Operational Technology (OT) Security Market Insights, 2032

The global operational technology (OT) security market was valued at USD 15.2 billion in 2022, and is projected to reach USD 84.2 billion by 2032, growing at a CAGR of 19% from 2023 to 2032.

Rising adoption of cloud-based operational technology security industry solutions and the surge in the integration of government initiatives in security standards are driving the growth of the market. In addition, the growing demand for cyber threat modeling solutions is fueling the growth of the operational technology security market. However, dearth of trained security staff to analyze OT security systems and the high installation cost of OT security solutions limit the market growth. Conversely, the rise in IoT connectivity between industrial operations and the internet and increased work-from-home activities widen the penetration of broadband is anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

OT security involves a range of technologies, processes, and policies that are designed to identify and mitigate threats to operational technology systems. This includes measures such as network segmentation, access control, intrusion detection, and incident response planning. In recent years, OT security has become increasingly important as more industrial control systems are connected to the Internet and other networks. This has increased the risk of cyber-attacks and other security threats that could potentially disrupt critical infrastructure and cause widespread damage. As a result, there has been a growing focus on improving OT security through increased investment, collaboration, and best practices.

The report focuses on growth prospects, restraints, and analysis of the global operational technology security market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global OT security market share.

Segment Review

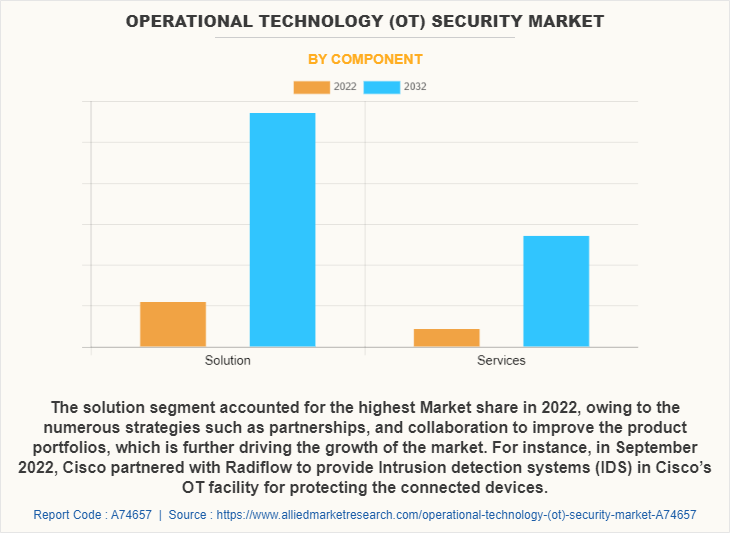

The global operational technology security market size is segmented into components, deployment mode, organization size, industry vertical, and region. Depending on the component, the market is divided into solutions and services. By deployment mode, the market is bifurcated into on-premise and cloud. By organization size, it is divided into large enterprises and small and medium-sized enterprises. As per end user, it is segmented into BFSI, manufacturing, energy & power, oil & gas, transportation & logistics, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on the component, the solutions segment dominated the OT security market share in 2022 and is expected to continue this trend during the forecast period, owing to the growing need for vulnerability assessment, penetration testing, and ensuring compliance with top government, defense, and industry security standards. However, the services segment is expected to witness the highest growth in the upcoming years, owing to an increase in the adoption of digital technologies across several industries and the availability of desired information from different online platforms is driving the need for privacy and protection services.

Region-wise, the operational technology security market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to several government authorities and cybercrime agencies employing these OT security solutions to streamline security operations, further contributing to the market growth within the region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the growing demand for OT security solutions to protect critical infrastructure from cyber threats.

The global operational technology security market share is dominated by key players such as Broadcom, Cisco, Darktrace, Forcepoint, Forescout, Fortinet, Kaspersky, Microsoft Corporation, Palo Alto Networks, and Thales Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Rising Adoption of Cloud-based OT Security Solutions

The rise in trend of cloud-based solutions for improving security and optimizing operations directly influences the growth of the global operational technology security market. The need for secure and efficient cloud-based solutions for OT security has increased due to surge in interconnection among operational technology systems, Information Technology (IT) systems, and the internet. Cloud-based OT security solutions offer benefits such as scalability, flexibility, & cost-effectiveness and help organizations to manage OT security in a more streamlined and centralized manner. Thus, these inherent features associated with cloud-based OT solutions are likely to contribute to the increased installation of operational technology security market around the world.

