Nonwoven Fabrics Market Research, 2033

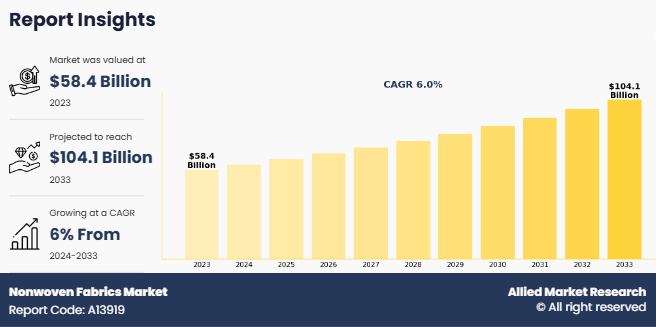

The global nonwoven fabrics market size was valued at $58.4 billion in 2023, and is projected to reach $104.1 billion by 2033, growing at a CAGR of 6% from 2024 to 2033. Nonwoven fabric refers to cohesive fabric-like textile manufactured by arranging fibers together using heat, chemicals, or pressure. Some of the commonly used production methods include fiber entanglement and chemical and thermal bonding of materials, such as olefin, polyester, and rayon. In comparison to the traditionally used fabrics, such as cotton, linen, wool, and silk, nonwoven fabrics are lighter and do not require weaving or knitting to manufacture interlinings, insulation & protection clothing, industrial workwear, chemical defense suits, and footwear. As a result, they find extensive applications across various industries, such as personal care & hygiene, automotive, healthcare, building & construction, and filtration.

Key Takeaways

- The global Nonwoven fabrics market is highly fragmented, with several players including Ahlstrom-Munksjo, Berry Global Inc., Kimberly-Clark Corporation, Glatfelter, DuPont, Toray Industries Inc., Lydall Inc., Fitesa, Suominen Corporation, Johns Manville, and Freudenberg Group.

- More than 4,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value Nonwoven fabrics market insights.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and Nonwoven fabrics market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Nonwoven fabrics market news and key industry trends are also included in the report.

Market Dynamics

The nonwoven fabrics market is driven by rising demand in hygiene products, including diapers, feminine care, and medical supplies, along with growth in the automotive, filtration, and construction industries. Increasing sustainability efforts and advancements in biodegradable nonwovens further fuel market expansion. However, fluctuating raw material costs and strict environmental regulations pose challenges. Opportunities lie in eco-friendly nonwoven innovations, expanding healthcare applications, and rising demand for durable and lightweight materials across multiple industries, driving future growth in the sector.

