Optical Communication And Networking Equipment Market Research, 2032

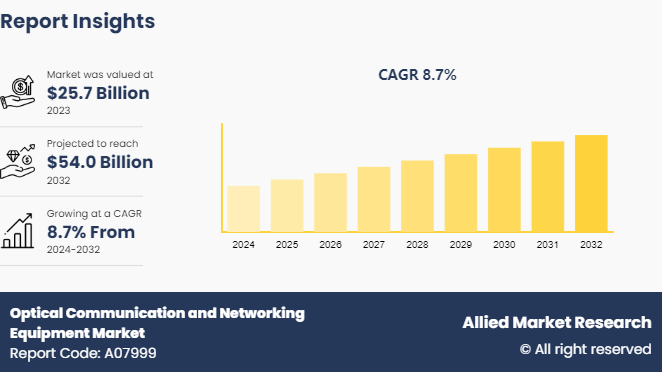

The Global Optical Communication and Networking Equipment Market was valued at $25.7 billion in 2023, and is projected to reach $54.0 billion by 2032, growing at a CAGR of 8.7% from 2024 to 2032.

Market Introduction and Definition

Optical communication and networking are a process to transfer information at a distance with the use of light as a carrier. Optical networks have become necessary for telecommunication by enabling portable devices and computers to exchange information almost instantly. The equipment for optical communication includes optical amplifiers, transceivers, transmission fibers, tunable filters, termination devices, add-drop multiplexers, and dispersion compensation equipment.

As there is demand for high-capacity links, optical communications networks have become increasingly important. Access and metropolitan area networks are increasingly being built with optical technologies. Optical communications equipment in the network provides several benefits such as long transmission distance, dielectric protection and construction, light weight, and relatively easy installation.

Key Takeaways:

- The optical communication and networking equipment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major optical communication and networking equipment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Industry Trends:

- In July 2023, India declared its investment plan of USD 13 billion to establish a nationwide optical fibre grid, focusing to improve connectivity and present affordable internet access.

- In June 2023, the federal government has allocated around USD 42.5 billion to expand broadband connectivity across the United States. The allocation of USD 42.5 billion is through the National Telecommunications and Information Administration’s (NTIA) Broadband Equity, Access and Deployment (BEAD) program.

- In October 2023, Hengtong, a leading manufacturer of optic fiber cable in China, announced its plan to invest USD 8 million to expand its fibre optic cable manufacturing plant in Egypt.

Key Market Dynamics

The optical communication and networking equipment industry is expanding due to several factors such as surge in data traffic owing to the increase in internet usage, surge in number of data centers, and rise in adoption of cloud based as well as virtualization services which fuels growth of the market. The emerging internet applications are increasingly becoming high-performance as well as network-based, relying on cloud computing and optical network services. In addition, enterprises around the globe are running a growing number of virtual machines (VMs) .

Hence, an increased amount of data needs to be processed, analyzed, stored, shared, and backed up. This has led to a rise in demand for faster network connections. As virtualization and cloud operations become core technology components in the organizations, there is major shift in network requirements. Hence, the aforementioned factors fuel adoption of optical communication and networking equipment across the enterprises to ensure improved network performance and bandwidth.

Optical communication and networking equipment provides safety, speed, and security; however, the initial investment cost for the optical communication and networking technologies is high. This factor can hinder market growth in upcoming years.

On the other hand, there is a rise in adoption of artificial intelligence (AI) technologies for applications such as virtual personal, assistants, smart vehicles, speech recognition, purchase prediction, and smart home devices. The Internet of Things (IoT) is creating a global network of smart connected devices that can enhance economies and businesses. Both the IoT and AI are increasingly being adopted to enable large and small enterprises to develop new intelligent and digitally agile business models. Optical communication and networking are tailor-made to handle such large amounts of data produced by AI & IoT. Thus, proliferation of AI & IoT is opportunistic for market growth.

