Monocrystalline Silicon Wafer Market Statistics - 2032

The global monocrystalline silicon wafer market was valued at $10.9 billion in 2022 and is projected to reach $20.1 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

A monocrystalline silicon wafer is a pure form of silicon that has been processed to have a particular electrical charge and orientation. It serves as the building block for the silicon-based discrete components and integrated circuits found in almost all contemporary electronic devices. These wafers are used in a variety of electronic devices, including solar cells, integrated circuits, and other semiconductor devices. Monocrystalline silicon is also used as a photovoltaic, light-absorbing material in the production of solar panels. To create monocrystalline silicon wafers, a metal binder such as ferricyanide or sodium silicate is used to bond a silicon crystal structure to an electric phase. After mixing silicon with an appropriate binder, a wafer can be created.

![]()

The major advantage is that monocrystalline silicon wafers is that they are more effective than polycrystalline cells because they contain a single silicon crystal, which gives electrons more freedom to travel around and produce an electrical current.

One of the important drivers of the monocrystalline silicon wafer industry is the increased demand for solar energy. The demand for solar energy is rising quickly as people and businesses look to cut their carbon footprint and switch to more sustainable energy sources. Monocrystalline silicon wafers are widely used in solar panels. These wafers are highly efficient in converting sunlight into electricity, which is why they are the most preferred choice of material for solar cells. The demand for solar energy is being driven by several factors, including concerns about climate change, energy security, and the rising cost of traditional sources of energy.

The increasing demand for electronics is also driving the growth of the monocrystalline silicon wafer industry, as monocrystalline silicon wafers are widely used in the production of electronic devices such as microchips, LEDs, and sensors. Monocrystalline silicon wafers are widely used in the production of electronic devices because of their high purity, high uniformity, and excellent electrical properties. Moreover, the growing demand for electronics continues to drive the growth of the market through certain factors such as the advancement of the Internet of Things (IoT), increasing use of artificial intelligence (AI) in various industries, and the growing popularity of electric vehicles.

On the other hand, monocrystalline silicon wafers involve several steps, including cell fabrication, polysilicon production, and ingot and wafer production. The production of high-quality monocrystalline silicon wafers requires specialized equipment and expertise, which can be costly and difficult to obtain. This technology requires skilled technicians and engineers who are familiar with the process and can adjust as needed, and also ensure that the crystal grows properly. Separately, the increase in the adoption of industrial automation creates opportunities for the monocrystalline silicon wafer market. Monocrystalline silicon wafers offer a high level of purity and consistency, which makes them ideal for use in the production of highly reliable and precise components.

Segmentation Overview

The monocrystalline silicon wafer market is segmented into Type, Sales Channel, and Application.

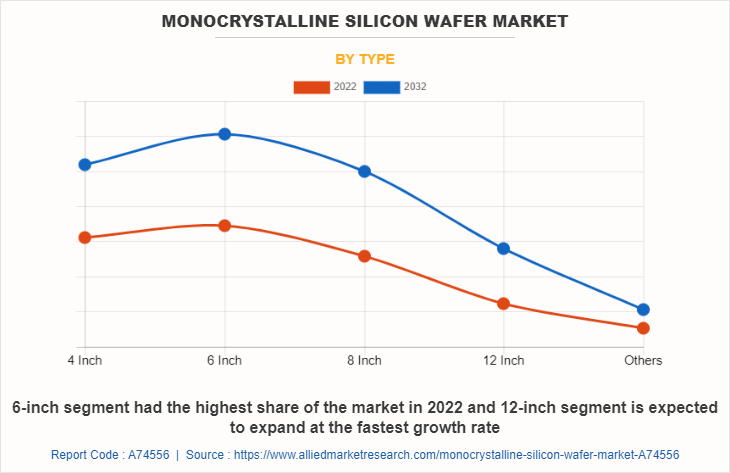

Based on type, the monocrystalline silicon wafer market share is classified into 4-inch, 6-inch, 8-inch, 12-inch, and others. The market was dominated by the 6-inch segment in 2022, whereas the 12-inch segment is expected to witness a higher growth rate during the forecast period. The popularity of 6-inch monocrystalline silicon wafers is primarily driven by their use in the fabrication of integrated circuits and other micro devices, as well as in solar panels in the renewable energy industry.

