Neurointerventional Devices Market Research, 2032

The global neurointerventional devices market size was valued at $2.6 billion in 2022, and is projected to reach $5.3 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032. Neurointerventional devices refer to a wide range of medical devices and tools, specifically designed for use in neurointerventional procedures. These procedures involve minimally invasive techniques for the diagnosis and treatment of various conditions affecting the brain, spine, and central nervous system. These devices are primarily used by neurointerventional radiologists or neurosurgeons to perform minimally invasive procedures, often known as endovascular procedures, which involve accessing and treating the affected areas of the brain or spinal cord through blood vessels.

Market dynamics

The neurointerventional devices market size in expected to grow significantly, owing to surge in prevalence of neurological disorders, increase in preference towards minimally invasive procedures, and rise in awareness regarding the neurological disorders among peoples and healthcare professionals.

Surge in the prevalence of neurological disorders has emerged as a significant driver for the neurointerventional devices market. Several factors contribute to this trend, including rise in aging population, changes in lifestyle and environmental factors, and increase in awareness about the symptoms and risk factors of neurological disorders. According to the 2022 fact sheet by National Library of Medicine, over past 30 years there has been a 70% increase in stroke incidence, 43% increase in deaths due to stroke, 102% increase in stroke prevalence, and 143% increase in Disability Adjusted Life Years (DALYs). Around 86% of deaths due to stroke and 89% of DALYs occur in lower and lower-middle-income countries. Thus, conditions such as stroke, aneurysms, arteriovenous malformations, and other neurovascular diseases are becoming more prevalent, necessitating advanced treatment options. Neurointerventional devices play a crucial role in the diagnosis and treatment of neurological disorders. These devices are designed to access and treat the affected areas of the brain or spinal cord through minimally invasive procedures. They enable physicians to navigate complex blood vessels, deliver therapies directly to the affected site, and restore blood flow to damaged areas. Thus, the rise in the prevalence of neurological disorders surges the need for neurointerventional devices and fuels the growth of the neurointerventional devices market.

Furthermore, increase in demand for minimally invasive procedures acts as a significant driver for the neurointerventional devices market. Minimally invasive techniques allow neurosurgeons and interventional radiologists to precisely target and treat specific areas of the brain or spinal cord, minimizing damage to surrounding tissues. This approach often leads to better clinical outcomes, including reduced morbidity and improved quality of life for patients. Furthermore, minimally invasive procedures offer distinct advantages for both, patients and healthcare providers. Patients benefit from shorter hospital stays, reduced pain, and quicker recovery times, allowing them to return to their daily activities sooner. Healthcare providers, on the other hand, experience increased efficiency and cost savings. Neurointerventional devices play a crucial role to enable minimally invasive procedures. These devices include various tools such as catheters, guidewires, stents, and embolic coils, which are specifically designed to navigate and treat conditions affecting the nervous system.

In addition, advances in technology have led to the development of sophisticated and precise neurointerventional devices, further supporting the growth of minimally invasive approaches. Neurointerventional devices play a crucial role in facilitating minimally invasive procedures. Neurointerventional devices are specifically designed to access and treat conditions within the brain and spinal cord, such as aneurysms, arteriovenous malformations (AVMs), and stroke. Thus, rise in preference towards the minimally invasive procedures by patients and healthcare professionals is anticipated to drive the growth of the market.

The rise in awareness regarding neurological disorders among both, the general public and healthcare professionals, has played a significant role to drive the neurointerventional devices market growth. Neurological disorders, such as stroke, aneurysms, arteriovenous malformations, and brain tumors, have a profound impact on individuals and the society. Rise in awareness about these conditions leads to greater emphasis on early diagnosis, treatment, and management of neurological disorders. The awareness programs such as World Stroke Day, is celebrated on 29th October every year, which is an initiative taken by World Stroke Organization, to spread knowledge about stroke such as main clinical risk factors for stroke, prevalence of stroke, and symptoms and treatment options for stroke. Furthermore, Brain Awareness Week is celebrated each year in the month of March. NIH National Institute of Neurological Disorders and Stroke plays an active role in Brian Awareness Week. Brain Awareness Week plays a significant role to increase public awareness about the brain and the progress and benefits of brain research. Since its founding in 1996, Brain Awareness Week has become a global education initiative that includes the participation of more than 7,300 partners in 120 countries. During the 2021 campaign, partner events were held in 32 states across the U.S. and in 44 additional countries.

However, the high cost of neurointerventional devices is expected to act as a significant restraint for the neurointerventional devices market. Healthcare organizations often face budget constraints and limited resources, making it difficult to allocate substantial funds towards acquiring neurointerventional devices.

