The global multispectral camera market size was valued at $1.9 billion in 2022, and is projected to reach $4.7 billion by 2032, growing at a CAGR of 9.4% from 2023 to 2032.

A multispectral camera is a kind of imaging device that records information not just at the visible light spectrum that is visible to the human eye, but also at numerous wavelengths across the electromagnetic spectrum. Thus, these cameras are able to view and capture data that is not visible to the human eye. Thermal imaging, night vision, and medical diagnostics can benefit from the ability to detect heat fingerprints through the use of infrared radiation. UV radiation: It is possible to utilize this to identify specific minerals, sunburns, and ozone depletion. In addition to being utilized in environmental research and plant health monitoring, near-infrared radiation can be used to see through haze and fog.

The multispectral camera market is segmented into Cooling Technology, End Use, Imaging Spectrum, Application and Platform.

Report Key Highlighters:

- The multispectral camera market is studied across more than 15 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2022-2032.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the multispectral camera market trends.

- The multispectral camera market share is moderately fragmented, with several players including Teledyne Digital Imaging Inc.; Leonardo DRS; Raytheon Technologies Inc (Collins Aerospace); HENSOLDT AG; SILIOS Technologies; JAI A/S, Telops Inc; L3Harris Technologies, Inc; Kappa optronics GmbH; Surface Optics Corporation. Key strategies such as contract, collaboration, expansion, agreement, partnership, and other strategies of the players operating in the market are tracked and monitored.

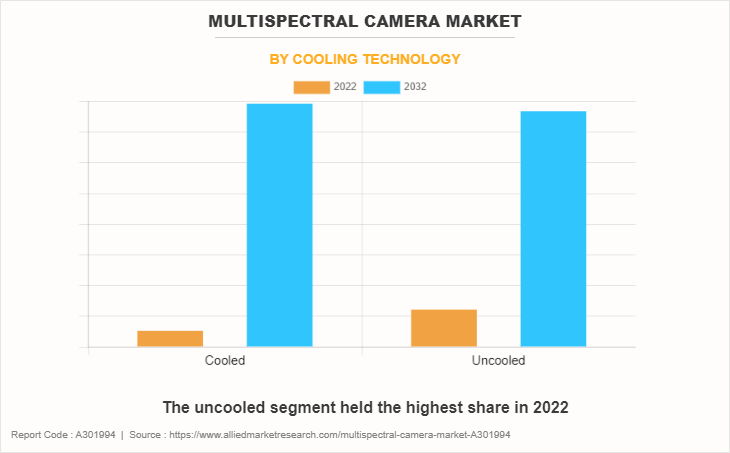

On the basis of cooling technology, the market is bifurcated into cooled and uncooled.

Factors like improved border security, counterterrorism and insurgency, marine security, and domestic production capabilities are driving the the global multispectral camera market demand. Nonetheless, regulations limiting their use in airplanes and their distribution over sensitive regions are among the barriers impeding the integration of multispectral cameras. Furthermore, these excellent cameras come at a hefty price. Thus, these are some of the challenges preventing the geographical expansion of the market.

Rise in Procurement of Multispectral Camera for Security & Surveillance

Multispectral cameras can provide defense forces with a revolutionary advantage in security and monitoring in this situation. These sophisticated sensors provide a more comprehensive image of the battlefield by capturing data at various wavelengths and penetrating through environmental barriers, darkness, and camouflage. Some of the examples of multispectral camera adoption are:

- In July 2023, Next-generation long-range reconnaissance pods with multispectral sensors were purchased by the US Army to improve target identification and situational awareness.

- In May 2023, Multispectral drones were used by the Indian Navy to detect threats and conduct real-time maritime surveillance on warships and coastal infrastructure.

- In February 2023, Multispectral displays installed on helmets were deployed by the British Army to enable soldiers to see through greenery and locate concealed enemy positions.

- In July 2023, to improve border security, US Customs and Border Protection granted a contract for 210 multispectral cameras.