Furthermore, the integration of cloud-based solutions allows organizations to collect and analyze security data from several OT & IT systems, including logs, network traffic, and security alerts, in a centralized cloud-based platform. Cloud-based Security Information and Event Management (SIEM) solutions provide real-time visibility and threat detection and can help organizations respond to security incidents more quickly and effectively. Hence, these multiple benefits offered by cloud-based OT security solutions are expected to boost demand in the market.

Moreover, several private and public companies are continuously involved in promoting digitalization in security operations and maintenance, as digitalization has become a necessary step in managing security operations and maintaining safety. For instance, in October 2021, Orca Security raised a fund of $550 million, led by Temasek, which focused on extending the transformation of the cloud security industry. Such investment pooling in the digitalization of the security solution is anticipated to fuel the demand for cloud-based OT security solutions, which in turn, augments the market growth on a global scale.

Surge in Integration of Government Initiatives in Security Standards

The supportive government policies and increase in investment by public and private authorities in security standards positively impact the market growth. Several regional governments have made strategic investments in expanding security operations. Governments around the globe have recognized the importance of cyber security and data protection in the digital age and have integrated proactive measures to safeguard end-users and businesses from cyber threats. Furthermore, government policies have undertaken increased initiatives to embrace advanced technology, with plans for integrating new digital security solutions.

For instance, in July 2020, the National Security Agency and the Cyber Security & Infrastructure Security Agency unveiled an advisory for critical infrastructure, OT, and control systems assets. This advisory solution further increases the awareness of cyber security threats among end users, improves service performance, and maintains safety standards in businesses. Therefore, operational technology security gained wider traction among end-users, which in turn, contributes to the robust OT security market growth.

Moreover, increase in government investments in OT security to protect critical infrastructure from cyber-attacks is the key factor contributing to the development of the operational technology security market. These investments include funding for R&D of OT security technologies, the establishment of regulatory frameworks, training programs, and public-private partnerships to enhance collaboration between government agencies and private sector organizations. For instance, in February 2023, the Technology Modernization Fund (TMF) raised over $650 million in funding, aiming to build and improve cyber security and digital services at the Social Security Administration. Such investments and advancements in improving security operations eventually contribute to the growth of the global operational technology security market.

Digital Capabilities:

Digital capabilities can play a critical role in ensuring the security of operational technology (OT) systems. Some of the key digital capabilities that can be leveraged for OT security solutions include cybersecurity analytics, Industrial Internet of Things (IIoT), and secure communication protocols. Digital capabilities can enable the development of advanced analytics tools that can help identify and analyze potential cyber threats in OT systems. These tools can use machine learning algorithms to detect anomalous behavior and identify potential security breaches before they occur. In addition, IIoT devices can be used to monitor OT systems and detect potential security threats. These devices can collect data from various sensors and transmit it to a central system for analysis, enabling security teams to quickly identify and respond to potential threats.

Digital capabilities can be used to develop secure communication protocols for OT systems. These protocols can help prevent unauthorized access to OT systems and ensure that data transmitted between systems is encrypted and secure. Furthermore, digital capabilities can be used to segment OT networks, creating isolated sub-networks that can be monitored and secured independently. This approach can help prevent the spread of cyber-attacks across the entire OT network. By leveraging these digital capabilities, organizations can develop comprehensive OT security solutions that help protect critical infrastructure from cyber threats.

End-User Adoption:

End user adoption is a critical factor in the success of any operational technology (OT) security solution. Here are some tips for ensuring that end users adopt and use OT security solutions effectively including involving end users in solution development. Involve end users in the development of the OT security solution to ensure that the solution meets their needs and is easy to use.

Furthermore, the OT security solution is as user-friendly as possible. Provide clear and concise instructions, intuitive interfaces, and training materials to help end users understand how to use the solution. Educate end users on the risks associated with cyber-attacks on OT systems to help protect the organization to increase the adoption of OT security solutions. Offer continuous training to end users to ensure that they stay up to date with the latest OT security practices and techniques. This will help them understand the importance of the OT security solution and how to use it effectively.

Moreover, the Operational Technology Security Industry solution provides a high return on investment (ROI) to end users to understand the value of the solution and how it can benefit the organization. Establish clear security policies and procedures that end users must follow when using OT systems. This will help ensure that end users understand their responsibilities when it comes to OT security and can help prevent security breaches caused by human error. Thus, these help to ensure that end users adopt and use OT security solutions effectively, helping to protect critical infrastructure from cyber threats.

