Optical Coating Market Research, 2030

The global optical coating market was valued at $11.8 billion in 2020, and is projected to reach $24.0 billion by 2030, growing at a CAGR of 7.41% from 2021 to 2030. The growth of the optical coating market is driven by increasing demand across industries such as consumer electronics, automotive, telecommunications, and healthcare. The rise in adoption of advanced display technologies, such as OLEDs and AR/VR devices, is boosting the need for anti-reflective and conductive coatings.

Introduction

Optical coating refers to a thin, uniform layer of material applied to the surface of an optical component, such as lenses, mirrors, or glass, to manipulate the reflection, transmission, and absorption of light. These coatings are engineered to enhance the performance of optical systems by controlling the interaction of light, thereby improving properties like anti-reflective effects, protection from environmental damage, or selective filtering of specific wavelengths. Optical coatings find application across a variety of industries, including consumer electronics, automotive, renewable energy, and healthcare technologies.

Market Dynamics

The growing demand in the consumer electronics sector is a key driver for the optical coating market, fueled by the widespread adoption of advanced devices such as smartphones, tablets, wearables, and smart displays. Optical coatings are essential in enhancing the performance of these devices by improving features like anti-reflective properties, glare reduction, and touchscreen responsiveness. With consumer preferences shifting toward devices with better visual clarity, energy efficiency, and durability, the demand for specialized coatings such as anti-reflective and protective layers has surged. All these factors drive the demand for the optical coating market.

However, advanced coating processes, such as vacuum deposition, sputtering, and electron beam evaporation, require specialized equipment and highly skilled operators to ensure precision and uniformity in the coating layers. These techniques are not only costly but also time-consuming, adding financial pressure to manufacturers. Additionally, the intricate nature of these processes can lead to inconsistencies or inefficiencies, which affect the performance of the final optical coatings. All these factors are expected to hamper the growth of optical coatings market.

Various thin-film layers fuse to form an optical coating, creating an interference effect and enhancing transmission or reflection properties within the optical system. They are manufactured from a variety of materials such as metals, oxides, &rare earth materials and are deposited on the optical surface. The coating improves optics and protects optics from extreme environmental conditions. Differences in the number of coating layers, the thickness of each layer, and the index of refraction at the layer interface indicate the performance of the optical coating. In addition to reflective properties, the optical coating is optically transparent for glass, lenses, solar panels, digital signage, thin film transistors (TFT), and LED screens. It is optically transparent, provides chemical resistance, abrasion resistance, UV resistance, antistatic, anti-glare, and provides anti-fog properties to the applied products.

Household appliances are the largest revenue contributors to the optical coating market. Owing to rapid economic growth and rise in disposable income, demand for home appliances such as thin-film transistors (TFTs) and LED screens has increased in emerging markets such as India, China, and Brazil. Construction activities, infrastructure development, and increased automotive production are expected to drive the optical coating market over the forecast period. In addition, the use of infrared &anti-reflection coatings in the military applications of targeting, night-vision cameras, thermal imaging cameras, and head-mounted missile seekers add to the growth of the market. However, the need for huge time and effort to produce optical coatings by the manufacturers, capital-intensive manufacturing processes, and fluctuating raw material prices can hinder this growth. Government policies, including incentives and subsidies to encourage the development of alternative energy sources, are expected to increase the consumption of optical coatings in solar applications.

According to US LEED (Leadership in Energy and Environmental Design) standards, Green Building Council (USGBC) optical coatings play an important role in reducing energy consumption through insulation. This is expected to create new opportunities in the market.

The optical coating market is segmented on the basis of type, technology, end-use industry, and region.

