Musical Instrument Insurance By Market Research, 2031

The global musical instrument insurance market size was valued at $1,650.00 thousand in 2021, and is projected to reach $2,475.33 thousand by 2031, growing at a CAGR of 4.3% from 2022 to 2031.

Musical instrument insurance is for anybody who owns an expensive musical gear. For parents who purchase an instrument for their child for their private music lessons, they might accidentally damage it while practicing. Or if the musician is in a band or other musical group that regularly travels to perform in various events and places, insuring their instrument is highly recommended. It protects the musical instruments against any damage, loss, or theft. In addition, musical instrument insurance is designed to cover circumstances that musicians typically encounter. Since musicians travel, coverage is global and is not limited to their city or state.

The high cost of musical instruments, such as electric guitars, piano, drums, and other may cost huge loss to the owner if their instrument is damaged due to any unforeseen circumstances. Therefore, to safeguard their costly instruments, which also holds emotional value for the owner, they prefer to purchase musical instrument insurance to cover any such cost for damages and repair or theft. Thus, this is a major driving factor for the musical instrument insurance market. In addition, the demand for musical instruments among consumers is growing and people are showing interest towards playing different instruments. Hence, the growing demand for musical instruments has increased the demand for musical instrument insurance. Furthermore, since musical instrument insurance is a new kind of insurance, many people are getting aware about its benefits. Thus, the demand for musical instrument insurance has grown rapidly. Therefore, these are some of the factors propelling the market growth. However, the risk factor for musical instruments is higher, as it may easily be damaged, and risk of theft is also higher as musicians are mostly travelling with their costly instruments. Hence, the price of musical instrument insurance is higher pertaining to higher risk factor, which stops people from purchasing these insurance policies for their instruments. Therefore, this is a major factor limiting the growth of musical instrument insurance market. On the contrary, the trend of taking music as a profession is growing as younger generation is attracted towards musicians. Hence, as the demand for music instruments grows, it will significantly impact the growth of musical instrument insurance, which is expected to provide lucrative growth opportunities for the musical instrument insurance industry in the coming years.

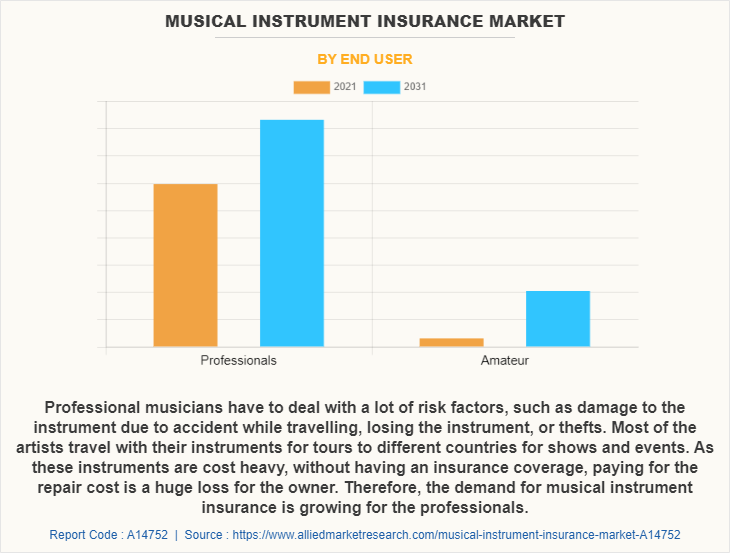

The musical instrument insurance market is segmented on the basis of application, distribution channel, end user, and region. By application, it is segmented into music production/direction and personal use. The music production/direction segment is further sub segmented into digital instruments, guitar, piano/keyboard, and others. The digital instruments sub-segment is further bifurcated into computers & tablets, and electronic wind instruments (EWIs). By distribution channel, it is bifurcated into direct response, musical stores, online channels, and others. By end user, it is segregated into professionals and amateur. By region, it is analysed across Asia-Pacific, Europe, North America, and LAMEA.

