Multifamily Software Market Research, 2033

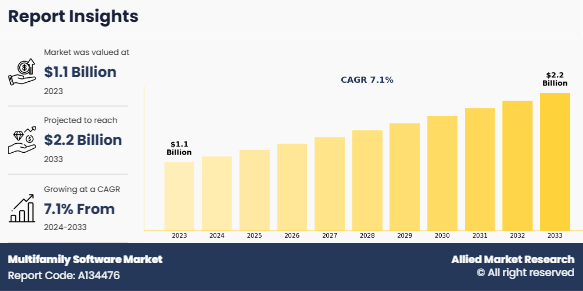

The global multifamily software market was valued at $1.1 billion in 2023, and is projected to reach $2.2 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033. Increasing demand for streamlined property management solutions and enhanced tenant experiences is driving the growth of the multifamily software market. This demand is fueled by the need for more efficient operations, better tenant engagement, and the ability to manage multiple properties with greater ease.

The multifamily software industry involves digital platforms and tools specifically designed to optimize the management, operations, and financial performance of multifamily residential properties, such as apartment complexes, condominiums, and co-living spaces. These software solutions cater to property managers, leasing agents, and owners, enabling them to efficiently handle key aspects of property management, including tenant screening, lease administration, rent collection, maintenance tracking, and financial reporting. Multifamily software leverages advanced technologies such as cloud computing, artificial intelligence (AI), and data analytics to provide real-time insights, automate routine tasks, and enhance decision-making capabilities. Tenant-centric features, such as online rent payment portals, self-service apps, and communication platforms, are integral to these solutions, offering an enhanced living experience while streamlining property management processes. The integration of Internet of Things (IoT) and smart home technologies further adds value by enabling energy management, security enhancements, and predictive maintenance. The market serves a diverse range of customers, including real estate developers, institutional investors, and property management firms, addressing their need for scalable, efficient, and compliant solutions. The growth of the market is driven by factors such as urbanization, rise in rental housing demand, and the digitization of the real estate sector. Despite challenges such as high implementation costs, data privacy issues, and complex regional regulations, the multifamily software industry continues to grow. This growth is driven by innovation and an increasing emphasis on sustainability, making the software an essential part of modern property management.

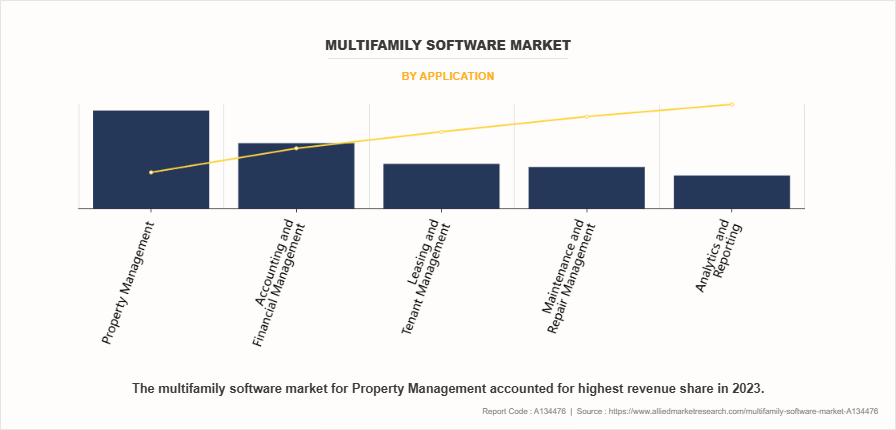

On the basis of application, the property management segment dominated the multifamily software market size in 2023 and is expected to maintain its dominance in the upcoming years as property management is a core function that affects every aspect of running multifamily properties. Property managers use software for essential tasks such as rent collection, lease tracking, and tenant communication, making it the most widely adopted application, which propels market growth significantly. However, the maintenance and repair management segment is expected to witness the highest growth in upcoming years, owing to increase in need for property managers to efficiently handle maintenance requests and keep properties in good condition. As tenants demand faster responses to maintenance issues and property owners look to reduce costs, the focus on effective maintenance management drives the growth of this segment.

