Non-PVC IV Bags Market Research, 2031

The global non-pvc iv bags market size was valued at $880.2 million in 2021, and is projected to reach $1,684.5 million by 2031, growing at a CAGR of 6.7% from 2022 to 2031. Non-PVC IV bags are intravenous bags that do not contain polyvinyl chloride as a material. However, PVC material can release harmful chemicals such as di-2-ethyl hexyl phthalate (DEHP), when in contact with the fluids. While, non-PVC bags are made from materials such as polypropylene, polyethylene, copolyester ether, and ethylene vinyl acetate (EVA). These bags are used in many healthcare settings including hospitals, clinics, and emergency medical services.

Non-PVC IV bags are also beneficial for homecare as they are made from materials that are resistant to chemicals, heat, and UV light which can help ensure the quality and stability of IV fluids. Non-PVC IV bags are most commonly used in homecare due to their safety, environmental benefits, and convenience to handle. The use of IV bags in homecare settings help improve the quality of care for patients and reduces the healthcare cost.

“The non-PVC IV bags market size decreased during the lockdown period owing to decline in sales of non-PVC IV bags. In addition, increase in trend of home healthcare settings due to COVID-19 is expected to slowly increase the growth of the non-PVC IV bags market.”

Market dynamics

Growth & innovations in the industry for manufacturing medical devices owing to massive pool of health-conscious consumers create an opportunity for the growth of the non-PVC IV bags market share. The growth of the non-PVC IV bags market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, and rise in prevalence of chronic diseases. In addition, in some countries there are regulations that limit the use of PVC material in products such as IV bags. This has increased the demand for non-PVC IV bags. Thus, rise in government regulations for IV bags drives the market growth. Moreover, PVC IV bags contain the di-2-ethyl hexyl phthalate (DEHP) a chemical that can leach out from the bags into IV fluids while non-PVC IV bags do not contain DEHP and PVC material which makes the product safer. Thus, rise in awareness regarding usage of non-PVC IV bags supports the market growth. Rise in demand for non-PVC IV bags with increase in number of hospitals and clinics for treatment of chronic diseases creates opportunity for the non-PVC IV bags market share.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries. The demand for non-PVC IV bags is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of polypropylene IV bags and polyethylene IV bags and increase in awareness toward harmful effects of PVC IV bags further drive the growth of the market. Furthermore, rise in consumer awareness related to preventive healthcare and ease of accessibility boost the adoption of non-PVC IV bags.

However, increase in healthcare expenditure is expected to drive the growth of the non-PVC IV bags market. In addition, strong presence of leading players such as B. Braun SE, BAUSCH Advanced Technology Group, ICU Medical, Inc., and others in the market create opportunity for the non-PVC IV bags market growth. These companies are focusing on strategic acquisitions and agreements to enhance their market presence. Thus, aforementioned factors contribute toward the market growth.

Moreover, factors such as high demand for home-based healthcare, numerous applications of non-PVC IV bags, rise in geriatric population, and surge in affordability in the developing economies are projected to supplement the market growth. Early diagnosis of chronic diseases at or near bedside or at home increases the chances of successful treatment and further minimizes the hospital expenditure. Home healthcare is gaining popularity as it is a cost-effective alternative to hospital-based treatments of chronic diseases. Portability, compact and ergonomic design, and user-friendly features of non-PVC IV bags are key contributors to their widespread adoption in home care settings. Furthermore, rise in preference of patients for non-PVC IV bags over PVC IV bags further supports the market growth.

In contrast, healthcare providers and patients may not be aware of benefits of non-PVC IV bags in emerging countries which can make it difficult to promote their use, Thus, less awareness regrading benefits of non-PVC IV bags and harmful effects of PVC IV bags hamper the market growth.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of healthcare. The global non-PVC IV bags market experienced a decline in 2020 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries. Decline in hospitals visit, and confinement of the population impacted the supply chains of life-saving medical products in the non-PVC IV bags market. In addition, pandemic has also disrupted global supply chains, making it difficult for manufacturers to obtain the materials required to produce non-PVC IV bags. Therefore, aforementioned factors are projected to restrain the market growth. However, the market witnessed recovery in 2021, and exhibited stable growth for the non-PVC IV bags market in the coming future. This is attributed to the increase in prevalence of chronic diseases and rise in number of surgeries.

