Online Food Delivery Market Research, 2032

The global online food delivery market size was valued at $343.7 billion in 2022, and is projected to reach $1.3 trillion by 2032, growing at a CAGR of 14.3% from 2023 to 2032.

Online food delivery industry is a modern culinary convenience that empowers individuals to use digital platforms to effortlessly procure dishes from their preferred eateries. Patrons peruse virtual menus, make their culinary selections, and complete transactions electronically. Once the order is verified, a designated courier embarks on a journey to the chosen restaurant, retrieves the ordered fare, and transports it to the customer's location. This streamlined process simplifies the dining experience, affording an extensive array of gastronomic choices while granting the luxury of ordering from one's own abode. Its surging popularity is notably enhanced by third-party delivery aggregators that collaborate with a multitude of culinary establishments.

Market Dynamics

The online food delivery market has undergone a significant transformation in recent years, and the COVID-19 pandemic accelerated this evolution. With the growing demand for convenience and contactless dining options, the market witnessed substantial growth. The pandemic led to a surge in online food ordering as people were forced to stay home, making online food delivery services more essential than ever. Furthermore, restaurants, faced with dine-in restrictions, turned to delivery services to maintain their revenue streams. As a result, the market has become a dynamic and competitive industry, marked by the presence of numerous players offering diverse cuisines and innovative solutions.

Several industry trends and growth drivers have shaped the online food delivery market. The shift towards digitalization has been a prominent trend, with consumers increasingly using mobile apps and websites to place food orders. This trend aligns with the broader shift towards online shopping and e-commerce, especially among tech-savvy millennials and Gen Z consumers. Moreover, the concept of virtual kitchens, often referred to as ghost kitchens, has gained traction. These kitchens focus solely on preparing food for delivery, eliminating the need for a traditional dine-in establishment. This trend caters to the growing online food delivery market Demand takeout options.

Additionally, personalized recommendations and loyalty programs have become a key online food delivery market Growth driver. Online food delivery platforms are using data analytics and artificial intelligence to offer users customized meal suggestions and discounts. These incentives keep customers engaged and encourage them to order more frequently. The COVID-19 pandemic acted as a catalyst for the online food delivery market's growth. Lockdowns and social distancing measures forced people to rely on delivery services. Consumers embraced the convenience and safety of online food ordering, resulting in a significant surge in demand for these services.

While the online food delivery market is experiencing robust growth, it also faces several challenges. One of the main challenges is the intense competition among delivery platforms. Numerous players, including both established companies and startups, are vying for market share. This fierce competition has driven up customer acquisition costs and reduced profit margins for many platforms. Regulatory and legal challenges can also be significant hurdles. Different regions and countries have varying regulations governing food delivery services. These regulations can affect everything from menu offerings to labor practices, creating complexities for businesses operating across multiple locations.

Ensuring food safety and maintaining quality during the delivery process is another challenge. Customers expect their meals to arrive hot and fresh, and addressing these expectations can be difficult, particularly for items with specific temperature and freshness requirements. Last-mile delivery logistics can be a logistical challenge. Efficiently managing and optimizing delivery routes while ensuring timely deliveries is essential but can be complex, especially in densely populated urban areas.

Despite the challenges, there are numerous business opportunities within the online food delivery market. Expanding into underserved or emerging markets presents a significant opportunity. Many regions, especially in Asia and Africa, offer untapped potential for growth. Partnering with local restaurants and adapting to regional tastes can help platforms capture these opportunities. Moreover, embracing sustainability and eco-friendly practices presents a chance for differentiation. Reducing plastic waste through sustainable packaging and promoting responsible sourcing can attract environmentally conscious customers.

Enhancing the customer experience through technology remains a critical area for innovation. Investing in user-friendly apps, efficient order tracking, and AI-driven recommendation systems can set businesses apart and improve customer loyalty. Collaborations with grocery stores or expanding into related services, such as alcohol delivery or catering, can diversify revenue streams and offer customers a more comprehensive solution for their dining needs.

In conclusion, the online food delivery market is a rapidly evolving industry with significant growth potential. The pandemic accelerated the adoption of online food delivery, but it also heightened competition and introduced various challenges. Nevertheless, the market's trends, growth drivers, and business opportunities make it an enticing space for companies that can adapt, innovate, and provide convenient and high-quality dining experiences for customers.

Segmental Overview

The online food delivery market forecast is segmented on the basis of type, channel type, payment method, and region. By type, the market is classified into restaurant-to-consumer, platform-to-consumer. By channel type, the market is classified into websites/desktop and mobile applications. Based on the payment method, the market is classified into cash on delivery and online. Region-wise, it is analyzed across North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Asia-Pacific), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Europe), and LAMEA (Brazil, Argentina, South Africa, and Rest of LAMEA).