- In June 2023, The Dubai Police Force for patrolling high-rise buildings and vital infrastructure deployed multispectral drones fitted with thermal imaging cameras.

Thus, the rise in adoption of multispectral cameras by the defense sector for security and surveillance applications is further contributing to the growth of the multispectral camera industry.

Asia-Pacific to Grow with the highest CAGR over the forecast period

Complex and diverse terrain, growing border security concerns, technological advancements, technological advancements, integration with AI and other sensors are some of the factors contributing toward the adoption of multispectral camera across the region. For instance, Multispectral drones have been used by the Indian Navy for threat identification and maritime surveillance on warships and coastal infrastructure. Multispectral cameras are another tool that the Indian Army is investigating for counterinsurgency and border security.

Similarly, The Chinese military is making significant investments in the development of both ground-based and aerial multispectral camera systems. Precision targeting, border security, and reconnaissance are just a few of the uses for these cameras. Additionally, multispectral cameras are being used by the Japan Self-protection Forces for maritime surveillance and coastal protection. They are also investigating the potential use of these cameras in search and rescue and disaster relief efforts. These cameras will have even greater capabilities and adaptability as technology progresses and integrates AI and more sensors. Thus, they are projected to contribute to a more stable and secure Asia-Pacific area by providing situational awareness, threat detection, and precise targeting.

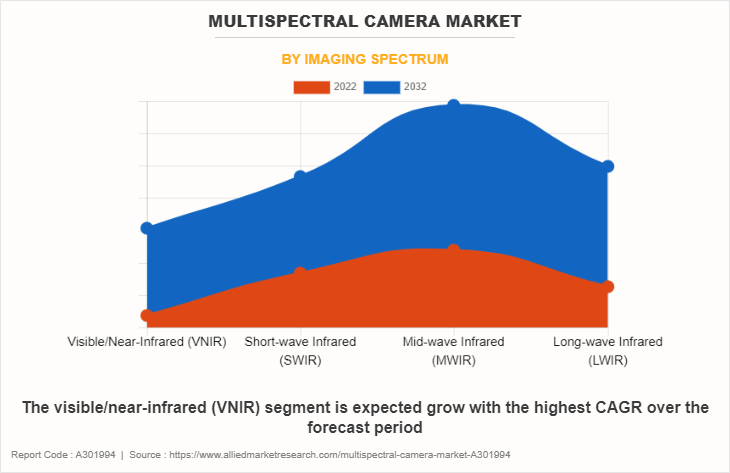

On the basis of imaging spectrum, the market is categorized into visible/near-infrared (VNIR), short-wave infrared (SWIR), mid-wave infrared (MWIR), and long-wave infrared (LWIR).

Challenges in Technology Adoption and Integration

Nevertheless, one of the obstacles preventing the integration of multispectral cameras is the existence of rules restricting the positioning of these cameras in airspace and their dispersion throughout sensitive areas. These quality cameras also have a high price tag. These, then, are some of the problems impeding the regional growth of the multispectral camera market.

Rise in Procurement of Advance Land, Air, Naval Vehicles

With the constant increase in the military spending across countries like U.S, Canada, UK, Germany, Russia, China, India, Brazil, Saudi Arabia, and Israel, the procurement of advanced land, air, and marine vehicles. For instance, some of the recent procurements are highlighted below:

- In January 2023, the US government announced the procurement of Abrams tanks for Ukraine to support the latter against the Russian attack.

- In June 2022, General Dynamics won a contract from the US army to build 42 light weighted tanks.

- In August 2023, The Indian army signed a contract for the procurement of 130 drones and 19 tank simulators for empowering their army.

These factors are thereby increasing the demand for advanced imaging systems for integrating the same in the vehicles for better targeting and tracking, thus, contributing to the growth of the market.

