The global on-demand logistics market was valued at $12.4 billion in 2021, and is projected to reach $80.6 billion by 2031, growing at a CAGR of 20.8% from 2022 to 2031.

On-demand logistics is a modern logistics strategy which enables companies to fulfill customers’ orders as soon as they are placed. It aids the companies to expand their customer reach by delivering the customer’s order within same-day, next-day or 2-days. In addition, it can support multichannel retailing, which streamlines and automates the fulfillment process for customer’s orders which are received through numerous sales channels. Moreover, on-demand logistics requires flexible fulfillment solutions, robust distribution network and advanced & modern technologies such as cloud computing, analytics and others. Furthermore, on-demand logistics provides several benefits such as enhanced customer base, reduction in the cost of infrastructure, fast courier tracking, and others.

The growth of the global on-demand logistics market is propelling, due to expansion of e-commerce industry globally, and increase in demand for fast delivery of packages. However, poor infrastructure and higher logistics costs is the factor hampering the growth of the market. Furthermore, development of aerial delivery drones that function smoothly in geographically challenging areas is the factor expected to offer growth opportunities during the forecast period.

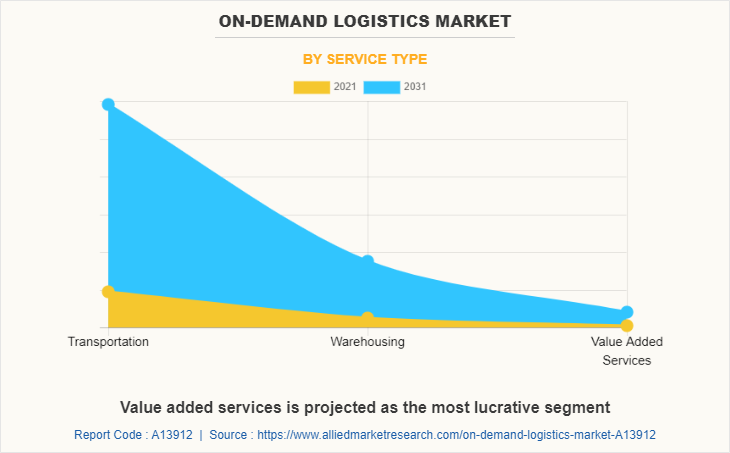

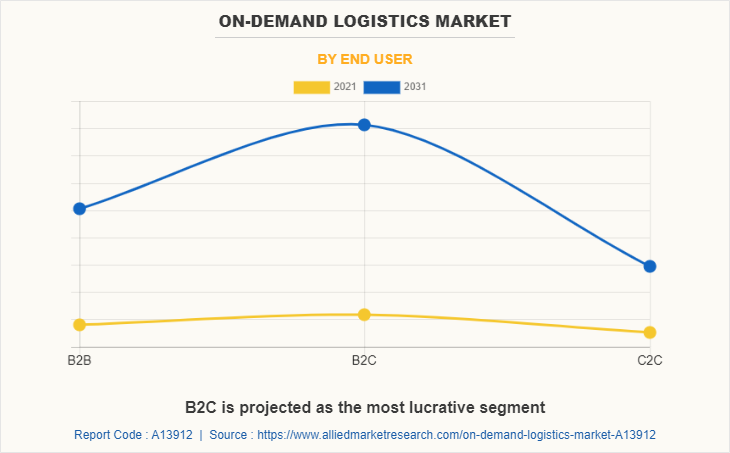

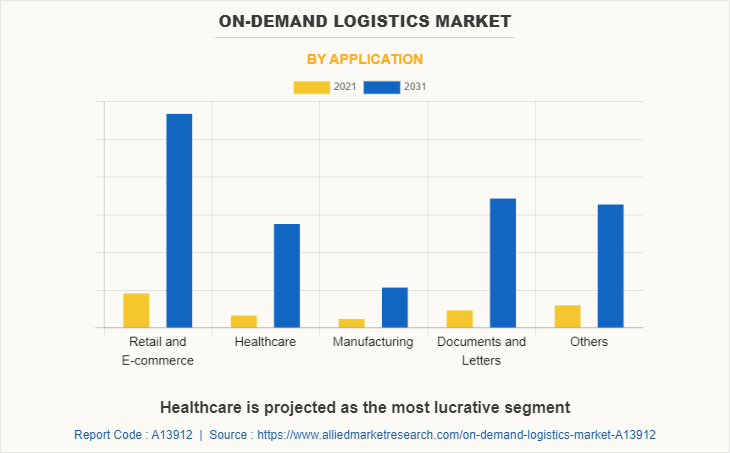

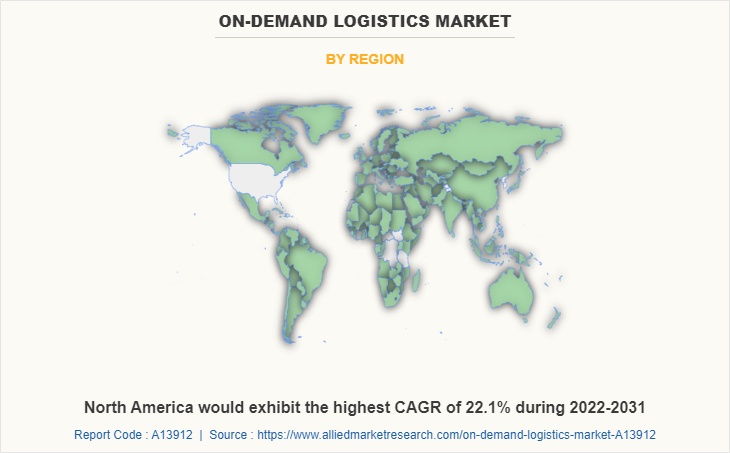

The on-demand logistics market is segmented on the basis of service type, application, end user, and region. By service type, it is segmented into transportation, warehousing, and value-added services. By application, it is fragmented into retail and e-commerce, healthcare, manufacturing, documents and letters, others. By end user, it is classified into B2B, B2C, and C2C. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the on-demand logistics market report comprises A1-Sameday Delivery Service, Inc., Amazon.com, Inc., Deutsche Post DHL Group, Dropoff, Inc, DSV A/S, FedEx, Flirty (Skydrop), Jet Delivery, Inc., Power Link Expedite Corporation, Uber Technologies, Inc., United Parcel Service of America, Inc., and XPO Logistics, Inc.

Expansion of e-commerce industry globally

