North America Oil Storage Market Overview:

The North America oil storage market size was valued at $667 million in 2016, and is projected to reach $931 million by 2023, growing at a CAGR of 4.8% from 2017 to 2023. In terms of volume, the market accounted for 54,154 thousand CBM in 2016, and is projected to reach 73,633 thousand CBM in 2023, registering a CAGR of 4.4% from 2017 to 2023. Oil storage is a trade where vertically integrated companies purchase oil for immediate delivery and store until the price of oil increases. Moreover, this storage can be for a short span of time as the oil could be transported for refinement process. The crude oil and natural gas are the naturally occurring petroleum resources, and are known as refinery feedstocks, which require appropriate storage. Petroleum products are transported to the storage facilities from oilfields and then to the refineries.

Market dynamics

The growth of the North America oil storage market is majorly driven by reduction in crude oil prices. Other factors boosting the market growth include increase in need for mega refining hub, high degree of product containment, and rise in import facilities in North America. However, factors such as decline in production & exploration activities and rise in inventory cost restrain the market growth. Conversely, the development of the strategic petroleum reserves segment and increase in oil demand are expected to provide lucrative growth opportunities for the market.

Market segmentation

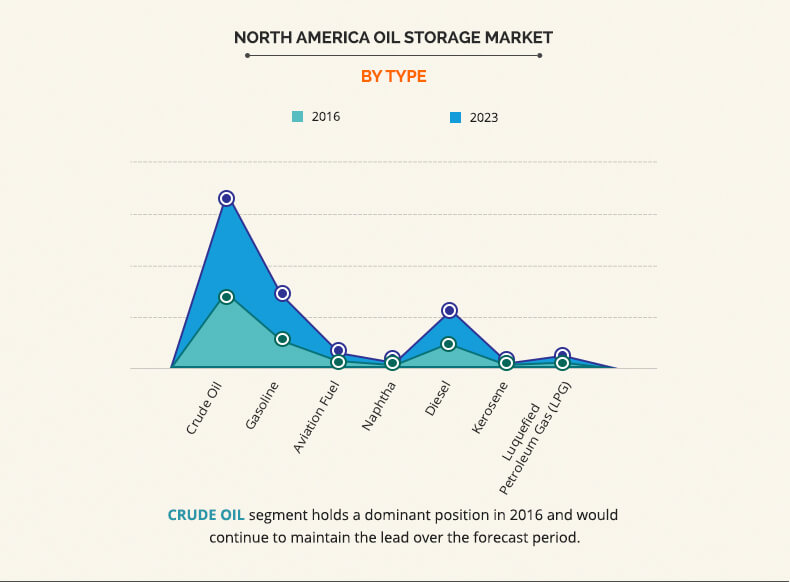

The North America oil storage market is segmented on the basis of type, material, product design, and country. Based on product, the market is categorized into crude oil, gasoline, aviation fuel, naphtha, diesel, kerosene, and liquefied petroleum gas (LPG). Crude oil segment accounted for the largest market share in 2016, and is expected to continue this trend throughout the forecast period. On the other hand, gasoline segment is anticipated to grow at a significant CAGR of 6.2% during the forecast period.

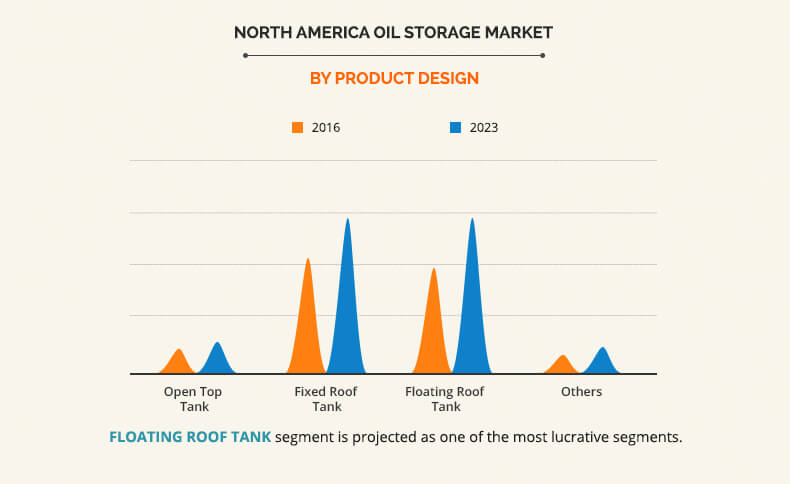

By material, the market is classified into steel, carbon steel, and fiber-reinforced plastic (FRP). Depending on product design, it is fragmented into open top tanks, fixed roof tanks, floating roof tank, and other storage tanks. Fixed roof tanks segment accounted for the largest market share in 2016, whereas floating roof tanks segment is expected to register the highest growth rate during the forecast period.