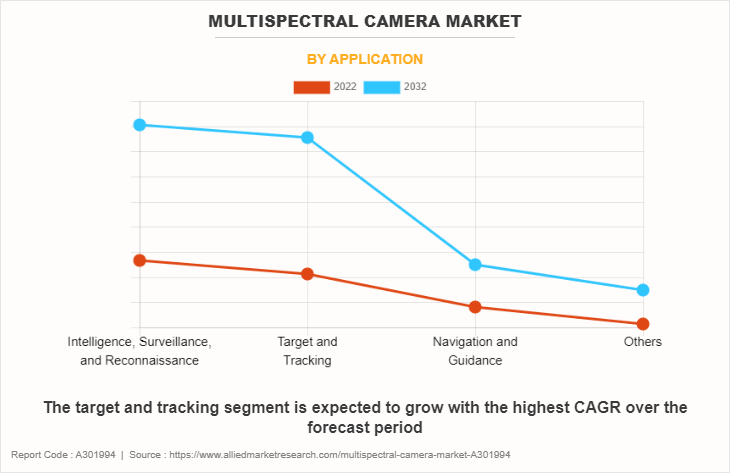

On the basis of application, the market is divided into intelligence, surveillance, and reconnaissance; target and tracking; navigation and guidance; and others.

North America includes the U.S., Canada, and Mexico. The factors contributing to the growth of the region includes constantly increasing military expenditure across the U.S and Canada. Both the countries are focused on procurement and integration of advanced technology across all its vehicles and weapons for empowering their army with the best top-class equipment across battlefields and for border security purposes domestically. In addition, the presence of major multispectral camera market players across the region and their rise in investment to develop new and advanced imaging devices including multispectral cameras are further contributing to the growth of the market over the years.

Impact of Russia-Ukraine War on Multispectral Camera Industry

On February 24, 2022, Russia initiated an invasion of Ukraine, marking a significant escalation in the ongoing Russo-Ukrainian War that commenced in 2014. Geopolitical tensions have the potential to disrupt economies globally, affecting investor confidence and financial markets. The fighting has increased the demand for improved border security and intelligence gathering. Due to their superior visibility through foliage and low light, multispectral cameras are becoming more and more in demand for the following applications: tracking military activities and troop movements; identifying and stopping cross-border infiltration; and evaluating damage to civilian areas and infrastructure. Multispectral camera technology has advanced quickly because of the war to meet the unique demands brought on by the war. This includes minimization and portability, facilitating the deployment of cameras in demanding the identification of targets and threats quickly and accurately.

On the basis of region, the market is segmented into North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Russia, Rest of Europe), Asia-Pacific (China, Japan, India. South Korea, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), and Middle East & Africa (Saudi Arabia, South Africa, UAE, Rest of Middle East & Africa)

