Non-alcoholic Spirits Market Summary

The global non-alcoholic spirits market size was valued at $325.8 million in 2023, and is projected to reach $706.7 Million by 2033, growing at a CAGR of 8.1% from 2024 to 2033. Growing consumer preference for healthy food and beverage products are expected to positively impact the growth of the non-alcoholic spirits market.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2023.

The global non-alcoholic spirits market share was dominated by the whisky segment in 2023 and is expected to maintain its dominance in the upcoming years

The organic segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 325.8 Million

- 2033 Projected Market Size: USD 706.7 Million

- Compound Annual Growth Rate (CAGR) (2024-2033): 8.1%

- North America: Generated the highest revenue in 2023

Market Introduction and Definition

Non-alcoholic spirits are made from a mixture of spices, herbs, and fruits. They are sweeter, fruitier, and balanced with strong and bitter flavors. The herbal aroma provides a lasting aftertaste. They are a perfect solution for those who want a mixed drink minus the side effects of alcohol. Alcohol-free spirits contain active ingredients that are designed to mimic the positive effects of alcohol. Moreover, non-alcoholic spirits are produced with plant-based sources such as flowers, spices, roots, berries, and extracts, among other ingredients. Also, non-alcoholic spirits are vegan, gluten-free, calorie-free, and allergen-free. Owing to this it can be a healthy substitute for alcoholic spirits. Furthermore, the health-conscious population seeks to reduce or eliminate alcohol from their diet in order to lose weight and improve sleep. They are an excellent alternative for those who crave alcohol but do not want its negative side effects.

Key Takeaways

- The non-alcoholic spirits market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the forecast period.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major non-alcoholic spirits industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global non-alcoholic spirits markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

- Non-alcoholic spirits are made from flowers, roots, botanical extracts, berries, and spices, among other plant-based sources. These alternatives deliver the exact same taste, aroma, complexity, and flavor compared to normal alcoholic spirits except it has 0% to 5% alcohol by volume (ABV) . Some non-alcoholic spirits are gluten-free, calorie-free, allergen-free, and vegan. Moreover, the increasing consumer focus on the consumption of healthy food & beverage products is expected to propel the non-alcoholic spirits market during the forecast period. Moreover, the health-conscious population aims to reduce or eliminate the alcohol content from their diet to reduce weight and improve sleep. They provide an excellent alternative to those who are craving alcohol but don't want to experience its side effects. Apart from that, non-alcoholic spirits are suitable to those with religious matters, pregnancy, dietary restrictions, and appropriateness at work.

- Consumers nowadays are inclined to spend more on what they drink and what they eat. According to the Organization for Economic Cooperation and Development (OECD) , the U.S., Luxembourg, Switzerland, Australia, Germany, Norway, France, and Netherlands, are some of the top countries with the highest disposable income in 2020. The increase in disposable income along with the changing consumer lifestyle are contributing toward the popularity of healthy drinking options, which is further driving the growth during the non-alcoholic spirits market forecast.

- The surge in per capita disposable income among developing countries has led to changing consumer habits while purchasing food & beverage products. The rise in the adoption of luxurious lifestyles among the middle-income population has led to a manifold increase in market size and overall demand. Furthermore, Latin America and the Middle East region have seen an increase in disposable income since the past decade, which is expected to rapidly boost the non-alcoholic spirits demand, thus contributing toward non-alcoholic spirits market growth.

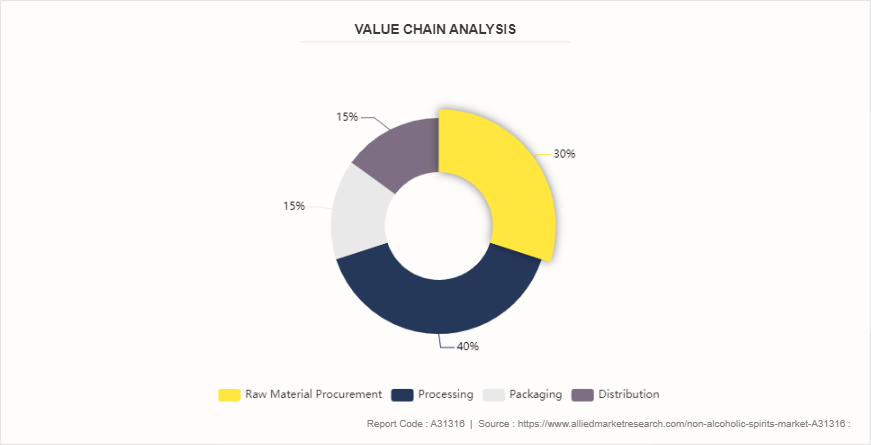

Value Chain Analysis

The value chain of the non-alcoholic spirits market comprises various stages that add a unique value to the overall market. Each of these stages shares a specific value at their point of operation and, in turn, contributes to the competitive value of the end product provided.