On the other hand, technological advancements in neurointerventional devices creates lucrative opportunities for the growth of neurointerventional devices. Robotics has revolutionized the way neurovascular procedures are performed by providing enhanced precision, stability, and dexterity to neurosurgeons. Robotic systems can assist in navigating catheters and guidewires through intricate anatomical pathways with greater accuracy, reducing the risk of human error, and improving patient outcomes. Furthermore, AI has played a crucial role in augmenting the capabilities of neurointerventional devices. Real-time image processing and analysis can be performed by integrating AI into neurointerventional devices, thus, aiding in accurate diagnosis and treatment planning.

The healthcare systems were overwhelmed with COVID-19 patients, leading to a redirection of resources and prioritization of COVID-19-related care. Non-urgent procedures and elective surgeries were postponed or canceled to free up hospital capacity, including those related to neurointerventional procedures. This sudden decrease in neurointerventional procedures had a notable impact on the demand for neurointerventional devices. Thus, the outbreak of COVID-19 showed negative impact on the neurointerventional devices market.

Segmental Overview

The neurointerventional devices market share is segmented on the basis of product, indication, application, and region. On the basis of product, the market is classified into stents, embolic coils, catheters, wires, and others. The others includes flow diverter, embolic protection device, and long sheath. On the basis of indication, the market is categorized into brain aneurysm, stroke, and others. The others includes vascular malformations, arteriovenous fistula, and arteriovenous malformation (AVM). By application, the market is segmented into hospitals and ambulatory surgical centers. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

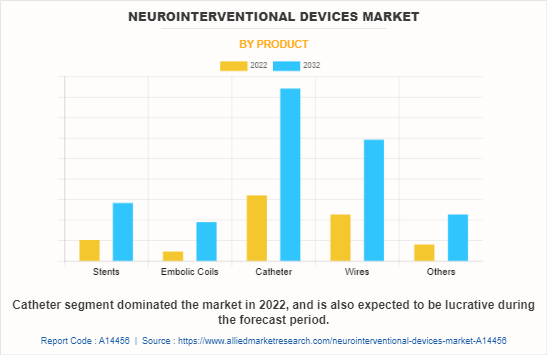

By Product :

The neurointerventional devices market share is segmented into stents, embolic coils, catheters, wires, and others. The others includes flow diverter, embolic protection device, and long sheath. The catheter segment dominated the global market in 2022 and is expected to remain dominant during the neurointerventional devices market forecast, owing to the use of catheters in a wide range of neurovascular surgeries.

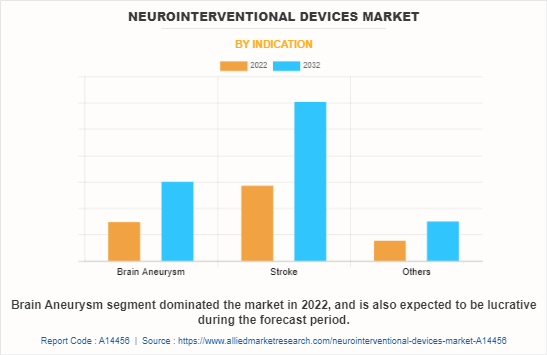

By Indication:

The neurointerventional devices market is segmented into brain aneurysm, stroke, and others. The others include vascular malformations, arteriovenous fistula, and arteriovenous malformation (AVM). The stroke segment dominated the global market in 2022 and is expected to remain dominant during the forecast period, owing to high prevalence of stroke and increase in demand for thrombectomy procedure.

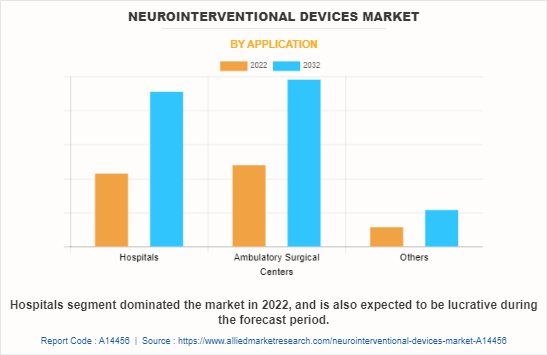

By Application:

The neurointerventional devices market is segmented into hospitals and ambulatory surgical centers. The hospitals segment dominated the global market in 2022, owing to the fact that majority of the neurovascular surgical procedures are carried out in hospitals.

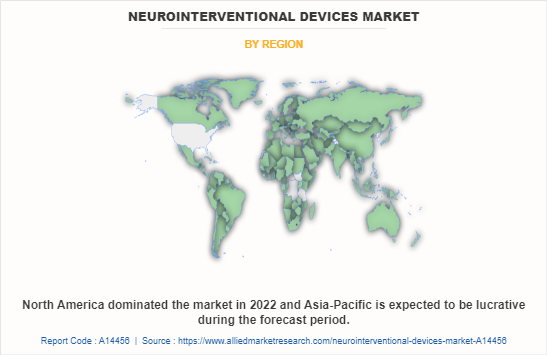

By Region:

The neurointerventional devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the neurointerventional devices market in 2022 and is expected to maintain its dominance during the forecast period, owing to rise in geriatric population, well developed healthcare sector, and strong presence of neurointerventional devices industry.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributed to a rise in prevalence of neurological disorders in the region and rise in medical tourism.

