Nasal Spray Market Research, 2031

The global nasal spray market size was valued at $9.2 billion in 2021 and is projected to reach $16.9 billion by 2031, growing at a CAGR of 6.2% from 2022 to 2031. Nasal sprays are used to provide drugs locally or systemically to the nasal cavities. Localized problems like nasal congestion and allergic rhinitis are treated with the help of nasal spray. Because it offers a more palatable option than an injection or pill, the nasal administration route may be chosen for systemic therapy in some circumstances.

Nasal sprays are generally safe with little or no side effects. However, it might cause nasal irritation at the time of application. Different types of nasal sprays, such as nasal steroid sprays, nasal antihistamine sprays, nasal anticholinergic sprays, nasal cromolyn sprays, and nasal decongestant sprays, are used to give medications either locally in the nasal cavities or systemically.

Market Dynamics

Growth & innovations in the pharmaceutical industry for the manufacturing of nasal spray products owing to massive pool of health-conscious consumers, creates an nasal spray market opportunity for the market. The growth of the nasal spray market size is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs and rise in prevalence of chronic respiratory disease. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries.

E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods. This is attributed to further supports nasal spray market growth. The demand for nasal spray products is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Moreover, increase in the number of product launches and increasing number of generic nasal spray product approvals for the treatment of respiratory diseases including allergic rhinitis by different key players further propel the market growth. For instance, in March 2020, Apotex Inc. introduced a generic version of Dymista, a nasal spray used to treat allergic rhinitis that combines the medications azelastine and fluticasone.

In addition, the geriatric population is more susceptible to nasal allergies and other respiratory disorders. Thus, the increase in geriatric population boosts the growth of the market. For instance, according to Population Reference Bureau, in 2019, regions such as Asia and Europe were home to some of the world's oldest populations reporting to 28 % (Japan) and (Italy) 23% of the total population. Thus, increase in the prevalence of nasal disorders is driving the growth during nasal spray market forecast by creating a greater demand for the effective treatments.

COVID-19 pandemic had a positive effect on the nasal spray industry owing to increase in demand for nasal sprays which can be used at home by self-administration with ease and also refilling the medication can be easily done at home itself. Nasal spray is now more frequently used to treat conditions such as allergic rhinitis, sinusitis, and other respiratory diseases. These factors improve the demand in the market. In addition, a number of pharmaceutical companies have been involved in the development of vaccines employing nasal drug delivery technology, and several of them are currently undergoing clinical trials.

Moreover, the COVID-19 pandemic has increased research and development for the use of nasal spray for the treatment and prevention of coronavirus infection. This is expected to boost the growth of the nasal spray market during the forecast period. For instance, in 2021, scientists at the University of Pennsylvania and Regeneron, a biotechnology company, announced that they were collaborating and investigating whether technology developed for Adeno-Associated Virus (AAV) gene therapy can be used to make a nasal spray that will prevent infection with the new coronavirus.

Segmental Overview

The nasal spray market is segmented into type, application, patient type and region. By type, the market is categorized into steroids, antihistamine, decongestant, saline solution and others. On the basis of application, the market is segregated into allergic rhinitis, sinusitis, nasal polyps, and others. On the basis of distribution channel, the market is divided into hospital pharmacies, drug stores & retail pharmacies, and online providers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

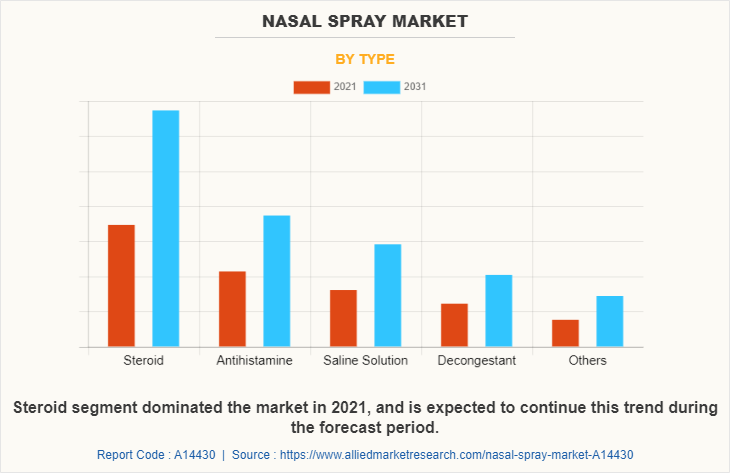

By Type

The market is segmented into steroids, antihistamine, decongestants, salt water solutions and others. The steroids segment dominated the global market in 2021, and is expected to remain dominant throughout the forecast period, owing to their use to treat a range of conditions, including hay fever, sinusitis, non-allergic rhinitis and nasal polyps drive the market growth. Furthermore, the commercialization of affordable generics of nasal steroid spray and its convenient availability further drives the market growth. For instance, In March 2020, Apotex Inc. introduced a generic version of Dymista, a nasal spray used to treat allergic rhinitis that combines the medications azelastine and fluticasone which further propel the growth of nasal spray market.

