Nutrigenomics Market Statistics, 2032

The global nutrigenomics market size was valued at $435.7 million in 2022, and is projected to reach $2.1 billion by 2032, growing at a CAGR of 17.2% from 2023 to 2032. Rising prevalence of chronic diseases is expected to influence the nutrigenomics market growth in the upcoming years. Over the past decade, rapid advancements in omic technologies such as proteomics, genomics, and metabolomics are combined with advanced bioinformatics to be broadly used for identifying diseases based on protein pathways. The findings of nutrigenomics have been used to some extent to treat diseases with a diet component like diabetes, cancer, and obesity, significantly boosting the global market size.

Nutrigenomics studies the effect of nutrients on gene expression. In other words, nutrigenomics provides a genetic understanding of how common dietary components affect the balance between health and disease by altering the expression and/or structure of an individual’s genetic make-up.

Government regulation regarding genetic research or testing may adversely affect the demand for nutrigenomics testing. Adoption of new regulations from the federal, state and/or local governments creates huge challenge for conducting genetic research and genetic testing. Such regulations limit or restrict genetic research activities as well as genetic testing for research or clinical purposes. Also, governments are quite inconsistent while adopting such regulations related to direct-to-consumer (DTC) testing. Hence, regulations relating to genetic research activities adversely affects the ability to conduct R&D activities and also possess major challenge for companies to advertise and sell products & services related to nutrigenomics testing. Moreover, getting government approvals for any new test launch also increases the costs of operations and restrict the ability to conduct testing business. Thus, adoption of new government rules and regulations related to genomic testing will directly hamper the growth of nutrigenomics industry.

Ever-increasing impetus to nutrigenomics has offered tremendous scope and opportunities to formulate personalized nutrition and tailor-made diets. The for nutrigenomics testing market is influenced by the increased need for personalized nutrition. Nutrigenetics is also being used to develop personalized diet and supplements. By analyzing an individual's DNA, doctors can identify and recognize genetic variations that affect their response to different nutrients, and develop supplements that are tailored for each individual’s specific needs. For instance, an individual with a genetic variation that affects their ability to absorb vitamin B12 may benefit from a supplement that is more easily absorbed by their body.

Nutrigenomics is highly applied in nutrition to develop tailor-made dietary recommendations, functional foods, and supplements according to each individual's unique genetic makeup. By examining an individual's DNA, researchers can point out genetic variations that affect their response to various nutrients and form targeted interventions leading to improved health and wellbeing. As nutrigenomics market evolve, the potential to provide the tools to achieve optimal health & wellness will outgrow and widen the scope for providing better dietary recommendations. Thus, nutrigenomics approach can be implemented efficiently after integrated use of omics techniques, developing cost effective related analytical methods, and considering various ethical issues. These factors are anticipated to have positive impact on nutrigenomics market forecast.

The key players profiled in this nutrigenomics market report include Ancestry, Nutrigenomix, 23andMe Inc., DNAfit, GX Sciences Inc., Xcode Life Koninklijke DSM N.V. (Royal DSM), BASF SE, Danone S.A., and The Gene Box. Partnerships, acquisition, and product launches are common strategies followed by major market players. For instance, in November 2021, 23andMe Holding Co. acquired Lemonaid Health through which the company acquired Lemonaid telehealth platform through which patients can access licensed healthcare professionals for medical consultation and treatment for a number of common conditions, and telehealth consultations for certain 23andMe genetic reports. Furthermore, in May 2023, Xcode Life launched India’s most comprehensive Gene Nutrition test covering nearly 50 aspects of nutrition which looks into macro (carbs, protein, and fats) breakup according to genotype, vitamin, and mineral deficiency risk, eating behaviors, weight management with nutrition, taste preferences, diet responses, and food sensitivities.

