Online Insurance Market Research, 2031

The global online insurance market was valued at $53.2 billion in 2021, and is projected to reach $330.1 billion by 2031, growing at a CAGR of 20.2% from 2022 to 2031.

Online insurance is a software or a tool that helps a company to monitor, create, manage and control the online insurance ecosystem. In addition, it helps companies to provide insurance quotes online. Furthermore, the online insurance platform enables an insurance managing general agent (MGA) to monitor, create, manage, and control the online insurance ecosystem. These platforms combine different modules and disparate systems in the online insurance ecosystem.

Increase in internet penetration and increase in smartphone usage are boosting the growth of the global online insurance market. However, digital transformation is time-consuming and privacy and security concerns are hampering the online insurance market growth. On the contrary, the increase in adoption of digital solutions is expected to offer remunerative opportunities for the expansion of the online insurance market during the forecast period.

The online insurance market is segmented into Enterprise Size, Insurance type and End User.

Segment Review

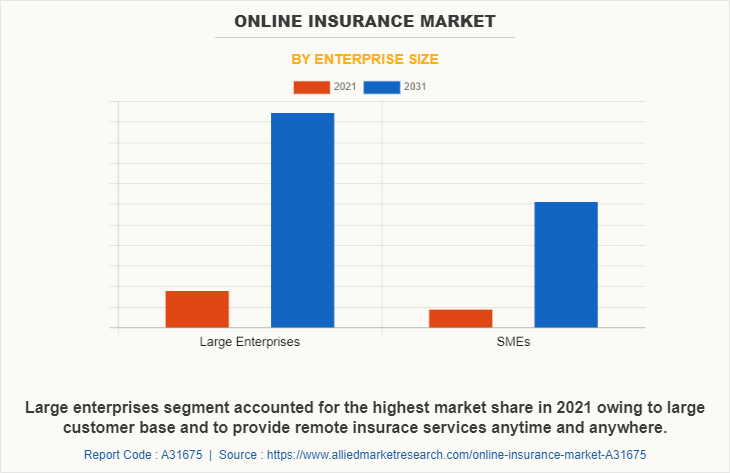

The online insurance market is segmented on the basis of by, enterprise size, insurance type, end user, and region. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. On the basis of insurance type, it is categorized into life insurance, motor insurance, health insurance, and others. By end user, it is classified into insurance companies, aggregators, and third-party administrators & brokers. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of enterprise size, the large enterprise segment holds the highest online insurance market share as it helps insurers to maintain transparency in the claim process, and human connections and improves the decision-making capability. However, the SMEs segment is expected to grow at the highest rate during the forecast period. These services reduce managing concerns efficiently and help to achieve their claim process & premium underwriting, and evaluation process effectively.

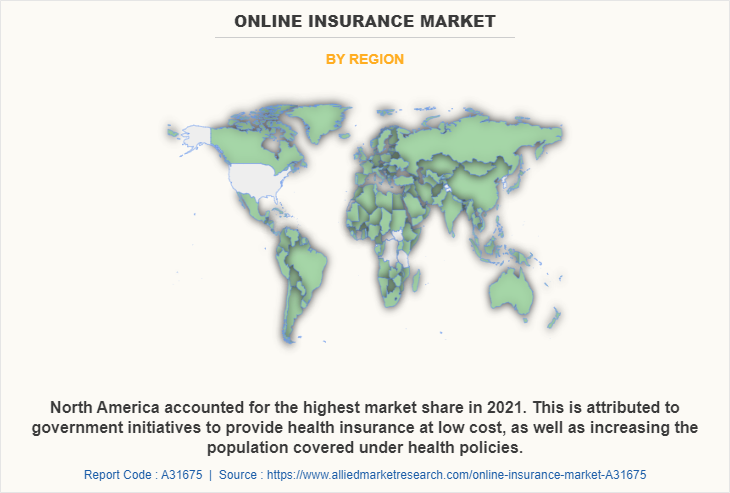

Region-wise, the online insurance market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to rise in the adoption of modern technologies in the insurance industry. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid adoption of online services rather than traditional insurance businesses.