By type

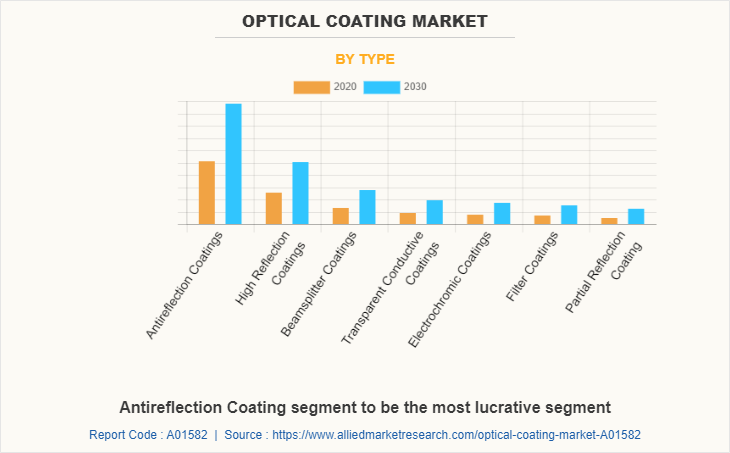

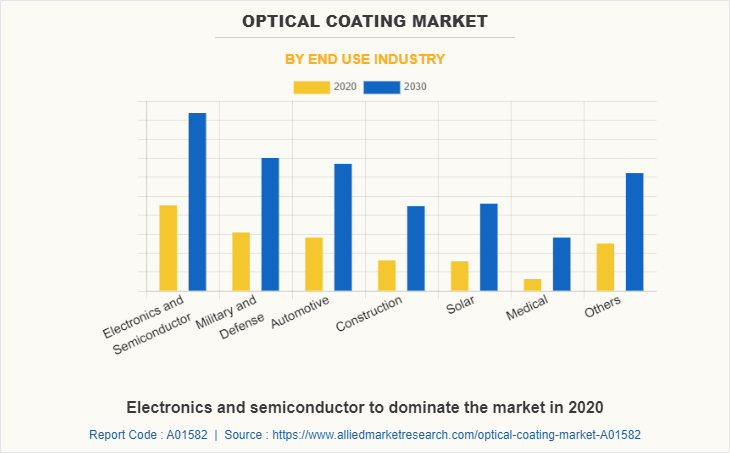

The optical coating market is divided into antireflection, high reflection, transparent conductive, filter, beamsplitter, electro chromic, and partial reflection coatings. By technology, the market is classified into vacuum deposition, E-beam evaporation technology, sputtering technology, and ion-assisted deposition technology. By end-use industry, the market is fragmented into electronics and semiconductor, military and defense, automotive, construction, solar, medical and others. By region, the optical coating market is analyzed across four regions, which include North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted highest CAGR, followed by LAMEA, North America and Europe. The high adoption of optical coating products in the region is expected to continue to bolster the optical coating market size, due to the presence of huge population base, increased investment in the infrastructure, and presence of many developing countries in this region.

The key players operating in the global optical coating market are E.I. Dupont De Nemours Company, PPG Industries, Zeiss Group, Nippon Sheet Glass Co., Ltd., Abrisa Technologies, Newport Corporation, Inrad Optical, Inc., Reynad Corporation, Artemis Optical Ltd., and II-VI Optical Systems. Other key players (not profiled in report) in the optical coating industry value chain are Optics Balzers, Zygo Corporation, and Optical Coating Technologies., etc. are competing for the share of the market through product launch, joint venture, partnership, and expansion of the production capabilities to meet the future demand for the optical coating market during the forecast period.

By Region

North America occupies most of the optical coating market and is made up of countries such as the U.S., Canada, and Mexico. The U.S. has the largest aerospace industry in the world. According to the Federal Aviation Administration (FAA), the total number of commercial jets is expected to reach 8,270 in 2037 due to the increase in air cargo. In addition, the U.S. mainliner fleet is expected to grow at a rate of 54 aircraft per year owing to the aging of the existing fleet. Strong exports of aerospace components to countries such as France, China, and Germany, as well as strong civilian and military consumer spending in the country, drive manufacturing activities in the aerospace industry. There is a major demand for new electronic products in order to promote innovation rapidly in technology industry, and research & development activities. The number of U.S. manufacturing facilities and development centers focuses on developing high-quality products, especially in particular with military and electronic equipment have huge demand for optical coatings to produce high quality products. Thus, the growth of the other end-user industry can increase demand for the optical coating market during the forecast period.

