Global non-woven adhesives market size is expected to grow at a CAGR of 9.9% from 2016 to 2022 to reach $2,809 million by 2022 from $1,451 million in 2015. Non-woven adhesives are thermoplastic adhesives that comprise a base polymer, tackifiers, plasticizers, and antioxidants. Hygiene products, including diapers, training pants, adult incontinence, feminine protection, and many others are manufactured using these superior adhesive solutions. Non-woven adhesives are preferred for industrial applications due to its superior properties such as low odor, softness, high elasticity, cohesion strength, and excellent processability.

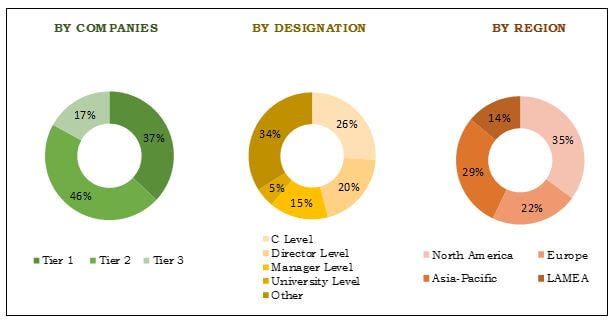

Breakdown of Primary Respondents

New product development with additional features to the existing product type in hygiene industry is the major factor that drives the growth of non-woven adhesives market. Asia-Pacific and LAMEA are expected to register substantial growth in the coming years as a result of growth in demand for disposable hygiene products in emerging economies such as China, Indonesia, India, Turkey, and Brazil.

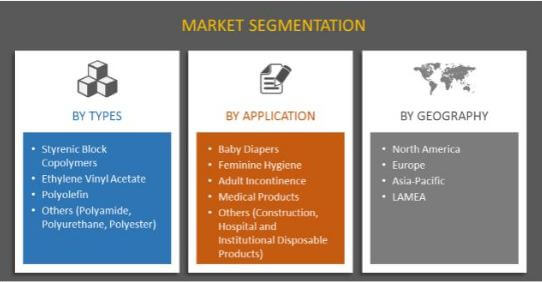

Segment Review:

The report segments the non-woven adhesives market on the basis of type, application, and geography. Based on type, the non-woven adhesives market is segmented into styrenic block copolymers (SBC), ethylene vinyl acetate (EVA), polyolefin (PO), and others. Others comprises polyamide, polyurethane, and polyester. By application, the non-woven adhesives market is classified into baby diapers, feminine hygiene, adult incontinence, medical products, and others, which include disposable products from construction, hospitals, and institutions. Geographical breakdown and deep analysis of each of the aforesaid segments is included for North America, Europe, Asia-Pacific, and LAMEA.

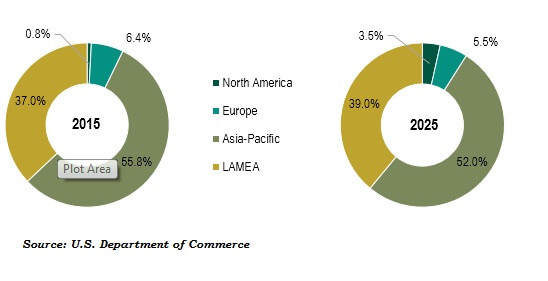

In the global non-woven adhesives market, Asia-Pacific shows highest growth rate in terms of volume and revenue. Although product penetration of hygiene products, especially disposable diapers, in Asia-Pacific is lower than that in North America and Europe, the large population base of this region makes it the largest consumer of disposable products. Product penetration is expected to increase in the developing areas of the region due to rise in willingness to use safe and comfortable products, thereby boosting the consumption volume of non-woven adhesives.

Population of Individuals in the Age Group of 0–3 Years, By Region, 2015 vs 2025

Raw Material Analysis

Although the basic composition remains similar, the raw materials used to produce non-woven adhesives vary according to the end applications.

Percentage Composition of Raw Materials

Raw Material | Percentage Composition (%) |

Base Polymer | 20–40 |

Tackifier Resin | 25–60 |

Diluent | 5–25 |

Additives | <5 |

Though majority of raw materials used are derived from crude oil, the falling oil prices have no effect on the adhesive prices, as there is less correlation between the declining crude oil prices and adhesive raw materials.