The key players that operate in the online insurance market are Allianz SE, assicurazioni generali spa, AXA Group, Munich Re, Swiss Re, Aviva, Zurich Insurance Group, Esurance Insurance Services, Inc, Lemonade, Inc., and RooT. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities

Online insurance enables the insurer to shift from a complex core system to greater technical agility and flexibility, digital fluency, and innovation in the existing business model. In addition, advanced technology is an integral part of online insurance industry, for both carriers and insureds which offers, a defined omnichannel to approach customer service and offer insurance quotes online. This is driving the pace of change in the insurance industry. Furthermore, many insurance companies of all sizes are searching for advanced technology that can scale and update with changing demands and capabilities to help them stay ahead of competitors. Predictive analytics is the form of technology used by many insurers to collect data that helps understand and predict customer behavior. Adopting predictive modeling tactics has also proved to increase revenue and accuracy for many insurers.

The use of artificial intelligence (AI) has rapidly expanded, with AI-enabled devices becoming commonplace in homes around the world. In addition, with AI insurers can improve claims turnaround cycles and fundamentally change the underwriting process and offer insurance quotes online. AI also enables insurers to access data faster, and cutting out the human element can lead to more accurate reporting in shorter periods of time. Internet of Things (IoT) in insurance companies help to save insurer money and can automate much of the data sharing by the insurer to insurance companies. Moreover, IoT is projected to boost other insurance technology with first-hand data, improving the accuracy of risk assessment, and giving insureds more power to directly impact their policy pricing. Furthermore, by utilizing AI and machine learning, chatbots can interact with customers seamlessly, saving everyone within an organization time – and ultimately saving insurance companies money.

Government Regulations

All well-governed insurance industries are capable to demonstrate due diligence to ensure regulatory compliance in applicable fields. Organizations are adopting online insurance to manage, store, and extract relevant and useful information from the data stored. For instance, California’s Online Protection Privacy Act provides explicit privacy rights and allows users to know how their information is used in the future. Furthermore, cloud security regulations are strongly adhered to by almost all online service providers to operate as global service providers; for instance, the U.S. security regulation is mandatory to be adhered to by the majority of players located in this country.

In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable to data that are involved in their operations. For instance, the Massachusetts Data Security regulations are majorly focused on security purposes and increasing the privacy of big data analytics. Europe is set to take the advantage of online insurance for providing data protection facilities to different organizations. For instance, the European Government adopted the new General Data Protection Regulation (GDPR). The act seeks to regulate the collection, storage, and processing of information about individuals. The key aim of GDPR is to protect critical data of the financial and banking sectors of the European nation.

Furthermore, the GDPR act imposed by the European Government mitigates the risk of cyber security and any potential data breaches. Emerging countries of Asia-Pacific are developing stringent big data regulations, which comprise privacy, government regulatory environment, and intellectual property protection. For instance, the Cybersecurity Bill established in Singapore encouraged multiple organizations in the country to adopt big data analytics to manage the massive volume of data.

End User Adoption

The global online insurance market is expected to register growth as it helps companies to create, manage, monitor and control the online insurance ecosystem. Thus, the increase in the adoption of online insurance, owing to its technology platform is one of the most significant factors driving the growth of the market. With a surge in demand for online insurance, various companies have established alliances to increase their capabilities. For instance, in July 2022, Allianz Direct partnered with CHECK24 in Germany and Spain, in addition, consumers in both countries will be able to access Allianz Direct products on CHECK24's comparison portals and also to improve growth, profitability, and the customer experience with this cooperation. For instance, in August 2021, Marsh partnered with Amazon to help its new digital insurance network to small business sellers to get affordable product liability coverage. For instance, in August 2022, Aviva partnered with Home Deposits Now – a provider of an alternative home deposit to help home buyers buy insurance online.

In addition, with further growth in investment across the world and the rise in demand for online insurance, various companies have collaborated with increased diversification among customers. For instance, in March 2022, APOLLO Insurance Solutions collaborated with Livelii to offer immediate digital products, specifically tailored to the independent workforce of Canada.

In addition, with further growth in investment across the world and the rise in demand for online insurance, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in April 2021, PolicyMe, a digital life insurance platform launched a completely digital way for Canadians to purchase life insurance. For instance, in September 2021, olive.ca, the leader in payment services and online vehicle protection plans launched greater North American expansion with the brand's launch in Canada. For instance, in October 2022, Foxquilt, a leading North American Insurtech company launched an eCommerce insurance product throughout the state of New York, to bring its eCommerce solution to New York first - one of the largest eCommerce hubs in the country.

