Noise, Vibration and Harshness Testing Market – 2031:

The global NVH testing market was valued at $2.0 billion in 2021, and is projected to reach $3.5 billion by 2031, growing at a CAGR of 5.9% from 2022 to 2031.

NVH testing refers to Noise, Vibration and Harshness testing. NVH testing is defined as the process of optimizing noise and vibration characteristics of vehicles to such an extent that it does not affect the inner as well as the outer environment of the vehicle. It is an essential procedure for vehicles during the design and development phase. This testing reveals any buzzing, vibrations, squeaking, and rattling in a vehicle design. Moreover, since numerous components such as engine and motor have a wider application in an automobile, they eventually produce intolerable noise, which is controlled with the help of NVH testing equipment.

The NVH testing market is experiencing growth, due to implementation of government regulations pertaining to reducing vehicle noise, and rise in customer preference for enhanced cabin comfort & luxury features. However, surge in usage of rental and secondhand NVH testing equipment is the factor hampering the growth of the market. Furthermore, rise in trend of engine downsizing, and technological advancements are the factors expected to offer growth opportunities during the forecast period.

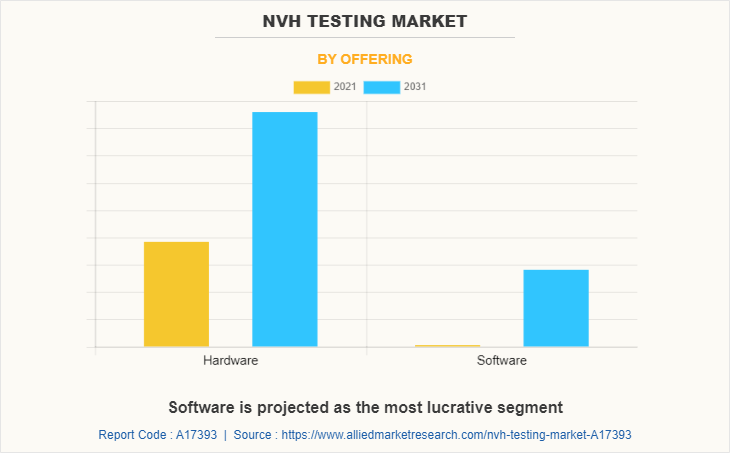

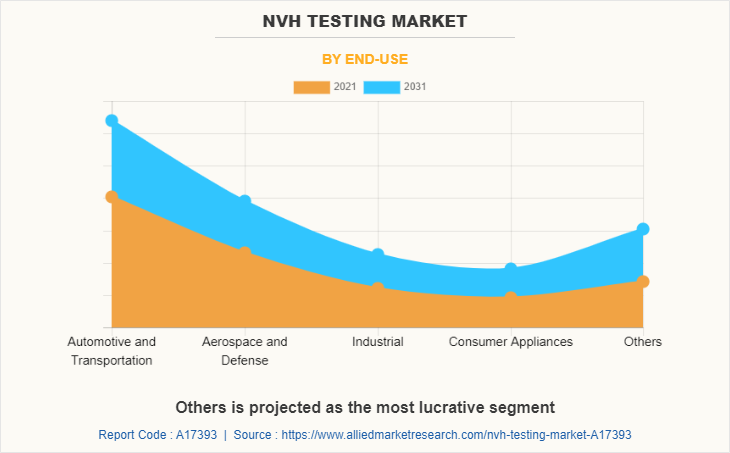

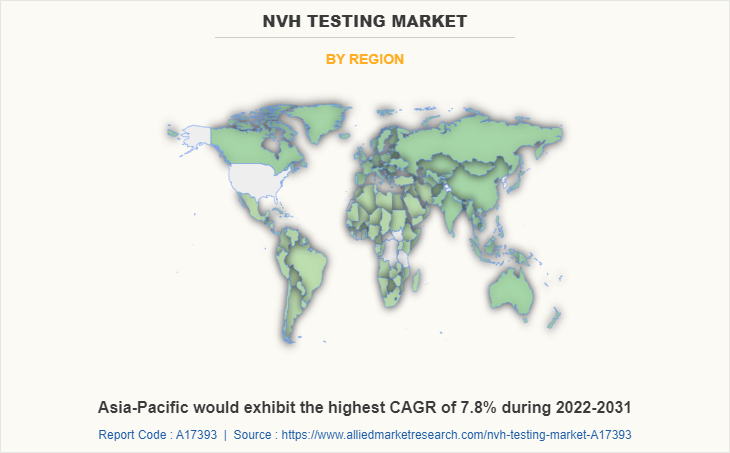

The NVH testing market is segmented on the basis of offering, application, end use, and region. By offering, it is segmented into hardware, and software. By application, it is fragmented into impact hammer testing & powertrain NVH testing, environmental noise measurement, noise source mapping, pass-by noise testing, and others. By end use, it is categorized into automotive & transportation, aerospace & defense, industrial, consumer appliances, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the NVH testing market report comprises AVL, Autoneum, Bertrandt AG, Bruel and Kjaer, EDAG Engineering GmbH, FEV Group GmbH, Head Acoustics GmbH, Honeywell International Inc, National Instruments Corp., Schaeffler Engineering GmbH, Siemens AG, and Dewesoft.

