Natural Fiber Composites Market Size & Insights:

The global natural fiber composites market size was valued at $4.2 billion in 2022, and is projected to reach $8.3 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032. The Natural Fiber Composites (NFCs) market is driven by rising demand in the automotive industry for lightweight, eco-friendly materials that enhance fuel efficiency and comply with green regulations. In addition, increasing investments in green technologies by governments and private entities support innovations in NFCs, enabling their application in diverse industries. These factors align with sustainability goals, fueling the market's growth globally.

Introduction:

Natural fiber composite (NFC) is a type of composite material in which the reinforcement fibers are generated from renewable and carbon dioxide-neutral resources such as plants or wood. NFCs are a desirable alternative to glass fiber and carbon fiber due to their appealing physical characteristics and chemical composition. In addition, they are environmentally friendly and exhibit prolonged shelf life. Moreover, low weight of NFCs make them applicable in furniture and automotive parts.

Report key highlighters

- Quantitative information mentioned in the global natural fiber composites market includes the market numbers in terms of value (USD Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on fiber type, technology, and application. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Bcomp Ltd., DuPont, Green Dot Bioplastics Inc., JELU-WERK J. Ehrler GmbH & Co. KG, Lingrove Inc, Plasthill Oy, Polyvlies, Procotex, TECNARO GmbH, and UPM, hold a large proportion of the natural fiber composites market.

- This report makes it easier for existing market players and new entrants to the prepreg business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Market Dynamics:

The growth of the natural fiber composites market is driven by surge in demand for electric, lighter, safer, and more fuel-efficient vehicles. This is attributed to the fact that these fibers exhibit superior strength, stiffness, fracture resistance, and thermal & acoustic insulation characteristics.

In addition, use of NFCs reduces the cost of components in automotive applications. Composite manufacturing is rapidly evolving into an economical alternative to traditional methods for producing automotive components. This environmentally beneficial approach is aided by plant-based fibers, including bamboo, kenaf, hemp, jute, flax, coir, sisal, and banana.

Furthermore, NFCs have low density, high strength-to-weight ratio, resistance to breaking during manufacture, and are recyclable. Moreover, they are suitable for use in automotive applications due to their low weight. It is feasible to reduce vehicle weight by up to 34%. Thus, multiple benefits associated with NFCs make them ideal for use in the production of vehicles. For instance, Bcomp Ltd. and BMW M Motorsport collaborated to provide an eco-friendlier touch to the new BMW M4 GT4. It has a body kit and an interior made of ampliTex and powerRibs natural fibers.

These natural fiber composites replace the parts that were previously made of plastic or carbon fibers. Furthermore, Porsche, a producer of sports cars, stated that the 718 Cayman GT4 Club sport racer, which launched in 2019, was the first automobile in the world to use exterior components strengthened with natural fibers such as hemp and flax.

Furthermore, natural fibers are economical, harmless to the environment, and durable for sustainable infrastructure. Hence, surge in usage of NFCs in the construction industry boosts the growth of the market. Concrete is extremely fragile, which leads to issues such as failure cracks. The characteristics of concrete are changed, and their strength is increased when artificial fibers like steel and glass are added.

However, the economy of the construction is seriously harmed. As a result, natural fibers are preferred as building materials for sustainable infrastructure because they can be reused, are non-abrasive, affordable, and readily available. In addition, they exhibit high flexibility, are versatile, and are cost-effective due to their widespread availability. As a result, the use of natural fibers as reinforcement in polymer composites is expected to increase in the coming years.

In structural and engineering applications, natural fiber composite are utilized to create load-bearing constructions such as beams, roofing, multipurpose panels, water tanks, and pedestrian bridges. Furthermore, NFCs find their application in making structural beams and frames of pedestrian bridges with low to moderate design loads. In addition, natural fiber composites are being used to produce beams due to their reduced cost, lower density, and beneficial effects on the environment such as the production of natural fiber composite requires less energy and emits less carbon dioxide than the production of synthetic composites.

The use of natural fibers in composites can further reduce the weight of the end product, which can lead to lower fuel consumption and emissions during transportation. Owing to the abovementioned factors, the utilization of NFCs in the construction sector is anticipated to increase significantly, thereby boosting the natural fiber composites market growth.

