Non-Fungible Tokens Market Research, 2032

The global non-fungible tokens market was valued at $22.5 billion in 2022, and is projected to reach $395.6 billion by 2032, growing at a CAGR of 33.5% from 2023 to 2032.

The non-fungible token (NFT) market is the environment, in which non-fungible tokens are bought, sold, and traded. Non-fungible tokens are one-of-a-kind digital assets that indicate ownership or proof of authenticity of a certain item or piece of material, such as artwork, collectibles, virtual real estate, or even in-game goods. Unlike fungible cryptocurrencies like Bitcoin or Ethereum, which can be swapped one-to-one, Non-fungible tokens have special features that make them indivisible and unique.

Furthermore, Non-fungible tokens give creators new ways to monetize their digital material. Artists and content creators can sell directly to consumers, avoiding traditional intermediaries, and potentially earn royalties on later resales. Moreover, the NFT marketplace is a platform for buying, selling, and trading NFTs. It includes companies such as OpenSea, Rarible, SuperRare, and NBA Top Shot. Non-fungible tokens market players offer a user-friendly interface for creators and consumers to connect with NFTs. In addition, various blockchain networks serve as the foundation for Non-fungible tokens creation and transactions. Although Ethereum has been the most renowned blockchain for Non-fungible tokens, other platforms such as Binance Smart Chain, Flow, and Tezos also allow NFT functionality.

Increased digital ownership is a major driving factor for non-fungible tokens providers, because NFTs use blockchain technology to establish provable ownership and authenticity, addressing the long-standing issue of digital ownership proof. This assurance appeals to people who appreciate the concept of possessing one-of-a-kind digital products, such as artwork, collectibles, or virtual real estate.

Furthermore, creative expression and monetization enchance the utilization of non-fungible token market. However, high volatility and speculative nature of the non-fungible tokens are major factors hampering the growth of the market, as non-fungible tokens are subject to severe price volatility and may rise in a matter of minutes due to hype, media attention, and celebrity endorsements. Prices can fall just as swiftly when market sentiment shifts or speculative bubbles collapse. This high volatility can make determining the underlying value of non-fungible tokens challenging for buyers and sellers, and it can dissuade potential investors looking for stability and predictability.

Moreover, Scalability and environmental concerns are further challenges as non-fungible tokens strive to differentiate themselves in the competitive landscape. On the contrary, the integration of non-fungible tokens into gaming and Virtual Reality (VR) platforms presents significant opportunities for the (NFT) market. By incorporating non-fungible tokens into these immersive digital environments, new avenues for monetization, ownership, and engagement are created. It can be used to represent virtual things, skins, or characters in-game, letting players to really own and sell them outside of the gaming ecosystem. This gives virtual belongings a new level of worth and rarity, appealing to collectors and enthusiasts. Thus, it will provide major lucrative opportunities for the growth of non-fungible token market.

The report focuses on growth prospects, restraints, and trends of the non-fungible token market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the non-fungible token market.

