Orthodontic Supplies Market Research, 2033

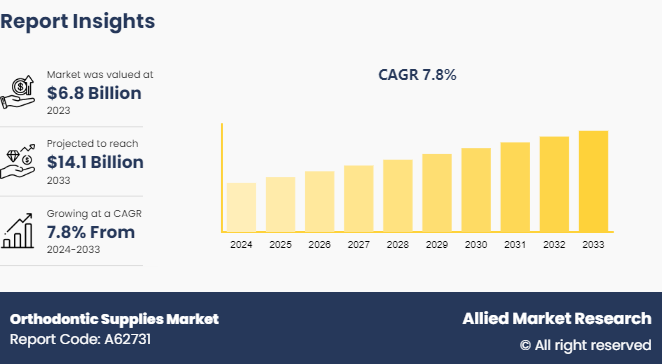

The global orthodontic supplies market size was valued at $6.8 billion in 2023, and is projected to reach $14.1 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033

Market Introduction and Definition

The orthodontic supplies industry offers a wide range of specialized tools and materials crucial for orthodontic treatment. This industry caters to the unique needs of orthodontic practitioners, empowering them with the resources necessary for accurate diagnosis, prevention, and correction of dental irregularities. From traditional braces and wires to innovative aligners and adhesives, these supplies form the backbone of orthodontic practice, enabling practitioners to achieve optimal dental alignment and enhance both oral health and aesthetics.

As the demand for orthodontic services continues to increase worldwide, driven by a rising emphasis on aesthetics and oral well-being, the orthodontic supplies market plays a pivotal role in meeting this demand. By offering high-quality products that ensure precision, efficacy, and patient comfort, this market not only supports the growth of orthodontic practices but also contributes significantly to the overall improvement of global oral health standards.

Key Takeaways

- The orthodontic supplies market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major orthodontic supplies industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Increasing awareness about the necessity for early orthodontic intervention boosts a number of parents to seek orthodontic treatments for their children. Subsequently, the demand for orthodontic supplies is rising as orthodontists necessitate a comprehensive arsenal of materials and tools to accurately diagnose and effectively treat these conditions. As this trend continues to increase, the orthodontic supplies market plays a pivotal role in meeting the evolving needs of practitioners and addressing the expanding scope of malocclusion treatments worldwide.

The cost of orthodontic treatments, notably advanced options like clear aligners, often presents a substantial financial obstacle for patients. This expense is primarily attributed to the sophisticated materials and technology utilized, along with the expertise demanded from orthodontic professionals. Such high costs can discourage individuals from pursuing orthodontic care. Therefore, this financial barrier hampers orthodontic supplies market growth, particularly in regions where affordability remains a significant concern.

The increasing trend of dental tourism presents a significant opportunity for the orthodontic supplies market players. As individuals seek more affordable alternatives for dental care abroad, particularly in developing countries like Turkey, Thailand, and Mexico, there arises an increase in demand for orthodontic supplies in these destinations. Orthodontic practitioners catering to dental tourists require a comprehensive range of high-quality materials and tools to deliver effective treatments, thus driving the demand for orthodontic supplies market opportunity in these emerging markets.

Global Orthodontic Supplies Market - Key Companies Overview

Align Technology, Inc., headquartered in San Jose, California, is a prominent global medical device company known for its flagship product, the Invisalign system of clear aligners. Specializing in the design, manufacture, and marketing of orthodontic solutions, Align offers a comprehensive range of products and services tailored to orthodontists and general dental practitioners (GPs) . Their portfolio includes the innovative Invisalign clear aligners for malocclusion treatment, Vivera retainers for retention, iTero intraoral scanners, and exocad CAD/CAM software for digital orthodontics and restorative dentistry.

On January 03, 2024, Align Technology, Inc. announced the completion of its acquisition of Cubicure GmbH, a leader in direct 3D printing solutions for polymer additive manufacturing. This strategic move strengthens Align's position in the digital orthodontics industry, expanding its capabilities in innovative materials, equipment, and processes for 3D printing.