Competition Analysis

Competitive analysis and profiles of the major players in the neurointerventional devices market, such as Stryker Corporation, Johnson & Johnson, Medtronic plc, Terumo Corporation, Lepu Medical Technology (Beijing) Co., Ltd, Merit Medical Systems Inc, Balt Group, Integer Holdings Corporation, Penumbra, Inc, and Cook Group Inc. Major neurointerventional devices industry have adopted product launch, expansion and acquisition as key developmental strategy to improve the product portfolio and gain strong foothold in the neurointerventional devices market.

Recent Product launch in the neurointerventional devices market

In May 2023, Johnson & Johnson, an American multinational company, announced the new CEREPAK Detachable Coils are commercially available in the U.S. and that the first patient cases have been performed. CEREPAK is the latest innovation to join the CERENOVUS hemorrhagic portfolio and further demonstrates the company’s commitment to treating hemorrhagic stroke.

In February 2022, Johnson & Johnson, an American multinational company, announced the launch of EMBOGUARD, a next-generation balloon guide catheter to be used in endovascular procedures, including those for patients with acute ischemic stroke.

Recent Acquisition in the neurointerventional devices market

In April 2022, Integer Holdings Corporation announced the acquisition of Connemara Biomedical Holdings Teoranta, including its operating subsidiaries Aran Biomedical and Proxy Biomedical. The acquisition increases Integer’s ability to offer complete solutions for complex delivery and therapeutic devices in high-growth cardiovascular markets such as structural heart, neurovascular, peripheral vascular, and endovascular as well as general surgery.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the neurointerventional devices market analysis from 2022 to 2032 to identify the prevailing neurointerventional devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the neurointerventional devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global neurointerventional devices market trends, key players, market segments, application areas, and market growth strategies.

Neurointerventional Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.3 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 282 |

| By Product |

|

| By Indication |

|

| By Application |

|

| By Region |

|

| Key Market Players | Johnson & Johnson, Penumbra, Inc, Integer Holdings Corporation, Merit Medical Systems Inc., Lepu Medical Technology (Beijing) Co., Ltd, Medtronic plc, Stryker Corporation., Cook Group Inc, Terumo Corporation, Balt Group |

Analyst Review

Neurointerventional devices are medical devices used in the field of neurointerventional radiology to diagnose and treat various conditions affecting the blood vessels of the brain and spinal cord. These devices are designed to access the blood vessels through minimally invasive procedures, such as catheterization, and deliver targeted treatments directly to the affected areas. Some common interventional treatments include embolization, thrombectomy, angioplasty, and stenting. The strategies such as product launch and acquisition adopted by key players are expected to drive the growth of the market.

In March 2023, Johnson & Johnson, an American multinational company, announced the launch of new CEREPAK Detachable Coils in the U.S. The CEREPAK Detachable Coils offer three shapes and multiple coil sizes, providing physicians with comprehensive options to embolize brain aneurysms, including coils shaped, specifically to achieve concentric aneurysm filling and contribute large volumetric filling. In June 2023, BIOTRONIK, a leading medical devices company, announced the limited release of its Oscar (One Solution: Cross. Adjust. Restore) multifunctional peripheral catheter.

In April 2022, Integer Holdings Corporation, a leader in advanced medical device outsourcing, announced the acquisition of Connemara Biomedical Holdings Teoranta, including its acquisition transferred ownership of Aran Biomedical and Proxy Biomedical to Integer Holdings Corporation. Aran Biomedical and Proxy Biomedical were operating subsidiaries of Connemara Biomedical Holdings Teoranta. The acquisition with Aran Biomedical further increases Integer’s ability to offer complete solutions for complex delivery and therapeutic devices in high-growth cardiovascular markets such as structural heart, neurovascular, peripheral vascular, and endovascular as well as general surgery.

The top companies that hold the market share in neurointerventional devices market are Stryker Corporation, Johnson & Johnson, Medtronic plc, Terumo Corporation, Lepu Medical Technology (Beijing) Co., Ltd, Merit Medical Systems Inc, Balt Group, Integer Holdings Corporation, Penumbra, Inc., and Cook Group Inc

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in medical tourism and surge in prevalence of neurological disorders.

The key trends in the neurointerventional devices market are due to surge in incidence of neurological disorders, technological advancement in minimally invasive procedures, and growing awareness among the patients and general population regarding the symptoms and risk factors of neurological disorders.

The base year for the report is 2022.

North America is the largest regional market for neurointerventional devices market

The total market value of neurointerventional devices market market is $2,545.78 million in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the neurointerventional devices market are high cost of neurointerventional devices.

Loading Table Of Content...

Loading Research Methodology...