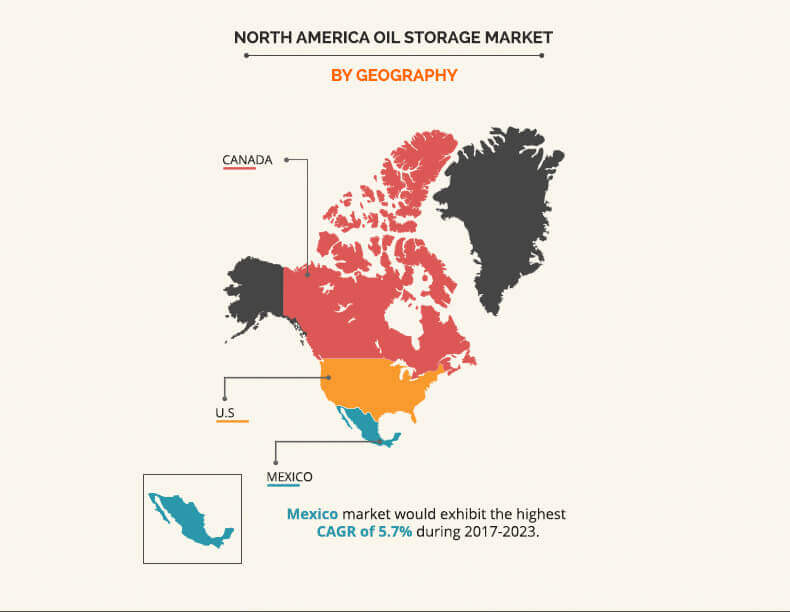

Country wise, the market is studied across U.S., Canada, and Mexico. The U.S. market is further divided into five PADD regions, namely, PADD I, PADD II, PADD III, PADD IV, and PADD V. Canada is further fragmented into Atlantic region, Central Canada, the West Coast, and the North, where the West Coast is subsegmented into the Prairie Provinces and other western regions. U.S. held the largest share of the market in 2016, followed by Canada. On the other hand, Mexico is anticipated to dominate the market during the analysis period.

Competitive Analysis

The key players of this market include Royal Vopak N.V., Kinder Morgan, Inc., Oiltanking GmbH (Marquard & Bahls), Buckeye Partners L.P., NuStar Energy L.P., International-Matex Tank Terminals, Inc., Magellan Midstream Partners, L.P., Energy Transfer Partners, LP., and Odfjell SE.

Other players (these players are not profiled in the report and the same can be included on request) in the value chain include Valero Energy Corporation, Superior Tank Co., Inc., Inclusive Energy LTD, and Husky Energy Co.

Key Benefits

- The study provides an in-depth analysis of the North America oil storage market with current trends and future estimations from 2016 to 2023 to elucidate the imminent investment pockets.

- Comprehensive analysis of factors that drive and restrict the market growth is provided.

- Identification of factors instrumental in changing the market scenario, rise in opportunities, and identification of key companies that can influence this market on a regional scale are provided.

- Key players are profiled and their strategies are analyzed thoroughly to understand the competitive outlook of the market.

North America Oil Storage Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Material |

|

| By Product Design |

|

| By Geography |

|

| Key Market Players | Macquarie Infrastructure Corporation (International-Matex Tank Terminals, Inc.), Magellan Midstream Partners, L.P., Energy Transfer Partners, LP. (Sunoco Logistics Partners), Odfjell SE, Kinder Morgan, Inc., Buckeye Partners L.P., Royal Vopak N.V., Marquard & Bahls AG (Oiltanking GmbH), NuStar Energy L.P., Vitol Group |

Analyst Review

Oil storage is used for safe storage of various crude oil products. These products are naturally occurring crude oil and petroleum resources, and are known as refinery feedstocks. Increase in oil production across North America has encouraged suppliers to develop storage infrastructure and enhance their inventories for oil storage. Oil storage offers protection from short-time supply fluctuations of crude oil and its derivatives. Generally, the storage of oil is temporary, as the oil needs to be transported to other places for further refinement.

Upsurge in demand for oil products is the major factor that drives the North America oil storage market. In addition, the development of strategic petroleum reserves, introduction of secondary containment, and increase in number of import export facilities significantly contribute towards the market growth. However, factors such as rise in inventory cost and decline in production & exploration costs are expected to impede the growth of the market.

Mexico is expected to register the highest CAGR from 2017 to 2023. U.S. market dominated the North America oil storage market in 2016, as it witnessed highest demand for oil storage, owing to the presence of large oil reserves and major export destinations such as Gulf Coast. In addition, the introduction to newer refineries propelled the demand for oil products, which in turn accelerated the market growth.

Loading Table Of Content...