Variations in the properties of natural fibers restrain the market growth. For instance, when a polymer is added to new composite materials, the behavior alters because natural fibers have certain performance limitations. The physical properties of the fiber do not seem to be constant; they fluctuate according to the seasons and the method of harvest. In addition, natural fibers respond differently based on the type of processing, the location, the fabric's maturity (woven or unwoven), the plant, and the manufacturing process.

Furthermore, products made from natural fibers tend to be expensive. In addition, natural fiber composites have several drawbacks when used as building materials, such as reduced toughness caused by high humidity, solvent absorption, concrete cracks caused by swelling and volume changes, and poor consistency with polymeric or cement matrices. Their poor consistency with numerous polymeric matrices demonstrates non-uniform effects.

Another major disadvantage of using fibers is their limited thermal stability. Natural fibers can endure temperatures up to 2,000°C, but once they reach this point, they begin to deteriorate and shrink, and due to their poor thermal stability, natural fiber composites perform less effectively than other materials.

On the contrary, implementation of stringent regulations on the use of synthetic fibers due to their detrimental effects on the environment led to rise in demand for natural fiber composites, which is anticipated to offer remunerative opportunities for the growth of the market. For instance, volatile organic compounds (VOCs), which are emitted by synthetic fiber production facilities, are being limited and reduced through the implementation of Environmental Protection Agency (EPA) Organic Chemicals, Plastics, and Synthetic Fibers (OCPSF) effluent guidelines and standards.

In addition, petrochemicals are employed in the production of synthetic fibers. As a result, the cost of synthetic fibers such as polyester, nylon, and acrylic are influenced by the price of crude oil. Therefore, any fluctuation in the price of oil may impact the cost of synthetic fiber. As concern over sustainability grows, particularly in industrialized economies, so does the demand for natural fibers as an alternative to synthetic fibers. Thus, all these factors collectively are expected to open new avenues for the expansion of the natural fiber composites market during the forecast period.

Segment Overview:

The global natural fiber composites market is segmented into fiber type, technology, application, and region. On the basis of fiber type, the market is classified into wood, cotton, flax, kenaf, hemp, and others. Depending on the technology, it is segregated into injection molding, compression molding, and others. By application, it is fragmented into automotive, electronics, construction, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

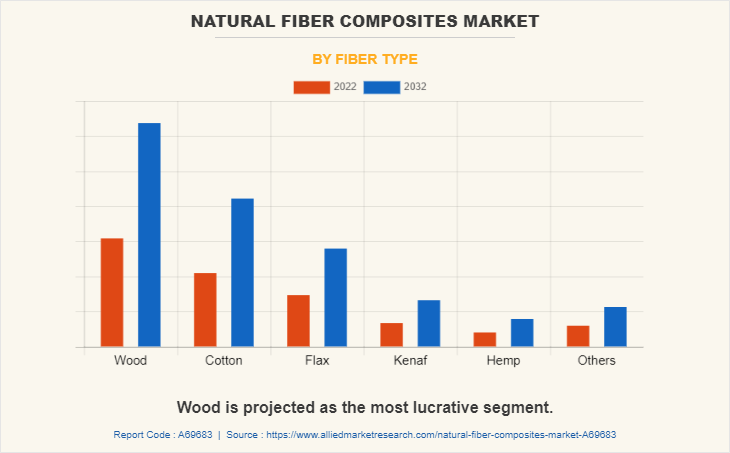

Natural Fiber Composites Market By Fiber Type

By fiber type, the market is divided into wood, cotton, flax, kenaf, hemp, and others. The wood segment held the largest market share in 2022 and is expected to register the highest CAGR during the forecast period. Wood has long been used as a construction material due to its strength and natural aesthetics. Wood is stiffer, less expensive, and stronger than these synthetic polymers, making it a useful filler or reinforcement. These factors contribute to the dominance of the wood segment in the natural fiber composites market.

