Multi-Cloud Networking In Fintech Market Research, 2031

The global multi-cloud networking in fintech market was valued at $362.3 million in 2021, and is projected to reach $1.9 billion by 2031, growing at a CAGR of 18.2% from 2022 to 2031.

Multi-cloud networking has enabled businesses to access a cost-effective solution for data storage and sharing options, with added benefits of secure storage, interoperability, and scalability. For the fintech sector, this comes with the added benefit of being able to operate across platforms/apps and also the ability to create customized experiences for clients across the globe. Moreover, multi-cloud networking in fintech helps to simplify organizational processes and increase accountability.

The increase in deployment of cloud service providers (CSPs), the rise in the adoption of multi-cloud networking in fintech, and the need for disaster recovery and contingency plans boost the growth of multi-cloud networking in fintech industry. However, the lack of a skilled workforce and the complexity in redesigning the network for the cloud hampers the multi-cloud networking in fintech market growth. On the contrary, the rise in the number of small- and medium-sized enterprises is expected to offer remunerative of multi-cloud networking in fintech market during the forecast period.

The multi-cloud networking in fintech market is segmented into Component, Enterprise Size and Cloud Type.

Segment Review

Multi-cloud networking in fintech market opportunity is segmented on the basis of component, enterprise size, cloud type, and region. On the basis of component, the market is categorized into solution and service. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. On the basis of cloud type, it is classified into public and private. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

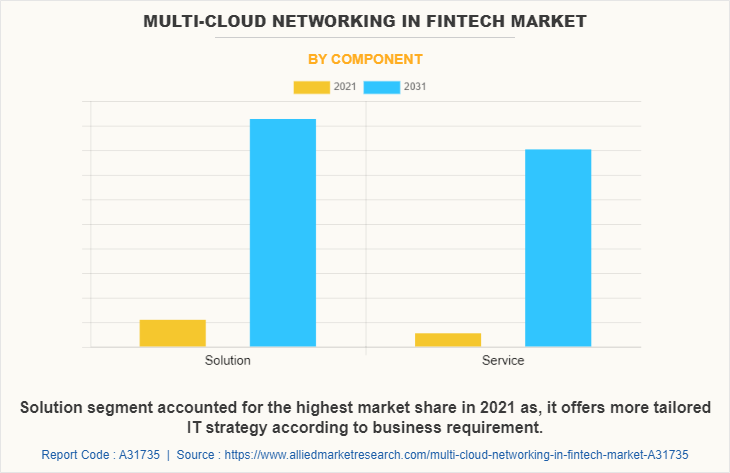

In terms of component, the solution segment holds the highest multi-cloud networking in fintech market share as it provides personalized services, accelerates throughput, and reduces operational costs. However, the service segment is expected to grow at the highest rate during the forecast period. It helps to manage concerns efficiently with personalized assistance and optimized performance development.

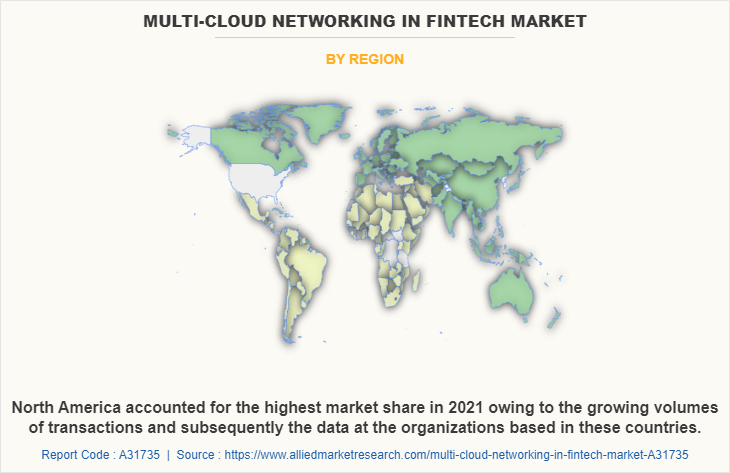

Region-wise, the multi-cloud networking in fintech market size was dominated by North America in 2021, owing to its high concentration of cloud and security vendors such as Microsoft Corporation, Cisco Systems, Inc., and Broadcom Inc. Asia-Pacific is also expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region.

The key players that operate in the multi-cloud networking in fintech market outlook are Aviatrix, VMware, Inc., Oracle Corporation, F5, Inc. Cisco System Inc., Nutanix, Cloudflare, Inc., Juniper Networks, Inc, Citrix Systems, Inc, and Versa Networks, Inc.These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities

Multi-cloud networking is the use of multiple cloud computing and storage services in a single network architecture; it can be all private, all public, or a combination of both. It is widely adopted by enterprises and organizations as it is more beneficial than traditional cloud models and provides more enhanced features. Furthermore, it includes virtual services such as software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS). Moreover, leading cloud providers such as Alibaba Cloud and AWS come with AI and ML integrations for predictive analysis of fintech data. They offer a highly secure cloud platform with advanced architecture. They also provide a suite of tailored services that help organizations to deliver an awesome customer experience.