Segments Overview

The nutrigenomics market is segmented on the basis of application, product type, end user, and region. By application, the market is divided into obesity, diabetes, cardiovascular diseases, and cancer research. By product, the market is classified into reagents & kits and services. By end user, the market is classified into online platforms, hospitals & clinics, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

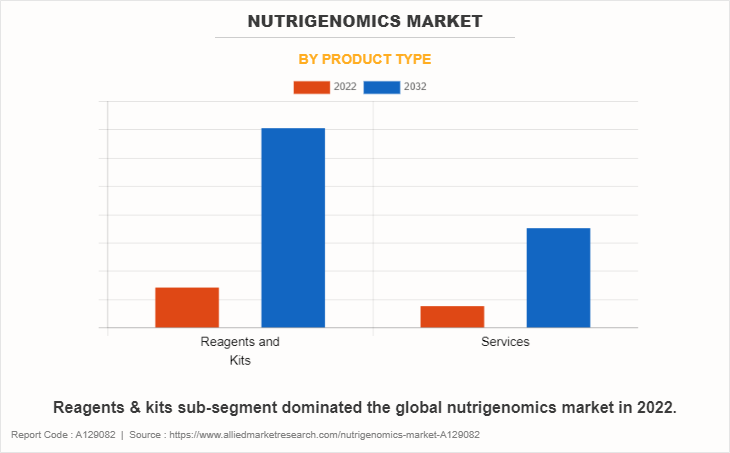

By Product

By product, the reagents & kits sub-segment held the highest nutrigenomics market share in 2022. This growth is due to an increase in chronic diseases and personalization of diet to provide protection against different diseases due to dietary change or unhealthy lifestyle. In recent years, several companies have started selling DNA testing kits via the Internet directly to consumers (DTC). Furthermore, adoption of telehealth services that include online medical visits, pharmacy services, and memberships is also driving the demand for reagents & kits in the nutrigenomics industry.

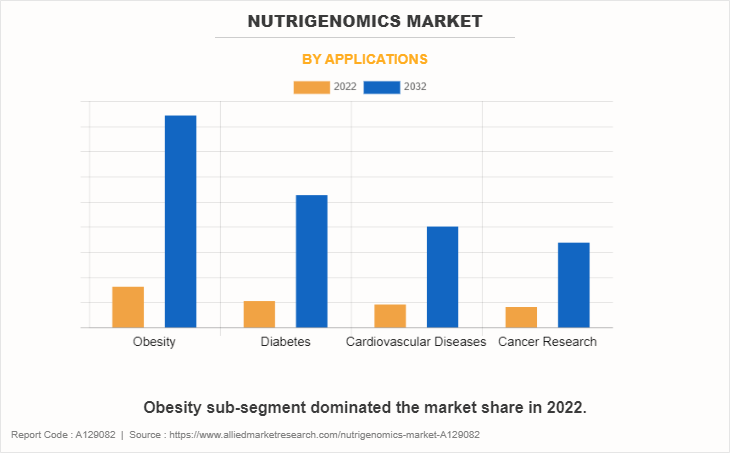

By Application

By application, the obesity sub-segment dominated the market in 2022. Overweight and obesity prevalence has risen dramatically in recent years. The World Obesity Federation’s 2023 Atlas predicts that 51% of the world, or more than 4 billion people, will be obese or overweight within the next 12 years. The report predicts the cost of health problems associated with being overweight will reach $4 trillion a year by 2035. Nutrigenomics explores the interaction between genetic factors and dietary nutrient intake on various disease phenotypes such as obesity. Therefore, this novel approach might suggest a solution for the effective prevention and treatment of obesity through individual genetic profiles and help improve health conditions. Hence, the rise in overweight population is expected to boost the nutrigenomics market growth for nutrigenomics testing in the future.