Segment Review

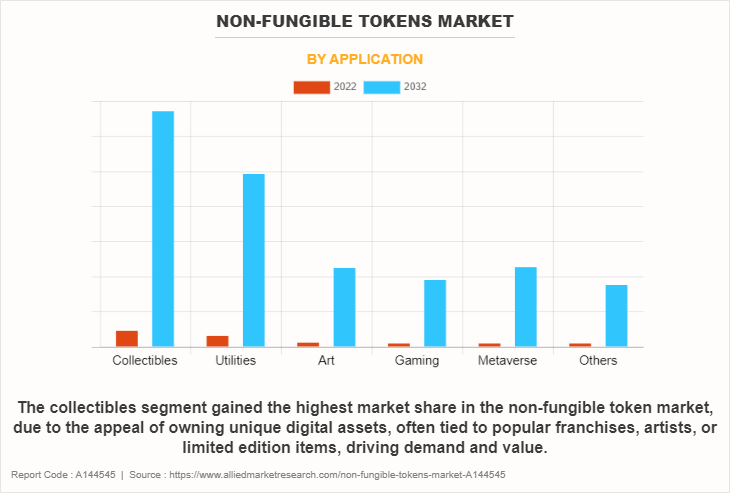

The non-fungible token market is segmented on the basis of offering, application, end user, and region. Based on offering, the market is segmented into business strategy formulation, NFT creation and management, and NFT platform-marketplace. By application it is segmented into collectibles, art, gaming, metaverse, and others. On the basis of end user, it is segmented into personal, commercial. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the collectibles segment attained the highest growth in 2022. This can be attributed to the fact that NFT-based collectibles provide a new and innovative way to possess and display digital assets, appealing to a diverse group of collectors who value the rarity and exclusivity of one-of-a-kind digital products. Furthermore, the blockchain technology that underpins NFTs creates a transparent and tamper-proof record of ownership and authenticity, addressing long-standing concerns in the collectibles market such as counterfeiting and provenance issues. This improved trust in the legality of NFT-based collectibles has drawn both, seasoned collectors and beginners to the market.

However, the gaming segment is expected to be the fastest growing segment in the Non-fungible tokens market during the forecast period. This projected growth can be attributed to its distinct ability to easily incorporate NFTs into interactive and immersive virtual experiences. NFTs have given game producers an innovative approach to representing in-game assets, characters, and virtual things on the blockchain as distinct digital tokens. This has changed the traditional gaming landscape, allowing gamers to genuinely own and trade their digital assets. The ownership and scarcity of NFT-based in-game assets have created a sense of worth and collectability, attracting both players and collectors to collect NFT tokens.

Region-wise, North America attained the highest growth in 2022, owing to a well-established and powerful digital infrastructure, which includes cutting-edge technological capabilities and broad internet connectivity. This strong foundation fosters the adoption and proliferation of NFTs, attracting inventors, purchasers, and investors. Furthermore, North America has a thriving and diversified cultural and creative community, which includes artists, musicians, content makers, and influencers. These people have embraced NFTs as a way to directly monetize their digital creations, avoiding traditional intermediaries and obtaining more control over their work. The presence of this robust creative ecosystem has aided in the expansion of the region's NFT business.

However, Asia-Pacific is expected to be the fastest growing region during the forecast period. This is attributed to the fact that the region has a large and digitally engaged population, with a significant number of tech-savvy individuals who are early adopters of emerging technologies. This tech-savvy population has shown a strong interest in NFTs, thus driving demand for NFT and fueling the market's expansion. Furthermore, Asia-Pacific has a thriving gaming and esports industry, which has embraced the integration of NFTs into virtual worlds and gaming ecosystems. The region is known for its passion for gaming, and the incorporation of NFTs into popular games and platforms has resonated strongly with the local gaming community. This convergence of gaming and NFTs has created a fertile ground for growth, attracting both, gamers and collectors.

The report analyzes the profiles of key players operating in the non-fungible tokens market analysis such as Binance, CONSENSYS, Enjin, Gala Games, Mintable., Nifty Gateway., Ozone Networks Inc, Rarible Inc., SuperRare, and The Sandbox. These players have adopted various strategies to increase their market penetration and strengthen their position in the non-fungible token market.

Market Landscape and Trends

In recent years, the non-fungible token (NFT) market has undergone tremendous growth and developing patterns. The non-fungible tokens market trends are characterized by an increasing number of NFT platforms, rising acceptance by mainstream companies, and emerging use cases across multiple sectors. Furthermore, a major trend is the rise of NFT platforms and marketplaces, established platforms like OpenSea, Rarible, and SuperRare continue to dominate the market, offering a diverse choice of NFTs for sale. However, other platforms and markets have evolved, catering to specialized niches or focusing on unique features. These platforms give artists and collectors more alternatives and possibilities to participate in the Non-fungible tokens market. Moreover, the integration of NFTs into mainstream industries, companies across sectors such as sports, entertainment, fashion, and music are recognizing the potential of NFTs to enhance fan engagement, create new revenue streams, and tokenize real-world assets. This integration has led to collaborations between artists, celebrities, and brands, driving further awareness and adoption of NFTs Therefore, the Non-fungible tokens market is expected to continue to grow in the coming years, driven by these factors.