- Raw Material Procurement:

The first stage in the supply chain analysis involves the procurement of raw materials. Fruits, berries, herbs, flowers, barks, wood, nuts, seeds, grasses, roots, juices, extracts, salts, honey, natural & artificial flavorings, and natural & artificial colorings are the major raw material for non-alcoholic spirits. The raw materials are directly procured from farmers or suppliers. Depending on the type of non-alcoholic drink, the raw materials are selected for processing.

- Processing

The processing steps involved maceration, thermal extraction, cooling, reverse distillation, and blending of the material to produce nonalcoholic beverages.

- Maceration: After the raw material procurement, the ingredients are soaked in a cold liquid in order to extract its flavors.

- Thermal extraction: In this process, the cold liquid is heated at a particular pressure. This process replicates the barrel aging process seen in traditional spirits.

- Cooling: The heated liquid is then cooled for the next phase.

- Reverse Distillation: In this process, the cooled liquid is heated at a particular pressure. This process is required to separate the ethanol from distillates. The distillate that remains is non-alcoholic.

- Blending: The spirit is now blended by selecting specific totes from various distillations, each with a unique character. The distillates are selected to form a perfect combination for the specific types of non-alcoholic spirits.

- Packaging:

It involves designing aesthetically pleasing and functional packaging that effectively communicates the brand’s identity and values. The design process takes into account visual appeal to attract consumers, practical considerations such as ease of use and transportation, and regulatory requirements for labeling and information disclosure. The spirits obtained from the raw material are filled in bottles and packed in attractive packaging. After packaging, the product is then sent for distribution.

- Distribution:

The distribution stage in the non alcoholic liquor market is essential for ensuring that products reach consumers efficiently and effectively. This stage involves establishing a robust logistics network to transport products from manufacturing facilities to various sales channels, including retail stores, bars, restaurants, and e-commerce platforms. Effective distribution requires meticulous planning and coordination to manage inventory levels, optimize warehousing, and ensure timely deliveries. Companies often partner with reliable logistics providers to handle shipping and manage the complexities of global distribution, including compliance with international trade regulations.

Market Segmentation

The non-alcoholic spirits market is segmented into product type, category, distribution channel, and region. Based on product type, the market is divided into whiskey, rum, vodka, tequila, and others. As per category, the market is segregated into conventional and organic. Based on the distribution channel, the market is divided into food service and food retail. Region-wise, the non-alcoholic spirits market share is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional Market Outlook

Region-wise, North America held the major non-alcoholic spirits market share in 2023. The non-alcoholic spirits industry holds a substantial scope for growth; however, its contribution to the world market will increase significantly within the next six years. Owing to the increasing interest in wellness and mounting selection of no-ABV beverages, 58% of consumers in the U.S. are drinking more alcohol-free beverages compared to last year while 61% of consumers want to have better quality products with wide availability when it comes to alcohol-free drinks. Therefore, owing to this, manufacturers are also looking to expand their product offerings with innovative flavors in the non-alcoholic category.

Moreover, investors are showing interest in investing in non-alcoholic spirits brands. CleanCo, a manufacturer of non-alcoholic rum, gin & tequila alternative secured $12 million in funding. Also, Diageo recently acquired a minority stake in Ritual Zero Proof. Apart from this, e-commerce (i.e., online) distribution channels such as Amazon, brand shopping sites, and grocery outlets are contributing to the growth of the non-alcoholic spirits market.

Industry Trends

- Non-alcoholic beverages offer significant advantages for businesses across the board. While newer brands have notably reaped rewards from their success, established industry players can also leverage these advantages to their benefit. Industry leaders such as Budweiser and Heineken can fortify their market resilience through two key strategies. Firstly, by expanding their presence in retail distribution channels, and secondly, by diversifying consumption opportunities.