In addition, with further growth in investment across the world and the rise in demand for online insurance, various companies have acquired the companies with increased diversification among customers. For instance, in October 2022, Munich Re acquired apinity, a start-up that supplies application programming interface (API) solutions in the form of Software as a Service (SaaS) for the insurance industry. The acquisition helps to forward the digitalization of the insurance value chain and of primary insurance and it will make it far easier for insurers in particular to participate in the key area of open insurance. For instance, in February 2021, ALKEME, one of the nation's top retail insurance platforms acquired Insurance Online, a digital insurance comparison engine, that provides real-time rates and insurance services help to compare the lowest auto and home insurance rates, allowing customers to obtain instant coverage without agent assistance.

Top Impacting Factors

Increase in Internet Penetration

Increase in internet penetration has a major influence on changing customer preferences. In addition, over the past few years, several initiatives have been taken by the government of India for digital transformation of the country. In India, the digital influence on insurance sales is 13% for life insurance, 15% for health insurance, 9% for motor insurance, and 21% for travel insurance. Moreover, this changing behavior of consumers in India toward online transactions is expected to have a significant impact on sales of online insurance policies. Furthermore, reduced cost associated with buying insurance through an online channel and availability of a wide range of product information for comparison of policies are expected to attract more customers toward buying insurance policies through the online channel.

Increase in Smart Phone Usage

Increase in smart phone usage has a major influence on changing customer preferences. In addition, the traditional model of buying insurance is still the most sought in countries, it was found that online research on life insurance has been observing an increasing trend and also anticipated to drive market growth over the forecast period. Moreover, many key market players are adopting mobile applications where consumers can view their details with convenience is expected to create substantial growth opportunities for market players over the forecast period. For instance, in May 2021, Marble, the all-in-one insurance rewards platform launched highly anticipated mobile apps to take control of nearly 20 million dollars of insurance premiums.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the online insurance market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global online insurance market trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The online insurance market analysis from 2022 to 2031 is provided to determine the market potential.

Online Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 330.1 billion |

| Growth Rate | CAGR of 20.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 263 |

| By Enterprise Size |

|

| By Insurance type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Munich Re, Zurich Insurance Group, Aviva, ASSICURAZIONI GENERALI S.P.A., Allianz SE, Swiss Re, Esurance Insurance Services, Inc, AXA Group, Lemonade, Inc., RooT |

Analyst Review

Online Insurance Market is growing every day. The insurance industry in India has undergone a profound change since the global financial crisis of 2008. Of course, the new IRDAI guidelines that aimed to restructure the cost of insurance policies to make them more customer-friendly, also contributed to this transformation. But that is all in the past. As internet penetration continues to grow in India, more and more people are becoming increasingly comfortable with making transactions online, and a surge is evident in the e-commerce space in the country.

The global online insurance market is expected to register high growth owing to increasing digitization, rising uptake of the Internet of Things technology, and transition of insurance companies from product-based towards consumer-centric strategies drives the growth of the market. With surge in demand for online insurance, various companies have established alliances to increase their capabilities. For instance, in July 2022, Allianz partnered with CHECK24 to improve growth, profitability, and the customer experience with this cooperation and also develop digital business model.

In addition, with further growth in investment across the world and the rise in demand for online insurance, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in April 2021, PolicyMe, a digital life insurance platform partnered with Canadian premier life insurance company to introduce digital way for Canadians to purchase life insurance.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, December 2021,Zurich acquired AI company AlphaChat for customer service automation, to further enhance the Group’s digital capabilities.

The online insurance market is estimated to grow at a CAGR of 20.2% from 2022 to 2031.

The online insurance market is projected to reach $ 330,071.28 million by 2031.

Increase in internet penetration and increase in smartphone usage contribute toward the growth of the market.

The key players profiled in the report include Allianz SE, assicurazioni generali spa, AXA Group, Munich Re, Swiss Re, Aviva, Zurich Insurance Group, Esurance Insurance Services, Inc, Lemonade, Inc., and RooT.

The key growth strategies of online insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...