Neurology Devices Market Research, 2031

The global neurology devices market was valued at $12.6 billion in 2021, and is projected to reach $27.2 billion by 2031, growing at a CAGR of 8.1% from 2022 to 2031. Neurology is a branch of medicine concerned with the study, diagnosis, and treatment of nervous system disorders and diseases. The nervous system is a complicated network of cells, tissues, and organs that coordinate and regulate the activities of the body. It includes the brain, spinal cord, and nerves. Neurology devices are medical devices designed for the diagnosis, treatment, and monitoring of conditions that affect the nervous system, including the brain, spinal cord, and peripheral nerves. Neurosurgery devices are medical instruments used by neurosurgeons to perform surgical procedures on the brain, spine, and nervous system. These devices are designed to facilitate the precise and delicate surgical techniques required for neurosurgery. Some common types of neurosurgery devices include microsurgical instruments, stereotactic radiosurgery systems, intraoperative MRI machines, navigation systems, and ultrasonic aspirators. The choice of device will depend on factors such as the type of surgery to be performed, location of tumor (in case of brain tumor) and the surgeon's preference.

Market Dynamics

The rise in the global geriatric population, high demand for minimally invasive surgeries, improvement in the healthcare system, and development of advanced devices are the major factors driving the global Neurology Devices Market Growth.

The prevalence of neurological disorders appears to be on the rise in recent years, possibly as a result of a combination of factors such as changes in lifestyle and environmental factors, enhanced diagnosis, and an aging of the population. Some neurodegenerative diseases, such as Alzheimer's and Parkinson's disease, are more prevalent among the elderly, and the number of people suffering from these conditions is projected to increase as the population ages. Furthermore, there may be hereditary and other biological factors that make a person more susceptible some people to developing neurological disorders. In addition, developments in health care and technology have made it easier to diagnose these conditions, which may contribute to the observed rise in prevalence. Furthermore, a rise in the geriatric population is expected to drive the growth of Neurology Devices Industry as the risk of developing neurological disorders such as Alzheimer's disease, Parkinson's disease, and stroke rises with age. For instance according to a study by Parkinson’s Foundation in 2022 nearly 90,000 people are diagnosed with Parkinson’s disease in the U.S. each year. In addition, neurostimulation can be used to treat chronic pain conditions such as neuropathic pain, complex regional pain syndrome, and back pain. In addition, neurostimulation devices are also used to treat various neurological disorders such as Parkinson's disease, epilepsy, and dystonia. These devices can help alleviate symptoms by modulating the activity of specific areas of the brain.

In addition, as per the report on epilepsy published by WHO in 2023, around 50 million people worldwide have epilepsy, making it one of the most common neurological diseases globally making it major driving factor for the neurological device market.

Furthermore the Neurology Devices Market Size is expected to get a boost due to the various favorable government initiatives. For instance, The National Institute of Neurological Disorders and Stroke (NINDS) which is a part of the United States' National Institutes of Health, and it is dedicated to supporting research into neurological disorders and developing new treatments.

However high cost of neurological devices used to diagnose and treat neurological disorder and lack of skilled professionals key factors anticipated to hamper the growth of Neurology Devices Market Size.

