On-Demand Insurance Market Research, 2032

The global on-demand insurance market was valued at $7.5 billion in 2022, and is projected to reach $23.7 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

On-demand insurance is a type of insurance which allows consumers to purchase insurance coverage on their smartphone whenever and wherever they want, usually when the asset requiring coverage is in use and at risk.

The main advantages of on-demand insurance is that it offers customers a personalized approach to insurance. Thus, this level of customization is particularly attractive to customers who are looking for flexible and tailored insurance solutions. Therefore, on-demand insurance provides a more personalized approach to insurance that meets the specific needs of individual customers, by allowing customers to choose the level of coverage they need.

Furthermore, developments in digital platforms and mobile apps have made it easier for consumers to purchase on-demand insurance quickly and conveniently. Thus, this has contributed toward the on-demand insurance market growth in the recent years. Therefore, flexibility is a key factor driving the growth of the on-demand insurance market, as it allows consumers to have greater control over their insurance coverage and only pay for what they need.

However, limited product offerings certainly act as a restraint for the on-demand insurance market, as customers may be hesitant to use a service that does not offer the specific coverage they require. Moreover, consumers are likely to choose a service that meets their specific needs rather than settling for a one-size-fits-all solution. On the contrary, cost-effectiveness of on-demand insurance policies make insurance accessible and affordable for people who may not have been able to afford traditional policies. Thus, cost-effectiveness is a key advantage for on-demand insurance companies, and help them to attract new customers and compete with traditional insurance providers.

The report focuses on growth prospects, restraints, and trends of the on-demand insurance market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the on-demand insurance market outlook.

Segment Review

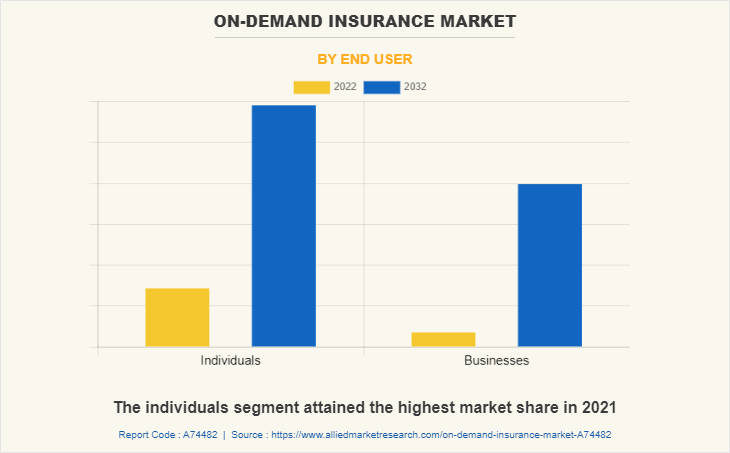

The on-demand insurance market is segmented on the basis of coverage, end user and region. Based on coverage, it is segmented into travel insurance, event insurance, renter's insurance, electronic equipment insurance, and others. By end user, it is segmented into individuals and businesses. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By end user, the individuals segment attained the highest growth in 2022. This is because there is a rise of micro-insurance, which provides coverage for short periods and specific events such as travel, sports activities, or rental cars. Thus, these types of insurance appeal to consumers who are looking for affordable and customizable insurance options, which leads to the growth of the market in this particular segment. However, the businesses segment is considered to be the fastest growing segment during the forecast period. This is because there is growing emphasis on providing businesses with more flexible and customizable insurance options that can be activated and deactivated as needed. Thus, this enables businesses to adapt their insurance coverage to their changing needs and helps them manage their insurance costs more effectively.

By region, North America attained the highest growth in 2022 in the on-demand insurance market due to the increased adoption of digital platforms and the growing demand for personalized insurance solutions. In addition, the rise of the sharing economy and the increase in use of mobile devices have also contributed to the growth of on-demand insurance in the region. Meanwhile, the Asia-Pacific region is considered the fastest growing region during the forecast period in the on-demand insurance market due to the surge in penetration of smartphones and internet connectivity, as well as the rise in demand for affordable and customized insurance products. The Asia-Pacific region has a large and growing middle class, which is driving demand for new and innovative insurance products. Furthermore, the region has a high rate of mobile and internet penetration, which makes it easier for insurance companies to offer on-demand insurance products to customers. The increase in awareness of the benefits of insurance and the growing adoption of digital platforms are expected to drive the growth of the on-demand insurance market share in the Asia-Pacific region in the coming years.