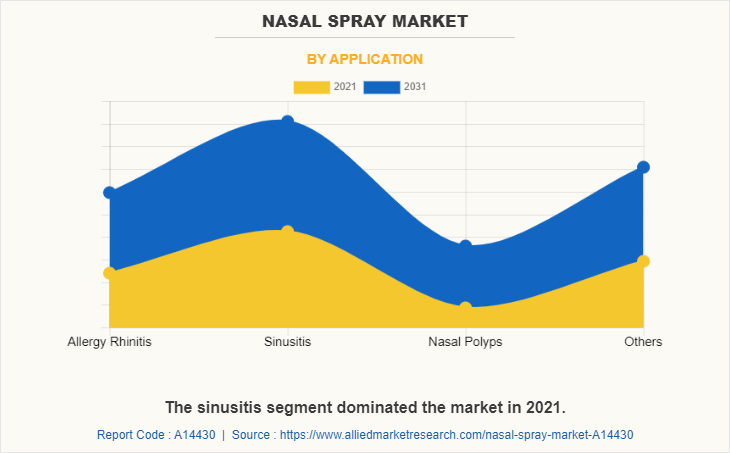

By Application

Nasal spray market is segregated into allergic rhinitis, sinusitis, nasal polyps, and others. The sinusitis segment dominated the global market in 2021. This is attributed to increase in prevalence of sinusitis. However, nasal polyps segment is expected to grow at fastest CAGR during the forecast period. This is attributed to rise in prevalence of nasal polyps. For instance, according to the National Center for Biotechnology Information (NCBI) in 2020, approximately 8% of the population of China and 6.9% population of South Korea are affected by chronic rhinosinusitis. In addition, the disease can occur with nasal polyps and lead to nasal obstruction, facial pain, and inflammation in the sinuses, which is expected to drive demand for nasal sprays products and drive growth of the market.

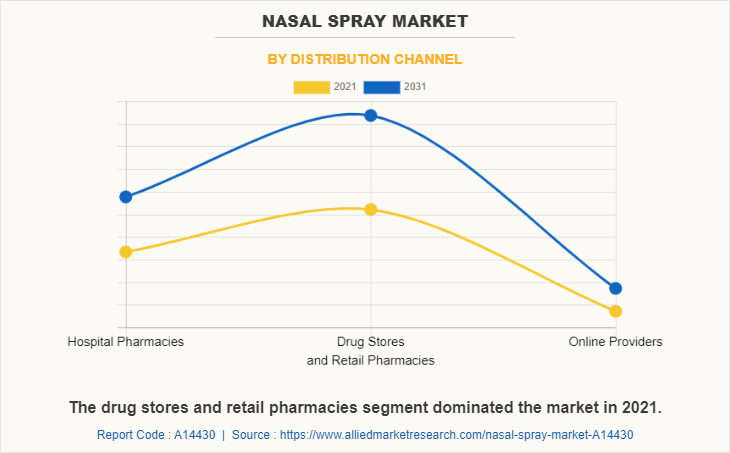

By Distribution Channel

The nasal spray industry is segregated into hospital pharmacies, drug stores & retail pharmacies, and online providers. The drug stores & retail pharmacies, segment dominated the global nasal spray market share in 2021, and is anticipated to continue this trend during the forecast period. This is attributed to the increase in number of patient suffering from nasal disorders including sinusitis which increases the demand of nasal spray in drug stores & retail pharmacies, thereby boost the market growth. In addition, some nasal sprays do not require a prescription including saline nasal sprays, and decongestant nasal sprays further increase the demand for over-the-counter (OTC) nasal sprays in drug stores & retail pharmacies.