Segmental Overview

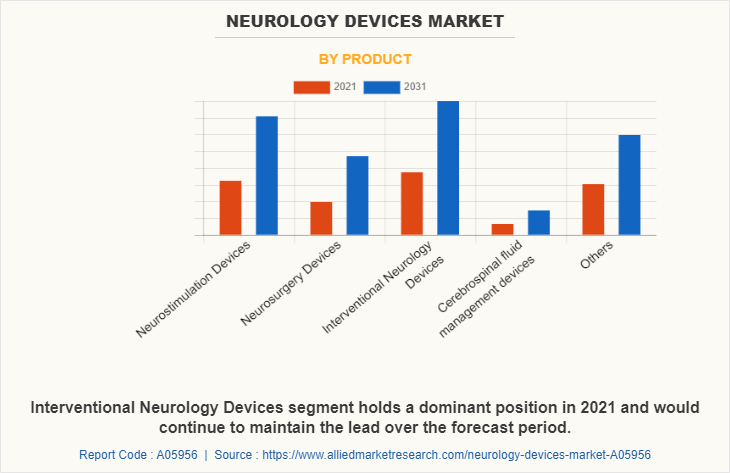

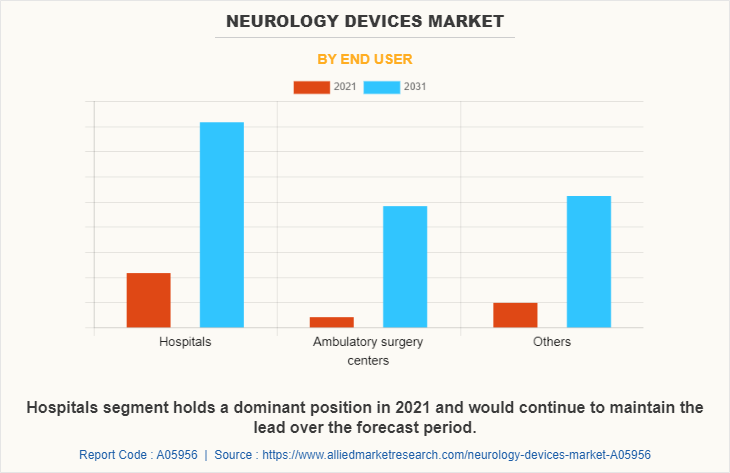

Neurology device market is segmented into product, condition and end user. On the basis of products, the market is categorized into neurostimulation devices, neurosurgery devices, interventional neurology devices, cerebrospinal fluid management devices and others. On the basis of conditions, the market is categorized into stroke, seizures, hydrocephalus, oncology and others. On the basis of end user, the market is categorized into hospitals, ambulatory surgery centers and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

The neurology devices market is segmented into Product, End User and Region.

By Product, the market is categorized into neurostimulation devices, neurosurgery devices, interventional neurology devices, cerebrospinal fluid management devices and others. In 2021, the interventional neurology devices segment accounted for the largest Neurology Devices Market Share in 2021 and is also expected to remain dominant during the forecast period, owing to rise in adoption of this devices owing to higher accuracy and recommended by national health authorities of many countries. The Neurosurgery Devices segment is projected to register the highest CAGR during the forecast period owing to increasing preference by doctors as well as patients due to its lesser recovery time following the treatment.

By End User, the market is categorized into hospitals, ambulatory surgery centers and others. The hospitals segment occupied the largest share in 2021 and is expected to register the highest CAGR owing to availability of advanced medical technologies, highly skilled healthcare professionals and a wide range of specialized services.

By Region, the neurology device market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a majority of the global neurology devices market share in 2021, and is anticipated to remain dominant during the Neurology Devices Market Forecast period. This is attributed to rise in the prevalence of neurological disorders, the prevalence of advanced healthcare infrastructure, and presence of key players offering neurology devices. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in number of neurosurgeries, rise in medical tourism, and surge in investments for the development of neurostimulants, is expected to drive the growth of the market during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the neurology device market, such as Integra Lifesciences, B.Braun SE, Medtronic plc, Natus Medical Inc, Stryker Corporation, Boston Scientific Corporation, Abbott Laboratories, LivaNova PLC, Zimmer Biomet Holding Inc. and Johnson & Johnson. are provided in this report. Major players have adopted acquisition, product launch, product approval and as key developmental strategies to improve the product portfolio of the neurology devices market.