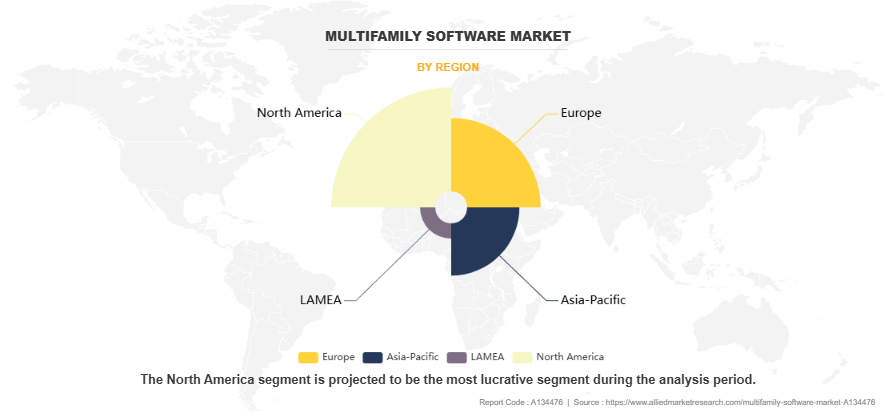

On the basis of region, North America attained the highest multifamily software market share in 2023, owing to the region’s advanced technology infrastructure, high adoption of technology, and advanced digital infrastructure. Property managers in North America have widely embraced software solutions to enhance operational efficiency and improve tenant satisfaction. On the other hand, LAMEA is projected to be the fastest-growing region for the multifamily software market size during the forecast period, owing to rapid urbanization, increase in investments in real estate, and rise in demand for modern property management tools. As more property developers in these regions look for ways to streamline operations, the need for multifamily software is set to rise quickly.

The report focuses on growth prospects, restraints, and trends of the multifamily software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the multifamily software market.

Segment Review

The multifamily software market is segmented on the basis of deployment type, application, end user, and region. On the basis of deployment type, the market is bifurcated into cloud based and on-premise. By application, it is divided into property management, accounting & financial management, leasing & tenant management, maintenance & repair management, and analytics & reporting. By end user, it is categorized into residential and commercial. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report analyzes the profiles of key players operating in the multifamily software market such as RealPage Inc., MRI Software LLC, AppFolio, Inc., Entrata, Inc., Rentec Direct, Yardi Systems, Inc, Zego (PayLease, LLC), Inhabit IQ, View the Space, Inc. and TenantCloud LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking-as-a-service market.

Competition Analysis

Recent Partnerships in the Multifamily Software Market

- On October 8, 2024, rental software platform 100 partnered with CLEAR, the secure identity company, to launch the Verified Renter Network. This strategic initiative follows 100's $5.2 million pre-seed funding round. The Verified Renter Network aims to simplify rental applications and improve the tenant screening process by incorporating advanced security measures. CLEAR's expertise in identity verification enhances the network’s ability to prevent fraud and ensure accurate applicant evaluation. By streamlining these processes, the partnership benefits both landlords and prospective tenants, reducing delays and creating a more secure rental ecosystem. This collaboration represents a significant step in leveraging cutting-edge technology for the multifamily rental market, addressing a growing need for efficient and trustworthy application processes. The partnership is expected to drive innovation in the multifamily software market and establish new benchmarks for security and convenience in tenant management.

- Furthermore, on June 18, 2024, ResidentIQ by Inhabit formed a partnership with Entryway, a nonprofit organization focused on training, employment, and housing solutions, in June 2024. ResidentIQ donated PropTech software, discounted packages, and consulting services to empower Entryway’s mission. This collaboration helps Entryway improve its operational capabilities and support its programs in multifamily housing. By leveraging ResidentIQ’s technology, Entryway can enhance its services, streamline internal processes, and expand its impact. The partnership also highlights the role of PropTech solutions in addressing societal challenges, such as affordable housing and employment. This initiative exemplifies how technology providers can contribute to meaningful social impact while showcasing the multifamily software market’s versatility. It further underscores the importance of community-driven partnerships in creating innovative solutions for underserved populations, aligning technological advancement with social responsibility.