Segmental Overview

The non-PVC IV bags market is segmented into product type, material type, end user and region. By product type, the market is categorized into single chamber and multi chamber. By material type, the market is segregated into polypropylene IV bags, polyethylene IV bags and others. By end user, the market is classified into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

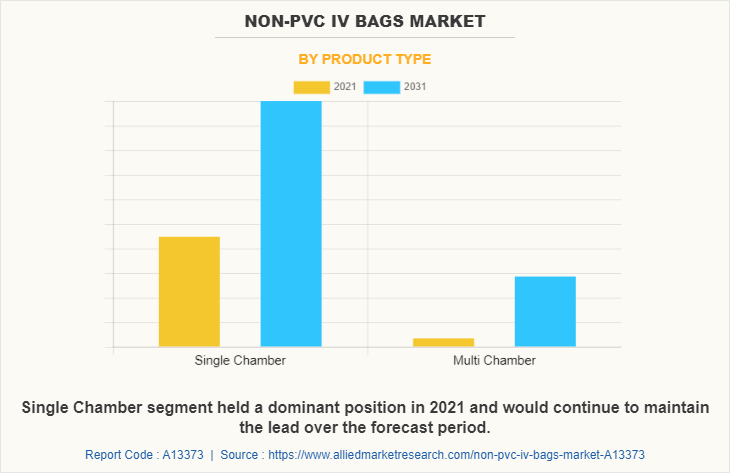

By Product Type:

The market is segmented into single chamber and multi chamber. The single chamber segment dominated the global market in 2021. This was attributed to rise in adoption of single-chamber non-PVC IV bags that are considered to be safer, more biocompatible, and reduces the risk of adverse reactions. However, the multi chamber segment is expected to register the highest CAGR during the forecast period. This is attributed to rise in adoption of multi chamber IV bags as these bags are convenient to use, safe for delivery of parenteral nutrition (PN) to patients, and administer the right dose at the accurate time.

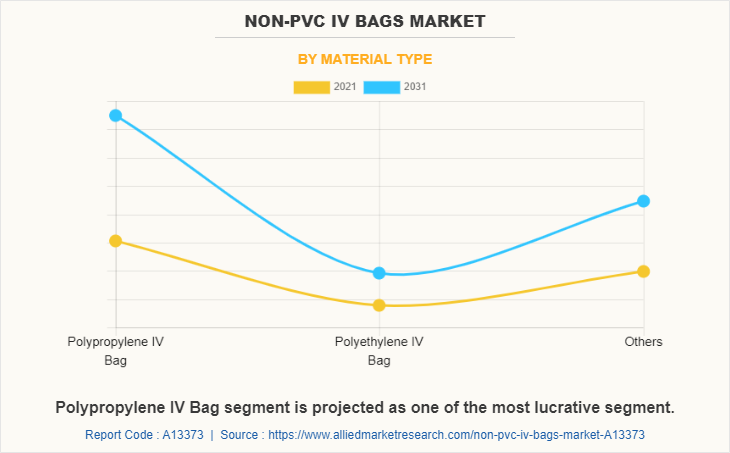

By Material Type:

The non-PVC IV bags industry is segregated into polypropylene IV bags, polyethylene IV bags and others. The polypropylene IV bags segment dominated the global market in 2021, and is anticipated to remain dominant during the non-PVC IV bags market forecast period. This is attributed to need for improved patient safety, increased environmental sustainability, provision of better clinical outcomes, cost-effectiveness, and regulatory pressure.

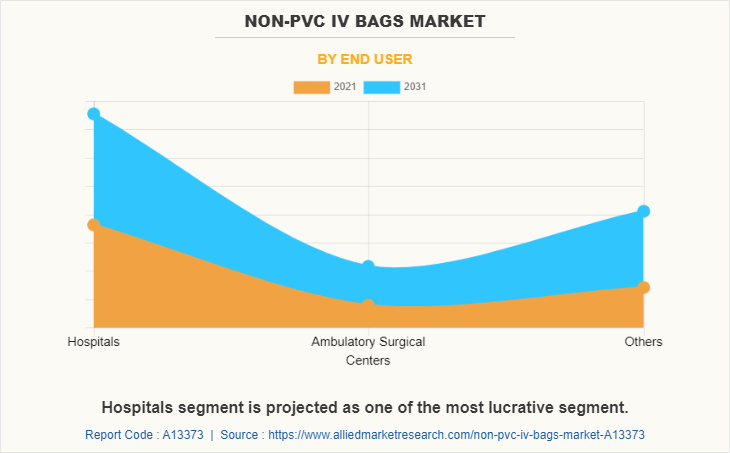

By End User:

The market is classified into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2021, and is expected to remain dominant throughout the forecast period, owing to increase in concerns about the safety and environmental impact of PVC. However, others segment is expected to register the highest CAGR during the forecast period. This is attributed to increase in focus on safety, and regulatory compliance has increased the adoption of non-PVC IV bags in emergency care centers and home care settings.