Envista, another significant player in the dental industry, operates as a global family of more than 30 trusted dental brands. Headquartered in Brea, California, Envista's portfolio encompasses a wide range of dental solutions aimed at improving patient care through digitization, personalization, and democratization of oral care. Their offerings cover various aspects of dental practice, including implant-based tooth replacements, orthodontic treatments, digital imaging and diagnostics, restoratives, endodontics, rotary instruments, infection prevention, and loupes.

Envista's Orthodontic Solutions businesses, including brands such as Ormco, Damon, Insignia, AOA, and Spark, have a rich history spanning over 60 years. Renowned for providing orthodontic professionals with high-quality, innovative products and educational support, Envista leads the industry in advanced orthodontic technology and services. Their product lineup includes brackets and wires, archwires, clear aligners, digital orthodontic treatments, retainers, and other orthodontic laboratory products. The Damon System, marketed as a leader in passive self-ligating metal brackets, utilizes innovative technology that requires significantly less force compared to traditional bracket systems. In 2021, Envista launched the Damon Ultima System, revolutionizing passive self-ligation braces technology for faster and more precise finishing. In addition, the introduction of the Ultima Hook in 2022 further represents Envista's commitment toward providing time-saving solutions for dental practitioners.

Market Segmentation

The orthodontic supplies market share is segmented into product type, patient, end user, and region. On the basis of product type, the market is divided into fixed braces, removable braces, adhesives, and others. As per patient, the market is segregated into children & teenagers and adults. On the basis of end user, the market is bifurcated into hospitals, dental clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The orthodontic supplies market size in North America is dynamic and consistently adapting to address the diverse requirements of both patients and practitioners. As per the American Association of Orthodontists, there were approximately 4 million individuals in the U.S. who either required or already had braces in 2022, while 65% of adults lacked properly aligned front teeth. This market segment benefits from a strong focus on technological progress and innovation, offering a wide range of products from traditional braces to advanced clear aligner systems. Factors such as growing awareness about dental aesthetics, increasing demand for orthodontic treatments, and a rising incidence of malocclusion cases are driving market growth. Leading industry players continuously strive to improve product effectiveness, comfort, and aesthetics, while also prioritizing environmentally friendly and sustainable solutions. Moreover, the presence of well-established healthcare infrastructure and favorable reimbursement policies further support the expansion of the regional orthodontic supplies market share.

- In December 2023, Braces On Demand, a premier online 3D printing platform for in-office fabrication of orthodontic fixed appliances, and EasyRx, a prominent supplier of universal lab prescription, digital workflow, and 3D software solutions, collaborated to enhance workflow efficiencies for orthodontic practices.

- In November 2022, American Orthodontics introduced a new B2B ecommerce platform aimed at distributing their intricate and personalized orthodontic equipment and accessories to more than 100 nations globally. With a clientele exceeding 25, 000 in 110 countries, the company needed a system enabling customers to order their regulated goods efficiently and precisely through diverse channels.

- In March 2022, TePe, a prominent oral hygiene brand, introduced a new Orthodontic Kit tailored for the meticulous cleaning of braces and fixed appliances. The TePe Orthodontic Kit showcased specialized cleaning tools that empowered patients to effectively cleanse all sections of their braces, promoting dental health. Equipped with the kit, individuals with braces can experiment with different combinations and establish a personalized dental cleaning regimen tailored to their specific needs.

- In March 2022, in American Fork, UT, OrthoSelect, a prominent orthodontics software company, and digital orthodontics laboratory, in collaboration with Braces On Demand, a provider of in-office 3D printing solutions for orthodontic brackets and appliances, announced the compatibility of their respective systems. The announcement stated that orthodontists were able to accurately position Braces On Demand’s personalized brackets using the DIBS AI digital indirect bonding platform, thereby enhancing treatment outcomes in a reduced timeframe.

Competitive Landscape

The major players operating in the orthodontic supplies market forecast include enVista LLC, American Orthodontics, 3M, Danaher, Henry Schein, Inc., Dentsply Sirona, and Align Technology, Inc.

Other players in orthodontic supplies market include G&H Orthodontics, Institut Straumann AG, Ultradent Products, Inc., 3Shape A/S, and Leone S.p.A.