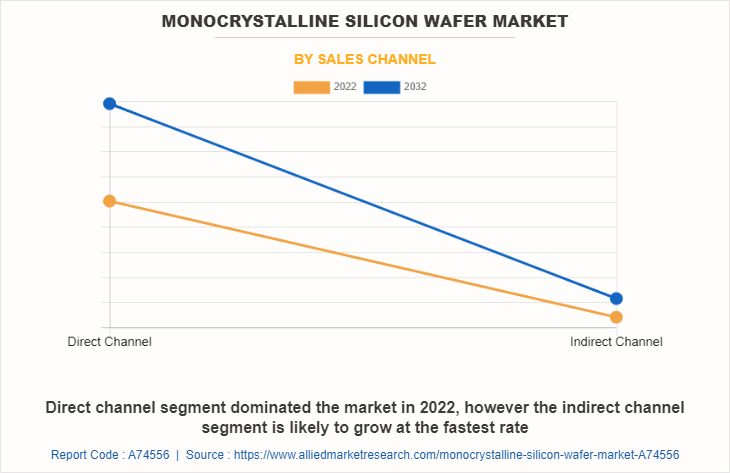

Based on sales channel, the monocrystalline silicon wafer market growth is classified into direct channel and indirect channel. The market was dominated by the direct channel segment in 2022, which is also expected to witness a higher growth rate during the forecast period. The direct channel segment of the monocrystalline silicon wafer market is an important part of the market, driven by the need for cost savings and greater supply chain control.

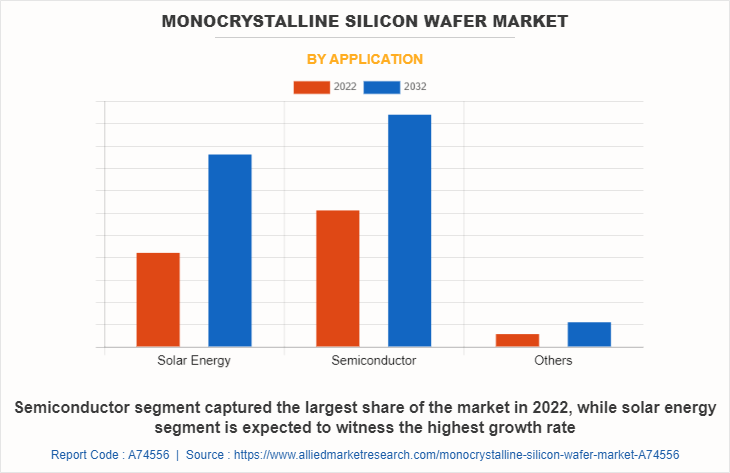

Based on application, the monocrystalline silicon wafer market analysis is classified into solar energy, semiconductor, and others. The market was dominated by the semiconductor segment in 2022, whereas the solar energy segment is expected to witness a higher growth rate during the forecast period. The increasing demand for renewable energy sources and the adoption of solar power as a sustainable energy solution are expected to drive the use of monocrystalline silicon wafers in making solar panels. Furthermore, the industry is a hotbed of innovation, with new types of technologies and equipment released frequently. This focus on research and development is also expected to be a major driver of the monocrystalline silicon wafer market.

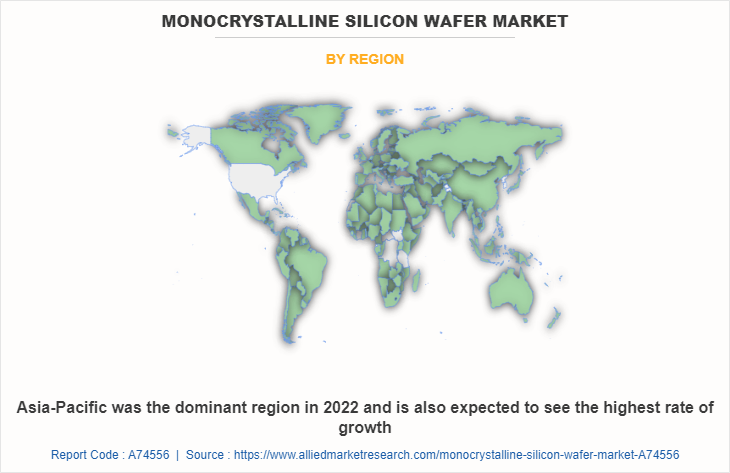

By region, the monocrystalline silicon wafer market forecast is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The market was dominated by Asia-Pacific in 2022 and is also expected to expand at the highest rate during the forecast period. A major advantage that can be attributed to the Asia-Pacific region is that there are many developing countries in the region, and hence, many fast-growing companies that are picking up advanced technology.

Competitive Analysis

Competitive analysis and profiles of the major monocrystalline silicon wafer market players that have been provided in the report include LONGi New Energy, Comtec Solar, Siltronic, MCL Electronic Materials Co., Ltd., Shin-Etsu Chemical, GRINM Semiconductor Materials Co., Ltd., Pure Wafer, Addison Engineering, SUMCO Corporation, and Ming Hwei Energy. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration, and business expansion to increase their market share in the global monocrystalline silicon wafer market during the forecast period.