Governments around the world are increasingly recognizing the importance of operational technology (OT) security and taking steps to promote the adoption of OT security solutions. Regulations & standards, funding & grants, and public-private partnerships are some examples of government initiatives aimed at promoting OT security solutions. Governments are introducing regulations and standards to ensure that critical infrastructure systems are protected from cyber threats. For example, in the United States, the Cybersecurity and Infrastructure Security Agency (CISA) has developed guidelines and standards for securing industrial control systems (ICS).

In addition, governments are providing funding and grants to support the development and deployment of OT security solutions. For example, the European Union has launched the Horizon 2020 program, which provides funding for research and innovation in cybersecurity. In addition, governments are partnering with the private sector to promote the adoption of OT security solutions. For example, in the United Kingdom, the National Cyber Security Centre (NCSC) has established a cybersecurity information-sharing platform to facilitate collaboration between government and industry.

Furthermore, governments are launching awareness campaigns to educate the public and private sectors on the importance of OT security. For example, in Australia, the government has launched a cybersecurity awareness campaign aimed at raising awareness of the risks associated with cyber-attacks on critical infrastructure. Governments are collaborating with other countries to promote the adoption of OT security solutions on a global scale. For example, the United States and Japan have established a joint cybersecurity dialogue to promote cooperation on cybersecurity issues. By promoting the adoption of OT security solutions through these and other initiatives, governments can help protect critical infrastructure systems from cyber threats and ensure the safety and security of their citizens.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global operational technology security market Forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global operational technology security market Analysis is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Operational Technology (OT) Security Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 84.2 billion |

| Growth Rate | CAGR of 19% |

| Forecast period | 2022 - 2032 |

| Report Pages | 385 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Broadcom Inc, Microsoft Corporation, Thales Group, Cisco System, Inc., Forescout, Palo Alto Networks Inc, Kaspersky Lab, Forcepoint, Fortinet, Inc., Darktrace Holdings Limited |

Analyst Review

OT security often involves unique challenges compared to traditional IT security because many OT systems are designed to operate for decades and are not easily updated or replaced. Additionally, many OT systems were not designed with security in mind, making them vulnerable to modern cyber threats. Some common OT security practices include network segmentation and access control. Separating OT systems from corporate networks and the internet to limit exposure to cyber threats. In addition, implementing strong authentication and authorization controls to ensure only authorized users can access OT systems.

Key players in the OT Security market such as Broadcom, Inc., Cisco System, Inc., Microsoft Corporation, and Thales Group account for a significant share of the market. With larger requirements for OT Security services, companies introduced various strategies to strengthen their market position capabilities. For instance, in May 2021, Broadcom Inc. introduced the launch of Expert Advantage, an expanded global channel services partner program, focused on customer success to drive growth across Broadcom Software solutions. Furthermore, expanding specialized services partnerships to extend global reach and address growing demands in digital transformation and cyber security. Such strategic initiatives by the market players will contribute to significant growth of the OT Security market across the globe.

Moreover, market players have expanded their business operations by enhancing their product portfolio by introducing new cloud services. For instance, in February 2023, Cisco introduces new cloud services in IoT Operations Dashboard to increase industrial asset visibility, securely manage assets from anywhere and provide Industrial Internet of Things (IoT) customers with a seamless path to cloud automation for Operational Technology (OT) teams. In addition, Cisco ThousandEyes introduces support for OpenTelemetry, unlocking internet and Cloud intelligence across a wide range of monitoring and IT platforms for expanded visibility, correlated insights and optimized digital experiences. Such factors and strategic advancements are propelling the growth of the OT Security market.

The global operational technology (OT) security market was valued at USD 15.2 billion in 2022, and is projected to reach USD 84.2 billion by 2032

The Operational Technology (OT) Security Market is estimated to grow at a CAGR of 19.0% from 2023 to 2032.

The key players profiled in the report include Broadcom, Cisco, Darktrace, Forcepoint, Forescout, Fortinet, Kaspersky, Microsoft Corporation, Palo Alto Networks, and Thales Group.

North America held the major share in 2022

Rise in adoption of cloud-based OT security solutions, the surge in the integration of government initiatives in security standards, and the surge in demand for cyber threat modeling solutions contribute toward the growth of the Market.

Loading Table Of Content...

Loading Research Methodology...