Recent Key Strategies and Developments

- In April 2024, KLOwen Orthodontics introduced a novel custom metal self-ligating (SL) solution, aiming to revolutionize orthodontic treatment. This innovative product seamlessly combined the advantages of low-friction and non-fatiguing ligation found in various conventional SL solutions with the control and efficiency offered by a custom prescription.

- In April, 2023, OrthoFX, a trailblazer in the advancement of orthodontic aligners, announced that their NiTime Aligners received 510 (k) clearance from the U.S. Food and Drug Administration (FDA) . The NiTime Aligners by OrthoFX marked a pioneering development as the inaugural aligner system explicitly engineered for overnight usage.

- In March 2022, Align Technology, Inc. (Align) , a leading global medical device company renowned for its Invisalign system of clear aligners, iTero intraoral scanners, and exocad CAD/CAM software for digital orthodontics and restorative dentistry, unveiled a new Cone Beam Computed Tomography (CBCT) integration feature for its ClinCheck digital treatment planning software. This user-friendly enhancement amalgamated roots, bone, and crowns into a unified three-dimensional model, facilitating doctors in visualizing a patient's roots as an integral component of the digital treatment planning process.

Industry Trends

- In January, 2024, Henry Schein Orthodontics, the orthodontics division of Henry Schein, Inc., unveiled its latest product, the Carriere Motion Pro bite corrector. This new addition to the Motion portfolio is designed to address the anteroposterior dimension of a patient’s occlusion by fitting to their teeth. It enables clinicians to achieve a Class I platform within an average of three to six months of treatment, even before placing brackets or aligners.

- In May 2022, Align Technology formed a strategic relationship with Asana, Inc. Through this strategic relationship, Align Technology will supply its Invisalign clear aligners to skilled doctors in the U.S. via the Asana Smile configurable workflow solution.

- In May 2022, Straumann acquired PlusDental to increase its presence in the doctor-led consumer orthodontics market in the Netherlands, Sweden, and the UK. Dentsply Sirona acquired Byte, an at-home aligner startup, in January 2021, with the goal of strengthening its clear aligner product line.

- In October 2021, DentalMonitoring, a company known for its innovation in dental and orthodontic care through artificial intelligence, introduced ScanBoxpro. This platform, designed for remote clinical monitoring of orthodontic treatments, is customizable and cloud-based, aiming to streamline the process for each patient and enhance the scalability of practices through a unified automated workflow.

Key Sources Referred

- Eastgate Dental Excellence.

- Align Technology, Inc.

- WHO

- American Association of Orthodontists

- Envista

- MJH Life Sciences

- Oral Health Foundation

- WebMD LLC

- Cleveland Clinic

- World Federation of Orthodontists

- International Association for Orthodontics

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the orthodontic supplies market analysis from 2023 to 2033 to identify the prevailing orthodontic supplies market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the orthodontic supplies market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global orthodontic supplies market trends, key players, market segments, application areas, and market growth strategies.

Orthodontic Supplies Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.1 Billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 380 |

| By Product Type |

|

| By Patient |

|

| By End User |

|

| By Region |

|

| Key Market Players | Danaher, American Orthodontics, ALIGN TECHNOLOGY, INC., Ultradent Products, Inc. (US), 3M, Henry Schein Inc, Dentsply Sirona, Institut Straumann AG, Envista Holding Corporation, 3Shape A/S |

Innovations in orthodontic technology are driving the market forward. Clear aligners, 3D printing, and digital orthodontics are becoming increasingly popular, offering more precise and personalized treatment options.

Orthodontic supplies are primarily used for treatments such as braces, clear aligners, retainers, and other appliances that help align teeth and jaws to improve dental aesthetics and functionality.

Asia-Pacific is the largest regional market for Orthodontic Supplies.

The global orthodontic supplies market was valued at $6.8 billion in 2023, and is projected to reach $14.1 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

The major players operating in the orthodontic supplies market include enVista LLC, American Orthodontics, 3M, Danaher, Henry Schein, Inc., Dentsply Sirona, and Align Technology, Inc.

Loading Table Of Content...