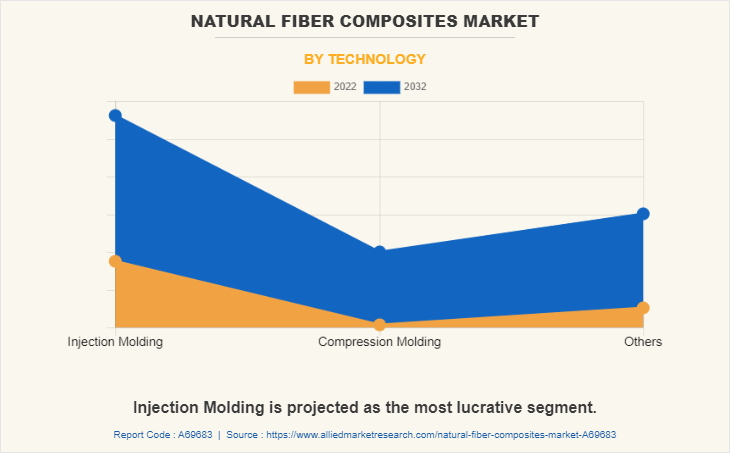

Natural Fiber Composites Market By Technology

By technology, the market is categorized into injection molding, compression molding, and others. The injection molding segment held the largest market share in 2022. The injection molding process is a popular manufacturing method for mass production. Although the reinforcement fiber degrades during the process, high processability is a key factor that triggers the popularity of injection molding. Increasing demand for composite materials from automotive, hardware/apparatuses, medical, and bundling enterprises has led to the dominance of the injection molding segment.

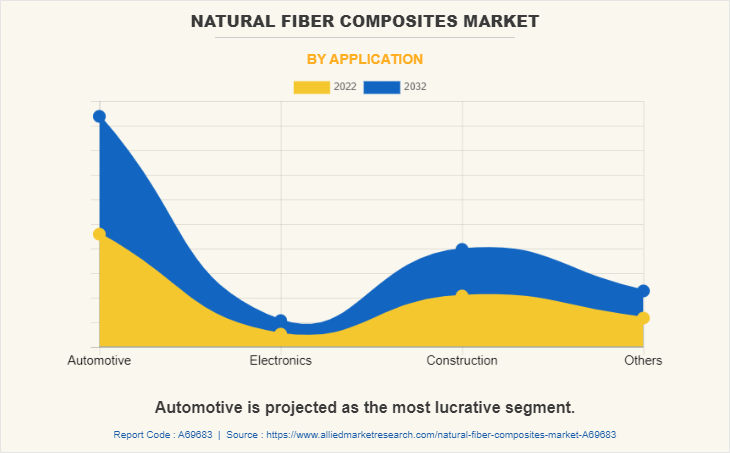

Natural Fiber Composites Market By Application

By application, the market is categorized into automotive, electronics, construction, and others. The automotive segment held the largest market share in 2022. The rising demand for hybrid and electric vehicles has led to an increase in investments by automakers across the world. The flourishing automotive industry worldwide continues to be a key contributor to the growth of the natural fiber composites market.

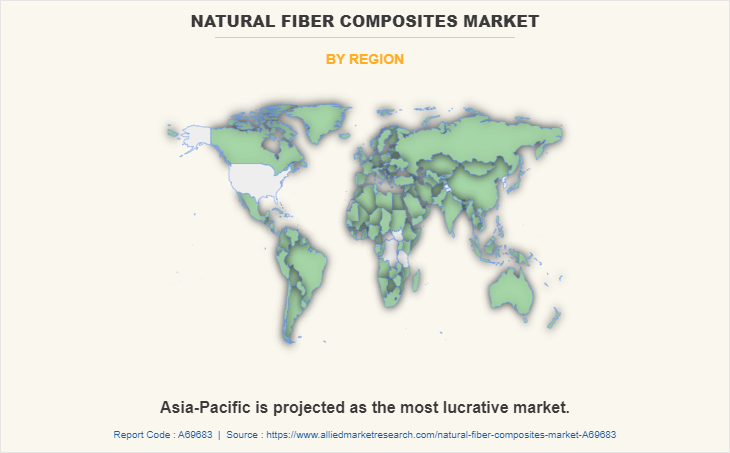

Natural Fiber Composites Market By Region

By region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is one of the fastest-growing regions in the world, with a large population and a growing middle class. The Asia-Pacific region is experiencing rapid industrialization, which is driving demand for lightweight and high-performance materials.

Natural fiber composites offer a sustainable alternative to traditional materials and are becoming increasingly popular in a range of applications. Natural fiber composites are becoming more cost-competitive as the cost of traditional materials such as metals and plastics increases. This is driving companies to adopt natural fiber composites as a way to reduce costs and improve profitability.

Competitive Analysis:

The key players operating in the global natural fiber composites market are Bcomp Ltd., DuPont, Green Dot Bioplastics Inc., JELU-WERK J. Ehrler GmbH & Co. KG, Lingrove Inc, Plasthill Oy, Polyvlies, Procotex, TECNARO GmbH, and UPM.

