Operational Technologies Market Research, 2032

The Global Operational Technologies Market size was valued at $146 billion in 2022, and is projected to reach $292.7 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Operational technology (OT) refers to the hardware and software systems used in industrial and infrastructural contexts to monitor, control, and manage physical processes. It includes process control technologies and gadgets that are specially designed to fulfill operational duties in industries such as manufacturing, energy, transportation, and utilities.

The primary factor driving the operational technologies industry includes the rise in government initiatives for the use of modern technologies in sectors. Furthermore, the rise in economic growth in developing nations such as Brazil and India, aided the market expansion in 2022. The global operational technologies industry research provides an in-depth analysis of the market. The research provides a detailed analysis of major market segments, trends, drivers, constraints, competitive landscape, and determinants.

The convergence of operational technology with Information Technology (IT) is an important industrial trend. Traditionally, operational technology and IT have worked in different environments; however, with the emergence of technologies such as the Industrial Internet of Things (IIoT) and cloud computing, the distinction between the two is reducing. This convergence allows for better communication, data exchange, and integration between OT and IT systems, resulting in greater operational efficiency and decision-making.

Segment Overview

The operational technologies market outlook is segmented into Component, Technology, and Vertical.

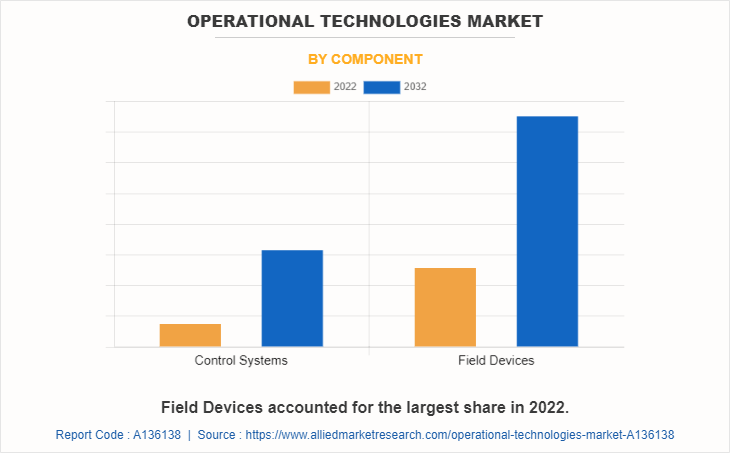

Based on components, it is categorized into field devices and control systems. Field devices are further bifurcated into industrial valves, transmitters, industrial sensors, and actuators. Control systems are divided into SCADA, WMS, DCS, HMI, and others. The field devices segment dominated the operational technologies industry, in terms of revenue in 2022, and is expected to follow the same trend during the forecast period.

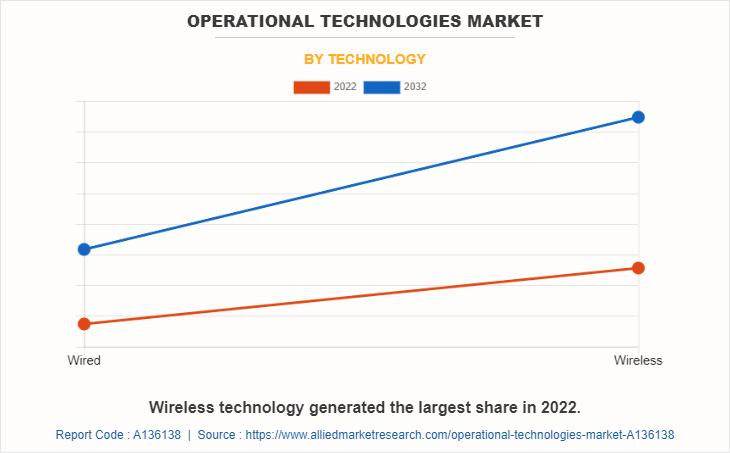

Based on technology, it is fragmented into wired and wireless. The wireless segment accounted for the highest market share in 2022.

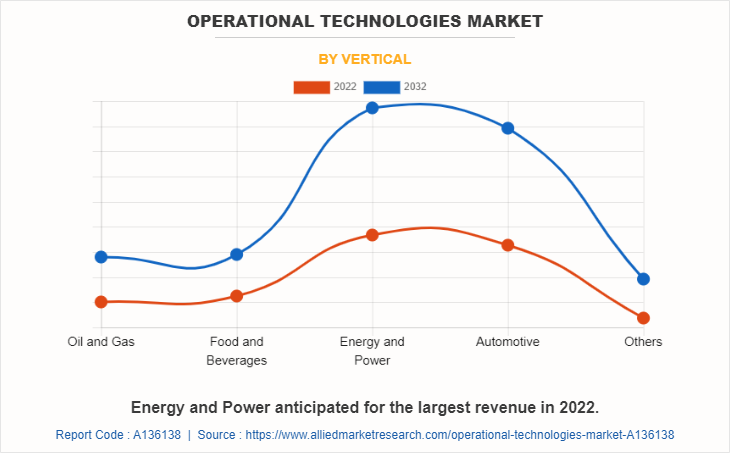

By vertical, it is divided into pharmaceuticals, food and beverages, oil and gas, energy, and power, automotive, and others. The energy and power segment accounted for the highest market share in 2022.