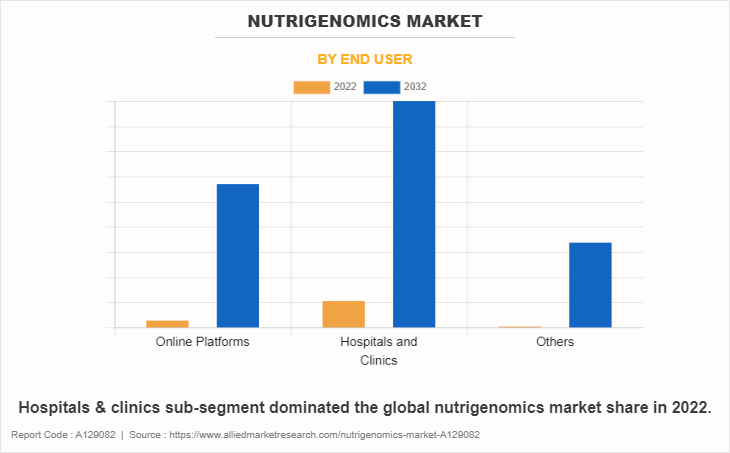

By End User

By end user, the hospitals & clinics sub-segment dominated the global nutrigenomics market share in 2022. As the practice of telehealth is relatively new and rapidly developing, regulation of telehealth is evolving and the application, interpretation, and enforcement of these laws, regulations, and standards can be uncertain or uneven. Although telehealth is gaining wider acceptance among customers, any healthcare provider is expected to comply with regulatory requirements which is quite time consuming. Hence, the hospitals & clinics sub-segment is expected to capture the largest share in the nutrigenomics testing market in the future.

By Region

By region, North America dominated the global market in 2022. In North America, the demand for nutrigenomics is expected to expand rapidly due to growing health disorders. According to the Centers for Disease Control and Prevention (CDC), as of 2022, all 50 states in the U.S. were having an obesity rate of over 20%. Currently, 17 states have an obesity rate of over 35%. Furthermore, companies in North America are releasing genetic reports for their subscribers and thus, contributing towards nutrigenomics research. For instance, in 2021, 23andME company generated 67 PRS reports, including 37 that are available exclusively for its subscribers. The presence of major nutrigenomics companies in region is projected to generate for opportunities in the nutrigenomics testing market in the future.

Impact of COVID-19 on the Global Nutrigenomics Market

- The pandemic led to an increase in demand for nutrigenomic testing as people were seeking to monitor their health status and ensuring they are not infected with COVID-19. This resulted in a rising number of people turning to nutrigenomic tests as a way to monitor their health and keep themselves and others safe.

- With the restrictions on travel and visits to healthcare providers, nutrigenomic testing became a more convenient option for consumers. People can access health information from the comfort of their own homes, which helped to mitigate the risk of exposure to the virus.

- The pandemic created new business opportunities for nutrigenomic testing companies, with many companies revolving to focus on COVID-19 testing and expanding their product offerings to meet the increase in demand.

- However, there are also limitations and concerns associated with nutrigenomic testing in the context of COVID-19. The accuracy and reliability of these tests are still being evaluated, and there are questions about the interpretation of test results and the potential for false positives or false negatives.

Key Benefits for Stakeholders

- This report provides quantitative information on the nutrigenomics market analysis, segments, current trends, estimations, and dynamics of the market from 2022 to 2032.

- The market research study is offered along with information related to nutrigenomics market opportunity, key drivers and restraints.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nutrigenomics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market along with the nutrigenomics market trends in those regions.

- Key player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global nutrigenomics market trends, key players, segments, application areas, and growth strategies.

Nutrigenomics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.1 billion |

| Growth Rate | CAGR of 17.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Product Type |

|

| By Applications |

|

| By End User |

|

| By Region |

|

| Key Market Players | Xcode Life, Genova Diagnostics, The Gene Box, Cura Integrative Medicine, Nutrigenomix Inc., Holistic Health, GX Sciences Inc., Metagenics, Inc., Interleukin Genetics, DNA Life |

Growing demand for personalized nutrition and rising prevalence of chronic diseases are the driving factors for the global nutrigenomics market growth. In addition, e-healthcare services and telehealth are projected to create several growth opportunities in the global nutrigenomics testing market during the forecast years.

The major growth strategies adopted by nutrigenomics testing market players are partnerships and agreement.

North America will provide more business opportunities for the global nutrigenomics testing market in the future.

Ancestry, Nutrigenomix, 23andMe Inc., DNAfit, GX Sciences Inc., Xcode Life, Koninklijke DSM N.V. (Royal DSM), BASF SE, Danone S.A., The Gene Box, and Cura Integrative Medicine are the major players in the nutrigenomics testing market.

The obesity sub-segment of the application held the maximum share of the global nutrigenomics testing market in 2022.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global nutrigenomics testing market from 2022 to 2032 to determine the prevailing opportunities.

Rising prevalence of obesity, cardiovascular diseases, diabetes, and cancer is anticipated to drive the adoption of nutrigenomics testing.

Integration of AI in nutrigenomics, precision medicine, and increasing rate of chronic diseases are few trends that can be overserved in the next few years.

Loading Table Of Content...

Loading Research Methodology...