Online TV Streaming Service Market Research, 2033

Market Introduction and Definition

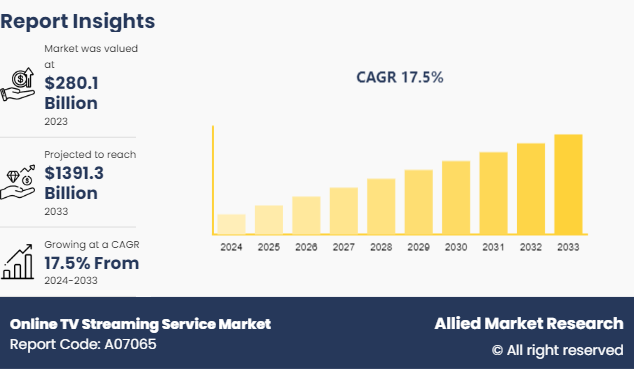

The global online TV streaming service market was valued at $280.1 billion in 2023, and is projected to reach $1, 391.3 billion by 2033, growing at a CAGR of 17.5% from 2024 to 2033. Online TV streaming service are digital services that distribute television material via the Internet, such as live broadcasts, on-demand episodes, movies, and original programming. Unlike conventional cable or satellite television, these services let customers stream information on a variety of devices, including smart TVs, laptops, tablets, and smartphones, providing the ease of viewing material at any time and from any location. Several important reasons are driving the expansion of the online TV streaming service market, including increased high-speed internet adoption, rise in popularity of smartphones and tablets, and the growing preference of consumers for flexible, on-demand streaming. Furthermore, changes in content consumption patterns, particularly among younger demographics, and the development of fresh content production by streaming platforms have fueled demand for online TV streaming services. The low cost of subscription plans as compared to conventional cable services, combined with the global penetration of major streaming companies into new areas, contributes to the market's expansion.

Key Takeaways

The online TV streaming service market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major online TV streaming service industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The broad availability and acceptance of high-speed Internet are the primary drivers for the online TV streaming service market growth. More individuals and households throughout the globe will be able to easily access and stream high-definition video as 5G technology and fiber-optic internet become more widespread. This enhanced connectivity enables improved streaming experiences, enticing more individuals to cut the cord from traditional TV providers and migrate to Internet platforms. As internet infrastructure improves, particularly in emerging countries, a prospective customer base for streaming service is likely to increase, propelling the online TV streaming service market demand.

The online TV streaming business is becoming increasingly competitive, with rise in number of competitors entering the fray, ranging from known tech behemoths to niche content producers. This fierce rivalry may contribute to market saturation, which makes it difficult for new competitors to establish a platform and current businesses to retain their subscriber base. The availability of various services can also overload customers, resulting in subscription fatigue, in which users are reluctant or unable to pay for several platforms, slowing the overall growth during the online TV streaming service market forecast period.

Technological advancements such as?artificial intelligence, machine learning, and upgraded user interfaces provide chances to improve the streaming experience and attract new customers. AI-powered suggestions, personalized content curation, and interactive functions may all improve user engagement and satisfaction. Furthermore, advances in streaming technology, such as shorter buffering times, better-quality video streaming, and the incorporation of augmented and virtual reality, may set platforms apart from rivals and create new ways to watch content. Using these innovations will assist streaming service in maintaining and attracting new customers.

Top 10 OTT Service Companies, By Subscribers, 2023

Netflix is the top OTT service provider based on the highest subscribers count in the world. As of 2023, Netflix has a total count of 231 million subscribers, due to its wide variety of shows and popularity at global level.

The primary goal of OTT (Over-the-Top) service providers is to draw in and maintain users by providing unique, high-quality content, smooth user experiences, and affordable pricing. To differentiate themselves in a competitive market, these platforms invest extensively in original programming and personalized content recommendations. Rivals compete fiercely, with each platform striving to distinguish itself through exclusive libraries, intuitive user interfaces, and strategic alliances. To gain an advantage, OTT providers are also looking at bundling options, regional content customization, and employing advanced technologies, such as AI-driven suggestions, to increase user engagement and retention.

Top 10 Companies with their Subscriber Count, 2023

Name of the Companies | Subscribers Count (Million) |

Netflix | 230 |

Amazon Prime Video | 201 |

Disney+ | 136 |

Tencent Video | 123 |

iQIYI | 107 |

HBO Max | 87 |

Hulu | 42 |

Paramount | 34 |

Apple TV+ | 26 |

Peacock | 19 |

Market Segmentation

The online TV streaming service market is segmented into service type, revenue model, end user, and region. On the basis of service type, the market is divided into Subscription-Based Streaming Services (SVOD) , Advertising-Based Streaming Services (AVOD) , Transactional Video on Demand (TVOD) , and Live Streaming Services. As per revenue model, the market is segregated into subscription revenue, advertisement revenue, transactional revenue, and hybrid revenue. Based on end user, the market is divided into individual users, and commercial users. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In Asia-Pacific, the fast growth of internet infrastructure and rise in cost-effectiveness of smartphones have created large new markets, notably in India, Indonesia, and Vietnam. The increased desire for local and regional content, along with the development of mobile-focused consumption, has transformed this region into an epicenter for streaming services.