Recent Product Launches in the Multifamily Software Market

On August 8, 2024, RealPage, the leading global provider of AI-enabled software platforms to the real estate industry, launched LOFT™, a fully integrated resident experience platform covering application, leasing, moving and living in one app, with over 30 property management companies (PMCs) and 200,000 units participating in the beta program announced in April. LOFT is built to streamline leasing, moving, payments and rewards, so that PMCs can level up their resident experience, boost efficiency, discover new revenue streams and drive retention and renewals.

Top Impacting Factors

Increasing demand for residential complexes

As urbanization continues to accelerate globally, more people are moving into cities in search of better job opportunities, amenities, and a higher standard of living. This shift has led to a rise in the need for multifamily residential units, such as apartment buildings, condominiums, and other large-scale housing complexes, to accommodate the growing population. Consequently, the demand for efficient and scalable property management solutions has surged. Managing these larger, more complex residential properties requires sophisticated software that streamline operations across various functions. Multifamily software solutions help property owners and managers address the complexities of managing multiple units, including leasing, tenant management, maintenance tracking, billing, and financial reporting. As the size and scale of these housing developments grow, manual management methods become increasingly inefficient and prone to error, necessitating the adoption of automated software systems to keep operations running smoothly. Furthermore, the rapid growth of multifamily housing developments has increased competition among property managers, requiring them to find innovative ways to stand out and offer better services to tenants. Multifamily software facilitates this by offering tools for improving tenant communication, ensuring prompt maintenance services, and managing online rental payments. This increased efficiency and better tenant experience further drive the adoption of such software. Moreover, with the rise of multifamily properties, particularly in urban centers, developers, property managers, and owners face greater pressures to optimize their operations and ensure profitability. Multifamily software equips property managers with the tools needed to make informed, data-driven decisions on key factors such as rent pricing, occupancy rates, and maintenance scheduling. These decisions directly influence a property's financial performance and overall efficiency. As the demand for residential complexes continues to rise, the need for these software solutions has grown, making them essential for effective and streamlined property management in today’s competitive market.

Increasing need of automation and streamlining operations

As property management becomes more complex, with larger portfolios, diverse tenant needs, and extensive operational tasks, automation offers a solution to manage these challenges more efficiently. Traditional property management methods, which rely heavily on manual processes such as paper-based recordkeeping, phone calls, and in-person interactions, are time-consuming and prone to human error. Traditional methods are no longer scalable as properties grow in size and the demands of tenants increase. Multifamily software simplifies property management by automating essential tasks such as lease management, rent collection, maintenance coordination, and financial reporting. This automation eases the workload of property managers and improves operational efficiency, enabling them to manage a larger number of properties with fewer resources. For instance, automated rent collection systems ensure that payments are processed on time, while maintenance requests are tracked and assigned to appropriate personnel automatically, leading to faster response times and improved tenant satisfaction. The demand for automation is also driven by the growing expectation for real-time information. With multifamily software, property managers are able to access up-to-date data on occupancy rates, revenue, and maintenance issues, helping them make quicker, more informed decisions. This level of efficiency is crucial in a competitive market, where delays or errors in managing day-to-day operations lead to lost revenue and tenant dissatisfaction. In addition, as property managers seek to optimize costs and improve profitability, automation plays a crucial role in reducing overhead. Multifamily software reduces the need for manual labor and minimizes the risks associated with human error by streamlining operations, ultimately leading to cost savings. As the need for automation continues to grow in property management, multifamily software has become an indispensable tool for enhancing productivity and meeting tenant expectations, further driving market expansion. For instance, in January 2023, Union, a multifamily property technology company, launched the first comprehensive centralized leasing software and support solution to enable sophisticated remote management of multifamily communities. Union transforms the traditional leasing operational model to solve for staffing shortages, a consumer shift to self-service, and a need for specialized operations.

