Off-the-Road Tire Market Research, 2032

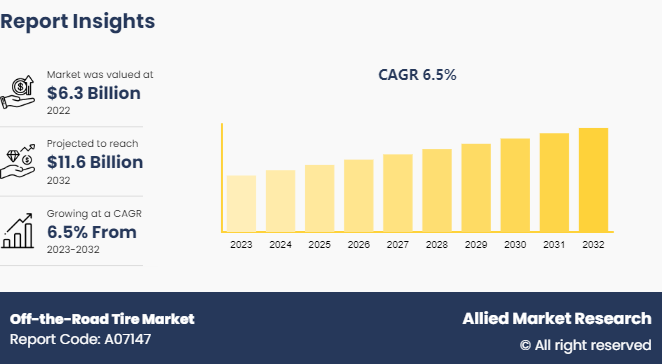

The global off-the-road tire market size was valued at $6.3 billion in 2022, and is projected to reach $11.6 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.

Market Introduction and Definition

Off-the-road tires, also known as off-road tires, are specifically designed for use in rugged and harsh off-road environments. These tires are commonly used on heavy-duty vehicles and equipment which are used in construction, mining, agriculture, forestry, and other industrial applications. These tires are extensively used in heavy machinery, which support heavy loads and provide durability and longevity in harsh operating conditions. Off-the-road tires are designed to withstand puncture and damage as compared to normal tires. There has been growth in demand for off-the-road tires due to an increase in construction and mining activity. Similarly, with the growth in recreational activities such as off-roading, these tires are extensively used in all-terrain vehicles and SUVs, further driving the market growth.

Key Takeaways

- The off-the-road tire market share covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major off the road tires market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- On March 20, 2024, The Goodyear Tire & Rubber Company launched the new three-star RL-5K Off-the-Road (OTR) tire for large wheel loaders and wheel dozers. The new tire range is capable of withstanding high air pressure which results in a 16% increase in load carrying capacity in heavy vehicles. The newly launched tire series also has 250-level durable threads, which can deliver high traction during heavy loads.

- On December 2, 2022, Bridgestone Corporation announced that its subsidy company, Bridgestone Mining Solutions Australia Pty. Ltd., has completed the acquisition of Otraco International Pty Ltd, an Off-the-Road (OTR) tire management solutions provider. This acquisition is a part of Bridgestone's strategic growth investment to accelerate the global expansion plan. According to the company, the mining tire and solutions business segment is an important business segment for the company, in which the group is continuously and proactively investing its strategic resources.

- On April 16, 2021, Bridgestone Corporation announced its plan to invest in modernization in its Shimonoseki Plant, as part of strategic growth investments. The modernization of the plan is expected to be completed by 2025, the company also announced. The addition of Solar power generation equipment to increase the portion of the Shimonoseki Plant electricity generation through renewable energy sources, reducing CO2 emissions and environmental impacts. The new manufacturing facility will look after the manufacturing of tires for mining and construction vehicles.

Key Market Dynamics

The global off-the-road tire market trends is growing due to several factors, such as increase in aftermarket demand, growth in industrialization, and increase in farm mechanization. However, the availability of low-cost tiers in the aftermarket and extreme weather conditions restrain the development of the market. In addition, retreading of OTR tires and strengthening emission regulations will provide ample opportunities for the market's development during off-the-road tire market forecast period.

In recent years, there has been an increase in instances of farm mechanization due to a scarce labor force, an increase in labor wages and the growing need to increase productivity in farms. For instance, in India, approximately 50% of the population is employed in agriculture, providing the country’s income and raw materials for numerous industries. India’s farming contributes 20% to the nation’s GDP. The Ministry of Agriculture and Farmers Welfare provided a thorough briefing on the status of the modernization of the farming sector in India. The country has been strongly focusing on farm mechanization in recent years due to rapid urbanization leading to a reduction in the labor workforce. Similarly, many developing nations around the world are shifting towards farm modernization, which is anticipated to drive the market for off the road tires market positively.

Similarly, there has been a growing demand for heavy-duty vehicles and construction equipment such as excavators, loaders, bulldozers, haul trucks, and drilling rigs to carry out large-scale excavation and construction operations due to growth in construction and mining activity and rise in industrialization. As there is growing construction and mining activity, the tires used in these vehicles are highly prone to wear and tear and thus require regular maintenance and replacement of off-the-road tires.

However, the off-the-road tire market faces challenges due to the availability of low-cost aftermarket tires, which is hindering its market growth. Low-cost unbranded tires create high competition rivalry among the companies operating in the global market. Low-cost aftermarket tires utilized low-quality materials to cut down on costs and increase their revenue. However, there is growing demand for aftermarket tires in developing countries, this creates steep competition for global companies operating in the market; thus, hindering the market growth.

