Newborn Screening Market Research, 2031

The global newborn screening market size was valued at $1.1 billion in 2021, and is projected to reach $2.0 billion by 2031, growing at a CAGR of 6.8% from 2022 to 2031.

Newborn screening identifies conditions that can affect a child’s long-term health or survival. This screening technology includes a series of tests essential for timely detection, early diagnosis, and health management to prevent overall disability and avert death of a child. These tests are performed shortly after the baby is born, and detect genetic, developmental, and metabolic disorders in newborn babies. Newborn screening is done by using a few drops of blood from the newborn’s heel, for certain genetic, endocrine, and metabolic disorders, and are tested for hearing loss and critical congenital heart defects (CCHDs) prior to discharge from a hospital or birthing center.

Market Dynamics

The global newborn screening market size is expected to exhibit significant growth, owing to increase in government support for newborn screening and development in screening technology. The key factors driving the growth of market are high birth rate and increase in incidence of neonatal diseases. However, lack of improvement in healthcare infrastructure and limited number of trained professionals restrict the market growth. Conversely, screening of genetic disorders and emerging market such as Brazil, China, and India Brazil provide significant opportunities to key players in this market due to increase in birth rates and rise in disposable income in these countries.

The global newborn screening market is segmented into product, test type, technology, and region. On the basis of product, the market is divided into instrument and consumables. According to test type, it is segregated into blood test, hearing screening test, and heart diseases screening test. Depending on technology, it is fragmented into tandem mass spectrometry (TMS), molecular assay, immunoassays & enzymatic assays, hearing screen technology, pulse oximetry screening technology, and others, on the basis of end user, the market is divided into hospitals and clinical laboratories .Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Coronavirus (COVID-19) was discovered in December 2019 in Hubei province of Wuhan city in China. The disease is caused by a virus, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted among humans.

After its discovery in Wuhan, the disease rapidly spread to other parts of the globe. Moreover, this virus causes various symptoms in patients, which range from common symptoms to serious symptoms. For instance, common symptoms include fever, dry cough, and fatigue. However, serious symptoms include difficulty in breathing or shortness of breath, chest pain or pressure, and loss of speech or movement. Furthermore, the virus has high potential of lethality in geriatric population. On March 11, 2020, the World Health Organization made an assessment that COVID-19 can be characterized as pandemic. In addition, only a few vaccines that received emergency approvals for COVID-19 prevention. Thus, social distancing is observed as the most important measure to stop the spread of this disease. Furthermore, to maintain social distancing, various countries across the world have adopted nationwide lockdowns.

The COVID-19 pandemic had a negative impact on the newborn screening, as majority of the screening centers experienced a broad spectrum of difficulties and most were affected more in the second wave of the pandemic. Samples arriving at screening centers and the availability of laboratory equipment and reagents were delayed due to postal delays and unreliability, as well as flight cancellation. Owing to infection, quarantine, or relocation within the healthcare facility, laboratory staff availability was occasionally limited. Home sample collection, second-tier tests, and follow-up were all impacted. These issues were exacerbated by social restrictions and public transportation disruptions. Only a few centers were able to keep their NBS (newborn screening) programs fully operational.

Segments Overview

The newborn screening market is segmented into Product Type, Test Type, Technology and End User.

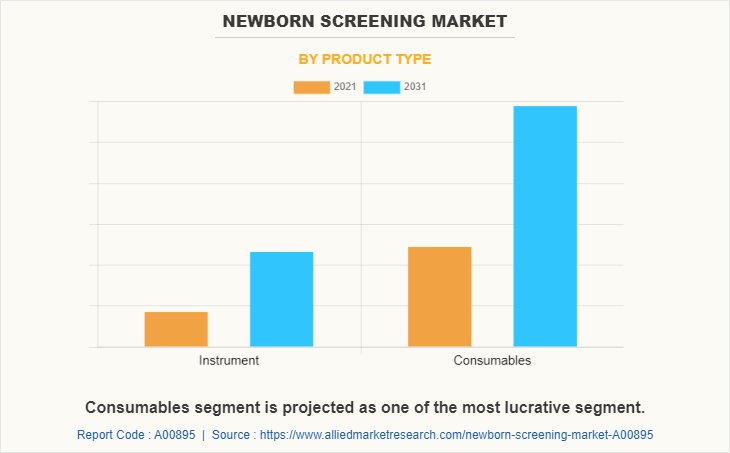

By Product Type

By product, the consumable segment presently dominated the market, and is expected to remain dominant during the forecast period, owing to increase in prevalence of newborn diseases and rise in newborn screening rate.