E-commerce refers to buying and selling of goods by utilizing internet. E-commerce is a virtual store where goods & services do not require any physical space and are sold through websites. The e-commerce industry utilizes logistics services to manage and oversee supply chain of e-commerce companies, thus, allowing these companies to focus on marketing and other business operations. Easy accessibility, convenient shopping experiences, and heavy discounts & offers make e-commerce a popular medium for purchase of a wide variety of products. These factors have collectively contributed toward growth of the market for e-commerce services.

In addition, COVID-19 also contributed in growth of the e-commerce industry across the globe. Several governments-imposed lockdown in their regions to restrict spread of the virus. As there were no access to physical marketplace, people started to purchase goods or products online, which, in turn, resulted in growth of the e-commerce sector.

Moreover, rise of the e-commerce industry has forced on-demand logistics industry to adopt digital technologies to address the increasing demand of customers. They have also started to use artificial intelligence, internet of things (IoT), and other technologies to ensure timely delivery of goods or products to customers. Thus, expansion of the e-commerce industry globally propels the growth of the on-demand logistics market.

Increase in demand for fast delivery of packages

With the advent in online shopping along with the customer’s inclination toward buying products through an online source, the demand for better and efficient delivery service for the products has increased. With the advent in the COVID-19 pandemic, customer’s preference toward online shipping of daily necessities has increased, which has supplemented the growth of the on-demand logistics market. For instance, there has been a spike in the e-grocery orders in China due to consumer’s inclination toward e-commerce companies such as JD.com, Alibaba Group and MTDP to shop virtually for their household needs. This is practiced to avoid face-to-face contact among individuals during the pandemic. Also, to curb the need to avoid direct contact among individuals, JD.com in China has deployed its autonomous robot delivery technology in Wuhan to handle grocery and medical packages deliveries. In addition, various means to deliver a package such as by drones or by autonomous vehicles have increased, due to the demand for fast delivery of packages, which further boosts the growth of the on-demand logistics market across the globe.