Top Impacting Factors

Some of the significant factors impacting the global monocrystalline silicon wafer market trends include their significant requirement in the electronics industry sector. The monocrystalline wafer is commonly used in the electronics industry to make a variety of electronic components, including solar cells, integrated circuits, and microprocessors. They are primarily required in the electronics industry because they are highly prized for their purity and uniformity. Solar energy is another sector where monocrystalline silicon wafers are used significantly, especially as the usage of solar energy itself is increasing. However, geopolitical factors that impact the monocrystalline silicon wafer market, such as trade disputes, tariffs, or restrictions on the export of certain materials, can disrupt supply chains and increase costs for manufacturers. On the other hand, technological developments in the industry present a significant opportunity to players in the market during the forecast period.

Historical Data & Information

The monocrystalline silicon wafer market overview is that it is a fairly competitive market, owing to the strong presence of existing vendors. Market vendors are expected to gain a competitive advantage over their competitors because they can cater to market demands with a wide range of products. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies are adopted by key vendors.

Key Developments/Strategies

LONGi Green Energy Technology, Siltronic AG, Pure Wafer, SUMCO Corporation, and Shin-Etsu Chemical are among the top companies that hold a prime share in the monocrystalline silicon wafer market. Top market players have adopted various strategies, such as agreements and acquisitions, to expand their foothold in the monocrystalline silicon wafer market.

- In January 2023, LONGi Green Energy Technology signed an investment agreement with the local government of Shaanxi province to manufacture 100 GW of monocrystalline silicon wafers and 50 GW of monocrystalline cells.

- In October 2022, Siltronic AG, one of the world’s largest silicon wafer manufacturers, signed a EUR 200m financing agreement with the European Investment Bank to support the development of the next generation of silicon wafers.

- In November 2021, Pure Wafer acquired Noel Technologies. Noel Technologies is a Silicon Valley-based process development and fabrication services provider that supports the world’s top semiconductor integrated device manufacturers (IDMs), semiconductor original equipment manufacturers (OEMs), and fabless semiconductor companies.

- In October 2021, Japan’s Sumco spent JPY 228.7 billion (US$ 2.05 billion) to step up production of the state-of-the-art 300 mm silicon wafers for semiconductors. The investment bolsters the competitiveness of Japan’s chip-making materials sector, which continued to thrive even as the country’s semiconductor and home electronics industries have faded.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the monocrystalline silicon wafer market from 2022 to 2032 to identify the prevailing monocrystalline silicon wafer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the monocrystalline silicon wafer market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global monocrystalline silicon wafer market trends, key players, market segments, application areas, and market growth strategies.

Monocrystalline Silicon Wafer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.1 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 281 |

| By Type |

|

| By Sales Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | MCL Electronic Materials Co. Ltd., Addison Engineering, Ming Hwei Energy, GRINM Semiconductor Materials Co. Ltd., Comtec Solar, LONGi New Energy, Shin-Etsu Chemical, Siltronic, SUMCO Corporation, Pure Wafer |

Analyst Review

Technological developments will play an important role in the monocrystalline silicon wafer market. The market for monocrystalline silicon wafers market is expected to grow significantly in the coming years. The growth is being driven by several factors, including the rising demand for electronics, such as smartphones, laptops, and smart home devices.

Advancements in technology, such as the development of passivated emitter and rear cell (PERC) technology is a recent innovation that has significantly improved the efficiency of solar cells. PERC cells have a passivation layer on the rear surface of the solar cell, which reduces the recombination of electrons and holes and increases the cell's efficiency. PERC solar cells are modified conventional cells that enable the cells to produce 6 to 12 percent more energy than conventional solar panels. PERC technology requires high-quality monocrystalline silicon wafers with a low defect density, making it a driving factor for the monocrystalline silicon wafer market.

The monocrystalline silicon wafer market is also expected to receive a particular boost in the Asia-Pacific region, as the entire region invests heavily in solar energy, as well as manufactures a large share of semiconductors. Within this region, the developed countries such as China, Japan, and South Korea are expected to account-for large shares of the market. Certain developing countries such as India are also expected to increase their importance in the monocrystalline silicon wafer market due to their increase in demand for the product.

The global monocrystalline silicon wafer market size is expected to reach $20,073.6 million in 2032, from $10,856 million in 2022, growing at a CAGR of 6.37% from 2022 to 2032.

6-inch segment was the leading type of monocrystalline silicon wafer in 2022

Semiconductor segment was the leading application of monocrystalline silicon wafer in 2022

Asia-Pacific was the leading region of monocrystalline silicon wafer in 2022

The key players operating in the Monocrystalline silicon wafer market are LONGi New Energy, Comtec Solar, Siltronic, MCL Electronic Materials Co. Ltd., Shin-Etsu Chemical, GRINM Semiconductor Materials Co. Ltd., Pure Wafer, Addison Engineering, SUMCO Corporation, and Ming Hwei Energy.

Loading Table Of Content...

Loading Research Methodology...