Online Retail Mobile Payment Transactions Market Research, 2031

The global online retail mobile payment transactions market was valued at $993.5 billion in 2021, and is projected to reach $10 billion by 2031, growing at a CAGR of 26.8% from 2022 to 2031.

Mobile payment refers to a payment method in which money is transferred from various mobile devices such as smartphones, tablets and others smart devices, for purchasing a product or services. In addition, various retailers are providing mobile payment services as they provide its customers with convenient, fast and secure payment processing systems. Furthermore, mobile payments eliminate the need of carrying cash, credit cards and debit cards for paying for a particular product and services as well as provide a secured substitute for the cash-based transaction. In addition, various industries such as retail, entertainment & media, transportation, BFSI and others, are rapidly adopting mobile payment services as they improve the security of the payment method and provide faster payment services, which is propelling the growth of the market.

Increase in adoption of online retail mobile payment transactions for online shopping due to reduced transaction time & convenience acts as a major driver in the market. In addition, increase in penetration of smartphones coupled with fast internet connectivity, rise in preference among consumers for online retail mobile payment transactions, and massive adoptions of this payment channel among merchants are accelerating the online retail mobile payment transactions market growth. However, increase in data breaches and expensive & geo-locational preference of payment gateways hamper growth of the market. On the contrary, developing economies offer significant opportunities for online retail mobile payment transactions companies to expand their offerings, owing to factors such as growth in the middle-class segment, rapid urbanization, rise in literacy level, and increase in tech-savvy youth generation. Moreover, growth in developments & initiatives toward digitalized payments is anticipated to provide a potential growth opportunity for the market.

The report focuses on growth prospects, restraints, and trends of the online retail mobile payment transactions market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the online retail mobile payment transactions market outlook.

The online retail mobile payment transactions market is segmented into Type, Age Group, Payment Type and End User.

Segment Review

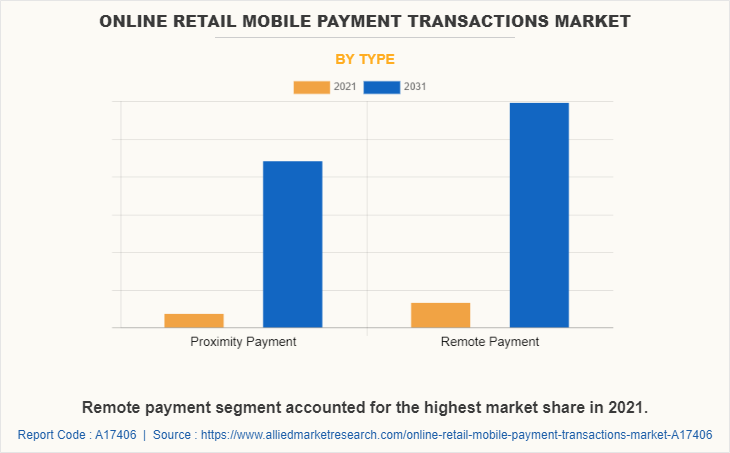

The online retail mobile payment transactions market is segmented into type, payment type, age group, end user, and region. By type, the market is differentiated into proximity payment and remote payment. The proximity payment is further segregated into near filed communication (NFC), and quick response (QR) code. The quick response (QR) code is further segregated into static QR code and dynamic QR code. The remote payment is further segmented into mobile web payments, SMS/direct carrier billing, digital wallet and others. Depending on payment type, it is fragmented into push payment and pull payment. The age group segment is segmented into 18 to 30 year, 31 to 54 year, 55 to 73 year and others. The end user segment is segregated into personal and business. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the remote payment segment is estimated to acquire the highest share of online retail mobile payment transactions market size in 2021. This is attributed to the fact that the growth of the e-commerce industry in emerging countries is driven by rise in online shopping through mobile devices, which, in turn, propels growth of the online retail mobile payment transaction market.

Region wise, Asia-Pacific dominated the online retail mobile payment transactions market share in 2021, and is expected to maintain this trend during the forecast period. This is attributed to the fact that rise in interest of smartphone manufacturers in the mobile wallet solution is driving the online retail mobile payment transactions market growth. Smartphone manufacturers, such as Apple, Samsung, and Xiaomi, are working on deploying NFC chips and QR code scanner into their smartphones to provide seamless connectivity for the payments in the retail industry.

The key players operating in the global online retail mobile payment transactions market include ACI Worldwide, Inc., Alipay.com, Amazon Payments, Inc., American Express, Apple Inc., Block, Inc., FIS, Google, Ingenico, JPMorgan Chase & Co., Mastercard, One97 Communications Limited, PayPal Holdings Inc., Samsung, Visa Inc., PayU, and Obopay. These players have adopted various strategies to increase their market penetration and strengthen their position in the online retail mobile payment transactions industry.

COVID-19 Impact Analysis

COVID-19 pandemic has a significant impact on the online retail mobile payment transactions industry, owing to increase in usage and adoption of online & digitalized payment methods among consumers globally. Online retail mobile payment transactions are experiencing massive growth as consumers are becoming familiar with the payment technology in the market. Moreover, retail industries are providing their customers with options of mobile payments across the globe to speed up their transaction process and enhance digitalized payments in the market. This, in turn, has become one of the major growth factors for the online retail mobile payment transactions market during the global health crisis.

