Offshore Drilling Fluid Market Research, 2031

The global offshore drilling fluid market size was valued at $3.2 billion in 2021 and is projected to reach $4.8 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031.

Drilling fluids, commonly known as drilling mud, play a crucial role in oil & gas extraction. They are also a part of mineral extraction and borewell drilling activities. The drilling fluids offer lubrication in the drilling operations. They are also used for removing cuttings, cooling drilling tools, maintaining consistency, and regulating pressure.

The offshore oil rig market is experiencing growth at a higher pace in recent years. With this growth comes complexity in the process as increasing production has become a necessity for meeting increasing demand. Drilling fluids are used for removing and preventing complexities and damage. This acts as a driving factor for market growth. Drilling for oil and natural gas beneath the water surface is far more difficult than on land. Offshore drilling is more challenging in terms of extraction, transportation, and environmental protection. Many petroleum companies have constructed offshore oil platforms for the extraction process to make it easier and more accessible. Offshore drilling fluids are required in huge amounts in daily extraction activities which also leads to market growth.

Market Dynamics

The growing government spending for development in the oil & gas industry is expected to increase the demand for offshore drilling fluids and an increase in drilling activities will further offer a variety of growth opportunities for the offshore drilling fluid market in the forecast period. Many players in the market are investing in oil and gas extraction activities which will again propel the demand for drilling fluids in offshore areas and thus lead to market growth.

Currently, 79.4% of the world's proven oil reserves are located in OPEC (Organization of the Petroleum Exporting Countries) member countries. It has been found that a large bulk of OPEC oil reserves are located in the Middle East, amounting to 64.5% of the total reserves. OPEC member countries have made significant additions to their oil reserves in recent years by adopting the best practices in the industry. These countries engage in intensive exploration and recovery operations. OPEC's proven oil reserves currently stand at 1,189.80 billion barrels. It has been found that oil & gas resources are not distributed evenly around the world.

According to the U.S. Department of Energy, about 15 countries account for more than 75% of the world’s oil production and hold roughly 93% of its reserves. These countries are projected to constitute a correspondingly large percentage of the world’s remaining undiscovered oil resources. Hence, companies in this market are unlocking revenue opportunities in key OPEC countries such as Saudi Arabia, Iran, and Kuwait among others. Thus, to tap into these reserves there is an increase in exploration activities which is further expected to act as a driving factor for the offshore drilling fluid market.

The drilling fluid generates toxic waste during the injection and disposal process. These toxic wastes are mixed with groundwater which leads to degraded water quality. Moreover, it disturbs the marine ecosystem, causes soil pollution, and affects aquatic life. These factors are likely to hamper the growth of the offshore drilling fluid market. This is due to the implementation of stringent rules and regulations regarding health and safety concerns.

The rise in industrialization activities and population has led to high consumption of energy per day. It has been found that fossil fuels supply about 84% of the world’s energy. Hence, the extraction of oil & gas, and fossil fuels has increased across the globe. A rise in investment in the exploration and production of offshore oil & gas is propelling the adoption of drilling fluids around the world. The International Energy Agency (IEA) prepares annual projections about potential energy demand using a number of different scenarios. According to the IEA 2021 report, global demand for natural gas is expected to increase by 31% by 2040, supplying 17% of the total energy consumed worldwide.

