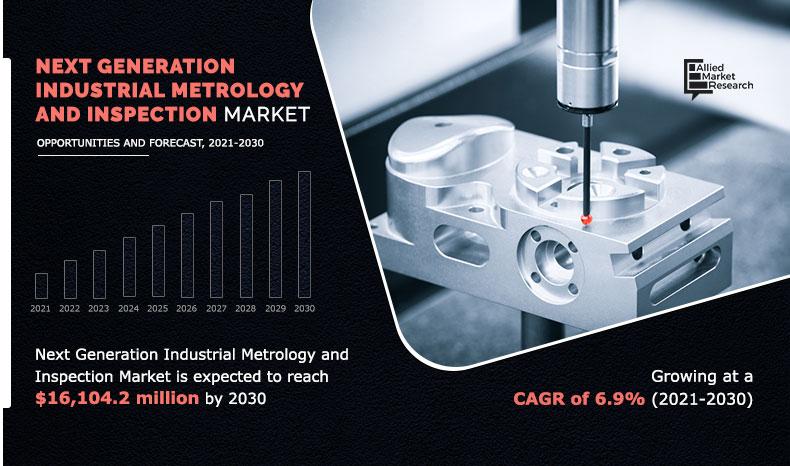

The next-generation industrial metrology and inspection market size is expected to reach $16,104.2 million by 2030, from $8,125.0 million in 2020, registering a CAGR of 6.9% from 2021 to 2030. Industrial metrology is a concept used in production and manufacturing sector to check dimensional conformity, quality control, and all methods to obtain measurement. Industrial metrology is compulsory implemented by the company to check whether validity of production, and confirm the products quality. Industrial metrology used to improve the product life cycle in appropriate manner.

Increase in global R&D spending on developing and launching new metrology products and solutions offers business opportunities to measurement companies. Nikon Corp, FARO Technologies, Hexagon AB, and Carl Zeiss AB are spending on R&D activities on industrial metrology products and services, as observed from annual reports published by these companies. All these companies have spent 10% on their research and development activities. In addition, rise in adoption of big data analytics in industrial applications, owing to generate and operate large volume of data in appropriate manner.

Major players such as ACCRETECH, Innovalia Metrology Systems and Solutions, and others are offering platform-as-a-service for manufacturing industry. For instance, ACCRETECH offered platform-as-a service. It is engaged in offering services such as specialized contract measurement, training, addition & updates, calibration, repair and maintenance, and installation services for industrial metrology products.

A rise in demand for coordinate measuring machine, owing to features such as high accuracy, 3D model, flexible, and scalable. Coordinate measuring machine is machine form an integral part of manufacturing processes, and used for quality assurance during manufacturing activities such as aerospace, defense, plastic & rubber, medical devices, and machine manufacturing sectors. The global growth in automation and smart manufacturing drives the demand for coordinate measuring machine (CMM). In addition, rise in spending on R&D in manufacturing industries fuels the next-generation industrial metrology and inspection market growth in France. For instance, the spending on R&S in France grew by 4.5% from 2018 to 2019.

Hence, the advantage of bolstered productivity in manufacturing industries drives the growth of next-generation industrial metrology and inspection market. High investment for setting up for metrological systems and increased security threats while using internet-enabled devices in industrial application is anticipated to restrain the growth of the market. Data-driven decision-making at the planning stage of construction projects is likely to anticipate better management of resources; thereby, improving project efficiency. However, adoption of cloud-based services to integrate large amount of data is anticipated to provide lucrative opportunities for market growth.

The next-generation industrial metrology and inspection market is segmented on the basis of offering, equipment, application, and region. Based on offering, the market is divided into hardware, software, and services. The hardware segment dominated the market in 2020. By equipment, the market is divided into coordinate measuring machine, measuring instruments, optical digitizer and scanner, and others.

By Offering

Hardware segment holds dominant position in 2020

Coordinate measuring machine (CMM) generated the highest revenue in 2020. Based on application, the market is divided into automotive and transportation, aerospace and defense, semiconductor & electronics, industrial machinery, and others. The automotive & transportation segment generated the highest revenue in 2020.