Digital transformation

Property owners and managers are increasingly acknowledging the benefits of digital tools, including improved operational efficiency, cost reductions, and higher tenant satisfaction. As a result, the demand for software solutions that simplify property management tasks has risen. The digital transformation in property management enables the automation of essential functions such as lease management, rent collection, maintenance tracking, and financial reporting, significantly minimizing manual effort and the chances of errors. Rise in awareness of digital tools is particularly impactful as the industry shifts from traditional, paper-based methods to more advanced, tech-driven approaches. Property managers are now more inclined to adopt software solutions that help them stay competitive, reduce operational costs, and provide better services to tenants. For example, multifamily software offers tools for online rent payments, automated tenant communications, and real-time maintenance management, all of which contribute to a smoother, more efficient operation. The shift is even more important as tenant expectations rise, with many seeking modern, digital experiences similar to those found in other industries. Moreover, as the benefits of digitization become more apparent, the multifamily software market has an opportunity to expand beyond traditional property managers to include a wider range of stakeholders, such as real estate developers, investors, and asset managers. These groups are increasingly looking for data-driven insights to make informed decisions regarding property investments and portfolio management. Multifamily software that offers analytics, reporting, and predictive tools meet this demand, providing valuable insights into occupancy rates, rent pricing trends, and property maintenance needs.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the multifamily software market forecast from 2023 to 2033 to identify the prevailing multifamily software market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth multifamily software market demand for segmentation to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global multifamily software market growth.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global multifamily software market trends, key players, market segments, application areas, and market growth strategies.

Multifamily Software Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.2 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 277 |

| By End User |

|

| By Application |

|

| By Deployment Type |

|

| By Region |

|

| Key Market Players | View the Space, Inc., Yardi Systems, Inc, Entrata, Inc., TenantCloud LLC., MRI Software LLC, RealPage Inc., Rentec Direct, AppFolio, Inc., Inhabit IQ, Zego (PayLease, LLC) |

Analyst Review

The multifamily software market is a vital segment of the property technology (PropTech) industry, delivering advanced digital solutions for the efficient management of multifamily residential properties such as apartment complexes, condominiums, and other multi-tenant housing units. This market is growing rapidly as property managers and owners increasingly adopt technology to streamline operations, enhance tenant satisfaction, and optimize financial performance. It is designed to handle complex processes such as tenant screening, lease management, rent collection, maintenance tracking, and financial reporting. These solutions leverage innovative technologies such as cloud computing, artificial intelligence, and data analytics to automate tasks, provide real-time insights, and improve decision-making. The demand for multifamily software is driven by urbanization, growth in rental housing market, and the need for efficient property management solutions in an increasingly competitive environment. Multifamily software enables property managers and owners to reduce operational inefficiencies, improve tenant engagement, and ensure regulatory compliance. Modern software solutions are transforming the tenant experience and elevating property management standards by integrating mobile platforms, self-service tenant portals, and smart home features. Key players in the multifamily software market differentiate themselves by offering customizable, scalable solutions with robust features such as online rent payment systems, real-time maintenance tracking, and advanced analytics for financial reporting. These capabilities empower property management firms and developers to manage large portfolios seamlessly and maximize profitability. The software supports customer relationship management (CRM), enabling companies to attract and retain tenants effectively.

Despite the market's strong growth trajectory, challenges remain. High implementation costs, concerns about data security, and resistance to adopting new technologies among traditional operators pose restrain in market growth. However, as digital transformation continues to reshape the real estate sector, these challenges are addressed through innovative solutions and increased industry awareness. As the need for cutting-edge, technologically advanced property management systems grows, the multifamily software industry is expected to experience consistent expansion. Multifamily software has become an essential component of the changing real estate market by facilitating operational efficiency, improving tenant experiences, and boosting financial success. For instance, in June 2024, ResidentIQ® partnered with Entryway, to provide substantial in-kind donations of PropTech software, package discounts, and consulting services to enhance Entryway's daily operating functions and further advance its mission to facilitate training, employment, and housing through multifamily partners for program participants. donating PropTech software, offering package discounts, and providing consulting services to improve Entryway's operations. The aim is to support homeless and near-homeless individuals and families, nearly half of whom are families, while also helping meet the growing demand for entry-level workers in property management.

The Multifamily software Market is estimated to grow at a CAGR of 7.1% from 2024 to 2033.

The Multifamily Software Market is projected to reach $2.2 billion by 2033.

The Multifamily Software Market is expected to witness notable growth including the increasing need for automation and streamlining operations and increasing demand for residential complexes.

The key players profiled in the report include RealPage Inc., MRI Software LLC, AppFolio, Inc., Entrata, Inc., Rentec Direct, Yardi Systems, Inc., Zego (PayLease, LLC), Inhabit IQ, View the Space, Inc. and TenantCloud LLC.

The key growth strategies of multifamily software market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...