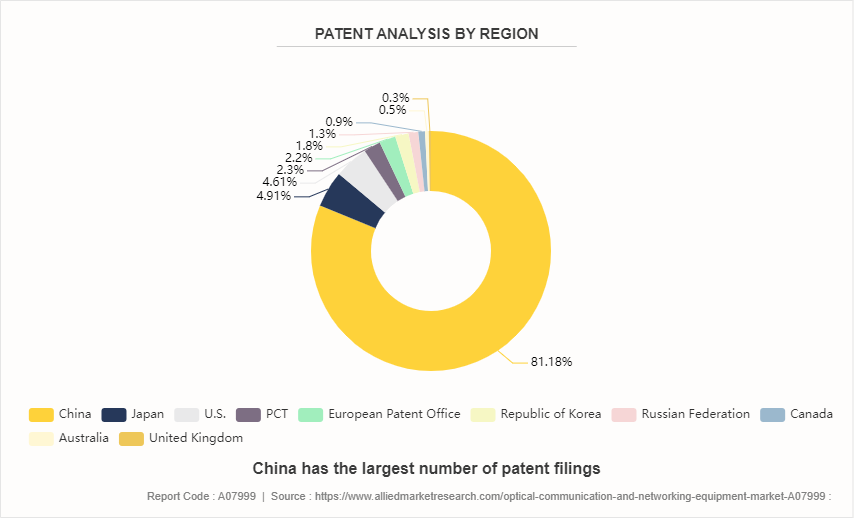

Patent Analysis of Optical Communication and Network Equipment Market

The global optical communication and networking equipment market is segmented according to the patents filed in the China, Japan, U.S., PCT, European Patent Office, Republic of Korea, Russian Federation, Canada, Australia, and UK, China has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. The patents registered by these countries are from 2015 to 2023.

Market Segmentation

The global optical communication and networking equipment market is segmented on the basis of component, technology, industry vertical, and region. On the basis of component, the market is segregated into optical fiber, transceiver, switch, and others. By technology, the market is classified into SONET, WDM, and Fiber Channel. On the basis of industry vertical, it is divided into IT & telecom, BFSI, military & defense, oil & gas and medical &healthcare. Region wise, the optical communication and networking equipment market trends are analyzed across North America (U.S., Canada, and Mexico) , Europe (Germany, France, Italy, UK and rest of Europe) , Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific) , and LAMEA (Latin America, Middle East, and Africa) .

Market Segment Outlook

By component, transceiver held the highest market share in 2023, accounting for almost one third of optical communication and networking equipment market size. Optical transceivers are powerful, small devices that can transmit as well as receive data. In optical communication and networking, data is sent via an optical fiber in the form of pulses of light. The transceiver is an important part of such a network as it is used to convert electrical signals to light signals and vice versa.

By technology, WDM held the highest market share in 2023, accounting for almost half of optical communication and networking equipment market size. Growing adoption of WDM technology for the data transfer over longer distances fuels growth of the segment. This is attributed to the fact that it significantly reduces the number of fibers used in the transmission line. In addition, factors such as need to enhance the scalability of the optical fiber and increasing demand for networks with high data transfer speed and capacity drives adoption of WDMs technology in optical fiber communication.

By industry vertical, IT Telecom segment held the highest market share, accounting for almost half of the optical communication and networking equipment market size. The surge in bandwidth requirements due to increasing internet users and data traffic fuels optical communication and networking equipment market in IT & telecommunication sector.

Competitive Landscape

The key players of optical communication and networking equipment market include Arista Networks, Inc., Cisco Systems, Inc., Ericsson, Fujitsu Optical Components Limited, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Mitsubishi Electric, NEC Corporation, Nokia Corporation, and ZTE Corporation. Key optical communication and networking equipment manufacturer have adopted various strategies such as product launch, expansion, collaboration, partnership, and acquisition to strengthen their foothold in the optical communication and networking equipment industry.