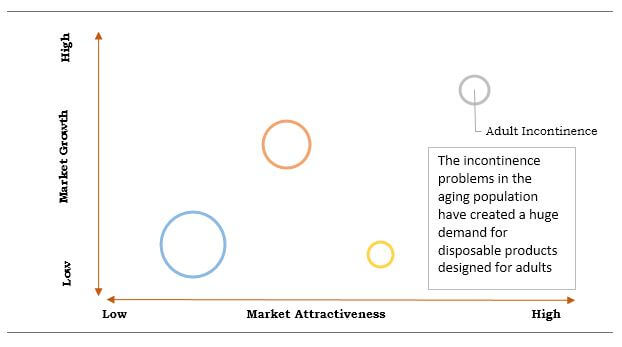

Top Investment Pockets

Incontinence problems in the geriatric population have created a huge demand for thinner cores, better absorption, and more fit & comfortable products, which has increased the use of non-woven adhesives globally.

Top Investment Pockets, By Application

Top Winning Strategies

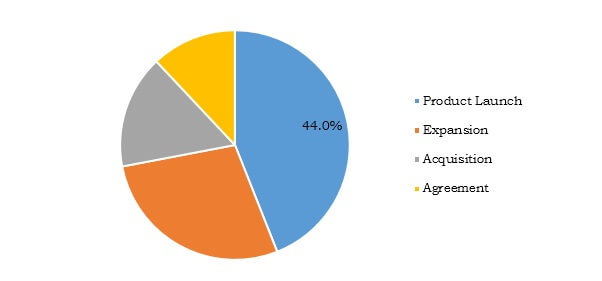

The key players in the global non-woven adhesives market industry have adopted product launches, expansions, acquisitions, and agreements as their key strategies to withstand the competition. The key market players profiled in this report are non-woven adhesive manufacturers and suppliers who serve the product globally to several end user industries.

Global Non-woven Adhesives Market Top Winning Strategies, 2012–2016* (%)

*Considered till July 2016

The above pie chart represents the percentage split of the strategies adopted by top companies operating in the global market. In non-woven adhesives industry, product launch and expansion are the leading strategies adopted by the key players, which covered 44.0 and 28.0% share, respectively, of the total number of strategies adopted from 2012 to 2016, followed by acquisition and agreement to widen their geographical outreach. H.B. Fuller Company and Bostik SA are the leading companies that adopted product launch as the key business strategy.

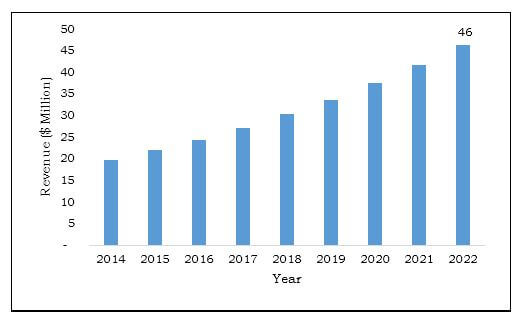

Canada Non-woven Adhesives Market Analysis:

The non-woven adhesives market in Canada generated revenue of $22 million in 2015. It is projected to reach $46 million by 2022, registering a high CAGR of 11.3% from 2016 to 2022.

Canada: Non-woven Adhesives Market, 2014–2022 ($Million)

The key market players in non-woven adhesives market industry are Henkel AG (Germany), H.B. Fuller (U.S.), Bostik SA (U.S.), Beardow Adams Ltd. (UK), Adtek Malaysia Sdn. Bhd. (Malaysia), Moresco Corporation (Japan), The Dow Chemical Company (U.S.), 3M Corporation (U.S.), Kraton Corporation (U.S.), and Evonik Industries AG (Germany).

Other key non-woven adhesives market players (not profiled) in value chain include Avery Dennison Corporation (U.S.), Cattie Adhesives Solutions, LLC (U.S.), Celanese Corporation (U.S.), Eastman Chemical Company (U.S.), GitAce Adhesives Company (Iran), ITW Dynatec Americas (U.S.), Klebstoffwerke COLLODIN GmbH (Germany), Lohmann Koester GmbH & Co. Kg (Germany), Max Frank Limited (UK), Michelman, Inc. (U.S.), Nordson Corporation (U.S.), Palmetto Adhesives Company, Inc. (U.S.), PAM Fastening Technology, Inc. (U.S.), Savaré Specialty Adhesives (U.S.), Shanghai Jaour Adhesive Products Co., Ltd. (China), Sika Ireland Ltd. (Ireland), Svenska Lim AB (Sweden), Tri-Tex Co Inc. (Canada), TSRC Corporation (Taiwan), and Udaipur Surgicals Pvt. Ltd. (India).