Anti-reflective segments can provide high-quality coatings with high transmission and low anti-reflection performance for components such as lenses, mirrors, screens, and anti-reflection coatings used in various industrial and consumer applications worldwide. Owing to these considerations, anti-reflective coatings have gained attention in the global optical coating market share and hold a significant of the entire optical coating market. The development of the eyewear and photovoltaic industry, as well as the increased use of anti-reflective coatings on the window glasses in the construction sector, is driving the optical coating market. However, market growth is hampered by high production costs, coating maintenance, and a lack of understanding of proper applications.

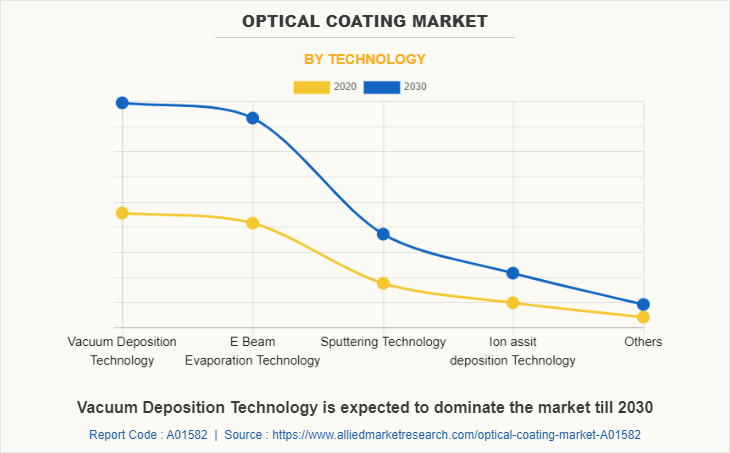

By Technology

The vacuum deposition segment dominates the global optical coating market.Vacuum deposition technology is a surface engineering treatment used to deposit layers of coating material atom-by-atom on the optical substrate. The process puts coating materials into vapor state. The vapors obtained from liquid or solid source is called physical vapor deposition. Whereas, the vapor obtained from chemical reaction is called chemical vapor deposition. The process takes place in vacuum, making it ecologically clean. The technique is applicable for coating magnetic films, semiconductors devices, mirrors, solar panels, and others.The presences of wide range of application conditions in various end-use industries have created lucrative opportunities for the market growth.

By End Use Industry

The electronics and semiconductor industries occupy a large share of the overall market due to optical coating market growth in demand for durable and dielectric coatings in photovoltaic (PV) cells, electronic assemblies, ICs, and other optoelectronic devices. According to the World Semiconductor Trade Statistics (WSTS), the global semiconductor market in 2021 was up by 26.2% and is projected to grow to $ 613.8 billion in 2022 with a growth rate of 10.4%. Similarly, according to a recent study by the Semiconductor Industry Association (SIA), the U.S. invested approximately $ 142.2 billion in computers and approximately $ 53 billion in consumer electronics such as mobile phones, televisions, and other similar applications. These electronic products use optical coatings on screens, lighting systems, surface reflectors, and camera optics.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the optical coating market analysis from 2020 to 2030 to identify the prevailing optical coating market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the optical coating market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global optical coating market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

Optical coatings are used to transform transmittance, reflectance, polarizer, and absorbance properties of optical substrate to improve the image quality. They are ergonomically designed for specific incidence angle and specific polarization of light. They are selected on the basis of wavelength or spectrum of light involved such as ultraviolet (UV), visible (VIS), and infrared (IR). The composition, number of layers, and thickness of metal oxides deposited alter the reflectivity and transmission of light through the coating material. Aluminum, silver, gold, titanium oxide, tantalum pent oxide, magnesium fluoride, calcium fluoride, and others are used as coating materials on the optical substrate.

