On Board Diagnostics Device Market Research, 2031

The Global On Board Diagnostics Device Market was valued at $21.3 billion in 2021, and is projected to reach $63.7 billion by 2031, growing at a CAGR of 11.7% from 2022 to 2031.

On board diagnostics is the process of analyzing the condition of the vehicle to determine whether the vehicle and its associated components are running in a proper condition. To carry out vehicle diagnosis, numerous hardware components and software are used to configure devices, which give the exact information about the component or vehicle part.

Segment Overview

The on board diagnostics device market is segmented into Type and Vehicle Type.

Diagnostic system designed for a vehicle can reveal problems within a vehicle's engine, transmission, exhaust system, brakes, and other major components as well as performance issues with the fuel injector, air flow & coolant, ignition coils, and throttle. Using specialized software, sensors, and microchips, vehicle diagnostic tools quickly and accurately point to problem areas in a vehicle’s engine or elsewhere. With the advancement in technology, vehicle service providers have developed on-board and off-board diagnostic systems, which give the exact information about the defected part installed in a vehicle.

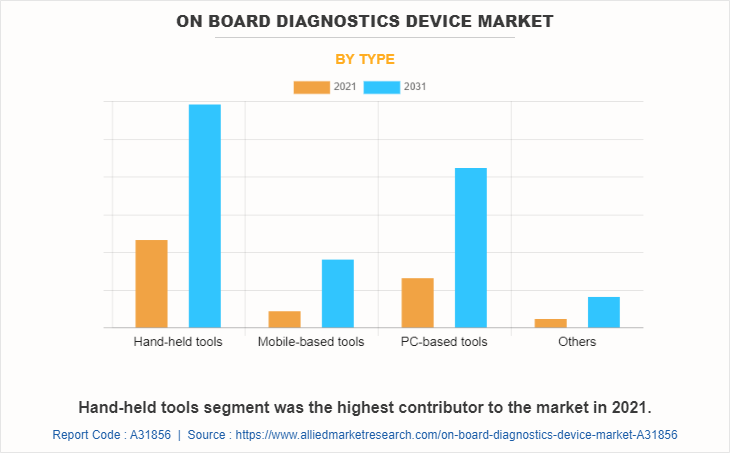

Depending on type, the market is segmented into hand-held tools, mobile-based tools, PC-based tools, and others. The hand-held tools segment was the highest contributor to the market in 2021.

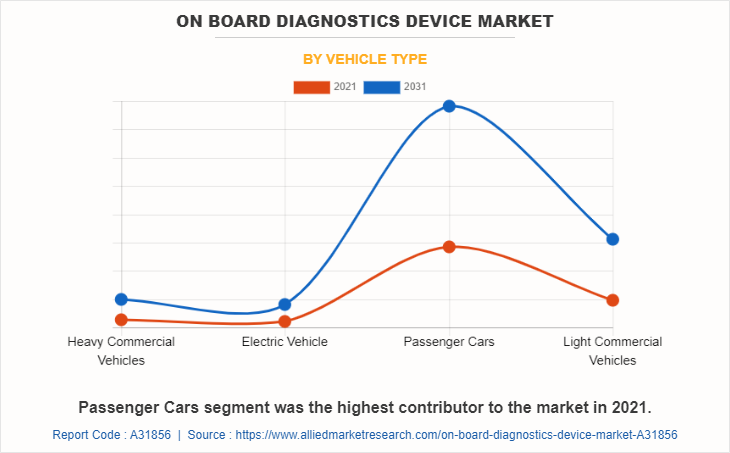

By vehicle type, the market is divided into passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. The passenger cars segment was the highest contributor to the market in 2021.

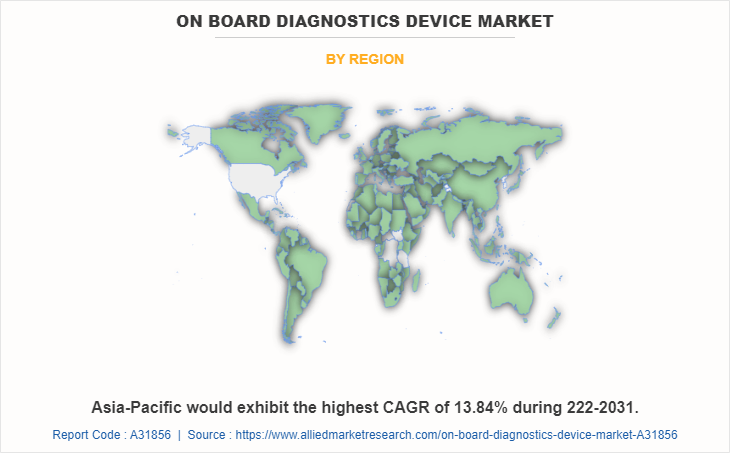

Region wise, the on board diagnostics device market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia and rest of Europe), Asia-Pacific (China, Japan, India, Australia and rest of Asia-Pacific) and LAMEA (Latin America, the Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the global on-board diagnostics device industry. Major organizations and government institutions in the country are intensely putting resources into the technology.