In North America, the industry is fiercely competitive, with major firms such as?Netflix, Disney+, and Amazon Prime Video contending for market dominance through aggressive content creation and acquisition methods. The trend of cord-cutting, in which consumers forsake traditional cable in favor of streaming, continues to drive growth.

Meanwhile, in Europe, the industry is being pushed by a significant demand for different content, such as multinational and multilingual programming that caters to the region's wide cultural population. Growth potential abounds in these locations, notably in the creation of specialized content, growth into underdeveloped markets, and the use of new technology such as AI to provide personalized watching experiences. Factors influencing market dynamics include regulatory obstacles, notably in Europe with tight data privacy regulations, and the growing importance of collaborations, as streaming services engage with telecom providers and local media producers to expand their reach. Overall, the confluence of these trends and variables propels the online TV streaming service industry ahead in these major areas.

Industry Trends:

Streaming services are increasingly using hybrid monetization methods that include membership payments and ad-supported programming. This strategy tries to entice economical viewers and those eager to spend for an ad-free experience.

The battle among big streaming platforms is heating up, with businesses vying for market share via exclusive content, price schemes, and technological breakthroughs. In 2023, Amazon Prime Video allegedly paid $1 billion per year for exclusive rights to Thursday Night Football in the U.S. This decision marked Amazon's aggressive foray into live sports, a market formerly controlled by cable networks and other streaming rivals.

Streaming services have included social and interactive elements that increase viewership, such as watch parties, real-time discussions, and interactive storytelling. Amazon Prime Video launched its "Watch Party" function in 2020, which became popular during the pandemic. By 2023, the product was witnessed with over 100 million people participating in watch parties worldwide.

Competitive Landscape

The major players operating in the market contributing to the online TV streaming service market size include Amazon.com, Inc., Apple, Inc., Brightcove Inc., Star India Private Limited, Google LLC, Limelight Networks Inc., Netflix, Inc., Microsoft Corporation, Roku, Inc., and Hulu, LLC.

Other players in the market looking for increasing their online TV streaming service market share includes Akamai Technologies, WarnerMedia Direct, LLC (HBO Max) , Tencent Holdings Ltd., PCCW Enterprises Limited, Rakiten, Indieflix, Kakao, Home Box Office, and others.

Recent Key Strategies and Developments

In 2024, Shemaroo Entertainment, a multimedia and entertainment giant, partnered with four foreign telecom providers to extend its OTT platform, ShemarooMe. This collaboration with Zain, STC, Mobily in Saudi Arabia, and Vodafone in Qatar, handled by DCB (Direct Carrier Billing) partners 3A Net and one97 Communications, exemplifies the company's worldwide dedication to providing different entertainment solutions.

In 2024, Verimatrix teamed with Amazon Web Services (AWS) to enhance the scalability, availability, and accessibility of their Streamkeeper Multi-DRM cloud-based OTT content protection technology.

In 2021, Roku, Inc. and TCL Electronics introduced a smart TV model in the UK that includes streaming channels, voice control support, improved image quality, and other features.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online tv streaming service market analysis from 2024 to 2033 to identify the prevailing online tv streaming service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online tv streaming service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online tv streaming service market trends, key players, market segments, application areas, and market growth strategies.

Online TV Streaming Service Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1391.3 Billion |

| Growth Rate | CAGR of 17.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 230 |

| By Service Type |

|

| By Revenue Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | Apple, Inc., Brightcove Inc., Amazon.com, Inc., Netflix, Inc., Star India Private Limited, Hulu, LLC, Roku, Inc., Microsoft Corporation, Limelight Networks Inc., Google LLC |

The global online TV streaming services market was valued at $280.1 billion in 2023 and is estimated to reach $1,391.3 billion by 2033, exhibiting a CAGR of 17.5% from 2024 to 2033

The online TV streaming services market registered a CAGR of 17.5% from 2024 to 2033.

The forecast period in the online TV streaming services market report is from 2024 to 2033.

The top companies that hold the market share in the online TV streaming services market include Netflix, Inc., Amazon.com, Inc., Apple, Inc., Brightcove Inc., Star India Private Limited, Google LLC, and others.

The online TV streaming services market report has 3 segments. The segments are service type, revenue model, and end user.

Loading Table Of Content...