Market Segmentation

The off the road tire industry is segmented into tire type, rim size, application, and region. By tire type, the global market has been segregated into radial, bias and solid. By rim size, the market is segmented into 14–24-inch, 25–30-inch, 31-50 inch, and above 50 inch. On the basis of application, the market is categorized into construction and mining equipment, agriculture tractors, industrial equipment, and all-terrain vehicles. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

There has been a rise in mining activities in China in recent years. The growth in increased mining and excavation activities is due to strong industrialization growth in the country, resulting in the growing demand for raw materials, especially iron ore, coal, copper, and aluminum. Moreover, the country has vast areas and natural resources. The abundance of natural resources provides a strong foundation for domestic mining activities, enabling China to meet its domestic demand for raw materials and reduce reliance on imported raw materials.

For instance, copper and battery metals were the key metals mined in China. Recently, the country has focused, exploration budgets have continued to focus on gold. In 2021, China was the largest producer of mined gold, with an output of 12.9 million ounces. In recent years, the country has also expanded its international mining operation, especially in countries located in Africa and Latin America region, to mine cobalt and lithium, which are extensively used in electric vehicles.

Competitive Landscape

The major players operating in the off the road tire industry include Continental AG, Bridgestone Corporation, Michelin, The Goodyear Tire & Rubber Company, Pirelli, Titan International, Inc., The Yokohama Rubber Company, Nokian Tyres plc., CEAT Tyres, and Magna Tyres

Other players in the off-the-road tire market analysis include The Carlster Group, Triangle Tire, Apollo Tyres, Double Coin Tires, Belshina OTR Tires, and others.

Industry Trends:

- On November 15, 2021, the U.S government announced the Infrastructure Investment and Jobs Act, which is set to provide $1, 200 billion in spending, $550 billion of which will be the new federal spending to be allocated over the span of next five years. The new proposed Infrastructure Investment and Job Act will support various infrastructure projects such as roads, bridges, public transit, water and energy. With the growing construction and maintenance activity, there will be an increase in demand for construction equipment, including earthmovers, loaders, graders, dump trucks, compactors, pavers, water trucks, skid steers and others. The growing infrastructure development and construction activity will create more demand for the off-the-road tire market during the forecast period.

Parent Market Analysis

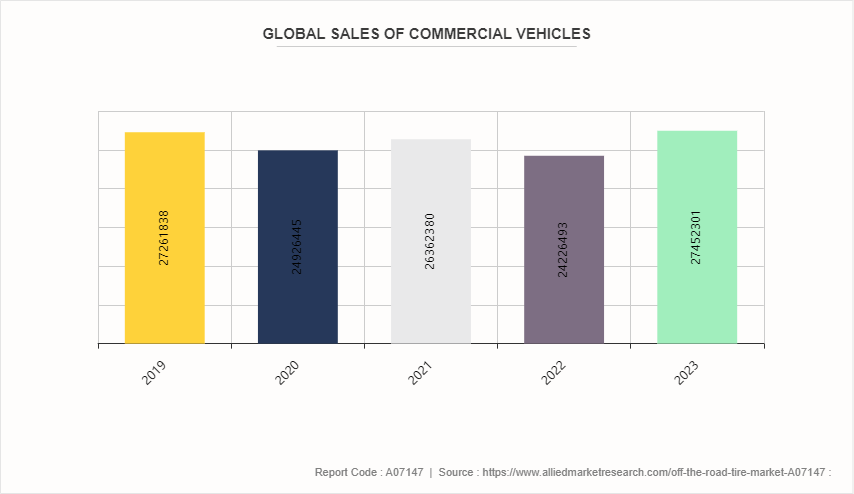

The global automotive market is witnessing strong growth in terms of vehicle production and sales. The major factor contributing to the growth of the automotive industry is due to the growing preference of consumers towards EV and hybrid commercial vehicles especially in Europe and North America region. The growth in commercial activities is creating more demand for commercial vehicles. Furthermore, with the growth in infrastructural development projects growth, including construction and development, roads, highways, and transportation networks, requires the use of commercial vehicles.

The below graph depicts the sale of commercial vehicles globally from 2019 to 2023.

Key Sources Referred

- European Automobile Manufacturers Association

- U.S. Department of Energy

- International Energy Agency

- World Economic Forum

- National Highway Traffic Safety Administration

- International Organization of Motor Vehicle Manufacturers (OICA) :

- U.S. Department of Transportation (DOT)

- Environmental Protection Agency (EPA)

- National Institute of Standards and Technology (NIST)

- European Union Open Data Portal

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the off-the-road tire market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing off-the-road tire market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the off-the-road tire market size, segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global off-the-road tire market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global off-the-road tire market growth trends, key players, market segments, application areas, and market growth strategies.

Off-the-Road Tire Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.6 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2023 - 2032 |

| Report Pages | 280 |

| By Tyre Type |

|

| By Rim Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | The Goodyear Tire & Rubber Company, Michelin, Titan International, Inc., Magna Tyres , CEAT Tyres, Bridgestone Corporation, Nokian Tyres plc. , Continental AG, Pirelli, The Yokohama Rubber Company |

Utilization of newer materials for the construction off-the-road tires is upcoming trend in the market.

Use of off-the-road tire for commercial application are upcoming trend in the market.

North America is the largest market for off-the-road tire.

The off-the-road tire market was valued at $6.28 billion in 2022.

Continental AG, Bridgestone Corporation, Michelin, The Goodyear Tire & Rubber Company are some of the top companies operating in the market.

Loading Table Of Content...