Development of the automotive industry, increase in demand for IoT-based technology, and high demand for safety features in vehicles acts as the key driving forces of the global on-board diagnostics device market. According to the recent on board diagnostics device market trends, demand for vehicle on board diagnostics and on board diagnostic connector is experiencing significant growth in the automotive sector. However, factors such as high implementation cost coupled with complexities in configuration and frequent requirement of troubleshooting & high maintenance of automotive software create a negative impact, thereby hampering the growth of the market across the globe. On the contrary, factors such as developments in semi-autonomous & autonomous vehicles and advent of multifunctional system are expected to create remunerative opportunities for the expansion of the global on board diagnostics device market during the forecast period.

Significant factors that impact the growth of the on board diagnostics device industry include rapid development of the automotive industry. Moreover, rapid increase in demand for IoT-based technology is expected to drive the market opportunity. However, frequent need for troubleshooting and need for constant maintenance of automotive software might hampers the on board diagnostics device market growth. On the contrary, developments in semi-autonomous and autonomous vehicles are offering potential growth opportunity for the on board diagnostics device market size during the forecast period.

The key players profiled in the global on board diagnostics device industry report are Autel Intelligent Technology Corp., Ltd., Robert Bosch GmbH, Detroit Diesel Corporation, Innova Electronics Corp., Vector Informatik, AVL DiTEST GmbH , Zubie Inc., ERM Electronic Systems LTD, Verizon Communications Inc and Denso Corporation.

Top market players have adopted various strategies, such as product launches, contracts, and others to expand their foothold in the on board diagnostics device market share.

In November 2020, Innova Electronics Corporation a leading supplier of test equipment and diagnostic launched its InnovaR. 7111 Smart Diagnostic System (SDS) diagnostic tablet. The first tablet from leading OBD2 diagnostic provider Innova, the Smart Diagnostic System is an all-in-one solution with a diagnostic tablet and the RepairSolutions2 knowledgebase delivering the most complete diagnostic system in single form factor to make it easier for technicians and advanced automotive enthusiasts to efficiently find and fix problems on today's vehicles.

- In September 2019, Bosch launched a new diagnostic tester onto the market which has specifically been developed for mobile and straightforward workshop use. The compact and robust Bosch KTS 250 is perfectly suitable for small automotive workshops, for use at workshops' vehicle reception or as an additional device for larger workshops. The tester stands out for its high user friendliness. A new, intuitive and Android-based user interface supports its operator. Equipped with Bosch ESI[tronic] workshop software, KTS 250 allows economical ECU diagnoses on almost any type of passenger car on the market.

- In August 2019, Autel announced the launch of its new MA600 MaxiSYS ADAS calibration system. The Autel MaxiSYS ADAS calibration solution is now more portable. A smarter service made simple, the easy-to-use MA600 frame folds and disassembles easily for transport to calibrate in multiple locations. Designed to support adapting repair businesses, the MA600 helps shops affordably target a new revenue stream of ADAS calibration. The MA600 software provides accurate calibration procedures for camera-based systems with accessories and oversized AVM patterns that are available to purchase separately. The new step-by-step tutorial graphics and five-line laser leveling process offer a quicker and more efficient centering and squaring procedure of the vehicle to the calibration frame.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the on board diagnostics device market analysis from 2021 to 2031 to identify the prevailing on board diagnostics device market opportunitiy.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the on board diagnostics device market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global on board diagnostics device market trends, key players, market segments, application areas, on board diagnostics device market forecast and market growth strategies.

On board diagnostics Device Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 63.7 billion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 193 |

| By Vehicle Type |

|

| By Type |

|

| By Region |

|

| Key Market Players | Robert Bosch GmbH, Zubie, Inc., Denso Corporation, Innova Electronics corp., Verizon Communications Inc., ERM Electronic Systems LTD, Vector Informatik GmbH, Detroit Diesel Corporation, AVL DiTEST GmbH, Autel Intelligent Technology Corp., Ltd. |

Analyst Review

The market is driven by numerous developments carried out by top on-board diagnostics device manufacturers. Moreover, technological advancements in vehicle safety and security components and the introduction of smart diagnosis system in vehicles are expected to drive the on-board diagnostics device market growth.

Development in automotive industry, increased demand for IoT-based technology, and high demand for safety features in vehicles supplement the growth of the market across the globe. Moreover, companies operating in the on-board diagnostics device industry are focusing on developments of products used in vehicle diagnostics, which is expected to create numerous opportunities for the growth of the market across the globe. Moreover, rise in investments on building driverless vehicles and technological advancements in advanced driver assistance systems are expected to provide lucrative opportunities for growth of the global market in the future.

The global on-board diagnostics device market is segmented into type, vehicle type, and region. Depending on type, the market is segmented into hand-held tools, mobile-based tools, PC-based tools, and others. By vehicle type, the market is divided into passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America is considered to be the largest regional market for r On board diagnostics Device.

The estimated industry size of On board diagnostics Device is expected to be $21,344.7 million in 2021.

The major players in the On board diagnostics Device industry are Autel Intelligent Technology Corp., Ltd., Robert Bosch GmbH, Detroit Diesel Corporation and others.

The On board diagnostics Device Market is expected to grow at a CAGR of 11.65% from 2022 to 2031.

The primary types of on-board diagnostics devices are hand-held tools, mobile-based tools, PC-based tools, and others.

Loading Table Of Content...

Loading Research Methodology...