Top Impacting Factors

Increased penetration of smartphones and access to high-speed internet

Rate of adoption of smartphones in countries, such as Canada, China, and India, has significantly increased in the past few years. In addition, proliferation of 3G and 4G connectivity has enabled customers to have hassle-free access to conduct payments on their smartphones. Moreover, 5G networks is gaining traction across North America, Asian, European, and Middle Eastern countries, and this is further propelling the growth of online retail mobile payment transactions market. Furthermore, extensive growth in distribution network of smartphone companies has made smartphone devices easily available for end users. For instance, Samsung, and MI are major mobile phone brands in rural India, owing to their pan India distribution channel, thus making online payments accessible for rural population through their mobile phones. Furthermore, rise in use of smartphones and surge in faster connectivity have enabled retailers and customers to receive payments through their smartphones, which propels the growth of the market.

Growth of m-commerce industry

A boom in mobile commerce has been witnessed over past few years, owing to growth in penetration of smartphones, coupled with fast connectivity. Consumers are gradually opting for mobile purchase for a number of goods and services such as apparel & accessories, groceries, health & beauty, computer & electronics, and books, owing to ease of ordering and receiving it at one’s doorstep. In addition, special offers and discount coupons offered by various vendors available on the m-commerce platforms attract customers toward mobile purchases. It is projected that by 2019, 1.05 billion mobile coupon users would be there as compared to 560 million in 2014. Mobile phones with internet connectivity provide access to several shopping sites; thus, consumers now opt more for mobile apps to make their purchases. In addition, this compels retailers to shift their business on online platforms to provide convenient services to their customers. China, Mexico, and the U.S. are the three major countries where shopping through apps is more popular. Moreover, millennial are major target customer segments for the mobile commerce industry as they use their smartphones for search or purchases, which propels growth of the online retail mobile payment transaction market.

Massive adoption of mobile payments for online and retail shopping

Several businesses that are engaged in providing wide range of goods are inclining toward offering mobile payment options to their customers. In addition, consumer experience on mobile sites has increased significantly, and the trend of click & collect is gaining high traction in the market. These factors made retail shopping for everyday purchases more common during the pandemic. In addition, consumers are gradually opting for digitalized payments while purchasing a number of goods & services such as apparel & accessories, groceries, health & beauty, computer & electronics, and books, owing to ease of making payments. For instance, a study conducted by PayPal in 2020 projected that 57% of consumers prefers merchants’ digital payment options while shopping from stores. Therefore, increase in preference among consumers for mobile payments and massive adoption of this payment channel among merchants strengthens the market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online retail mobile payment transactions market forecast from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of online retail mobile payment transactions market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online retail mobile payment transactions market segmentation assists to determine the prevailing Online Retail Mobile Payment Transactions Market Opportunity

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online retail mobile payment transactions market trends, key players, market segments, application areas, and market growth strategies.

Online Retail Mobile Payment Transactions Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Age Group |

|

| By Payment Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Alipay.com, American Express, Google, Visa Inc., One97 Communications Limited, Ingenico, Block, Inc., PayPal Holdings Inc., Apple Inc., FIS, PayU, ACI Worldwide, Inc., Mastercard, Amazon Payments, Inc., Samsung, Obopay, JPMorgan Chase & Co. |

Analyst Review

With enabling data-driven personalization and enhancing user experience, retailers are increasingly looking to accommodate consumer demand for secure and hassle-free transactions via online retail mobile payment transactions method. Moreover, consumers continue to use innovative payment technology in replacement of cash. Benefits associated with online retail mobile payment transactions such as increase in convenience & reduced transaction time and rise in adoption of smartphones among end users drive the market growth. In addition, several key players are enhancing & providing advanced online retail mobile payment transactions options and are offering coupons & promotions by directing customers to a landing page or downloadable coupons, which can be used for their next purchase.

The COVID-19 outbreak has a significant impact on the online retail mobile payment transactions market, and has accelerated the usage & adoption of online selling & purchases among retailers and consumers, respectively. Moreover, during this global health crisis, the adoption of online retail mobile payment transactions technology increased among large & small retailers. This, as a result promoted the demand for online retail mobile payment transactions, thereby accelerating the revenue growth.

The online retail mobile payment transactions market is fragmented with the presence of regional vendors such as ACI Worldwide, Inc., Alipay.com, Amazon Payments, Inc., American Express, Apple Inc., Block, Inc., FIS, Google, Ingenico, JPMorgan Chase & Co., Mastercard, One97 Communications Limited, PayPal Holdings Inc., Samsung, Visa Inc., PayU, and Obopay. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for online retail mobile payment transactions across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The online retail mobile payment transactions market is estimated to grow at a CAGR of 26.8% from 2022 to 2031.

The online retail mobile payment transactions market is projected to reach $10,366.9 billion by 2031.

Increased penetration of smartphones and access to high-speed internet, growth of m-commerce industry and massive adoption mobile payments for online and retail shopping majorly contribute toward the growth of the market.

The key players profiled in the report include ACI Worldwide, Inc., Alipay.com, Amazon Payments, Inc., American Express, Apple Inc., Block, Inc., FIS, Google, Ingenico, JPMorgan Chase & Co., Mastercard, One97 Communications Limited, PayPal Holdings Inc., Samsung, Visa Inc., PayU, and Obopay.

The key growth strategies of online retail mobile payment transactions market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...