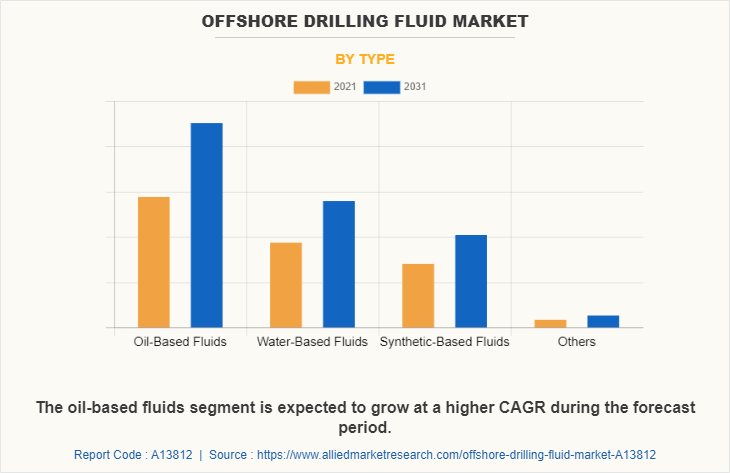

Based on type it is categorized into oil-based fluids (OBF), water-based fluids (WBF), synthetic-based fluids (SBF), and others. OBF garnered the highest market share for 2021 ad is projected to grow at a higher CAGR during the studied years. This is owed to its improved lubricity. Due to the increasing demand for lesser corrosion of drilling tools, and higher thermal stability, it will grow at a CAGR of 4.8% during the forecast period.

Oil-based drilling fluid is used in drilling engineering and is the composition of oil and water in continuous and dispersed phases, respectively. Oil-based is expected to gain significance in the future, owing to its improved lubricity. Due to the increasing demand for lesser corrosion of drilling tools, and higher thermal stability, it is expected to gain momentum in growth during the forecast period. Though oil-based fluid is anticipated to witness significant growth in the coming years, its reaction affects the environment, resulting in stringent regulations imposed by the government on its use.

Synthetic-based fluid is anticipated to witness growth due to biodegradability characteristics. Synthetic fluids are expected to gain importance during the forecast period due to their low toxicity, low fluid loss, and low bioaccumulation potential. Increasing concerns about downhole losses, and maintenance cost in deep waters projects has urged oil and gas companies to move toward, a better, less harmful, and more efficient fluid system

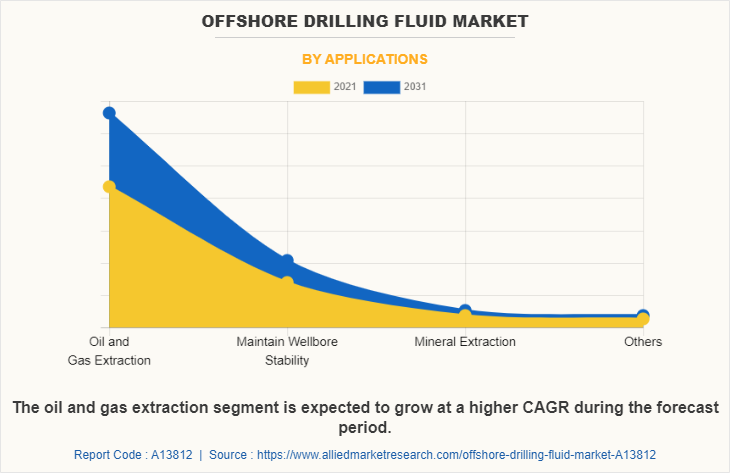

Depending on the application, the market bifurcation is done into oil and gas extraction, maintaining wellbore stability, mineral extraction, and others. Oil & gas extraction dominated the offshore drilling fluid market share for 2021. The same is expected to grow at a higher CAGR during the forecast period owing to increased activities in offshore rigs due to increased investment to boost oil and gas industry growth. Oil and gas extraction is a process that refers to the exploration and production of petroleum and natural gas from wells. Oil and gas extraction companies operate oil and gas wells and areas may be onshore and offshore. The oil and gas extraction industry generate wastewater from the water extracted from the geological formations and from chemicals used during exploration, well drilling, and production of oil and gas.