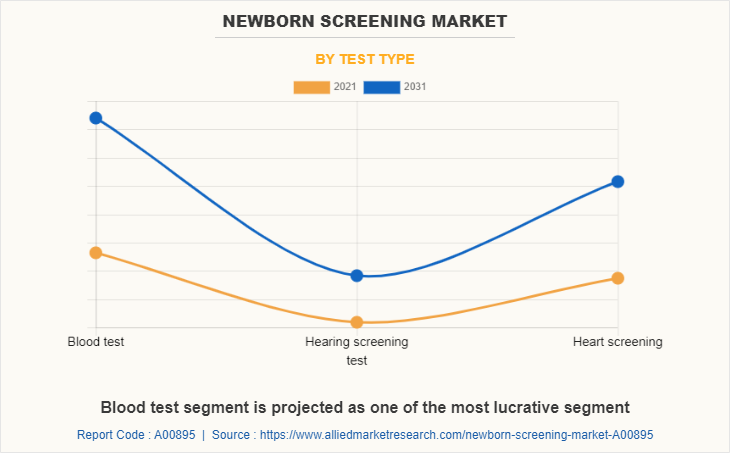

By Test Type

By test type, the blood test segment was the major revenue contributor in 2021, and this segment is projected to exhibit fastest growth during the forecast period, owing to increase in the usage of blood test for serological diagnosis of infectious or autoimmune disease and easy and effective diagnosis as compared to other testing methods further boost the market growth.

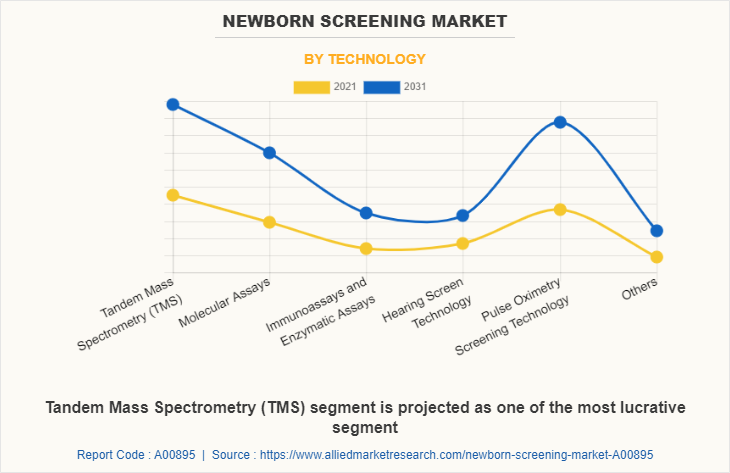

By Technology

By technology, the tandem mass spectrometry presently dominates the Newborn Screening Market size, and is expected to remain dominant during the forecast period. This is attributed to the cost-effectiveness, high applicability, and technology upgrades.

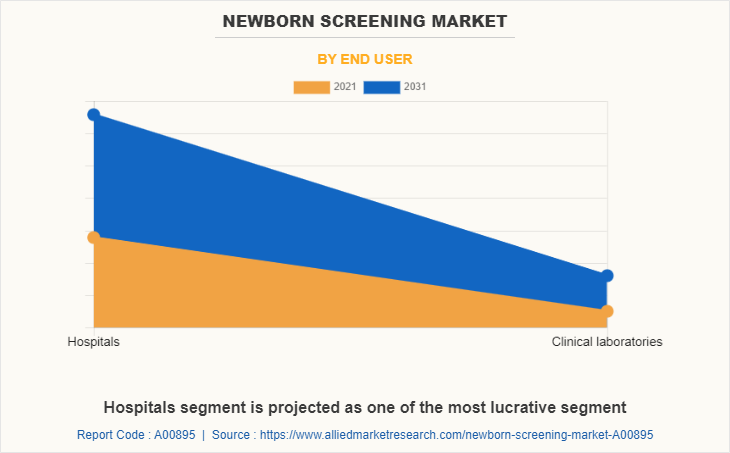

By End User

On the basis of end user, in Newborn Screening Market share, the hospital segment dominated the market in 2021, and is expected to exhibit prominent growth rate, owing to increase in prevalence of neonatal disorders, rise in disposable income with rise in need for hospitalization for patients, Development in healthcare for infrastructure of hospitals and high-tech equipment in the hospitals further propel the market growth.