By Region

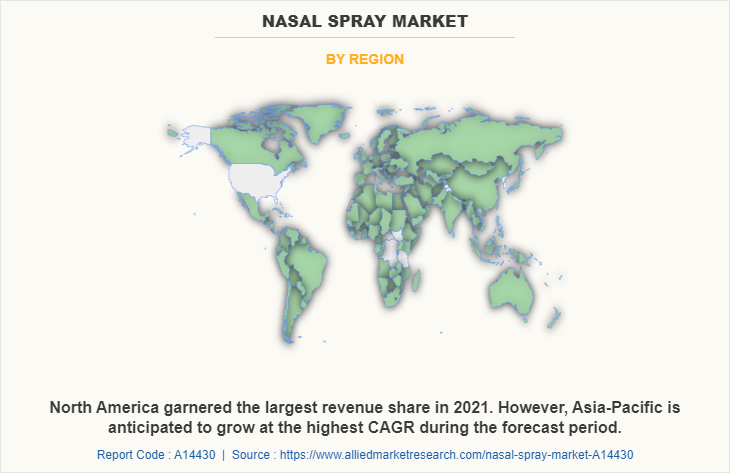

The nasal spray market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the Nasal Spray Market share in 2021 and is expected to maintain its dominance during the forecast period.Key factors drive the growth of the market are the substantial presence of major pharmaceutical and biopharmaceutical companies in the North American region. Additionally, it is anticipated that rising demand for preventative healthcare will further boost market growth. Moreover, increasing government and private sector efforts to promote healthy lifestyles are anticipated to fuel market expansion in the region during the forecast period.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in geriatric population and increase in prevalence of respiratory disorder disorders such as nasal congestion drive the growth of the market.

Competition Analysis

Competitive analysis and profiles of the major players in the nasal spray market, such as Apotex Inc., Aurena Laboratories, Bayer AG, Cipla Ltd, GlaxoSmithKline plc, Leeford Healthcare Limited, Novartis AG, Sunovion Pharmaceuticals Inc., Sun Pharmaceutical Industries Ltd, and Viatris Inc. Major players have adopted product approval and product launch as key developmental strategies to improve the product portfolio of the nasal spray market.

Product Launches of Nasal Spray Market

• In June 2021, Apotex Inc. introduced a generic version of Dymista, a nasal spray used to treat allergic rhinitis that combines the medications azelastine and fluticasone.

Recent Product Approval of Nasal Spray Market

• In December 2022, Bayer announced that the U.S. Food and Drug Administration (FDA) has approved Astepro Allergy (Azelastine HCI .15%) as an over-the-counter (OTC) product for the temporary relief of nasal congestion, runny nose, sneezing and itchy nose due to hay fever or other upper respiratory allergies.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nasal spray market analysis from 2021 to 2031 to identify the prevailing nasal spray market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nasal spray market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global nasal spray market trends, key players, market segments, application areas, and market growth strategies.

Nasal Spray Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 16.9 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 397 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Sun Pharmaceutical Industries Ltd, Viatris Inc., Leeford Healthcare Limited, Sunovion Pharmaceuticals Inc., Bayer AG, Cipla Ltd, Novartis AG, Aurena Laboratories, Apotex Inc., GlaxoSmithKline plc |

Analyst Review

Nasal spray products are gaining high traction in the market, owing to increase in prevalence of nasal allergies and other respiratory disorders, rise in R&D investments in drug discovery & development, and increase in awareness about nasal spray usage.

Furthermore, key players in the market are focusing on adopting strategies to increase accessibility and utilization of nasal spray products in developing economies. Moreover, the market gains interest of healthcare companies, owing to its unmet demands in developing economies such as India and China where the population is growing rapidly, which further propel the market growth.

North America is expected to witness highest growth, in terms of revenue, owing to robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in geriatric population, unmet medical demands and increase in public–private investments in the healthcare sector.

The major factor that fuels the growth of the nasal spray market are rise in prevalence of nasal disorders, increase in number of generic nasal spray product approvals, and availability of nasal spray for nasal allergies and structural blockage.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries with a CAGR of 7.1%. This is due to increase in technological innovations in drug discovery, surge in funding provided by the government and private organizations, presence of large number of healthcare reforms, and increase in aging population suffering from chronic respiratory disorder.

Nasal sprays are intravenous bags made up of non-polyvinyl chloride film which helps to reduce the risks associated with conventional IV bags, such as transportation issues and drug interactions with packaging and disposable containers.

Steroids segment is the most influencing segment in nasal spray market which is attributed to adoption of steroid spray for effective treatment of nasal allergies

The total market value of nasal spray is $9,212.12 million in 2021.

Top companies such asNovartis AG, GlaxoSmithKline plc, Bayer AG, and Sun Pharmaceutical Industries Ltd. held a high market position in 2021. These key players held a high market postion owing to the strong geographical foothold in different regions.

The market value of nasal spray in 2031 is $16,855.69 million.

The base year is 2021 in nasal spray market.

The forecast period for the nasal spray market is 2022 to 2031

Loading Table Of Content...