Furthermore, cloud services help save costs and provide greater capacity related to server-based applications. Another scope of cloud computing in banking and fintech is that it helps banks to mitigate risk related to redundancy, capacity, and resiliency. It is competent in quickly identifying various threats and vulnerabilities. Moreover, migration to the cloud enables banks to relocate resources from IT administration and becomes more prolific and flexible in their internal and external processes. Furthermore, cloud computing in banking and Fin-Tech decreases all the capital expenditure of buying and setting up hardware and software at data centers.

Cloud-based answers present banks with more extensive space for transformation and satisfying the requirements of customers. For instance, in September 2022, Jack Henry a leading provider of technology solutions for the financial services industry, collaborated with Google Cloud to enable a next-generation technology strategy focused on helping the community and regional financial institutions innovate faster as per the evolving needs of account holders.

End-user Adoption

With an increase in competition, major market players have started acquiring companies to expand their market penetration and reach. For instance, in January 2021, F5 acquired Volterra, a multi-cloud management startup. Through this acquisition, F5 aimed to further advance its adaptive applications strategy through an Edge 2.0 platform provided by Volterra to address complicated multi-cloud reality enterprise customers’ experiences. Similarly, in February 2022, Juniper Networks acquired WiteSand, a zero-trust security start-up. Following this acquisition, the company aimed to integrate the access control technology of WiteSand into its Mist network management platform. Moreover, in September 2021, F5 acquired Threat Stack, a leading cloud security and workload protection company. Following this acquisition, the company aimed to incorporate cloud security expertise and capabilities of Threat Stack into the application and API protection solutions of F5 to facilitate for customers to adopt constant and reliable security across any cloud. For instance, in August 2022, Laurentian Bank of Canada partnered with IT infrastructure service provider Kyndryl to launch a new cloud landing zone for the Bank, leveraging cloud platforms such as Microsoft Azure. In addition, the new environment will allow the digital services offered by the Bank to operate efficiently and securely.

Due to technological advancements across the world and the rise in demand for multi-cloud networking in fintech, various companies have expanded their current product portfolios and innovations with increased diversification among customers. For instance, in June 2021, Huawei launched its all-new financial cloud-network solution designed to enable financial institutions to build a "stable and high-speed" bimodal architecture. The end goal is to accelerate service innovation, deliver secure and reliable financial services, and lay the cornerstone of connectivity for intelligent finance. With rise in demand for multi-cloud networking in fintech, various companies have established alliances to increase their capabilities; for instance, in September 2021, Citrix partnered with Nutanix, an American cloud computing company. Under this partnership, Nutanix would help Citrix in deployments of hybrid and multi-cloud. Moreover, the Nutanix Cloud Platform would offer an appropriate environment in order to support desktop services and virtual apps of Citrix within a hybrid multi-cloud capacity.

Moreover, with the rise of innovative services such as Internet finance and inclusive finance, the financial services industry has gradually entered a new era defined by all-scenario intelligent finance. According to the China Banking Industry Service Report 2020 released by the China Banking Association, the number of contactless transactions exceeded 370 billion, the off-counter banking transaction rate reached 90.88%, and a myriad of financial services such as personal credit service all went online. Many government agencies are prioritizing multi-cloud adoption to secure data and protection. For instance, in April 2022, according to a survey by VMware (the study was based on 500 agency leaders and IT decision-makers at federal, state, and local governments in the United States and Canada), 74% of respondents choose cloud providers to prioritize security, and 57% of agencies are concerned about data security as they increase cloud adoption. In addition to security, agencies also prioritize lower total cost (67%), interoperability of applications (66%), ease of use (66%), agency contracting equity goals (63%), and regulatory compliance (58%) when searching for cloud providers. Smart agencies are moving to multi-cloud networking, which the study claims a new reality for government agencies.

Government Regulations

All well-governed industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are increasing adoption of multi cloud networking in fintech heavily influenced by COVID-19. In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable for data that are involved in their operations. For instance, the Gramm-Leach-Bliley Act not only covers banks, but also securities firms, and insurance companies, and companies providing many other types of financial products and services. For instance, in March 2022, U.S. and European Commission announce New Trans-Atlantic Data Privacy framework to put in place new safeguards to ensure that signals surveillance activities are necessary and proportionate in the pursuit of defined national security objectives. Furthermore, the GDPR act imposed by the European Government mitigates the risk of cyber security and any potential data breaches. Emerging countries of Asia-Pacific are developing stringent regulations, which comprise privacy, government regulatory environment, and intellectual property protection. For instance, the Cybersecurity Bill established in Singapore encouraged multiple organizations in the country to manage the massive volume of data.