NON-WOVEN ADHESIVES MARKET KEY BENEFITS FOR STAKEHOLDERS

- This report entails the detailed quantitative analysis of the non-woven adhesives market forecast and estimations from 2014 to 2022, which assists to identify the prevailing market opportunities.

- Factors that drive and impede the non-woven adhesives market growth are comprehensively analyzed in this study.

- Key raw materials of the market are analyzed on the basis of composition and their individual market trends.

- Micro-level analysis is conducted based on type, application, and region.

- Porter’s Five Forces model illustrate the potency of buyers and sellers.

- The projections in this report are made by analyzing the current trends and future market potential, in terms of value and volume.

- Key manufacturers are profiled in the report and their developments in recent years are listed, which help in understanding competitive outlook of global non-woven adhesives market.

Non-woven Adhesives Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Geography |

|

| Key Market Players | Henkel AG & Co. KGaA, Adtek Malaysia SDN BHD, Evonik Industries AG, H.B. Fuller Company, 3M Corporation, Kraton Corporation, Beardow Adams Ltd., Moresco Corporation, The Dow Chemical Company, Bostik SA (ARKEMA) |

| Other players in the value chain include | Avery Dennison Corporation (U.S.), Cattie Adhesives Solutions, LLC (U.S.), Celanese Corporation (U.S.), Eastman Chemical Company (U.S.), GitAce Adhesives Company (Iran), ITW Dynatec Americas (U.S.), Klebstoffwerke COLLODIN GmbH (Germany), Lohmann Koester GmbH & Co. Kg (Germany), Max Frank Limited (UK), Michelman, Inc. (U.S.), Nordson Corporation (U.S.), Palmetto Adhesives Company, Inc. (U.S.), PAM Fastening Technology, Inc. (U.S.), Savar Specialty Adhesives (U.S.), Shanghai Jaour Adhesive Products Co., Ltd. (China), Sika Ireland Ltd. (Ireland), Svenska Lim AB (Sweden), Tri-Tex Co Inc. (Canada), TSRC Corporation (Taiwan), Udaipur Surgicals Pvt. Ltd. (India) |

Analyst Review

Nonwoven adhesives possess properties such as high elasticity, superior absorption, and cohesion strength, which make them ideal for industrial applications. Nonwoven adhesives sealing competes with ultrasonic sealing, though ultrasonic healing cannot be a substitute to nonwoven adhesives sealing as it is highly expensive, especially for application in disposable products such as diapers and pads. These adhesives, for feminine hygiene, accounted for the largest share, occupying more than half of the global market. Incontinence problems in the geriatric population have created a huge demand for adult diapers with thinner cores, better absorption, and more fit & comfortability. In developed nations, such as U.S., Germany, and other North American & European countries, the adoption of such products is high, whereas it will take few more years in developing nations such as Asia-Pacific and LAMEA.

Styrenic block copolymers (SBC), ethylene vinyl acetate (EVA), polyolefin (PO), polyester, polyamide, and polyurethane are some of the base polymers employed to manufacture of nonwoven adhesives. The demand for raw materials for production of nonwoven adhesives has increased considerably over the years, whereas the number of raw material suppliers are limited. Although the basic composition remains similar, the raw materials used to produce these adhesives vary according to the end applications. Though majority of raw materials used are derived from crude oil, the falling oil prices have no effect on the adhesive prices, as there is less correlation between the declining crude oil prices and adhesive raw materials.

Increase in health awareness in emerging economies such China and India has fueled the demand for sanitary protection products in Asia-Pacific. China has the maximum production capacity for ethylene vinyl acetate (EVA) copolymers, which is used as a base polymer in production of nonwoven adhesives. Asia-Pacific market is expected to register substantial growth in future due to growth in usage of nonwoven adhesives in medical products such as wound dressings and elastic bandages. New technologies are being developed by key leading players in the region to produce biodegradable diapers offering enhanced properties.

Loading Table Of Content...