Segments Overview

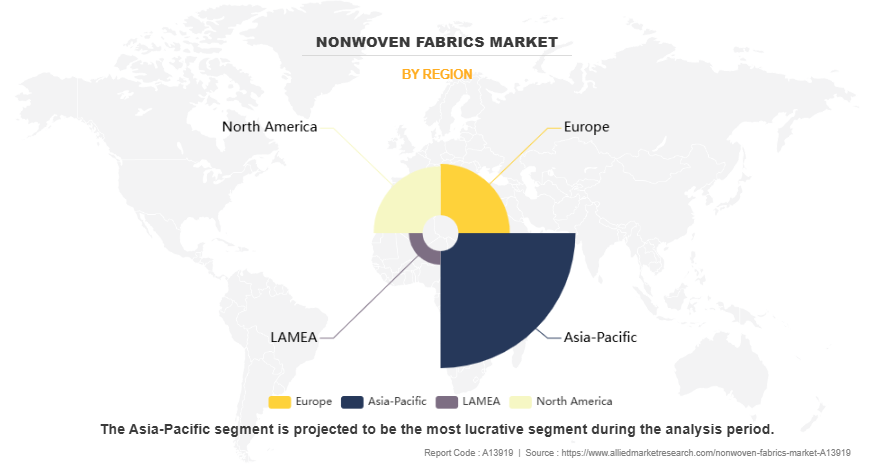

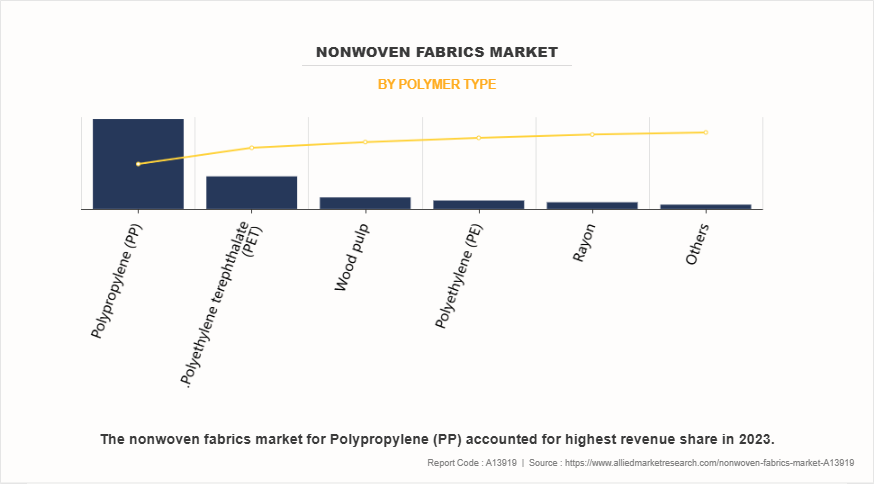

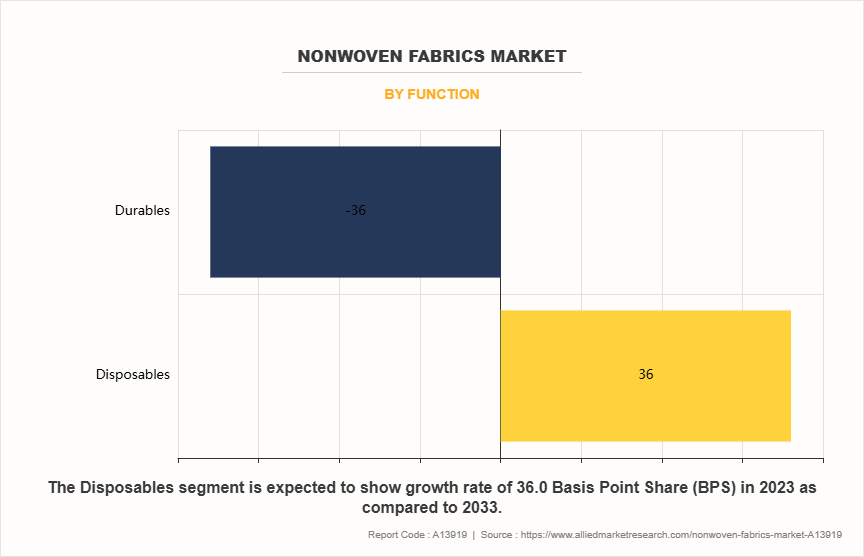

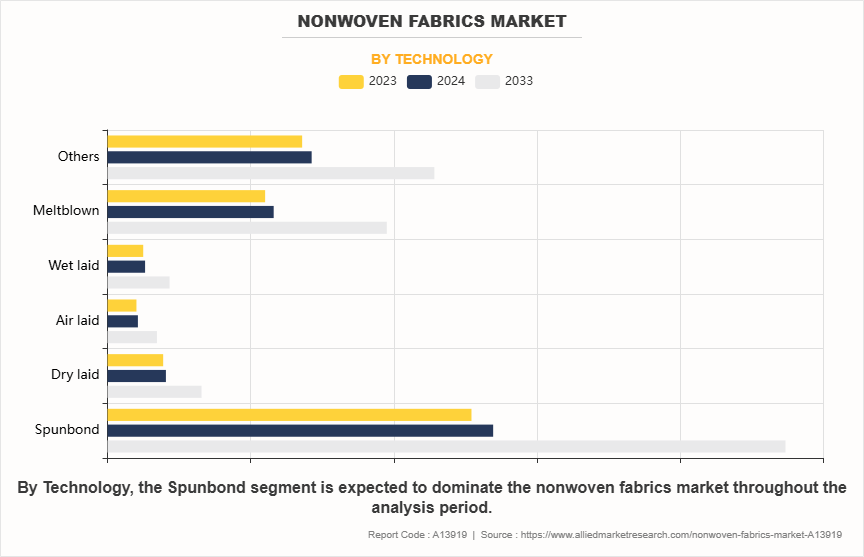

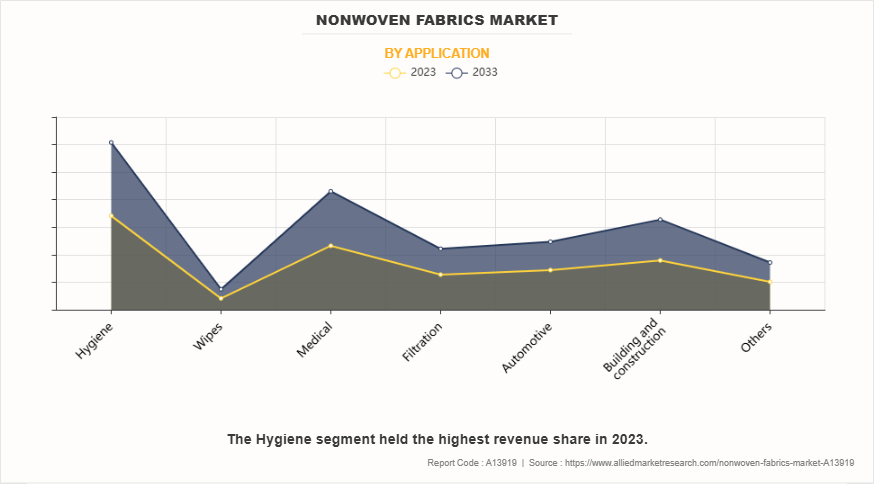

The global nonwoven fabrics market is segmented into polymer type, technology, function, technology, application, and region. By polymer type, the market is categorized into polypropylene (PP), polyethylene (PE), polyethylene terephthalate (PET), wood pulp, rayon, and others. On the basis of function, it is bifurcated into disposable and durables. Depending on technology, it is segregated into spunbond, dry laid, air laid, and wet laid. The applications covered in the study include hygiene, medical, filtration, automotive, building & construction, and others. Region wise, the nonwoven fabrics market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Asia-Pacific nonwoven fabrics market is experiencing rapid growth, driven by increasing demand from hygiene, medical, construction, automotive, and packaging industries. The region is home to some of the world's largest nonwoven fabric manufacturers, with China, India, Japan, and South Korea leading production and consumption. Rising population, urbanization, and improving healthcare standards are key factors boosting the demand for nonwoven hygiene products such as baby diapers, feminine hygiene items, and adult incontinence products. The medical sector is another major growth driver, especially after the COVID-19 pandemic, which led to a surge in demand for surgical masks, gowns, and PPE kits. Government initiatives promoting universal healthcare and infection control further support market expansion.

In construction and infrastructure, nonwoven fabrics are widely used in geotextiles, roofing membranes, insulation materials, and filtration. Rapid urbanization and large-scale infrastructure projects in China, India, and Southeast Asia are fueling demand for durable and cost-effective nonwoven materials. The automotive industry is also driving nonwoven fabric consumption, as lightweight and high-performance materials are increasingly used in vehicle interiors, soundproofing, and filtration systems. The rise of electric vehicles (EVs) is further accelerating the demand for advanced nonwoven insulation and battery separators. Additionally, sustainability trends and government regulations are encouraging the use of biodegradable and recyclable nonwoven fabrics in packaging and consumer goods. Countries like China, India, and Indonesia are implementing stricter policies on single-use plastics, promoting the shift towards eco-friendly nonwoven alternatives.