By end user, the professionals segment attained the highest growth in 2021. This is attributed to the fact that professional musicians have to deal with a lot of risk factors, such as damage to the instrument due to accident while travelling, losing the instrument or thefts. Most of the artist travel with their instruments for tours to different countries for shows and events. As these instruments are cost heavy, without having an insurance coverage, paying for the repair cost is a huge loss for the owner. Therefore, the demand for musical instrument insurance market outlook is growing for the professionals.

Region-wise, North America attained the highest growth in 2021. This is attributed to the fact that consumers in North America are increasingly purchasing musical instruments as amateur musicians have been growing in the region. In addition, availability of music classes has further increased the purchase of musical instruments such as guitars and piano. Moreover, parents have been more supportive towards their child pursuing musical careers, thus increasing the demand for musical instruments in the region.

The report focuses on growth prospects, restraints, and trends of the musical instrument insurance market analysis. The study provides Porter‐™s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the musical instrument insurance industry.

The report includes profiles of key players operating in the musical instrument insurance market analysis such as Aon plc., AXA Insurance Ltd., Assetsure, Aston Lark, Anderson Musical Instrument Insurance Solutions, LLC, Allianz Insurance plc, Bajaj Finance Limited, EBM, Erie Indemnity Co., Front Row Insurance, Insurance Zebra, Insuranks.com, musicGuard, MusicPro Insurance Agency LLC, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, and ValuePenguin. These players have adopted various strategies to increase their market penetration and strengthen their position in the musical instrument insurance market.

COVID-19 Impact Analysis

The COVID-19 pandemic had a moderate impact on the musical instrument insurance market. This is attributed to the fact that many music concerts and events got cancelled during the lockdown, and hence, the musicians had to quit their music profession, which negatively impacted the musical instrument insurance industry. However, many people took music as a hobby during the lockdown as everyone was inside their home and they had enough free time to learn new instruments. Thus, the demand for music instruments grew. This growth in the demand for music equipment insurance led to rise in demand for music instrument insurance, as people were mostly amateur and risk of damage to the instrument was high. Thus, the COVID-19 had a moderate impact on the musical instrument insurance market.

Top Impacting Factors

Surge in demand for musical instruments

The demand for musical instruments have grown in recent years as people are showing interest in learning new instruments. Moreover, individuals show keen interest in learning to play new musical instruments or take it as a hobby. Moreover, parents want their children to learn to play clarion instrument as extracurricular activity. In addition, schools and colleges offer music classes to students, thereby increasing the demand for music instruments. Furthermore, it is observed that an individual that knows to play music instruments is socially recognized and therefore, people want to play music instruments. Hence, as the demand for music instruments increase, consumers want to protect their instruments from damage and theft, and thus, they purchase musical instrument insurance. Therefore, the increasing demand for musical instruments is one of the major driving factor of the musical instrument insurance market.

High prices of musical instrument insurance

Since the prices of musical instruments are high and the risk of damage is also high, the price of musical instrument insurance is generally high. Musical instruments such as violins, pianos, and violas are among the most expensive instruments. For instance, a Bosendorfer piano costs more than $50,000 while violins and violas, depending on the quality, can also cost thousands of dollars. Insurance for these musical instruments is set according to their current list price. Therefore, for a large number of people, it is very difficult to purchase a musical instrument insurance. Thus, this is a major factor hampering the growth of the musical instrument market.

Interest of young population towards music instruments

The younger generation is showing keen interest towards music instruments. Moreover, they want to pursue music as their main profession. Music profession such as music producer, recording engineer, session musician, professional drummer, guitarist, and others are seen as a promising careers. Furthermore, music schools that have opened up in various countries, offer certificates for learning new instruments. Moreover, parents are supportive towards their child pursuing music as a career and want them to learn new instruments at a young age. Therefore, as the demand for music profession has increased, people are purchasing new instruments to play professionally. Thus, these factor are expected to offer major lucrative opportunities for the musical instrument insurance market growth in the upcoming years.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the musical instrument insurance market share from 2021 to 2031 to identify the prevailing musical instrument insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the musical instrument insurance market forecast segmentation assists to determine the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global musical instrument insurance market trends, key players, market segments, application areas, and market growth strategies.