Many oil major companies are also moving more of their drilling offshore and overseas because U.S. shale opportunities are now limited with all prime acreage already taken up. The Middle East oil companies including those in Saudi Arabia, Abu Dhabi, and Kuwait are currently expanding offshore production as they are looking to gain back market share by expanding production. Such activities lead to market growth for offshore drilling fluid. Mining is the extraction of valuable minerals or other geological materials from the earth, usually from an ore body, lode, vein, seam, reef, or placer deposit. In geotechnical and mineral exploration, there are several types of drilling that use minimal amounts or no drilling fluids and these include auger drilling, both solid stem, and hollow stem, along with coring. The two main types of drilling that employ the use of drilling fluids are mud rotary drilling and air drilling

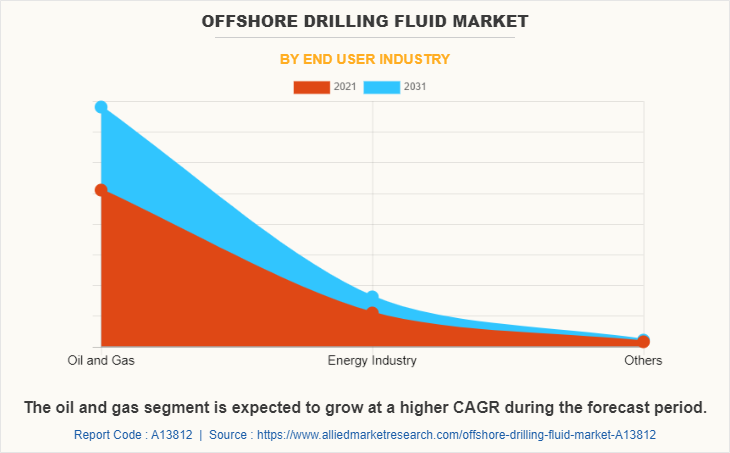

On the basis of end user industry, the market segmentation is done into oil and gas, energy industry, and others. The oil and gas industry had the highest revenue share in 2021 and will continue to grow fastest during the forecast period. This is attributed to rising investments to boost the oil and gas industry’s economy. The oil and gas industry is exploring new untapped reserves for increasing its production. There are huge investments being made to explore and extract oil and natural gas. Moreover, revitalizing abandoned oil wells and natural gas storage activities are also on the rise. Such activities raise the demand for drilling fluids for drilling and extraction. Thus, it acts as a driving factor for the offshore drilling fluid market growth.

The primary energy demand witnessed growth in demand by 5% in 2021. This was attributed to rising in urbanization, electrification, and infrastructural activities that have been gaining momentum. Such activities demand electricity and energy from fossil fuels as well as renewable fuels. Since, the base load for electricity generation is majorly bored by fossil fuels, the demand for oil and natural gas rises. There is an increase in the production of oil and gas to meet the rise in demand from the primary energy sector. This leads to growth in drilling activities which further boosts the demand for drilling fluids. In others, end user industries such as the automotive industry and others are studied. Drilling fluids are also used as automotive lubricants. Drilling fluids are used in body shop applications in the automotive industry, the technique utilizes a fastener as both drills and joining elements an efficient and flexible joining technology. Thus, the use of drilling fluid in the automotive industry boosts the market growth

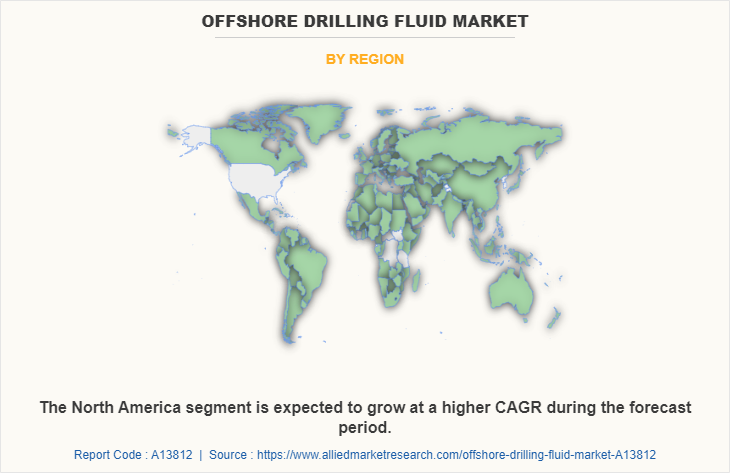

Region-wise, offshore drilling fluid market analysis is done for North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). North America dominated the market share followed by LAMEA. This is attributed to the rise in activities in the oil & gas industry, and the increase in demand for primary energy. Moreover, mineral extraction also encourages the growth of the offshore drilling fluid market. Also, massive oil reserves in Canada play a major role in driving the demand for exploration and extraction activities for oil and natural gas in the region. Canada is the fifth-largest producer of crude oil and natural gas. The significant development in Canada’s oil & gas field has been a key influencer in the industry growth in the region.