Top Impacting Factors

Increased Digital Ownership

Non- Fungible Tokens (NFTs) allow for the development and tokenization of limited-supply digital assets. Unlike fungible cryptocurrencies such as Bitcoin or Ethereum, which can be exchanged, NFTs are one-of-a-kind and unchangeable. This distinguishing feature enables the visual representation of numerous digital goods, such as artwork, music, films, virtual real estate, collectibles, and more. Creators can create a sense of ownership and exclusivity in the digital environment by tokenizing these assets as NFTs. Furthermore, NFTs use blockchain technology, often implemented on platforms such as Ethereum, to produce a unique digital token that represents a certain asset and piece of content. These tokens provide metadata that can be used to validate the asset's legitimacy and ownership. NFTs use blockchain's decentralized nature and cryptographic security to create a transparent and immutable record of ownership, preventing counterfeiting or copying. Therefore, the rare and unusual digital assets, and authenticity & ownership verification have significantly increased digital ownership for the non-fungible tokens market.

Creative Expression and Monetization

Non-Fungible Tokens (NFTs) provide a digital platform for artists and creators to express themselves. Images, films, music, virtual reality experiences, and even virtual real estate can all be created and tokenized by artists. NFTs allow artists to establish provenance and ownership of their digital creations, allowing them to be sold and distributed securely. Furthermore, NFTs have provided new ways for artists and creators to monetize their work, as artists can monetize their digital creations by selling their NFTs directly to collectors and through online markets. In addition, NFTs can contain built-in smart contracts that automatically pay artists royalties every time their NFT is purchased in the secondary market, providing constant cash streams. Therefore, digital art, music, and entertainment, as well as digital monetization have significantly enhanced creative expression and monetization for the non-fungible token market.

Growing Interest in Blockchain Technology

The decentralized structure of the blockchain means that once a non-fungible token (NFT) is created and stored on the blockchain, it cannot be changed and tampered with. This gives a high level of security and immutability, critical for verifying digital asset ownership and validity. Furthermore, the blockchain enables the creation of transparent and auditable records of NFT transactions. Each NFT transfer and sale is recorded on the blockchain, providing the asset with a traceable history and provenance. This transparency aids in verifying the NFT's validity and ownership history. Therefore, growing interest in blockchain technology for the non-fungible token market, such as security, immutability, transparency, and provenance are growing interest in blockchain technology for the non-fungible token market.

High Volatility and Speculative Nature

The high volatility and speculative nature of the non-fungible token (NFT) market is anticipated to present market challenges The Non-fungible tokens market has seen increase in interest and hype, attracting both NFT holders and speculative investors looking for quick returns. This increased demand, which can often be caused by media attention and celebrity endorsements, can result in price bubbles and market saturation, as the excitement wears off, demand and prices must fall. Furthermore, NFTs have sold for huge quantities. There have also been example of impulsive price decline, particularly in some areas such as digital art, while some NFTs have sold for large sums. Also, there have been instances of sharp price drops. Thus, NFTs have a high volatility and this volatility can make determining the long-term value of NFTs challenging for investors and collectors and can discourage some people from participating in the market. Therefore, price volatility, market saturation, hype-driven demand for high volatility, and speculative nature are the major resistance for the non-fungible tokens market growth.

Scalability and Environmental Concerns

Scalability and environmental concerns are major factor that can hamper the non-fungible tokens market share. Scalability issues hamper blockchain networks such as Ethereum, which is extensively used for NFTs as NFTs acquire popularity, the network must become overburdened, resulting in increased transaction fees and longer transaction processing times. Thus, the higher transaction fees and longer transaction processing time issue restricts the user experience and could discourage potential users, particularly those who must find the fees and delays burdensome. Furthermore, the blockchain networks, particularly those based on proof-of-work (PoW) consensus algorithms, use a substantial amount of energy. The amount of energy necessary for mining and validating transactions has generated worries about the environmental impact of blockchain technology, especially NFTs, as critics claim that the carbon footprint connected with various blockchain networks is significant and unsustainable. Therefore, scalability, energy consumption, and environment impact of major factors hamper the growth of the non-fungible tokens market size.