The polypropylene (PP) nonwoven fabric segment has emerged as a significant revenue contributor, exhibiting a compound annual growth rate of 6.5%. This growth is largely driven by the material's increasing utilization in geotextiles, attributed to its exceptional properties such as high tear and puncture resistance, tolerance to temperature fluctuations, and durability. These characteristics make PP nonwoven fabrics particularly suitable for demanding applications in civil engineering and construction projects.

Beyond geotextiles, the demand for PP nonwoven fabrics is on the rise across various end-use industries, including hygiene, medical, automotive, agriculture, and furnishing. In the personal care and hygiene sector, PP nonwoven fabrics are extensively used in the production of sanitary products for babies, women, and adults. Their attributes such as excellent absorption, softness, stretchability, strength, tear resistance, opacity, and breathability, make them ideal for items like diapers, sanitary napkins, and adult incontinence products. This widespread applicability underscores the material's versatility and its pivotal role in meeting the evolving demands of these industries.

The durables segment has emerged as a significant revenue contributor in the nonwoven fabrics market, exhibiting a compound annual growth rate of 5.9% during the forecast period. This growth is largely driven by the automotive industry's focus on reducing vehicle weight to enhance fuel efficiency and lower CO emissions. Nonwoven materials, being 15-20% lighter than traditional alternatives, can decrease a vehicle's weight by up to 2 kilograms, thereby improving performance and environmental sustainability. Beyond weight reduction, durable nonwoven fabrics offer enhanced comfort and safety, leading to their adoption in over 40 automotive applications, including filters, carpets, and battery separators. Notably, nonwoven filtration systems contribute to lowering CO emissions, aligning with the industry's environmental objectives. These advantages are anticipated to drive the demand for durable nonwoven fabrics in the automotive sector during the forecast period.

Spunbond segment was the highest revenue contributor to the market growing with a CAGR of 6.5%, exhibiting robust growth driven by its widespread application across various industries. Spunbond technology is favored for producing nonwoven fabrics due to its efficiency in yielding high quantities of material. This process involves the direct conversion of polymer granules into continuous filaments, which are then laid into a web and bonded to form the fabric. The resulting spunbond nonwovens are characterized by a random fibrous structure, low drapeability, and high liquid retention capabilities, making them suitable for diverse applications.