Implementation of government regulations pertaining to reducing vehicle noise

Noise is one of the most frequent ecological problems in the community. Vehicles produce more noise when they are equipped with different components such as engine and chassis. Internal combustion engine (ICE) based engines majorly produce more noise, due to the combustion process carried out within them. This noise produced by vehicles disturbs the driver and creates a negative impact on the surroundings. Thus, stringent government regulations have been implemented to reduce the vehicle noise. The United Nations Economic Commission for Europe (UNECE) published a series of 137 regulations on vehicle noise, starting from Directive 70/157/ЕЕС in 1970. In addition, the International Organization for Standardization (ISO) and its Technical Committee 43 (ISO/TC 43) are dealing with global acoustics problems, some of which are related to vehicle noise problems. Thus, enforcement of regulations across the globe drive need for incorporation of NVH testing equipment in automotive, which fuels the growth of the global NVH testing industry.

Rise in customer preference for enhanced cabin comfort and luxury features

Presently, every customer’s preference is for comfortable cabin experience in vehicle. Customers require luxury features such as the cabin infotainment system and electronic controls in the vehicle cabin, which lead to the growth of the global NVH testing market. However, deployment of these systems results in airborne noise, structure noise, and other such noise, which, in turn, augments the adoption of NVH testing equipment in the automobile industry.

Other noise sources such as tires, door interiors, roof & floor, and trunk panels are added to the interior cabin noise, which can be reduced by the usage of NVH testing equipment with the help of virtual and physical testing & simulation, thereby providing driving comfort to customers. Thus, all these factors significantly contribute toward the growth of the global market.

Surge in usage of rental and secondhand NVH testing equipment

The growth of the NVH testing market is being affected owing to availability of secondhand NVH testing equipment. Several models of NVH testing equipment with factors such as low price, less maintenance, have resulted in increased adoption of secondhand NVH testing equipment compared to new equipment. In addition, numerous service providers prefer to use NVH testing equipment on rent instead of buying them, owing to the fact that new NVH testing equipment’s components and software are highly expensive. Moreover, the availability of a wider variety of NVH testing equipment depending on the type of vehicle hampers the market. Thus, instead of keeping a variety of equipment in the service area, companies prefer to rent the NVH testing equipment, which eventually restrains the market growth.

Rise in trend of engine downsizing

Engine downsizing involves the use of a smaller and lightweight engine in a vehicle that provides the power of a larger engine. This may be done by reducing engine displacement and number of cylinders or by adding a forced aspiration device such as a turbocharger or supercharger and direct injection technology. Both aspects however might have a strong negative effect on the overall vehicle noise, vibration, and harshness (NVH) behavior. Moreover, higher vibrations and speed irregularities due to lower cylinder numbers and displacements reduce the sound quality of vehicles. Thus, rise in trend of engine downsizing is anticipated to offer remunerative opportunities for the expansion of the global NVH testing market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the NVH testing market analysis from 2021 to 2031 to identify the prevailing nvh testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the NVH testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global NVH testing market trends, key players, market segments, application areas, and market growth strategies.

NVH Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.5 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 257 |

| By Offering |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Brüel & Kjær, National Instruments, Honeywell International Inc, FEV Group GmbH, Autoneum Holding AG, Siemens AG, Dewesoft d.o.o., EDAG Engineering GmbH, Schaeffler Engineering GmbH, AVL List GmbH, Bertrandt AG, HEAD acoustics GmbH |

Analyst Review

The global NVH testing market is expected to witness significant growth due to implementation of government regulations pertaining to reducing vehicle noise, and rise in customer preference for enhanced cabin comfort & luxury features.

Technological advancements in sensor and processor technologies are contributing in enhancement of NVH testing equipment. In addition, launch of new sensor technologies having applications in NVH testing equipment, by numerous companies are creating opportunities for NVH testing solution providers. For instance, in 2019, Bruel & kjaer introduced a ¼” low-noise microphone. It is optimized for utilization in pressure field applications such as use with couplers, or flush-mounting. Microphone also works as a general measurement device when the operator utilizes inclusive electronic corrections. Such type of development carried out by companies is expected to create opportunities for the expansion of the global NVH testing market during the forecast period.

Key players operating in the market include Autoneum, AVL, Bertrandt AG, Bruel & Kjaer, Dewesoft, Edag Engineering GmbH, FEV Group GmbH, Head Acoustics GmbH, Honeywell, National Instruments, Schaeffler Engineering GmbH, and Siemens Industry Software Inc.

The global NVH testing market was valued at $1,980.0 million in 2021 and is projected to reach $3,482.6 million in 2031, registering a CAGR of 5.9%.

The top companies in the market include AVL, Autoneum, Bertrandt AG, Bruel and Kjaer, EDAG Engineering GmbH, FEV Group GmbH, Head Acoustics GmbH, Honeywell International Inc, National Instruments Corp., Schaeffler Engineering GmbH, Siemens AG, and Dewesoft.

The leading application is impact hammer testing and powertrain NVH testing.

The upcoming trends include greater application of NVH testing for electric vehicles, and rise in demand from the construction sector.

The largest regional market is North America.

Loading Table Of Content...