Region wise, the next-generation industrial metrology and inspection market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, Italy, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). In 2020, North America was the highest contributor to the next-generation industrial metrology and inspection market share.

By Application

Automotive and Transportation segment is expected to grow at a significant CAGR

Competition Analysis

The key players profiled in the next-generation industrial metrology and inspection industry report include Hexagon AB, Renishaw PLC, Carl Zeiss AG, FARO Technologies, Jenoptik AG, Automated Precision Inc, KLA Corporation, Applied Materials Inc, Nikon Metrology, and Trimet Group.

Major players are adopting acquisition, products launch, and business expansion as key developmental strategy to improve the product portfolio of digital manufacturing products. For instance, in October 2020, Nikon Corporation launched a new APDIS laser radar inspection system from Nikon metrology as its twice as other inspection system. It maintains accuracy and precision control.

By Region

North America Region is expected to dominate the market during the forecast period.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current next-generation industrial metrology and inspection market trends and future estimations.

- Extensive analysis of next-generation industrial metrology and inspection market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The next-generation industrial metrology and inspection market forecast analysis from 2021 to 2030 is included in the report.

- The key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the next-generation industrial metrology and inspection market.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Equipment

- Coordinate Measuring Machine (CMM)

- Measuring Instruments

- Optical Digitizer and Scanner (ODS)

- Others

By Application

- Automotive and Transportation

- Aerospace and Defense

- Semiconductor and Electronics

- Industrial Machinery

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- Hexagon AB

- Renishaw PLC

- Carl Zeiss AG

- FARO Technologies

- Jenoptik AG

- Automated Precision Inc

- KLA Corporation

- Applied Materials Inc

- Nikon Metrology

- Trimet Group.

Next-Generation Industrial Metrology and Inspection Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Equipment |

|

| By Application |

|

| By Region |

|

| Key Market Players | TRIMET GROUP, FARO TECHNOLOGIES, INC., CARL ZEISS AG, APPLIED METROLOGY SERVICES (PTY) LTD, JENOPTIK AG, AUTOMATED PRECISION, INC., .NIKON CORPORATION, HEXAGON AB, Renishaw plc., KLA CORPORATION |

Analyst Review

The industrial metrology is the use of science of measurement, theoretically and practically in the manufacturing process, ensuring accuracy and quality of manufactures parts and components. It is used for calibration and quality control standards. Industrial metrology is largely used in automotive, transportation, defense, and manufacturing industries. North America is the largest shareholder of the next-generation industrial metrology industry, owing to the large manufacturing and connectivity infrastructure and a strong foothold in the construction and manufacturing industry. In addition, the South Korean government is also promoting inclusion of smart manufacturing technologies in industries such as automotive, consumer packaged goods, and others to operate production smoothly and effectively.

Increase in use of mobiles, smart phones, and connected devices technologies across business processes and manufacturing departments fuels the growth of the next-generation industrial metrology and inspection market. In addition, rise in adoption of industrial metrology solutions in the food, defense sectors, and smart city initiatives boosts the growth of the market.

Moreover, inclusion of IoT, machine learning, metrology equipment, and robotics in automotive and general manufacturing sectors and electric motor vehicles is anticipated to provide lucrative opportunities for growth of the next-generation industrial metrology and inspection market.

The Next Generation industrial metrology and inspection market size was $8,125.0 million in 2020 and is projected to reach $16,104.2 million in 2030, growing at a CAGR of 6.9% from 2021 to 2030.

The forecast period considered for the Next Generation industrial metrology and inspection market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

The base year considered in the Next Generation industrial metrology and inspection market is 2021.

The report for Next Generation industrial metrology and inspection market doesn’t provides Value Chain Analysis, but if there is a requirement for the same, it could be added as an additional customization.

On the basis of equipment, the coordinate measuring machine (CMM) segment is expected to be the most influencing segment growing in the Next Generation industrial metrology and inspection market report.

Based on application, automotive & transportation segment generated the highest revenue, accounting for 26.12% of the market share, and is projected to grow at a CAGR of 7.8% from 2021 to 2030.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

North America is expected to provide more business opportunities for Next Generation industrial metrology and inspection market in the future.

Loading Table Of Content...