Region-wise, the operational technology market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific accounted for the largest share in 2022.

Country-wise, China acquired a prime share in the operational technologies market in the Asia Pacific region and is expected to grow at a significant CAGR during the forecast period of 2023-2032. China holds a major market share in terms of revenue generation from the sale of products because of the higher presence of automation technologies manufacturers.

In Europe, the UK, dominated the operational technologies market, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. Owing to companies investing heavily in operational technologies R&D projects are driving the expansion of the regional market and thus creating lucrative growth opportunities for the operational technologies market in Germany.

In North America, the U.S. is expected to emerge as a significant market for the operational technologies market, owing to the increased adoption of field devices that are driving the demand for operational technologies in North America.

By LAMEA region, the Latin America country garner significant market share in 2021 The Latin American market has huge potential for the operational technologies to have considerable advantages, aggressive investments into R&D activities are developing sensory components, which are expected to provide enhanced features, such as proximity, speed, and motion detection for increased efficiency and applicability. These factors are expected to reshape the operational technologies market growth in the Middle East.

Competitive Analysis

Competitive analysis and profiles of the major market leaders profiled in the report include ABB Ltd., Siemens, Schneider Electric SE., Rockwell Automation Inc., Honeywell International Inc., Emerson Electric Company, General Electric, IBM Corp, Oracle Corporation, and Fuji Electric Co., Ltd. These key players have adopted strategies, such as geographical expansion, product launches, acquisitions, partnerships, and business expansion, to enhance their market penetration. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration, and business expansion to increase the operational technologies market share during the forecast period.

Top Impacting Factors

Significant factors impacting the growth of the operational technologies market analysis include a rise in strategic initiatives by the government, which drives the demand for operational technology. In addition, the market is influenced by growth in the machine control system market in emerging economies. However, high installation and maintenance costs hamper the market growth. Moreover, the integration of operational technology with artificial intelligence (AI) and machine learning (ML) provides a lucrative operational technologies market opportunity.

Historical Data & Information

The global operational technologies market is highly competitive, owing to the strong presence of existing vendors. Vendors of the operational technologies market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as advancements in communication applications, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

General Electric, Schneider Electric, Rockwell Automation Inc., Emerson Electric company, and Honeywell International Inc. are the top 5 companies holding a prime share in the operational technologies market. Top market players have adopted various strategies, such as product launches, contracts, and others to expand their foothold in the operational technologies market.

- In December 2022, Rockwell Automation, Inc. announced that Fortinet, a global leader in broad, integrated, and automated cybersecurity solutions, joined the Partner Network Program as a Gold Technology Partner. The partnership resulted in secure operational technology environments.

- In July 2023, Honeywell acquired SCADAfence, a leading provider of operational technology (OT) and Internet of Things (IoT) cybersecurity solutions for monitoring large-scale networks. SCADAfence brings proven capabilities in asset discovery, threat detection, and security governance which are key to industrial and building management cybersecurity programs.

- In November 2022, Honeywell announced the release of its operational technology (OT) cybersecurity solutions, designed to assist customers in defending the availability, reliability, and safety of their industrial control systems and operations. The offerings include an advanced monitoring and incident response (AMIR) dashboard and updated cyber app control.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global operational technologies market forecast is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the operational technologies market.

- The report includes the market share of key vendors and global operational technologies market trends.

Operational Technologies Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 292.7 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 550 |

| By Component |

|

| By Technology |

|

| By Vertical |

|

| By Region |

|

| Key Market Players | General Electric, Oracle Corporation, Fuji Electric Co., Ltd., Honeywell International Inc., ABB Ltd., IBM Corp, Schneider Electric SE., Emerson Electric Company, Siemens, Rockwell Automation Inc. |

Analyst Review

The operational technology market is anticipated to be a prominent growth during the forecast period, owing to various factors, such as increase in strategic initiatives and development of operational technology, which fuel the demand for operational technology. In addition, the market is influenced by growth in investments in the industrial sector and rise in urbanization. However, high installation and maintenance costs hamper market growth to a certain extent. Moreover, rapid industrial growth in emerging countries fuels the growth of the market. Each of these factors is anticipated to have a definite impact on the global operational technology market during the forecast period.

The operational technology market exhibits high growth potential in energy and power and automotive sectors. The current business scenario has witnessed an increase in demand for energy, particularly in developing regions such as China and India, owing to surge in population and rise in demand for energy. Companies in this industry have adopted various innovative techniques, such as mergers and acquisitions, to strengthen their business position in the competitive matrix.

The key players of the operational technology market include ABB Ltd., Siemens, Schneider Electric SE., Rockwell Automation Inc., Honeywell International Inc., Emerson Electric Company, General Electric, IBM Corp, Oracle Corporation, and Fuji Electric Co., Ltd

Wireless is the leading technology of operational technologies market.

The upcoming trends of operational technology includes rise in strategic initiatives by the government and increased cyber-attacks against operational technologies such as supervisory control.

Asia-Pacific is the largest regional market for operational technologies.

The global operational technologies market was valued at $146 billion in 2022.

General Electric, Schneider Electric, Rockwell Automation Inc, Emerson Electric company, and Honeywell International Inc. are the top 5 companies holding a prime share in the operational technologies market.

Loading Table Of Content...

Loading Research Methodology...