Recent Key Strategies and Developments

- ADVA Optical Networking introduced a new MicroMux Edge BiDi device in March 2022, designed to empower operators by enhancing capacity and resolving fiber limitations within access networks. This innovative BiDi pluggable offers a dual benefit of cost reduction and latency optimization.

- In March 2022, Huawei partnered with ZainTech to explore opportunities for digital solution development. Also, develop ZainTech’s ecosystem with Huawei’s expertise and best practices in the public cloud, and discover new local cloud opportunities.

- In February 2022, ZTE Corporation introduced a series of new 5G products and solutions at the Mobile World Congress event. The companies’ new products and solutions present ZTE’s great commitment to building the simplest 5G network with energy efficiency, increasing the digital transformation of industries with an all-in-one private network, and operating the complex network with ease.

- In February 2022, FUJITSU acquired oobe, services, and a product portfolio that spans end-user computing, applications, data, cloud, and cyber, with a focus on Microsoft and Azure. The acquisition enables Fujitsu to leverage oobe’s market-leading expertise and experience as a leading Microsoft cloud, modern workplace, and security provider to accelerate its customers’ digital transformation journeys.

Key Sources Referred

- The Fiber Optic Association (FOA)

- Communications Cable & Connectivity

- British Cable Association

- Cellular Operators Association of India

- Internet and Mobile Association of India (IAMAI)

- Broadband India Forum (BIF)

- Digital Infrastructure Providers Association (DIPA)

- Association of Competitive Telecom Operators (ACTO)

Key Benefits For Stakeholders

- This optical communication and networking equipment industry report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics, and of optical communication and networking equipment market forecast analysis from 2024 to 2032 to identify the prevailing optical communication and networking equipment market opportunities.

- The optical communication and networking equipment market analysis is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the optical communication and networking equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market. Major countries market such as optical communication and networking equipment for US market and optical communication and networking equipment for China market covered in the report.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the optical communication and networking equipment manufacturer. Also information regarding related market such as fiber optic communication is also covered in the report.

- Optical communication and networking equipment market data is estimated on the basis of authenticate secondary and primary sources. Optical communication and networking equipment company list can be customized according to client requirement.

- The related report information such as fiber optic communication and free space optical communication will be covered in the report for qualitative information.

- The report includes the analysis of the regional as well as global optical communication and networking equipment market trends, optical communication and networking equipment company list, optical communication and networking equipment market size by country, optical communication and networking equipment market share by companies, optical communication and networking equipment sector analysis, optical communication and networking equipment market insights.

Optical Communication and Networking Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 54.0 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 300 |

| By Component |

|

| By Technology |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Huawei Technologies Co., Ltd, Juniper Networks, Inc, Nokia Corporation, Mitsubishi Electric, NEC Corporation, ZTE Corporation, Cisco Systems, Inc., Arista Networks, Inc., Ericsson, Fujitsu Optical Components Limited |

The Optical Communication and Networking Equipment Market is estimated to grow at a CAGR of 7.2% from 2020 to 2027.

The Optical Communication and Networking Equipment Market is projected to reach $26.83 billion by 2027.

To get the latest version of sample report

Fiber optics offer increased bandwidth to its users; hence, there is upsurge in demand for optical communication and networking equipment drives the growth of Optical Communication and Networking Equipment Market.

The key players profiled in the report include Arista Networks, Inc., Cisco Systems, Inc., Ericsson, Fujitsu Optical Components Limited, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Mitsubishi Electric, NEC Corporation, Nokia Corporation, and ZTE Corporation.

On the basis of top growing big corporations, we select top 10 players.

The Optical Communication and Networking Equipment Market is segmented on the basis of component, technology, industry vertical, and region.

The key growth strategies of Optical Communication and Networking Equipment market players include product launch, product development, collaboration, partnership, and agreements to influence the market growth.

Transceiver segment holds a dominant position throughout the forecast period.

WDM segment will grow at a highest CAGR of 7.7% during 2020 2027.

Loading Table Of Content...