Musical Instrument Insurance Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | Progressive Casualty Insurance Company, Allianz Insurance plc, Aon plc, Assetsure, Benzinga, MusicPro Insurance Agency LLC, ValuePenguin, Nationwide, Insurance Zebra, Insuranks.com, Bajaj Finance Limited, Erie Indemnity Co., Anderson Musical Instrument Insurance Solutions, LLC, Aston Lark., Front Row Insurance, AXA Insurance Ltd., EBM |

Analyst Review

For professionals, a musical instrument is often expensive and need to be insured. The musical instrument insurance is particularly suitable for professional musicians and persons using an instrument as part of their activity. A musical instrument insurance includes different covers. The most common are related to damage, fire, theft, deterioration and water damage. A professional liability cover and a contract cancellation due to the work instrument damage may be included. Other covers may be extended to the contract based on the needs of the underwriter. For amateur musicians wishing to insure their instrument, a cover can be found in certain homeowner's insurance contracts. Indeed, in this particular case, the musical instrument is part of the transferable capital. It is thus covered in the event of theft, fire or water damage. This contract does not cover losses taking place outside the residence site. Thus, the underwriting of a theft and breakage policy is highly recommended if the owner may be required to carry out trips.

Furthermore, major companies have launched their musical insurance programs due to rising demand for the policy insurance. For instance, in 2021, Great American Alternative Markets announced its newest national program, offered in conjunction with Heritage Insurance Services, located in Feasterville, Pennsylvania. The 30-year program focuses on coverage for fine musical instruments throughout the U.S. and currently supports over 10,000 clients. The specialty program provides dealers, makers, and repair shops specialized coverage under the Heritage “Workbench Policy” designed specifically for the musical arts trade. For owners of fine musical instruments, coverage is provided on a Heritage Musical Instrument Policy. Some of the key players profiled in the report include Aon plc., AXA Insurance Ltd., Assetsure, Aston Lark, Anderson Musical Instrument Insurance Solutions, LLC, Allianz Insurance plc, Bajaj Finance Limited, EBM, Erie Indemnity Co., Front Row Insurance, Insurance Zebra, Insuranks.com, musicGuard, MusicPro Insurance Agency LLC, Nationwide Mutual Insurance Company , Progressive Casualty Insurance Company, and ValuePenguin. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global musical instrument insurance market size was valued at $1,650.00 thousand in 2021, and is projected to reach $2,745.33 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031.

The global musical instrument insurance market size is projected to reach $2,745.33 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031.

The high cost of musical instruments, such as electric guitars, piano, drums, and other may cost huge loss to the owner if their instrument is damaged due to any unforeseen circumstances. Therefore, to safeguard their costly instruments, which also holds emotional value for the owner, they prefer to purchase musical instrument insurance to cover any such cost for damages and repair or theft. Thus, this is a major driving factor for the musical instrument insurance market.

Aon plc., AXA Insurance Ltd., Assetsure, Aston Lark, Anderson Musical Instrument Insurance Solutions, LLC, Allianz Insurance plc, Bajaj Finance Limited, EBM, Erie Indemnity Co., Front Row Insurance, Insurance Zebra, Insuranks.com, musicGuard, MusicPro Insurance Agency LLC, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, and ValuePenguin are the leading players in the market.

The musical instrument insurance market is segmented on the basis of application, distribution channel, end user, and region. By application, it is segmented into music production/direction and personal use. The music production/direction segment is further sub segmented into digital instruments, guitar, piano/keyboard, and others. The digital instruments sub-segment is further bifurcated into computers & tablets, and electronic wind instruments (EWIs). By distribution channel, it is bifurcated into direct response, musical stores, online channels, and others. By end user, it is segregated into professionals and amateur. By region, it is analysed across Asia-Pacific, Europe, North America, and LAMEA.

By end user, the professionals segment attained the highest growth in 2021. This is attributed to the fact that professional musicians have to deal with a lot of risk factors, such as damage to the instrument due to accident while travelling, losing the instrument or thefts. Most of the artist travel with their instruments for tours to different countries for shows and events. As these instruments are cost heavy, without having an insurance coverage, paying for the repair cost is a huge loss for the owner. Therefore, the demand for musical instrument insurance market outlook is growing for the professionals.

Loading Table Of Content...