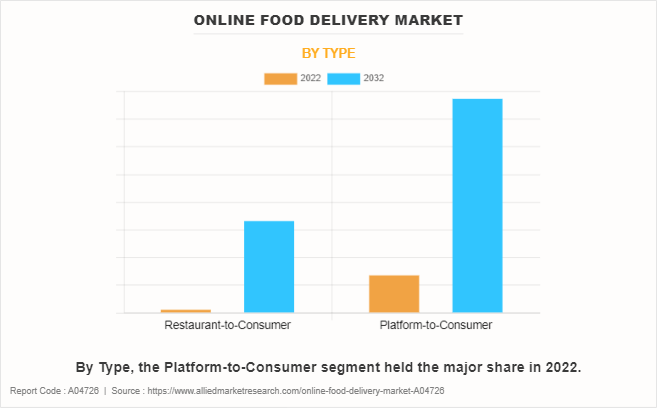

By Type

By type, the market is classified into restaurant-to-consumer, platform-to-consumer. The platform-to-consumer segment accounted for a major online food delivery market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The "Platform to Consumer" segment in the market is experiencing rapid growth for several compelling reasons. Firstly, it offers consumers unparalleled convenience by aggregating a wide range of restaurant choices in one app or website, simplifying the ordering process.

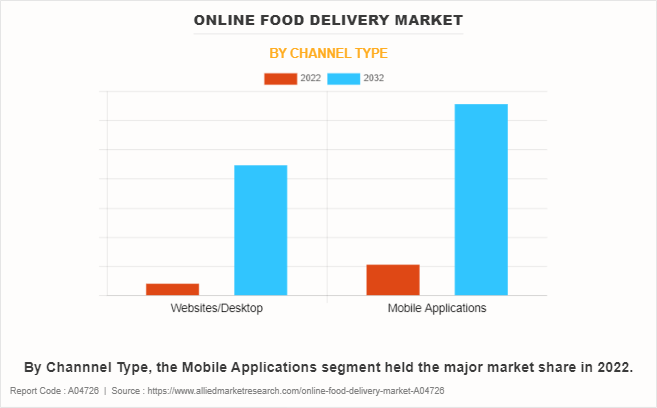

By Channel Type

By channel type, the market is classified into websites/desktop and mobile applications. The mobile applications segment accounted for a major share in the online food delivery market in 2022 and is expected to grow at a significant CAGR during the forecast period. The "Mobile Applications" segment in the market pertains to the channel type through which customers access food delivery services via dedicated mobile applications on their smartphones or tablets.

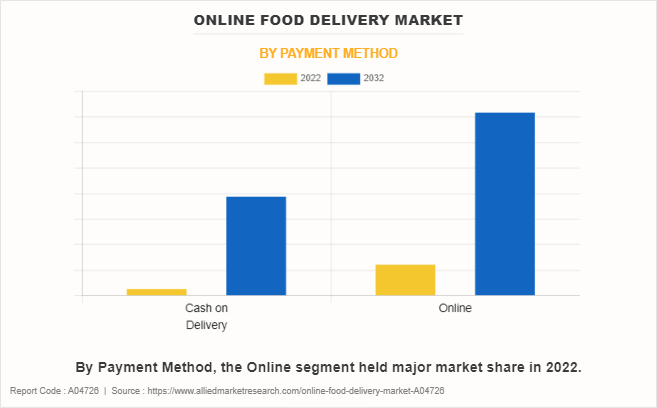

By Payment Method

By payment method, the market is classified into cash on delivery and online. The online segment accounted for a major share in the market in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for the "online" payment segment in the market is on the rise due to several compelling reasons. Firstly, it offers a convenient and contactless payment option, which has gained significance in light of health and safety concerns, such as the COVID-19 pandemic. Secondly, online payments provide users with a seamless, cashless experience, reducing the need for physical currency.

By Region

By region, it is analyzed across North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Asia-Pacific), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Europe), and LAMEA (Brazil, Argentina, South Africa, and Rest of LAMEA). The Asia-Pacific region accounted for a major share in the market in 2022 and is expected to grow at a significant CAGR during the forecast period. The growth of the market in the Asia-Pacific region can be attributed to various factors. The region's vast and diverse population, along with evolving consumer preferences, provides a significant customer base. Rapid urbanization, busy lifestyles, and widespread smartphone usage have increased the demand for convenient dining solutions.