Integration of NFTs into Gaming and Virtual Reality (VR) Platforms

The incorporation of non-fungible tokens (NFTs) into gaming and virtual reality (VR) platforms opens up opportunities for the Non-fungible tokens market. NFTs enable game creators to build unique, configurable, and transferable in-game objects. NFTs allow players to customize their characters, weapons, and virtual surroundings, giving them a sense of ownership and individuality. NFTs can also symbolize limited edition or unique objects that enhance the gaming experience by providing exclusive rewards and access to special content. Furthermore, NFTs in gaming and VR platforms have the potential to create play-to-earn models, in which users can earn real-world value by engaging in and excelling at games. Players commercialize their talents and achievements through NFTs by selling valuable in-game products and by joining decentralized autonomous organizations (DAOs) that administer virtual economies. This economic empowerment has the potential to attract a larger audience and encourage more participation in gaming and VR platforms. Therefore, game experience creativity, pay-to-earn, and economic empowerment are the opportunities for the non-fungible tokens industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the non-fungible tokens market forecast from 2022 to 2032 to identify the prevailing non-fungible tokens market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the non-fungible tokens market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Non-fungible tokens market trends, key players, market segments, application areas, and market growth strategies.

Non-Fungible Tokens Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 395.6 billion |

| Growth Rate | CAGR of 33.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 382 |

| By Offering |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Consensys AG, Rarible, Inc., The Sandbox, Ozone Networks, Inc., Mintable, Nifty Gateway, Enjin, Binance Limited, SuperRare, Gala Games |

Analyst Review

The non-fungible token (NFT) industry has experienced increased adoption by mainstream industries including art, gaming, entertainment, sports, and fashion, with established businesses and celebrities embracing NFTs. Furthermore, NFTs are being incorporated into virtual worlds and metaverse platforms, thus opening new possibilities for virtual asset ownership, immersive experiences, and virtual economies. In addition, blockchain infrastructure advancements, such as better scalability and interoperability improve the efficiency and usability of NFTs, thus boosting the market growth. The increasing digital transformation across industries has created a demand for digital assets and virtual experiences, offering NFTs as a digital ownership and monetization solution. In addition, the growing investor, venture capital, and institutional interest has resulted in increased funding and support for NFT projects, further boosting the market expansion and development. Furthermore, NFTs allow creators to engage directly with their fan base by providing exclusive content, experiences, or advantages to NFT holders, thereby deepening audience ties. Moreover, NFTs are appealing to persons who value distinctive digital ownership as they offer a secure and transparent means to demonstrate ownership and authenticity over digital goods. NFTs provide new revenue streams for creators by allowing them to directly monetize their digital material and earn royalties on subsequent sales.

Furthermore, market players are adopting various strategies to enhance their services in the market and improve customer satisfaction. For instance, in June 2021, according to PR newswire, Gala Games partnered with Opera to create natural NFTs. Gala Games uses NFTs to empower players by granting them true ownership of their game assets, whereas Opera empowers its users by providing a superior web-browsing experience and simple access to Web3 and blockchain technology. These empowering aims, together with the charitable emphasis of both Opera and Gala Games, are bringing the two organizations together for a productive collaboration. Furthermore, in March 2022, according to economics times, NFTs surpassed predictions, with their total market valuation reaching close to $50 billion in the previous year. NFTs are powered by the same blockchain technology as crypto assets, as the use of blockchain technology eliminates the potential for duplication. NFT offers a few marketplaces that can assist users in launching and managing their NFTs from the comfort of their own homes. These strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Binance, CONSENSYS, Enjin, Gala Games, Mintable, Nifty Gateway, Ozone Networks Inc, Rarible Inc., SuperRare, and The Sandbox. These players have adopted various strategies to increase their market penetration and strengthen their position in the non-fungible token market.

In recent years, the non-fungible token (NFT) market has undergone tremendous growth and developing patterns. The market landscape is characterized by an increasing number of NFT platforms, rising acceptance by mainstream companies, and emerging use cases across multiple sectors.

North America is the largest regional market for Non-Fungible Tokens

The global non-fungible token market was valued at $22485.13 million in 2022, and is projected to reach $395549.8 million by 2032, growing at a CAGR of 33.5% from 2023 to 2032.

Binance, CONSENSYS, Enjin, Gala Games, Mintable., Nifty Gateway., Ozone Networks Inc, Rarible Inc., SuperRare, and The Sandbox

Loading Table Of Content...

Loading Research Methodology...