Top Impacting Factors

Increasing Deployment of Cloud Service Providers (CSPs)

As more organizations move to the cloud, they need to be proactive in securing their cloud applications, and multi-cloud networking in fintech provides a comprehensive level of visibility, compliance, and data security for the cloud transformation of the organization. Moreover, due to the explosive rate of enterprises moving toward the use of cloud service providers (CSPs), organizations are seeking new methods and best practices to implement security controls in cloud environments. In addition, many key players are enhancing their services to provide security for sensitive enterprise information. For instance, in February 2022, F5 launched application security and delivery offerings, a range of solutions built on distributed cloud services for more security. The goal is to streamline security and bring automation within processes to allow application teams to focus on the delivery of functionality and features to improve customer experience. Such factors are anticipated to fuel the growth of multi-cloud networking in the fintech market in the near future.

Rise in Adoption of Multi-cloud Networking in Fintech

The rise in adoption of multi-cloud network solutions in fintech and increasing concerns regarding cloud security have directly influenced the growth of cloud computing in the fintech market. Furthermore, enhanced overall customer experience, along with lower operational expenses, are also positively impacting the growth of multi-cloud networking in fintech market. Moreover, the growing preference for convergent billing systems and the growing use of multi-cloud networks in the telecom industry are also boosting the growth of the market.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of multi-cloud networking in fintech market forecast along with current trends and future estimations to explain the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on multi-cloud networking in fintech market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The multi-cloud networking in fintech market analysis from 2022 to 2031 is provided to determine the market potential.

Multi-Cloud Networking in Fintech Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.9 billion |

| Growth Rate | CAGR of 18.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 276 |

| By Component |

|

| By Enterprise Size |

|

| By Cloud Type |

|

| By Region |

|

| Key Market Players | Cloudflare, Inc., Nutanix, F5, Inc., Versa Networks, Inc., VMware, Inc., Cisco Systems Inc., Oracle Corporation, Aviatrix, Juniper Networks, Inc., Citrix Systems, Inc. |

Analyst Review

Multi-cloud networking is a cloud computing architecture in which an organization distributes applications and services across several clouds, which may include two or more private clouds, two or more public clouds, or a blend of public, private, and edge clouds. Furthermore, multi-cloud networking in fintech helps to avoid lock-ins with one vendor and also provides a high-speed low-latency infrastructure with better resilience.

The global multi-cloud networking in the fintech market is expected to register high growth as it expedites the next phase of digital transformation, businesses are leveraging multiple cloud services and platforms to speed up app transformation as well as the delivery of new applications. Thus, the increase in the adoption of cloud technology, owing to its security is one of the most significant factors driving the growth of the market. With the surge in demand for multi-cloud networking in fintech, various companies have established alliances to increase their capabilities. For instance, in February 2022, U.S. Bank Corporation partnered with Microsoft Corporation to create compelling, personalized, and leading-edge experiences. The transition to the cloud that improves the security of data, financial assets, and customer privacy by adding resiliency for the bank and strengthening technology risk management.

In addition, with further growth in investment across the world and the rise in demand for multi-cloud networking in fintech, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in August 2020, the Laurentian Bank of Canada partnered with Kyndryl for a new cloud landing zone, leveraging cloud platforms such as Microsoft Azure. With this new environment, the bank will have its digital services function efficiently and securely, which will in turn allow its customers to benefit from an optimal and seamless experience at all interaction touchpoints.

Moreover, with an increase in competition, major market players have started acquiring companies to expand their market penetration and reach. For instance, in December 2020 IBM acquired Expertus Technologies Inc to strengthen IBM Payments Centre capability in Canada and add further value to clients and the financial services industry.

The multi cloud networking in fintech market is estimated to grow at a CAGR of 18.2% from 2022 to 2031.

The multi cloud networking in fintech market is projected to reach $ 1929.62 million by 2031.

The increase in deployment of cloud service providers (CSPs), the rise in the adoption of multi-cloud networking in fintech, and the need for disaster recovery and contingency plans contribute toward the growth of the market.

The key players profiled in the report include Aviatrix, VMware, Inc., Oracle Corporation, F5, Inc. Cisco System Inc., Nutanix, Cloudflare, Inc., Juniper Networks, Inc, Citrix Systems, Inc, and Versa Networks, Inc.

The key growth strategies of multi cloud networking in fintech market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...