Historical Trends in Natural Fiber Composites (NFCs) Market

Initial Use and Recognition (1940s-1950s):

Natural fibers like jute, hemp, and flax were first used as reinforcements in polymer matrices during World War II due to material shortages. Early applications included lightweight panels for vehicles and military equipment, demonstrating the potential of natural fiber composites (NFCs).

Early Commercial Applications (1960s-1980s):

Industries began exploring NFCs for non-structural components, particularly in furniture and packaging. Low cost, abundance, and biodegradability of natural fibers such as sisal and coir drove their use in developing countries, primarily for low-performance applications.

Renewed Interest and Research (1990s):

Growing environmental awareness led to renewed interest in NFCs as eco-friendly alternatives to synthetic composites. Research focused on improving fiber-matrix compatibility and developing processing techniques to enhance mechanical properties, expanding potential applications in automotive and construction industries.

Commercialization in Automotive Sector (2000s):

NFCs gained popularity in the automotive sector, particularly in Europe, for interior parts like door panels, dashboards, and seatbacks. Automakers valued NFCs for their lightweight properties, cost-effectiveness, and reduced environmental impact. Partnerships between industry and academia accelerated material development.

Emergence of Biodegradable Matrices (2010-2015):

Advances in biodegradable polymers, such as polylactic acid (PLA), enhanced the sustainability of NFCs. Research efforts focused on creating fully biodegradable composites suitable for packaging, consumer goods, and agricultural applications, further diversifying NFC markets.

Focus on High-Performance Applications (2015-2020):

Innovations in fiber treatments and hybrid composites allowed NFCs to compete in high-performance markets. Aerospace, sports equipment, and marine industries began exploring NFCs for lightweight and durable components. Governments supported these efforts through sustainability initiatives.

Emphasis on Circular Economy (2020s):

With the global push toward a circular economy, NFCs became central to strategies for reducing plastic waste. Applications in green building materials, renewable energy (e.g., wind turbine blades), and bio-based packaging gained traction. Research prioritized scalable production and recycling technologies.

Market Diversification and Growth (2021 onwards):

The NFC market continues to expand, driven by increasing demand for sustainable materials in automotive, construction, and consumer goods sectors. Enhanced performance characteristics and advancements in manufacturing techniques are unlocking new applications, particularly in lightweight composites for emerging industries like electric vehicles and 3D printing.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the natural fiber composites market analysis from 2022 to 2032 to identify the prevailing natural fiber composites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the natural fiber composites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global natural fiber composites market trends, key players, market segments, application areas, and market growth strategies.

Natural Fiber Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.3 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 353 |

| By Fiber Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Green Dot Bioplastics Inc., DuPont, Plasthill Oy, UPM, TECNARO GMBH, Polyvlies, JELU-WERK J. Ehrler GmbH & Co. KG, Lingrove Inc, Bcomp Ltd., Procotex |

Analyst Review

According to the insights of various CXOs of leading companies, natural fiber composites are gaining high traction in the market due to development of the automotive industry. This is attributed to the fact that natural fiber composites can be customized to meet specific performance requirements, such as strength, stiffness, and impact resistance, making them suitable for a variety of automotive applications.

However, moisture sensitivity with respect to natural fiber composites are projected to hinder the expansion of the market. Moisture sensitivity can affect the mechanical properties and durability of natural fiber composites and can lead to issues such as dimensional instability and degradation.

The CXOs further added that North America is projected to register robust growth during the forecast period. The automotive industry has been a major driver of the demand for natural fiber composites in North America, as manufacturers seek to reduce the weight of vehicles to improve fuel efficiency and reduce emissions. In addition, the construction industry has shown increasing interest in these materials to reduce the carbon footprint of buildings.

New product launch by key players to expand the market presence is expected to contribute to the market growth. This trend is estimated to uplift the market growth in the near future. For instance, in October 2021, Lanxess has added a new product to its Tepex line of continuous-fibre-reinforced thermoplastic composites.

Automotive and construction are the potential customers of Natural Fiber Composites market industry

Asia-Pacific region will provide more business opportunities for Natural Fiber Composites market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Bcomp Ltd., DuPont, Green Dot Bioplastics Inc., JELU-WERK J. Ehrler GmbH & Co. KG, Lingrove Inc, Plasthill Oy, Polyvlies, Procotex, TECNARO GmbH, and UPM are the top players in Natural Fiber Composites market.

Loading Table Of Content...

Loading Research Methodology...