Some Examples Of Product Approvals In The Market

- In April 2022, Boston Scientific announced it has received U.S. Food and Drug Administration (FDA) approval for its latest image-guided programming software, Vercise Neural Navigator with STIMVIEW XT

- In January 2021, Boston Scientific Corporation had received U.S. Food and Drug Administration (FDA) approval of its fourth-generation Vercise Genus Deep Brain Stimulation (DBS) System

- In June 2021 Medtronic announced it has received U.S. Food and Drug Administration (FDA) approval for Vanta, a high-performance recharge-free implantable neurostimulator (INS) with a device life that can be optimized up to 11 years.

Some Examples Of Product Launch In The Market

- In October 2019 Medtronic plc announced the U.S. launch of its advanced Patient Programmer technology for Deep Brain Stimulation (DBS) therapy at the Samsung Developers Conference in San Jose, Calif.

- In January 2021 Boston Scientific had announced a limited market release of the WaveWriter Alpha portfolio of Spinal Cord Stimulator (SCS) systems.

- In January 2019 Boston Scientific Corporation had launched the Vercise Primary Cell (PC) and Vercise Gevia Deep Brain Stimulation (DBS) Systems featuring the Vercise Cartesia Directional Lead.

- In February, 2023 LivaNova PLC, a market-leading medical technology and innovation company, today launched SenTiva DUO, an implantable pulse generator (IPG) with a dual-pin header to provide VNS Therapy for the treatment of drug-resistant epilepsy. The dual-pin header distinguishes this latest IPG from the original SenTiva, which is only available in a single-pin format. Now, with SenTiva DUO, patients considered “the pioneers of VNS Therapy” who were originally implanted with a dual-pin lead and IPG can receive the benefits of the latest VNS Therapy technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the neurology devices market analysis from 2021 to 2031 to identify the prevailing Neurology Devices Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the neurology devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global neurology devices market trends, key players, market segments, application areas, and market growth strategies.

Neurology Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 27.2 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Abbott Laboratories, Integra Lifesciences, Medtronic plc, Boston Scientific Corporation, B.Braun SE, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holding Inc., Natus Medical Inc., LivaNova PLC |

Analyst Review

This section provides various opinions of top-level CXOs in the neurology devices market. According to the insights of CXOs, increase in demand for neurology devices and rise in investments for neurology devices globally are expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives and higher spending for neurology device, has piqued the interest of several companies to develop neurology device.

CXOs further added that increase in adoption of non-invasive and minimally invasive treatments to avoid the scaring which was caused by traditional surgical methods and surge in the prevalence of neurological disorders such as epilepsy, neuromuscular disorders, autism, attention-deficit disorder (ADD), brain tumors, and cerebral palsy is expected to boost the growth of the market. In addition, increase in awareness of neurological disorders across the globe has resulted in rise in demand, thus driving the growth of the market. Further, neurology devices have evolved significantly in recent years with the development of new technologies such as miniaturization and wireless technology Robotics and AI.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in awareness of neurological disorders in patients, rise in prevalence of neurological disorders and surge in healthcare infrastructure drive the growth of the neurology device. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of neurology device and increase in number of key players manufacturing neurology device, drive the growth of the market during the forecast period

The total market value of the Neurology Devices Market is $12567.71 million in 2021.

The forecast period in the report is from 2022 to 2031

North America is the largest regional market for Neurology Devices.

The increase in the prevalence of neurology disorders, the presence of key players, and the high population base are the key market trends of emerging countries

The top companies that hold the market share in the Integra Lifesciences, B.Braun SE, Medtronic plc, Natus Medical Inc, Stryker Corporation, Boston Scientific Corporation, Abbott Laboratories, LivaNova PLC, Zimmer Biomet Holding Inc. and Johnson & Johnson.

The base year for the report is 2021.

There are 10 Neurology Devices manufacturing companies are profiled in the report.

The key trends in the Neurology Devices Market are the increasing prevalence of neurology disease, the rising incidence of brain tumor, and a surge in technological advancement in Neurology Devices.

Loading Table Of Content...