Competitive Landscape

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the online food delivery industry include Delivery Hero SE, Grab Holdings Inc., Just Eat Holding Limited, Demae-Can Co., Ltd, Uber Technologies Inc., Deliveroo, Yum! Brands Inc., Delivery.com, LLC, Domino's Pizza, Inc., iFood, Swiggy.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online food delivery market analysis from 2022 to 2032 to identify the prevailing online food delivery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online food delivery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online food delivery market trends, key players, market segments, application areas, and market growth strategies.

Online Food Delivery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.3 trillion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 465 |

| By Type |

|

| By Channel Type |

|

| By Payment Method |

|

| By Region |

|

| Key Market Players | Deliveroo plc, Uber Technologies, Inc., iFood, Demae-Can Co., Ltd, Delivery.com, LLC, DoorDash, Inc., Delivery Hero SE, Grab Holdings Limited, Dominos Pizza, Inc., Swiggy, Yum! Brands Inc. |

Analyst Review

According to the insights of the CXOs, the global online food delivery market is expected to witness robust growth during the forecast period. This is attributed to mobile app proliferation. The proliferation of mobile apps has emerged as a powerful catalyst for the exponential growth of the online food delivery market. With the widespread adoption of smartphones, these apps have become ubiquitous, placing the world of culinary convenience at consumers' fingertips. Mobile apps have simplified the ordering process, offering an intuitive interface that allows users to effortlessly explore an array of restaurant options, customize orders, and securely complete transactions from anywhere, at any time. This accessibility aligns seamlessly with the on-the-go nature of modern lifestyles, making it easier for busy individuals to satiate their cravings without the need for a computer or a physical menu.

However, Quality and food safety concerns present significant restraints to the growth of the online food delivery market. According to a report by the Food Standards Agency, a substantial 42% of consumers expressed worries about food safety in online orders. Instances of mishandled or contaminated food during delivery are not uncommon, eroding trust among consumers. Furthermore, the inability to visually inspect food before consumption can lead to dissatisfaction, as taste and presentation might not meet expectations. Such concerns can result in customer complaints, refunds, and the loss of loyal patrons.

The global online food delivery market size was valued at USD 343.7 billion in 2023, and is projected to reach USD 1,302.4 billion by 2032.

The global online food delivery market is projected to grow at a compound annual growth rate of 14.3% from 2023-2032 to reach USD 1,302.4 billion by 2032.

The key players profiled in the reports includes Delivery Hero SE, Grab Holdings Inc., Just Eat Holding Limited, Demae-Can Co., Ltd, Uber Technologies Inc., Deliveroo, Yum! Brands Inc., Delivery.com, LLC, Domino's Pizza, Inc., iFood, Swiggy.

Asia-Pacific dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Ghost Kitchens and Virtual Restaurants: Anticipated to gain momentum, the rise of ghost kitchens (commercial kitchens set up solely for fulfilling online orders) and virtual restaurants (brands that exist only in the digital space) is expected to reshape the food delivery landscape. This model allows for more flexibility and innovation in menu offerings without the constraints of a physical location. Technology Integration: Continued integration of advanced technologies such as artificial intelligence and machine learning is expected. This includes personalized recommendations based on user preferences, improved order accuracy, and the use of data analytics to enhance operational efficiency and customer experiences. Contactless Delivery and Safety Measures: With the ongoing emphasis on safety and hygiene post-COVID-19, the demand for contactless delivery options and enhanced safety measures in food preparation and delivery is likely to persist. This includes the use of tamper-evident packaging and real-time tracking features for transparency. Focus on Sustainability: Increasing awareness of environmental concerns is likely to drive a focus on sustainability within the industry. This includes efforts to reduce single-use plastics, promote eco-friendly packaging, and encourage sustainable sourcing practices for ingredients. Expansion into Grocery and Essentials Delivery: Some platforms are expected to expand their services beyond restaurant meals to include grocery and essential items. This diversification responds to the changing needs and preferences of consumers who are looking for a one-stop-shop for their daily necessities. Health-Conscious Menus: A growing awareness of health and wellness is expected to influence menu offerings. Platforms may increasingly feature health-conscious options, including dietary-specific menus, nutritional information, and partnerships with health-focused restaurants. Subscription Models and Loyalty Programs: To enhance customer retention, online food delivery platforms may introduce subscription models and loyalty programs. These initiatives could offer perks such as discounts, exclusive deals, and faster delivery for subscribers, fostering brand loyalty. Global Cuisine Exploration: Consumers' increasing openness to diverse culinary experiences is likely to lead to a continued exploration of global cuisines. Online food delivery platforms may partner with a wider range of international restaurants, offering users the ability to experience a variety of authentic dishes from around the world.

Loading Table Of Content...

Loading Research Methodology...