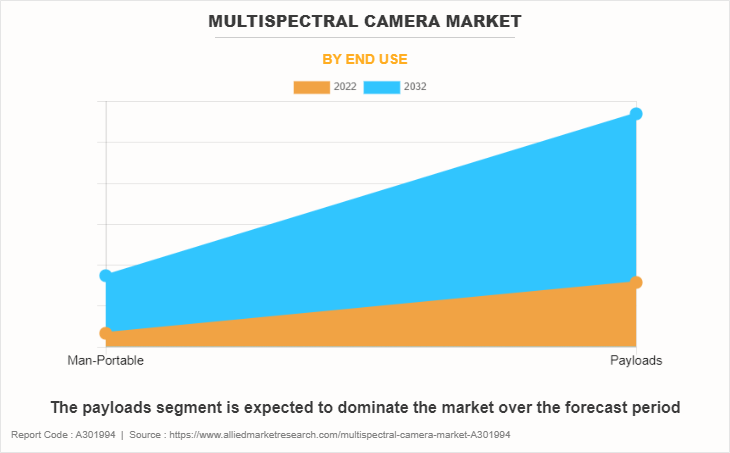

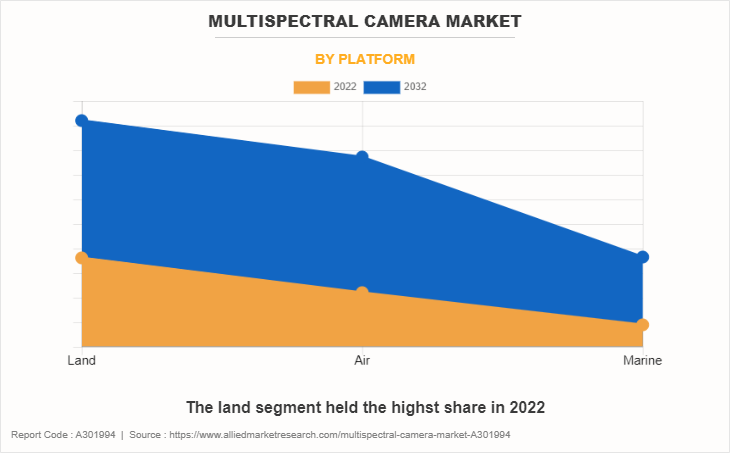

The global multispectral camera market is analyzed by cooling technology, end use, imaging spectrum, application, and platform. On the basis of cooling technology, the market is bifurcated into cooled and uncooled. On the basis of end use the market is segmented into man-portable and payloads. On the basis of imaging spectrum, the market is categorized into visible/near-infrared (VNIR), short-wave infrared (SWIR), mid-wave infrared (MWIR), and long-wave infrared (LWIR). On the basis of application, the market is divided into intelligence, surveillance, and reconnaissance; target and tracking; navigation and guidance; and others. On the basis of platform, the market is segmented into land, air, and marine.

Recent Developments in the Multispectral Camera Industry

- In October 2023, Leonardo DRS announced the launch of its new high-resolution EMIR-SR multispectral camera for aerial intelligence, surveillance, and reconnaissance (ISR) missions applications.

- In November 2023, The US Army awarded L3Harris Technologies a $51.6 million contract to supply Viper Long-Range Reconnaissance Pods (LRRP). Multispectral sensors are housed in these pods to improve intelligence gathering and long-range target identification.

- In December 2023, The French Army awarded Airbus Defense and Space a 90 million deal to deliver its EUROFLIR 410M multispectral targeting pods for use on Tiger attack helicopters. With their high-resolution visible and infrared imagers, these pods can identify targets and improve situational awareness in a variety of settings.

- In December 2023, EUROFLIR 410M/Airbus Defence and Space: The French Army's Tiger attack helicopters are equipped with this multispectral targeting pod, which was unveiled in December 2023. Its high-resolution visible and infrared imagers cut through difficult situations and identify threats with razor-sharp accuracy.

- In May 2023, Mitsubishi Heavy Industries (MHI) was given a contract by the Japan Maritime Self-Defense Force (JMSDF) to deliver 12 multispectral observation pods for its SH-60J Seahawk helicopters.

- In April 2023, Advanced multispectral cameras for border security purposes have been successfully developed and tested by India's Defence Research and Development Organization (DRDO).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the multispectral camera market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Multispectral Camera Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.7 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Cooling Technology |

|

| By End Use |

|

| By Imaging Spectrum |

|

| By Application |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Leonardo DRS, Kappa Optronics GmbH, surface optics corporation, Collins Aerospace, JAI A/S, SILIOS Technologies, L3Harris Technologies, Inc., Telops Inc,, Teledyne Digital Imaging Inc., HENSOLDT AG |

The size of the global multispectral camera market was valued at $1,940.9 million in 2022 and is projected to reach $4,714.8 million by 2032.

Teledyne Digital Imaging Inc.; Leonardo DRS; Raytheon Technologies Inc (Collins Aerospace); HENSOLDT AG; SILIOS Technologies; JAI A/S, Telops Inc; L3Harris Technologies, Inc; Kappa optronics GmbH; Surface Optics Corporation are the major companies in the multispectral camera market.

Procurement contracts and new product launch are the two key strategies opted by the operating companies in global multispectral camera market.

The uncooled cooling technology segment holds more than 50% share in the global multispectral camera market.

The intelligence, surveillance, and reconnaissance application held more than 35% share in the global multispectral camera market.

Loading Table Of Content...

Loading Research Methodology...