The versatility of spunbond nonwovens has led to their increased demand in sectors such as hygiene products, construction, coating substrates, agriculture, battery separators, wipes, and filtration. In the hygiene industry, these fabrics are utilized in products like diapers and feminine care items due to their softness and absorbency. The construction sector employs spunbond nonwovens for geotextiles and roofing materials, leveraging their durability and strength. Additionally, their application in agriculture includes crop covers and weed control fabrics, benefiting from their permeability and protective qualities. Furthermore, the consumption of spunbond nonwovens is expanding in areas such as industrial insulation and metal core packaging, driven by the material's high tear strength and resilience. These attributes make spunbond nonwovens a preferred choice for applications requiring robust and reliable materials.

The hygiene segment led the nonwoven fabrics market, recording the highest revenue contribution and a CAGR of 6.0%. This growth is largely driven by the increasing adoption of nonwoven materials as alternatives to traditional textiles in hygiene products, owing to their superior characteristics such as excellent absorption, softness, smoothness, strength, comfort, stretchability, and cost-efficiency. Enhanced living standards and rising consumer awareness regarding skin health continue to fuel demand for these materials in hygiene applications like baby diapers, feminine hygiene products, and adult incontinence items. The COVID-19 pandemic further accelerated the demand for nonwoven hygiene products, unlocking new growth avenues for manufacturers. For example, the surge in need for personal protective equipment (PPE), including face masks and medical gowns, prompted industry players like DuPont to scale up production of Tyvek nonwoven materials in 2024.

Competitive Analysis

The key players operating in the nonwoven fabrics market are Ahlstrom-Munksjo, Berry Global Inc., Kimberly-Clark Corporation, Glatfelter, DuPont, Toray Industries Inc., Lydall Inc., Fitesa, Suominen Corporation, Johns Manville, and Freudenberg Group.

Key Strategies and Developments

- In 2024, Berry Global completed the spin-off and merger of its Health, Hygiene, and Specialties Global Nonwovens and Films business with Glatfelter Corporation. This merger led to the creation of Magnera Corporation, now recognized as the largest nonwovens company globally. Magnera began trading on the New York Stock Exchange under the ticker symbol "MAGN" on November 5, 2024.

- In 2024, Freudenberg Performance Materials expanded its healthcare technologies to include bioresorbable nonwovens, initially targeting surgical hemostasis management. These nonwovens are made from materials that the body can absorb, eliminating the need for a second surgery to remove them. Future collaborations aim to offer solutions for bioactive wound healing, drug release, and regenerative medicine based on this technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Nonwoven fabrics market analysis from 2023 to 2033 to identify the prevailing Nonwoven fabrics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Nonwoven fabrics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Nonwoven fabrics market trend, key players, market segments, application areas, and market growth strategies.

Nonwoven Fabrics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 104.1 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 1147 |

| By Polymer Type |

|

| By Function |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | DuPont, Fitesa, Freudenberg Group, Ahlstrom-Munksjö, Kuraray Co., Ltd., Toray Industries, Inc., Suominen Corporation Oyj, Berry Global Inc., Johns Manville, Kimberly-Clark Corporation, Lydall, Inc. |

Analyst Review

According to CXOs of leading companies, the global nonwoven fabrics market is anticipated to witness growth over the forecast period, driven by rise in product demand across various end-use industries, including hygiene, medical, automotive, agriculture, and furnishing. Rapid technological advancements and innovations in this field, such as the design of nonwoven fabrics with skincare and softness, have propelled the market growth. In addition, increase in demand for protective clothing is anticipated to have a positive impact on market development. This is attributed to the fact that nonwoven fabrics offer high strength, barrier qualities, and prevent penetration of dust particles and microorganisms. Furthermore, the enhanced focus of manufacturers on the production of specialty products using the most cost-effective, productive, and simple technology called spunbond is likely to spur market growth. This factor is expected to notably contribute toward the market growth during the forecast period.

The global nonwoven fabrics market was valued at $58.4 billion in 2023, and is projected to reach $104.1 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

The key players operating in the nonwoven fabrics market are Ahlstrom-Munksjo, Berry Global Inc., Kimberly-Clark Corporation, Glatfelter, DuPont, Toray Industries Inc., Lydall Inc., Fitesa, Suominen Corporation, Johns Manville, and Freudenberg Group.

Asia-Pacific is the largest regional market for Nonwoven Fabrics.

Hygiene is the leading application of Nonwoven Fabrics Market.

The nonwoven fabrics market is driven by rising demand in hygiene products, including diapers, feminine care, and medical supplies, along with growth in the automotive, filtration, and construction industries.

Loading Table Of Content...

Loading Research Methodology...