The report analyzes the profiles of key players operating in the on-demand insurance market such as AXA, Chubb, GetSafe, Metromile, Munich Re, Ping An Insurance, Root, Zurich, Zego, and Zuno. These players have adopted various strategies to increase their market penetration and strengthen their position in the on-demand insurance market size.

Market Landscape and Trends

The on-demand insurance market is a relatively new and rapidly growing sector of the insurance industry. Furthermore, on-demand insurance market is experiencing significant growth and innovation as consumers seek more flexible and customizable insurance solutions. One of the major trends in this market is the increasing use of technology to streamline the insurance process, from purchasing to claims processing. This includes the use of mobile apps, chatbots, and artificial intelligence to provide more convenient and personalized experiences for consumers. Another trend is the expansion of on-demand insurance offerings beyond traditional products like auto and home insurance, to cover niche areas such as travel, pets, and events. Additionally, partnerships between insurance companies and other industries are becoming more common, as they seek to offer more comprehensive and convenient on-demand insurance options to their customers. Overall, the on-demand insurance market is expected to continue growing as more consumers seek flexible and personalized insurance solutions that meet their specific needs. Therefore, these are the major market trends of on-demand insurance industry.

Top Impacting Factors

Offers a Personalized Approach to Insurance

One of the main advantages of on-demand insurance is that it offers customers a personalized approach to insurance. Moreover, traditional insurance policies are often based on a one-size-fits-all model, which may not be suitable for everyone. Whereas, on-demand insurance allows customers to purchase insurance when they need it, for the exact duration they require, and for the specific risk they want to insure against. Thus, this level of customization is particularly attractive to customers who are looking for flexible and tailored insurance solutions. Therefore, on-demand insurance provides a personalized approach to insurance that meets the specific needs of individual customers, by allowing customers to choose the level of coverage they need. Hence, this in turn, is driving the growth of the on-demand insurance market, as more customers are seeking out these types of insurance products.

Provides Flexible Insurance Services

On-demand insurance allows customers to purchase insurance coverage for a specific duration or for a specific event, rather than having to commit to a long-term policy. Thus, this flexibility is particularly appealing to consumers who may only need coverage for a short period of time or who want insurance that is tailored to their specific needs. Moreover, on-demand insurance allows customers to easily adjust their coverage as their needs change. For instance, if someone is renting a car for a weekend trip, they can purchase on-demand insurance for the specific days they will be driving the car, rather than having to purchase a long-term auto insurance policy.

Furthermore, introduction of digital platforms and mobile apps has made it easier for consumers to purchase on-demand insurance quickly and conveniently. This has contributed to the growth of the on-demand insurance market in recent years. Therefore, flexibility is a key factor driving the growth of the on-demand insurance market, as it allows consumers to have greater control over their insurance coverage and only pay for what they need.

Limited Product Offerings

Limited product offerings certainly act as a restraint for the on-demand insurance market, as customers may be hesitant to use a service that does not offer the specific coverage they require. Moreover, consumers are likely to choose a service that meets their specific needs rather than settling for a one-size-fits-all solution. Therefore, if an on-demand insurance provider offers only a limited range of products, it may struggle to attract and retain customers. Furthermore, the impact of limited product offerings will depend on the specific market and the needs of its customers. For instance, if the on-demand insurance market is focused on a specific niche, such as ride-sharing or home-sharing services, it may be possible to offer a limited range of products that meet the specific needs of that market. Therefore, such factors restrain the growth of the market.

Regulatory Constraints

One of the main challenges for on-demand insurance is compliance with regulatory requirements, as insurance is a heavily regulated industry, and insurers must comply with a wide range of laws and regulations to operate in a particular jurisdiction. Moreover, these regulations can vary from state to state and country to country, and compliance can be a complex and time-consuming process. Furthermore, another challenge is that on-demand insurance may not fit neatly into existing regulatory frameworks as traditional insurance policies are typically sold on an annual basis, and the regulatory requirements for these policies are well-established. However, on-demand insurance policies may be sold for shorter periods or for specific events, which may not fit into existing regulatory frameworks; thus, making it difficult for on-demand insurers to navigate the regulatory landscape and comply with all the relevant requirements.