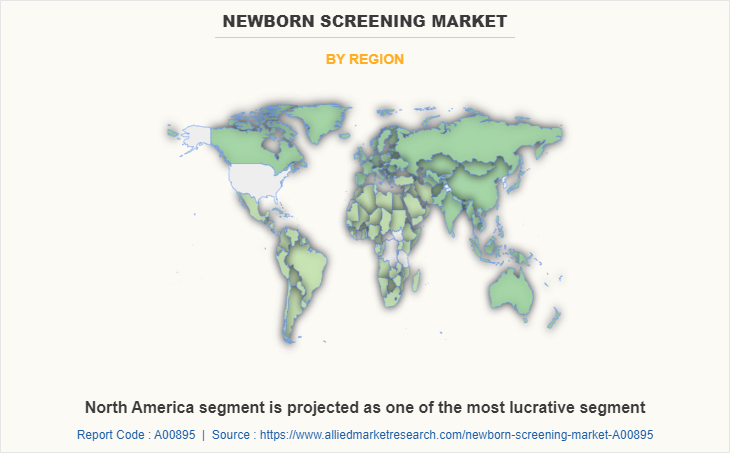

By Region

North America dominated the Newborn Screening Industry in 2021, accounting for the highest share, and is anticipated to maintain this trend throughout the Newborn Screening Market forecast period. The availability of newborn screening programs, favorable reimbursement policies, and strong market players presence are anticipated to drive the Newborn Screening Market growth.

This report provides comprehensive competitive analysis and profiles of prominent market players such as key players operating in the Ab Sciex LLC (subsidiary of Danaher Corporation), Perkinelmer, Inc., Waters Corporation, Natus Medical Incorporated, Masimo Corporation, Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Covidien Plc, Ge Healthcare (subsidiary of General Electric Company), and Trivitron Healthcare.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the newborn screening market analysis from 2021 to 2031 to identify the prevailing Newborn Screening Market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the newborn screening market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global newborn screening market trends, key players, market segments, application areas, and market growth strategies.

Newborn Screening Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Test Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Trivitron Healthcare, Bio-Rad Laboratories Inc., PERKINELMER, INC., Agilent Technologies Inc., Ge Healthcare, Natus Medical Incorporated, Covidien Plc, MASIMO CORPORATION, Ab Sciex LLC, Waters Corporation |

Analyst Review

Newborn screening aids in the early detection of signs that may harm a newborn's health in the long term. Newborn screening technology consists of a set of tests that are necessary for early detection, diagnosis, and management of a child's health in order to prevent overall disability and death. These tests reveal genetic, developmental, and metabolic problems in newborn babies and are conducted shortly after the baby is delivered.

According to the CXOs of key companies, the adoption of newborn screening is anticipated to increase in the future, owing to increasing government support for newborn screening and development in screening technology. Moreover, the supply of newborn screening products is anticipated to become streamlined and effective, owing to improved Current Good Manufacturing Practice (cGMP) guideline from the FDA. Manufacturers are expected to gain additional income by diversifying their product offering to cater to the needs of new markets. Premium pricing is projected to remain a source of concern and limit the rate of adoption of these modules; however, the availability of funds and grants from the government is expected to drive growth of this market.

As per the perspective of CXOs, North America is expected to dominate the automated radiosynthesis module market during the forecast period, followed by Europe. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to the key players during the forecast period.

The upcoming trends of Newborn Screening Market includes increasing government support for newborn screening and development in screening technology.

The leading application of Newborn Screening Market is diagnosis and infection screening.

North America is the largest regional market for Newborn Screening Market

The global newborn screening market valued at $ 1,055.24 million in 2021, and is projected to reach $ 2,038.47 million by 2031, registering a CAGR of 6.8% from 2022 to 2031.

The major companies profiled in the report include the Ab Sciex LLC (subsidiary of Danaher Corporation), Perkinelmer, Inc., Waters Corporation, Natus Medical Incorporated, Masimo Corporation, Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Covidien Plc, Ge Healthcare (subsidiary of General Electric Company) and Trivitron Healthcare.

Loading Table Of Content...