Network-Attached Storage Market Research, 2032

The global network-attached storage market was valued at $25.6 billion in 2022 and is projected to reach $96.1 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032. Network-attached storage market growth offers heterogeneous clients, authorized network users, and the ability to store and retrieve data from a central place. The market for network-connected storage is anticipated to increase significantly over the next year, owing to its advantages, including flexibility and scale-out, simplicity in setup, and low installation and maintenance costs.

The surge in the requirement for data access from any location on business networks and the internet is one of the major drivers fueling the network-attached storage market. The need for NAS technology is fueled by the increase in usage of remote and virtual office settings, business continuity planning, and the requirement to give employees remote access to corporate networks. Confidential data backups are necessary for business operations, and NAS systems are the ideal solution. These backup targets and files to keep copies of the data are the reason this technology is being used more frequently. The ability of NAS devices to store redundant copies of data via data compression is expected to enhance their use.

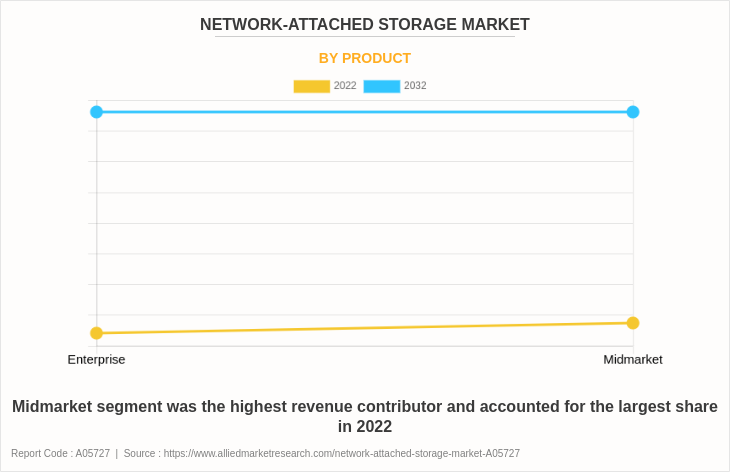

The small- and medium-business-focused solutions of the network-attached storage industry are increasingly giving way to more sophisticated, large-enterprise-focused solutions. Small and medium-sized businesses utilize this solution for pertinent data storage and sharing applications; on the other hand, large organizations use NAS for generic data sharing that is not required for applications, as well as for workgroups, departments, and distant offices.

These network-attached storage units have been offering a practical way to transfer data from the PCs and produce data backups while preserving remote access to the contents. These devices use secured and dedicated IP addresses to provide access for authorized on-site and network access while centrally storing information. To fulfill the demands of both home users and large as well as small organizations, these devices provide a variety of features that are practical and adaptable.

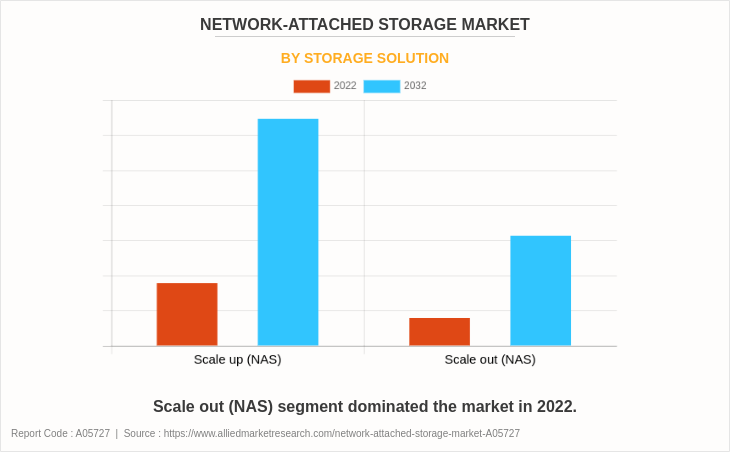

At the outset of the COVID-19 pandemic, the Network-Attached Storage Industry experienced an upturn due to an increase in demand for network-attached storage and home systems. Post-pandemic, the industry quickly adjusted as the demand for network-attached storage devices grew alongside an increase in sales of scale-out and scale-up NAS. This shift led to innovation and a subsequent rebound in the network-attached storage market.

Segments Overview

The network-attached storage market outlook is segmented into Storage Solutions, Products, and Industry Verticals.

By storage solution, the network-attached storage market is classified into scale-up and scale-out. Scale out. The scale-out segment dominated the market in 2022.

By product, it is bifurcated into enterprise and midmarket. The midmarket segment acquired the largest share in 2022.

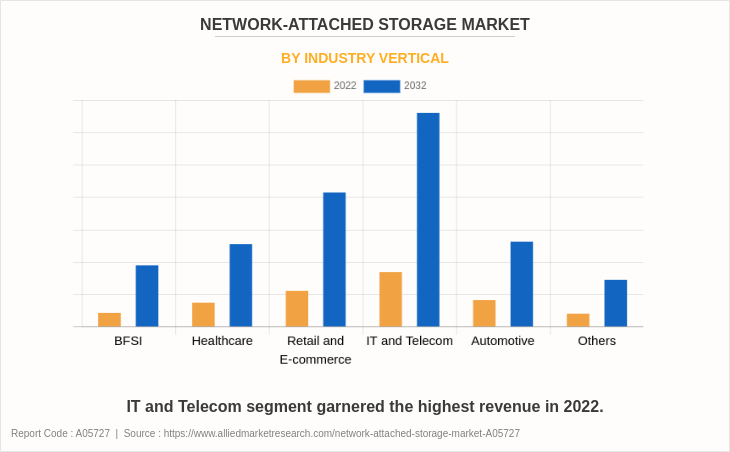

By industry vertical, it is divided into BFSI, healthcare, retail & e-commerce, IT & telecom, automotive, and others. The IT & telecom segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

Based on region, the network-attached storage market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Country-wise, the U.S. acquired a prime share in the network-attached storage in the North American region, and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, the UK dominated the network-attached storage market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the UK is expected to emerge as the fastest-growing country in Europe's surround soundbars market with a CAGR of 13.97%.