Offers Cost-effectiveness to Customers

The cost-effectiveness of on-demand insurance policies can make insurance accessible and affordable for people who may not have been able to afford traditional policies. Furthermore, on-demand insurance, also known as pay-per-use insurance or usage-based insurance, allows customers to only pay for the insurance coverage they need, based on their usage or behavior. This can be particularly cost-effective for people who do not use certain types of insurance frequently or who have lower risk profiles.

For instance, on-demand car insurance allows drivers to pay for coverage only when they are actually driving, rather than paying for traditional coverage that assumes they are driving their car every day. Thus, this can save customers money while still providing them with the coverage they need when they are driving. Similarly, on-demand health insurance could allow people to pay for coverage only when they need medical care, rather than paying for more comprehensive coverage that they may not use. Moreover, cost-effectiveness is particularly important for younger generations, who are more likely to prioritize experiences over possessions and may not want to pay for traditional insurance products that they do not use frequently. Overall, cost-effectiveness is a key advantage for on-demand insurance companies, and can help them to attract new customers and compete with traditional insurance providers.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the on-demand insurance market analysis from 2023 to 2032 to identify the prevailing on-demand insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the on-demand insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global on-demand insurance market trends, key players, market segments, application areas, and market growth strategies.

On-Demand Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23.7 billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 332 |

| By Coverage |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ping An Insurance, Root, AXA, zego, Metromile, Zurich, Munich Re, Zuno, Chubb, GetSafe |

Analyst Review

On-demand insurance refers to a type of insurance that allows customers to purchase coverage only when they need it, rather than being locked into a long-term policy. It is a flexible and convenient insurance option that provides coverage for specific periods, events, or activities. Moreover, on-demand insurance is usually offered through mobile apps or online platforms that allow customers to quickly purchase coverage with just a few clicks. Thus, this type of insurance is particularly popular in the sharing economy, where people may only need insurance coverage for the duration of a rental or service.

Furthermore, market players are adopting strategies like partnership for enhancing their services in the market and improving customer satisfaction. For instance, in May 2021, Slice Labs partnered with American Family Insurance to offer on-demand insurance coverage for homeshare hosts. This partnership will allow hosts to purchase coverage for the exact duration of their guests' stay, rather than being locked into a long-term policy. Therefore, such strategies boost the growth of the market in the upcoming years.

Moreover, some of the key players profiled in the report include AXA, Chubb, GetSafe, Metromile, Munich Re, Ping An Insurance, Root, Zurich, Zego, and Zuno. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The on-demand insurance market is expected to continue its growth trajectory, driven by increased consumer demand for flexible, customized insurance solutions. Key trends include the integration of on-demand insurance into digital platforms and ecosystems, the use of data and analytics to personalize risk assessments and pricing, and the expansion of on-demand insurance beyond traditional categories such as travel and event cancellation. Additionally, there is a growing interest in using blockchain technology to improve transparency and efficiency in the on-demand insurance industry. Overall, the on-demand insurance market is expected to continue evolving and innovating to meet the changing needs and expectations of consumers.

Travel insurance is currently the leading application of on-demand insurance, with a significant portion of on-demand insurance products being offered in this category. On-demand travel insurance offers consumers flexibility and convenience, allowing them to purchase coverage only when they need it, such as for a specific trip or activity. Additionally, the COVID-19 pandemic has accelerated the adoption of on-demand travel insurance, as travelers seek out flexible and personalized coverage that can adapt to changing travel restrictions and risks. However, on-demand insurance is also expanding into other categories, such as event cancellation and rental insurance, as consumers seek out more flexible and customizable insurance solutions.

North America is the largest regional market for On-Demand Insurance

The global on-demand insurance market was valued at $7,492.68 million in 2022, and is projected to reach $23,692.85 million by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

AXA, Chubb, GetSafe, Metromile, Munich Re, Ping An Insurance, Root, Zurich, Zego, and Zuno

Loading Table Of Content...

Loading Research Methodology...