Optical coating in electronics & semiconductor industry has witnessed the highest growth rate globally. Rise in utilization of consumer electronics, coupled with emergence of new technologies in smartphones, tablets, TVs, and computers is expected to drive the demand for optical coating in this industry.

Optical coatings are widely used in applications, including architecture, consumer electronics, solar panels, automotive, medical, telecommunication, and military & defense. The rapid growth of the optical coatings market is driven by the increasing focus on clean energy generation through solar panels where antireflective coatings are used, and rise in demand for consumer electronics are anticipated to fuel the market growth over the forecast period.

Optical Coating Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | NEWPORT CORPORATION, INRAD OPTICS, ZEISS GROUP, REYNARD CORPORATION, ABRISA TECHNOLOGIES, II-IV OPTICAL SYSTEM, PPG INDUSTRIES, E. I. DU PONT DE NEMOURS AND COMPANY, ARTEMIS OPTICAL LTD., NIPPON SHEET GLASS CO. |

| | Optics Balzers, Zygo Corporation, Optical Coating Technologies |

Analyst Review

Optical coatings are used to transform transmittance, reflectance, polarizer, and absorbance properties of optical substrate to improve the image quality. They are ergonomically designed for specific incidence angle and specific polarization of light. They are selected on the basis of wavelength or spectrum of light involved such as ultraviolet (UV), visible (VIS), and infrared (IR). The composition, number of layers, and thickness of metal oxides deposited alter the reflectivity and transmission of light through the coating material. Aluminum, silver, gold, titanium oxide, tantalum pent oxide, magnesium fluoride, calcium fluoride, and others are used as coating materials on the optical substrate.

Optical coating in electronics & semiconductor industry has witnessed the highest growth rate globally. Rise in utilization of consumer electronics, coupled with emergence of new technologies in smartphones, tablets, TVs, and computers is expected to drive the demand for optical coating in this industry.

Optical coatings are widely used in applications, including architecture, consumer electronics, solar panels, automotive, medical, telecommunication, and military & defense. The rapid growth of the optical coatings market is driven by the increasing focus on clean energy generation through solar panels where antireflective coatings are used, and rise in demand for consumer electronics are anticipated to fuel the market growth over the forecast period.

Increase in awareness regarding energy efficient buildings and anti-reflection coating improves visual acuity are the key factors boosting the Optical Coating market growth

The market value of Optical Coating in 2030 is expected to be US$ 24.0 Billion

E.I. Dupont De Nemours Company, PPG Industries, Zeiss Group, Nippon Sheet Glass Co., Ltd., Abrisa Technologies, Newport Corporation, Inrad Optical, Inc., Reynad Corporation, Artemis Optical Ltd., and II-VI Optical Systems.

Electronics and Semiconductor industry is projected to increase the demand for Optical Coating Market

The optical coating market is segmented on the basis of type, technology, end-use industry, and region. By type, the optical coating market is divided into antireflection, high reflection, transparent conductive, filter, beamsplitter, electrochromic, and partial reflection coatings. By technology, the market is classified into vacuum deposition, E-beam evaporation technology, sputtering technology, and ion-assisted deposition technologies. By end-use industry, the market is divided into electronics and semiconductor, military and defense, automotive, construction, solar, medical and others. By region, the optical coating market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Increase in application of optical coating in solar cells is the Main Driver of Optical Coating Market

Electronics and Semiconductor, Military and Defense and automotive industry are expected to drive the adoption of Optical Coating

Optical coating manufacturers were affected in 2020 due to business shutdown mandates, social distancing norms, and limited local &state government office activities. COVID-19 had a major impact on the aerospace & defense industry, which is one of the largest end-users of optical coatings.

Loading Table Of Content...