, vegetarian, and vegan softgel formulations. The innovation will be showcased at Vitafoods Europe 2024 in Geneva.

In August 2024, Al Ghurair Foods initiated construction of a Corn Starch Manufacturing Plant in KEZAD, Abu Dhabi, targeting the production of native and modified starches, glucose syrups, and maltodextrin to boost local food production and UAE food security.

In June 2024, Omnia Europe SA announced expansion plans for specialty starches and sweeteners, including a Modified Waxy Food Starches facility (completion by Q4 2024) and upcoming production of Polyols and Dextrose Monohydrate by Q1 2026.

Industry Trends:

The modified starch market is expanding due to rise in demand for modified starch in food, pharmaceutical, paper, and textile industries. Governments promoting food security and agricultural development are driving growth. For example, India’s National Food Processing Policy and subsidies on maize and cassava cultivation boost domestic starch production. Similarly, the U.S. Department of Agriculture (USDA) reports indicate increasing corn production, supporting the market for modified starch as a key ingredient in food processing, including as a thickening, stabilizing, and gelling agent.

Health-conscious consumer trends are also shaping the market, with a preference for clean-label and gluten-free products. The European Union's Regulation (EU) No 1169/2011 on food labeling has led manufacturers to adopt modified starches as alternatives to synthetic additives. This demand is further propelled by government-backed research into non-GMO and organic starch sources, driving innovation in the market. As a result, modified starches are increasingly used in processed foods, convenience meals, and functional foods.

- In the industrial sector, the paper and textile industries utilize modified starch as a coating and sizing agent. The Made in China 2025 policy, emphasizing technological advancement in manufacturing, has increased the use of modified starch in paper production. Government initiatives focusing on eco-friendly production processes are also boosting the adoption of modified starch in biodegradable packaging and sustainable textile processing.

- Government Incentives for Promoting the Utilization of Modified Starch:

- In the U.S., the Food and Drug Administration (FDA) Regulation 21 CFR Part 172.892 permits the use of modified food starch in various food products, ensuring safety for consumption. The USDA's BioPreferred Program (2002 Farm Bill, Section 9002) promotes bio-based products, including modified starches, to reduce reliance on petroleum-based materials. In addition, the USDA Agricultural Research Service (ARS) invests in research to develop high value uses for starch, enhancing its application in food, pharmaceuticals, and industrial sectors.

- Canada's Food and Drug Regulations (SOR/2016-305, Division 16) govern the use of food additives, including modified starches, in various food products, emphasizing safety standards. The Canadian Agricultural Partnership (CAP) provides funding and support for the agriculture and agri-food sector, promoting the production of starch-rich crops like corn and potatoes. This indirectly benefits the modified starch market by boosting raw material availability and promoting innovation in starch modification techniques.

- The European Union's Regulation (EC) No 1333/2008 on food additives sets standards for using modified starches in food processing, ensuring consumer safety. The Common Agricultural Policy (CAP) encourages the cultivation of starch-rich crops, providing subsidies that support the starch industry. Moreover, the EU’s Horizon Europe (Regulation (EU) 2021/695) research framework funds projects for developing bio-based materials, including modified starches, to foster sustainability and innovation.

- In India, the National Food Processing Policy promotes agro-based industries, including starch production, by providing incentives and subsidies. The Food Safety and Standards Authority of India (FSSAI) Regulations (2011) govern the use of modified starches as food additives. In China, the National Key Research and Development Program supports biotechnology, driving research into modified starch production for food, pharmaceuticals, and bio-based materials, aligning with the country’s focus on sustainability and food security.

Modified Starch Market, by Raw Material Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.4 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 570 |

| By Raw Material |

|

| By Type |

|

| By Function |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cargill, Incorporated, Tereos, Tate & Lyle PLC, EMSLAND GROUP GmbH & Co. KG, ADM, AVEBE U.A., Royal Ingredients Group, AGRANA Beteiligungs-AG, Ingredion Incorporated., Roquette Freres |

Analyst Review

The modified starch market has experienced significant growth in recent years and is expected to continue to expand. Factors such as the rise in demand for convenience foods, change in dietary patterns, and the need for functional ingredients in various industries (including food, pharmaceuticals, and textiles) drive the market growth. Moreover, consumers have become more conscious of the ingredients used in their food products. A surge in preference has been witnessed for clean label products that contain natural and minimally processed ingredients. In response, many companies focus on offering modified starch derived from natural sources and ensure transparency in labeling and meeting the demands of health-conscious consumers

Furthermore, CXOs added that sustained economic growth coupled with rapid development of pharmaceutical, personal care & cosmetics, and food & beverage sector may lead the modified starch market to witness a significant growth.

Escalating demand from food and beverage sector and robust demand for clean labels are the upcoming trends in the global modified starch market.

Food and beverages is the leading application of modified starch market.

Asia-Pacific is the largest regional market for modified starch.

The modified starch market was valued for $9.0 billion in 2022 and is estimated to reach $14.4 billion by 2032, exhibiting a CAGR of 4.9% from 2023 to 2032

ADM, AGRANA Beteiligungs-AG, AVEBE U.A., Cargill, Incorporated, EMSLAND GROUP GmbH and Co. KG, Ingredion Incorporated., Roquette Freres, Royal Ingredients Group, Tate and Lyle PLC, Tereos are the top companies to hold the market share in the modified starch market.

Loading Table Of Content...

Loading Research Methodology...