Optical Transceiver Market Outlook – 2030

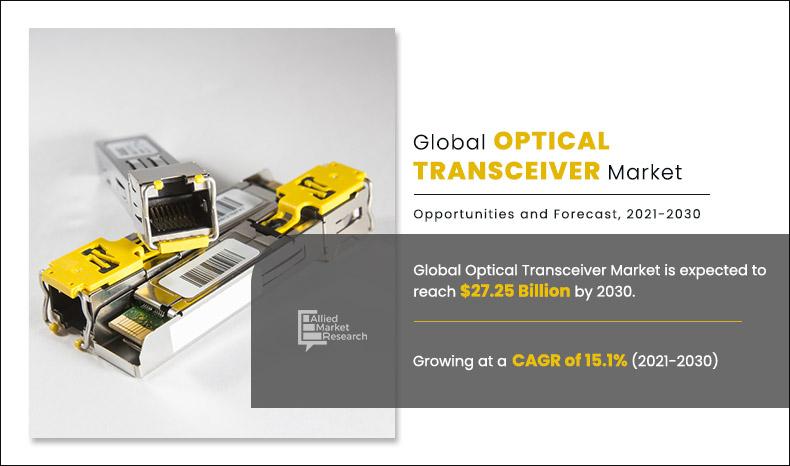

The global optical transceiver market size was valued at $7.18 billion in 2020 and is projected to reach $27.25 billion by 2030, registering a CAGR of 15.1% from 2021 to 2030.

The optical transceiver is a powerful, small device that can transmit as well as receive data. In optical communication and networking, data is sent via an optical fiber in the form of pulses of light. The transceiver is an important part of such a network, as it is used to convert electrical signals to light signals and vice versa. Depending on the type of data to be transported as well as the speed and distance, various transceivers are available for different tasks.

The surge in data traffic due to increased internet usage acts as the prime factor that drives the growth of the optical transceiver industry. Furthermore, the increase in several data centers accelerates the optical transceiver market growth rapidly. Moreover, increase in demand for advanced network equipment due to the COVID-19 pandemic, which is opportunistic for market growth.

An increase in the deployment of VoIP, LTE, and 5G networks is expected to notably contribute toward the expansion of the optical transceiver market. However, high investment associated with optical cable networking acts as a major restraint of the optical transceiver market growth. On the contrary, the rise in the adoption of AI and IoT is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

Segment Overview

The global optical transceiver market is segmented into form factor, data rate, fiber type, distance, wavelength, connector, application, and region.

Based on form factor, the market is fragmented into SFF, SFP, QSFP, CFP, XFP, and CXP. The QSFP segment dominated the market, in terms of revenue in 2020, and is expected to follow the same trend during the forecast period.

By Form Factor

QSFP segment will dominate the market by the end of 2030

By data rate, the market is segregated into less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, and more than 100 Gbps. The more than 100 Gbps segment was the highest revenue contributor in 2020 and is anticipated to garner significant market share during the forecast period. Depending on fiber type, the market is bifurcated into single-mode fiber and multimode fiber.

By Data Rate

10 Gbps to 40 Gbps segment will lead the market throughout the forecast period

By fiber type, the market share for the single-mode fiber segment was highest in 2020, however, the multimode fiber is expected to grow at a high CAGR from 2021 to 2030. As per distance, the market is segregated into less than 1 km, 1-10 km, 11-100 km, and more than 100 km. The market share for the 11-100 km segment was the highest in 2020, while the more than 100 km segment is expected to grow at the highest CAGR from 2021 to 2030.

According to wavelength, the market is fragmented into 850 nm band, 1310 nm band, 1550 nm band, and others. The 1310 nm band segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period.

By Fiber Type

Single Mode Fiber segment will maintain the lead during the forecast period

Based on the connector, the market is differentiated into LC connector, SC connector, MPO connector, and RJ-45. The LC connector segment dominated the market, in terms of revenue in 2020, and is anticipated to witness a significant market share during the forecast period.