- Local and state regulations impose constraints on retailers stocking various beverage brands. Nevertheless, brands can broaden their market presence by introducing non-alcoholic alternatives readily available in the conventional beverage section of natural-focused grocery stores or accessible for home delivery through online vendors. According to recent study, a growing number of consumers are exploring non-alcoholic beverage options, with a significant influx through Amazon (77% more) , Sprouts (53%) , and Whole Foods (16%) .

- There's a significant focus on innovation in product development, with companies creating non-alcoholic spirits that closely mimic the taste, aroma, and mouthfeel of their alcoholic counterparts. This includes using botanicals, distillation methods, and other techniques to achieve authentic flavors.

Competitive Landscape

The major players prolied in the non-alcoholic spirits market analysis include Bacardi Limited, Caleño, Pernod Ricard, Rheinland Distillers GmbH, Diageo plc., la martiniquaise, Everleaf Drinks, ArKay Beverages LTD, Spirits of Virtue, Spiritless Inc, ALTD SPIRITS, Ritual Zero Proof, Aplós, Ecology & Co., Lyre's Spirit Co, Elegantly Spirited LTD, Salcombe Distilling Co, Drink Monday, FLUÈRE, Escape Mocktails.

Recent Key Strategies and Developments

- In 2023, Pernod Ricard acquired a majority stake in Código 1530, an ultra-premium and prestige tequila, Skrewball, a super-premium whiskey, and ACE Beverage Group, the Canadian RTD market leader.

- In 2023, Coca-Cola Company and Pernod Ricard partnered on Absolut Vodka with Sprite.

- In 2023, Pernod Ricard announced a €238 million investment in the construction of a carbon-neutral Jefferson’s distillery in Kentucky. The signing of the first sustainability-linked loan for €2.1 billion euros.

- In 2023, Diageo announced that it had completed the acquisition of Don Papa Rum, a super-premium, dark rum from the Philippines.

Key Sources Referred

- International Alliance for Responsible Drinking (IARD)

- The Beverage Institute

- The Distilled Spirits Council of the United States (DISCUS)

- European Federation of Spirits Producers (EFSP)

- The Brewers Association

- National Restaurant Association (NRA)

- American Beverage Association (ABA)

- World Health Organization (WHO)

- United States Department of Agriculture (USDA)

- International Trade Centre (ITC)

- Food and Agriculture Organization (FAO)

- National Institute on Alcohol Abuse and Alcoholism (NIAAA)

- The Alcohol and Drug Foundation (ADF)

- The Beverage Industry Environmental Roundtable (BIER)

- The Food and Drug Administration (FDA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the non-alcoholic spirits market size, segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing non-alcoholic spirits market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the non-alcoholic spirits market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global non-alcoholic spirits market trends, key players, market segments, application areas, and market growth strategies.

Non-alcoholic Spirits Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 706.7 Million |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 323 |

| By Product Type |

|

| By Category |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Spiritless Inc, Pernod Ricard, Bacardi Limited, ALTD Spirits Co., ArKay Beverages LTD., Diageo plc., Spirits of Virtue LLC., Everleaf Drinks, Rheinland Distillers GmbH, Caleño |

The global non-alcoholic spirits market size was valued at USD 325.8 million in 2023, and is projected to reach USD 706.7 million by 2033.

The global non-alcoholic spirits market is projected to grow at a compound annual growth rate of 8.1% from 2024-2033 to reach USD 706.7 million by 2033.

The key players profiled in the reports includes Bacardi Limited, Caleño, Pernod Ricard, Rheinland Distillers GmbH, Diageo plc., la martiniquaise, Everleaf Drinks, ArKay Beverages LTD, Spirits of Virtue, Spiritless Inc, ALTD SPIRITS, Ritual Zero Proof, Aplós, Ecology & Co., Lyre's Spirit Co, Elegantly Spirited LTD, Salcombe Distilling Co, Drink Monday, FLUÈRE, and Escape Mocktails.

Europe dominated in 2023 and is projected to maintain its leading position throughout the forecast period.

Health and Wellness Trends, Dietary and Lifestyle Preferences, Consumer Shifts Towards Premium Products, Increase in Disposable Income, Lifestyle Changes in Emerging Markets, Social and Cultural Shifts, majorly contribute toward the growth of the market.

Loading Table Of Content...