By Region:

The non-PVC IV bags industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the market in 2021, and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as ICU Medical, Inc., BAUSCH Advanced Technology Group, Fagron Sterile Services US, KRATON CORPORATION and advancement in manufacturing technology of non-PVC IV bags in the region drive the growth of the market. Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of ecofriendly non-PVC IV bags are expected to drive the market growth. Furthermore, product launch, agreement, and acquisitions adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of medical devices manufacturer companies as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in personalized medicine expenditure and adoption of high-tech processing to improve the production of non-PVC IV bags drive the growth of the market.

Asia-Pacific offers profitable opportunities for key players operating in the non-PVC IV bags market, thereby registering the fastest growth rate during the forecast period, owing to developments in infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the non-PVC IV bags, such as B. Braun SE, BAUSCH Advanced Technology Group, Fagron Sterile Services US, Fresenius SE & Co. KGaA, ICU Medical, Inc., JW Holdings, KRATON CORPORATION, MEDI PHARMA PLAN Co.,Ltd., Sippex IV bags, and Technoflex are provided in this report.

Some Examples Of Product Launch In The Market

In April 2022, Fresenius Kabi a division of Fresenius SE and Co. KGaA launched the Calcium Gluconate Injection in freeflex bags in the U.S.

Acquisitions In The Market

In January 2022, ICU Medical Inc. announced that it has completed its acquisition of Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care.

Agreement In The Market

In August 2022, ICU Medical Inc. announced that it has entered into a long-term agreement with Grifols to provide customers non-PVC/non-DEHP IV containers for 0.9% Sodium Chloride Injection, USP in U.S. ICU Medical's non-PVC/non-DEHP product line now include container sizes from 50 mL to 1000 mL due to this new agreement.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the non-pvc iv bags market analysis from 2021 to 2031 to identify the prevailing non-pvc iv bags market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the non-pvc iv bags market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global non-pvc iv bags market trends, key players, market segments, application areas, and market growth strategies.

Non-PVC IV Bags Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.7 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Product Type |

|

| By Material Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | ICU Medical, Inc., Fresenius SE and Co. KGaA, Fagron Sterile Services US, Technoflex, B. Braun SE, BAUSCH Advanced Technology Group, JW Holdings, MEDI PHARMA PLAN Co.,Ltd. , Sippex IV bags, KRATON CORPORATION |

Analyst Review

This section provides various opinions in the global non-PVC IV bags market. Non-PVC IV bags are safer and ecofriendly alternative, as they do not contain harmful substances such as phthalates. ?In addition, non-PVC IV bags are designed to be more durable and puncture-resistant than traditional PVC bags, providing improved safety and reliability in the clinical setting.

The non-PVC IV bags market has gained interest of the healthcare industry, owing to rise in number of chronic diseases such as chronic kidney disease, increase in geriatric population and high incidences of cancers across the globe. In addition, increase in number of surgical procedures has a positive impact on the non-PVC IV bags market, because in surgeries, intravenous (IV) fluid administration is a common practice for maintaining fluid balance and delivering medications to patients. In addition, the use of non-PVC IV bags in surgeries has several potential benefits, including increased patient safety, improved product compatibility, enhanced durability, improved environmental sustainability, and increased cost-effectiveness. For example, non-PVC IV bags do not release harmful chemicals, reducing the risk of exposure to harmful substances for patients during surgeries.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in the knowledge about novel devices. However, Asia-Pacific is anticipated to witness notable growth, owing to surge in presence of the local manufacturers and development of healthcare infrastructure.

The upcoming trends of the non-PVC IV bags market are surge in burden of chronic diseases, environment friendly nature of non-PVC IV bags, and increase in use of non-PVC IV bags.

Administers fluids, medications and nutrients directly into a person's vein is the leading application of Non-PVC IV Bags Market.

North America is the largest regional market for Non-PVC IV Bags.

The global non-PVC IV bags market was valued at $880.21 million in 2021, and is projected to reach $1,684.5 million by 2031, registering a CAGR of 6.7% from 2022 to 2031.

Top companies such as,B. Braun SE, Fresenius SE and Co. KGaA, ICU Medical, Inc., and MEDI PHARMA PLAN Co., Ltd. held a high market position in 2021. These key players held a high market position owing to the strong geographical foothold in different regions.

Single chamber segment is the most influencing segment in non-PVC IV bags market which is attributed to increase in demand for single chamber non-PVC IV bags due to increase in prevalence of chronic conditions.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 5.6%. This is due to rise in demand for sophisticated medical facilities, higher prevalence of urological disorders, and increase in R&D activities that are undertaken by the key players with respect to imaging technologies.

Loading Table Of Content...