By Connector

SC Connector segment will secure the leading position during 2021 - 2030

The applications covered in the study include telecommunication and data centers. The market share for the telecommunication segment was highest in 2020, whereas the data center is expected to grow at a high CAGR from 2021 to 2030

By Application

Data Center segment will dominate the market with a highest CAGR of 16.6% during 2021 - 2030

Region-wise, the optical transceiver market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). The North America optical transceiver market is expected to grow at the highest rate during the forecast period.

By Region

Asia-Pacific region would exhibit the highest CAGR of 18.1% during 2021 - 2030

Top Impacting Factors

Significant factors that impact the growth of the optical transceiver market include an increase in several data centers, the surge in data traffic due to increased internet usage, and an increase in demand for advanced network equipment due to the COVID-19 pandemic. However, high investment associated with optical cable networking hampers the market growth. On the contrary, the rise in adoption of AI & IoT and the increase in deployment of VoIP, LTE, and 5G networks are expected to offer lucrative opportunities for the expansion of the optical transceiver market during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major optical transceiver market players, such as Arista Networks Inc., Broadcom Inc., Cisco Systems, Inc., Fujitsu Optical Components Limited, Huawei Technologies Co. Ltd., Juniper Networks, Inc., Lumentum Operations LLC, NEC Corporation, Sumitomo Electric Industries Ltd., and ZTE Corporation are provided in this report. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration, to enhance their market penetration.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the optical transceiver market along with the current trends and future estimations to depict the imminent investment pockets.

- The overall optical transceiver market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current optical transceiver market forecast is quantitatively analyzed from 2020 to 2030 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the market.

- The report includes the optical transceiver market share of key vendors and market trends.

Optical Transceiver Market Report Highlights

| Aspects | Details |

| By form factor |

|

| By data rate |

|

| By fiber type |

|

| By distance |

|

| By wavelength |

|

| By connector |

|

| By application |

|

| By Region |

|

| Key Market Players | Cisco Systems, Inc., A Arista Networks Inc., Juniper Networks, Inc., ZTE Corporation, Sumitomo Electric Industries Ltd, Huawei Technologies Co., Ltd., Broadcom Inc., NEC Corporation, Lumentum Operations LLC, Fujitsu Optical Components Limited |

Analyst Review

The optical transceiver module is the major building block in the fiber-optic network, which conveys the information across communication channels for optical systems. The speed and stability of the network are gaining high traction in the market, owing to high bandwidth and low attenuation brought by fiber-optics.

Moreover, the optical transceiver module is evolving rapidly to meet the escalating demand for speed and capacity. The tendency is that the fiber-optic transceiver module is evolving to have a smaller size and higher data rate. This makes it optimum to use in data centers, wherein large data is processed. Hence, optical transceivers are of high significance in the modern high-capacity networks.

Introduction of in embedded and high-density integrated optical transceivers, owing to huge investment in development of communication infrastructure is expected to notably contribute toward the growth of the global market. For instance, in January 2020, FireFly demonstrated embedded optical modules that consumed less power and were optimal for liquid cooling purposes. Apart from innovation, the industry is seeing an increased number of merger and acquisitions activities along with partnerships to expand its market presence and support prominent vendor's data center and telecommunication module offerings.

The key players profiled in the report include Arista Networks Inc., Broadcom Inc., Cisco Systems, Inc., Fujitsu Optical Components Limited, and Huawei Technologies Co. Ltd., Juniper Networks, Inc., Lumentum Operations LLC, NEC Corporation, Sumitomo Electric Industries Ltd., and ZTE Corporation.

The optical transceiver market is estimated to grow at a CAGR of 15.1% from 2021 to 2030.

The optical transceiver Market is projected to reach $27.25 billion by 2030.

To get the latest version of sample report

Increase in number of data centers, surge in data traffic due to increased internet usage, and increase in demand for advanced network equipment.

The key players profiled in the report include Arista Networks Inc., Broadcom Inc., Cisco Systems, Inc., Fujitsu Optical Components Limited, and many more.

On the basis of top growing big corporations, we select top 10 players.

The optical transceiver market is segmented on the basis of form factor, data rate, fiber type, distance, wavelength, connector, application, and region.

The key growth strategies of optical transceiver market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Data Center segment would grow at a highest CAGR of 16.6% during the forecast period.

North America region will dominate the market by the end of 2030.

Loading Table Of Content...