In Asia-Pacific, China is expected to emerge as a significant network-attached storage market for the network-attached storage industry, owing to a significant rise in investment by prime players due to an increase in the growth of consumer electronics in rural and urban regions.

In the LAMEA region, the Middle East garnered a significant network-attached storage market share in 2022. The LAMEA market has witnessed an improvement, owing to the growth in the inclination of prime vendors towards utilizing the network-attached storage across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 13.76% from 2023 to 2032.

Competitive Analysis

Competitive analysis and profiles of the major global network-attached storage market players that have been provided in the report include Dell Technologies, NetApp, Inc., Hitachi Ltd., Western Digital Corporation, Seagate Technology PLC, Netgear Inc., Synology Inc., IBM Corporation, Buffalo Technology, and Hewlett-Packard Enterprise Development LP. The key strategy adopted by the major players in the market is product launch.

Top Impacting Factors

The network-attached storage market is expected to witness notable growth owing to a surge in the use of mobile computing devices, with growing data generation, and propelling the growth and demand for NAS devices and related solutions. Moreover, the surge in demand for hybrid cloud storage is expected to provide a lucrative network-attached storage market opportunity during the forecast period. On the contrary, performance-related issues associated with network-attached storage (NAS) systems limit the growth of the network-attached storage market demand.

Historical Data & Information

The global network-attached storage market analysis is highly competitive, owing to the strong presence of existing vendors. Vendors of network-attached storage with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Dell Technologies, NetApp, Inc., Hitachi Ltd., Western Digital Corporation, and Seagate Technology PLC are the top companies holding a prime share in the market. Top market players have adopted various strategies, such as product launches, to expand their foothold in the network-attached storage market.

- In April 2023, Seagate Technology Holdings plc and QNAP Systems Inc., a leading network attached storage (NAS) vendor, announced an integrated portfolio of edge-to-cloud enterprise storage solutions. The portfolio delivers a range of innovative enterprise-scale solutions that include Seagate's IronWolf Pro Hard Drives (HDDs), QNAP's high-capacity NAS solutions with Exos E series JBOD systems, and Seagate Lyve Cloud.

- In July 2021, Taiwan-based network-attached storage (NAS) manufacturer QNAP announced that it had addressed a critical security vulnerability that could have enabled attackers to compromise its NAS devices' security. The improper access control vulnerability, tracked as CVE-2021-2880,9, was found by the TXOne IoT/ICS Security Research Labs in HBS 3 Hybrid Backup Sync, which is QNAP's disaster recovery and data backup solution. The security issue was caused by buggy software that does not correctly restrict attackers from gaining access to the system resources, enabling them to escalate privileges, execute commands remotely, or read sensitive info without authorization.

- In June 2022, StorCentric launched the Nexsan EZ-NAS, a Network Attached Storage (NAS). This system features a 1U form factor and four drives with a capacity of 72 TB and 1.5 GB/s of throughput. The new platform is suitable for edge deployments in SMEs and large enterprises. The platform also delivers enhanced modern features, including in-line compression and data-at-rest encryption.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the network-attached storage market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall network-attached storage analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current network-attached storage market forecast is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the network-attached storage.

- The report includes the market share of key vendors and market trends.

Network-Attached Storage Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 96.1 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 402 |

| By Storage Solution |

|

| By Product |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Dell Technologies, Buffalo Technology, IBM Corporation, Hitachi Ltd., NetApp, Inc., Seagate Technology PLC, Hewlett Packard Enterprise Development LP, Synology Inc., Western Digital Corporation, Netgear Inc. |

Analyst Review

The network attached storage market is expected to leverage high potential for the scale-out and scale-up network attached storage during the forecast period. Network attached storage vendors, investing in R&D and skilled workforce, are anticipated to gain a competitive edge over their rivals. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The surge in demand for network attached storage in IT and telecommunication across the globe for data generation and data storage drives the need for enhanced network attached storage. Moreover, major economies, such as the U.S., China, the UK, and Japan plan to develop and deploy advanced network attached storage in various sectors.

On the basis of region, the network-attached storage market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive analysis and profiles of the major global market players that have been provided in the report include Dell Technologies, NetApp, Inc., Hitachi Ltd., Western Digital Corporation, Seagate Technology PLC, Netgear Inc., Synology Inc., IBM Corporation, Buffalo Technology, and Hewlett Packard Enterprise Development LP. The key strategies adopted by the major players of the network-attached storage is product launch.

North America is the leading industry vertical of Network-Attached Storage Industry Market.

The upcoming trends of Network-Attached Storage Industry Market are surge in use of mobile computing devices with growing data generation and propelling the growth and demand for nas devices and related solutions.

IT and telecom segment is the leading industry vertical of Network-Attached Storage Industry Market.

The global network attached storage industry generated $25.65 billion in 2022

Dell Technologies, NetApp, Inc., Hitachi Ltd., Western Digital Corporation, and Seagate Technology PLC are the top companies holding a prime share in the network-attached storage market.

Loading Table Of Content...

Loading Research Methodology...