Europe is predicted to witness a huge industry expansion due to significant drilling fluid requirements in horizontal wells, particularly in Italy, Norway, Denmark, the Netherlands, France, and the UK. Growing demand for crude oil has been influencing E&P businesses in Europe to get involved in extensive drilling activities in onshore and offshore locations. The growing offshore industry, mainly in the Persian Gulf, is expected to witness growth in the drilling fluid market during the forecast period. The region includes major oil producing countries and has some of the world’s largest petroleum reserves. In addition, revival of abandoned oil wells in Persian Gulf and ongoing rig operations is also expected to drive the offshore drilling fluid market growth in the region

These geographies are further sub-categorized into countries to cover offshore drilling fluid market scenarios in respective regions. The key players operating in the offshore drilling fluid industry are Halliburton Company, Aker Hughes Inc., General Electric, Akzo Nobel N.V., China Oilfield Services Limited, National Energy Services Reunited Corp., National Oilwell Varco, Inc., Shell Plc., Gumpro Drilling Fluids Pvt. Ltd, and Weatherford International Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the offshore drilling fluid market forecast from 2021 to 2031 to identify the prevailing offshore drilling fluid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the offshore drilling fluid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global offshore drilling fluid market trends, key players, market segments, application areas, and market growth strategies.

Offshore Drilling Fluid Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.8 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 263 |

| By Type |

|

| By Applications |

|

| By End user industry |

|

| By Region |

|

| Key Market Players | China Oilfield Services Limited, National Energy Services Reunited Corp., Shell Plc., National Oilwell Varco, Inc., Halliburton Company, Weatherford International Ltd., Akzo Nobel N.V., General Electric, Gumpro Drilling Fluids Pvt. Ltd, Baker Hughes Inc. |

Analyst Review

According to the insights from CXOs, the offshore drilling fluid market is highly fragmented in nature. It has highly competitive as there are many players in the market. Companies in the offshore drilling fluid Market are expanding their regional presence considering the increased usage of crude oil as a source of energy. Concurrently, the large presence of multinational corporations has created intense competition among the players. These players are involved in the development of new products for air drilling fluids and other specialty chemicals.

They are investing in R&D to create multi-functional fluid additives that would give them a competitive advantage and contribute toward offshore drilling fluid market expansion. Rising investments in offshore oil & gas exploration are expected to lead to the offshore drilling fluid market expansion between 2022 and 2031. Numerous countries across the globe are trying to develop technologically well-equipped gas resources owing to the rise in exploration activities. Innovations in drilling fluid used in a range of settings have broadened the growth prospects of the offshore drilling fluid industry.

Offshore drilling fluids are used as shale inhibitors, corrosion inhibitors, defoamers, emulsifiers, filtration reducers, breakers, biocides, and weighting operators, with particular additives.

Oil and Gas is the leading application of Offshore Drilling Fluid Market

The estimated industry size of Offshore Drilling Fluid is $4.8 billion by 2031.

North America is the largest regional market for Offshore Drilling Fluid

Halliburton Company, Aker Hughes Inc., General Electric, Akzo Nobel N.V., China Oilfield Services Limited, National Energy Services Reunited Corp., National Oilwell Varco, Inc., Shell Plc., Gumpro Drilling Fluids Pvt. Ltd, and Weatherford International Ltd. are the top companies to hold the market share in Offshore Drilling Fluid market.

Loading Table Of Content...