Poor infrastructure and higher logistics costs

Logistics demands for good infrastructure, supply chain, and trade facilitation. Without these, firms have to build up more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, lack of infrastructure hinders the on-demand logistics market as it increases costs and reduces supply chain reliability.

These include significant inefficiencies in transport, complex tax structure, low rate of technology adoption, and poor skills of logistics professionals. For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of the region’s roads are unpaved. Further, inconsistency in the address and postal system is the other challenge for parcel delivery in Latin American countries. As many countries lack postal codes and rely on local landmarks for addresses, shipping companies often have trouble delivering parcels successfully. Moreover, logistics costs are heavily determined by the availability and quality of infrastructure. Infrastructure directly influences transport costs and indirectly affects the level of inventories, and consequently financial costs.

Thus, owing to poor transport infrastructure, firms need to have high levels of inventories to account for contingencies, which can result in higher overall logistics cost. Therefore, poor infrastructure along with high inventory prices and insufficient warehousing space are expected to hamper the on-demand logistics market growth.

The on-demand logistics market is segmented into Service Type, End User and Application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the on-demand logistics market analysis from 2021 to 2031 to identify the prevailing on-demand logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the on-demand logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global on-demand logistics market trends, key players, market segments, application areas, and market growth strategies.

On-demand Logistics Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amazon.com, Inc., A1 SameDay Delivery Service, Inc., Dropoff, Inc., Uber Technologies Inc., Jet Delivery, Inc., FedEx Corporation, DSV A/S, United Parcel Service of America, Inc., Deutsche Post DHL Group, Flirtey Holdings, Inc., XPO Logistics Inc., Power Link Expedite Corporation |

Analyst Review

The on-demand logistics market is expected to witness significant growth, owing to expansion of e-commerce industry globally, and increase in demand for fast delivery of packages.

Drones have evolved significantly in the past few years and offer a smart mobility alternative for businesses and consumers worldwide. The evolution of technologies such as artificial intelligence, 3D imaging, big data, analytics, and others has promoted the growth in the adoption of these advanced technologies in drones for accomplishing time-sensitive missions.

In addition, various developments have been carried out by the top companies for the development of aerial delivery drones, which can deliver products and services in geographically challenged areas. This reduces the human involvement to deliver products and services to distant places as this can be carried out by means of aerial delivery drones. During the COVID-19 pandemic situation, last mile delivery giant UPS has collaborated with Germany based drone maker company Wingcopter. This collaboration is to accelerate the adoption of aerial drones for contactless delivery of packages. Such collaborations and developments carried out by several other players is expected to boost the growth of the on-demand logistics market in the region. In addition, regions such as South Korea, have carried out tests for delivery of packages in the remote areas hoping to improve the lifestyle of residents in the region. Thus, the development of aerial delivery drones that function smoothly in geographically challenging areas is anticipated to provide lucrative growth opportunities for the market during the forecast period.

Major players adopted different strategies, for instance, business expansion, acquisition, partnership, agreement, and collaboration. Among this business expansion is the leading strategy used by prominent players such as Uber Technologies Inc., Amazon.com, Inc., Deutsche Post DHL Group, DSV A/S, and FedEx.

The global on-demand logistics market was valued at $12.40 billion in 2021 and is projected to reach $80.63 billion in 2031, registering a CAGR of 20.8%.

The leading application is retail and e-commerce.

The largest regional market is Asia-Pacific.

The top companies in the market include A1-Sameday Delivery Service, Inc., Amazon.com, Inc., Deutsche Post DHL Group, Dropoff, Inc, DSV A/S, FedEx, Flirty (Skydrop), Jet Delivery, Inc., Power Link Expedite Corporation, Uber Technologies, Inc., United Parcel Service of America, Inc., and XPO Logistics, Inc.

The upcoming trends include development of autonomous delivery solutions and rise in B2C applications.

Loading Table Of Content...