Orthodontics Market Size Projections and Insights, 2030

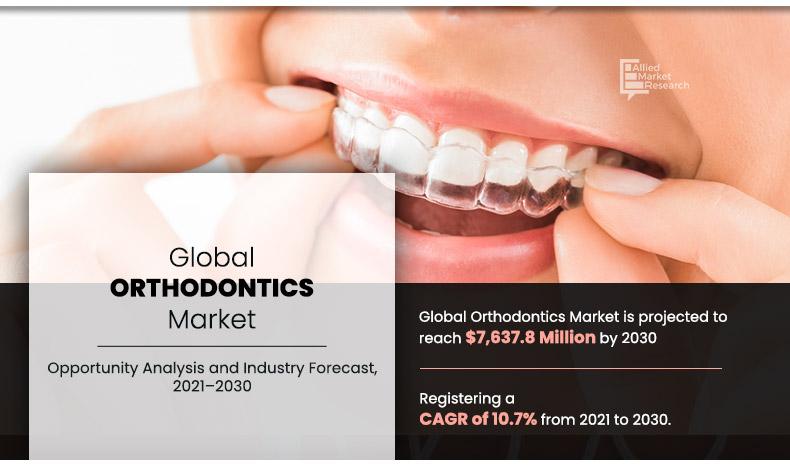

The global orthodontics market size was valued at $2,767.4 million in 2020, and is projected to reach $7,637.8 million by 2030, registering a CAGR of 10.7% from 2021 to 2030. The North America orthodontics industry is significantly impacted by the growing influence of social media on beauty standards. Children segment dominated market share in segmentation by age group in 2020.

Orthodontics Market Growth Drivers

Orthodontics is a specialized branch of dentistry that focuses on diagnosing, preventing, and treating dental and facial irregularities, primarily involving misaligned teeth and jaws. It addresses issues such as overcrowded, crooked, or protruding teeth, as well as bite problems like overbites, underbites, and crossbites. Orthodontic treatment typically involves the use of braces, clear aligners, or other corrective devices to gradually move teeth into their proper position.

The Orthodontics market is primarily driven by the increasing prevalence of dental malocclusion and a rising focus on dental aesthetics. For instance, according to World Health Organization (WHO), it is estimated that oral diseases affect nearly 3.5 billion population in 2020. As patients seek solutions for both functional and cosmetic issues, there is a growing demand for advanced orthodontic treatments like clear aligners, which provide a discreet and convenient alternative to traditional braces. In June, 2021, Ormco Corporation, a global leader in orthodontic solutions, received U.S. Food and Drug Administration (FDA) clearance for the use of its ‘Spark Clear Aligner System’ for orthodontic treatment in younger patients.

Additionally, technological innovations, including 3D imaging and customized treatment plans, are enabling more accurate and efficient procedures. Despite these positive trends, the market is restrained by the high cost of treatments and limited reimbursement options in several regions, making them inaccessible to some patients. Opportunities, however, are abundant, particularly with the expansion of dental care services in emerging economies and increasing awareness of orthodontic care in adult patients. The digitalization of orthodontics and the growing demand for personalized treatments are also key growth areas. A shortage of skilled professionals and the complexity of treatment methods present challenges to the market growth.

By Age Group

Adults segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Industry Highlights

- Growing awareness of dental aesthetics and the increasing demand for invisible orthodontic solutions, such as clear aligners, are driving consumption in the orthodontics market.

- Innovations in 3D printing and digital imaging for customized treatment plans are enhancing production efficiency and improving patient outcomes in orthodontics.

- The rising disposable income in developing economies and growing medical tourism have led to a surge in spending on orthodontic procedures globally.

- A trend towards less invasive, comfortable treatments, such as lingual braces and self-ligating braces, is reshaping patient preferences and fueling market growth.

Technological advancements, particularly the development of clear aligners and the integration of digital tools like 3D imaging, have profoundly impacted the orthodontics industry. Clear aligners have revolutionized orthodontic treatment by offering a more aesthetically pleasing and comfortable alternative to traditional metal braces. Their popularity is driven by their invisibility, removability, and the ability to provide precise, gradual tooth movement. Meanwhile, the integration of digital tools, such as 3D imaging, has significantly enhanced treatment planning and outcomes.

3D imaging allows for highly accurate diagnostics and customized treatment plans, enabling orthodontists to visualize and simulate the end result before commencing treatment. This technology improves the efficiency of treatments and patient satisfaction by ensuring more precise adjustments and reducing the need for multiple visits. Together, these advancements are driving market growth by increasing the appeal of orthodontic treatments and expanding their accessibility, leading to more personalized and effective care solutions.

By Type

Brackets segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key Areas Covered in the Report

- The report analyzes the competitive landscape, including the strategies and market share of leading players in the orthodontics market. It identifies major companies, emerging players, and their market positioning.

- Insights into consumer preferences, such as the growing demand for clear aligners and advanced orthodontic technologies, are explored. The report also covers trends influencing patient choices and treatment outcomes.

- The report applies Porter's Five Forces Model to assess the competitive pressures within the orthodontics market. It evaluates the threat of new entrants, bargaining power of suppliers and buyers, threat of substitute products, and the intensity of competitive rivalry.

- The report highlights strategic initiatives undertaken by companies, such as mergers and acquisitions, technological innovations, and product development efforts aimed at addressing market needs and enhancing competitive advantage.

The orthodontics treatment is essential for improving dental aesthetics and oral health by correcting misaligned teeth and bite issues, reducing the risk of tooth decay, gum disease, and jaw disorders. Consumer preference has shifted towards more discreet and convenient treatments, such as clear aligners, which are preferred for their comfort and aesthetic appeal over traditional braces. Rising awareness of oral health and an increase in disposable income, particularly among adults, have further fueled the demand for orthodontic solutions.

Key industry developments include the integration of digital tools like 3D imaging and computer-aided design (CAD) technology, which improve diagnosis and enable personalized treatment plans. Technological advancements, such as self-ligating brackets and clear aligners, have reduced treatment times and enhanced patient comfort. These innovations, along with the growing focus on aesthetics, are expanding access to orthodontic care and transforming the market. Overall, the orthodontics market is evolving rapidly, driven by consumer demand for more effective and less invasive treatments

Topics discussed in the report

- Adoption of orthodontic treatment among different age group

- Different type of orthodontic products such as brackets, anchorage appliances, ligatures and arch wires.

- Technological advancement in imaging technology

- Product development such as clear aligners

- Role of sustainability in the Orthodontics industry

Orthodontics Market Segment Overview

The orthodontics market is segmented on the basis of age group, type and region. By age group, the market is mainly categorized into adults and children. By type, it is categorized in brackets, anchorage appliances, ligatures and archwires. The brackets are further classified into fixed brackets and removable brackets. The anchorage appliances are divided into bands & buccal tubes and miniscrews. The ligatures are categorized into elastomeric ligatures and wire ligatures. By region, the orthodontics market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Arabia, South Africa, and LAMEA).

The brackets segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to the advancement in brackets and increase in number of key players to manufacture advanced orthodontic product. Moreover, children segment dominated the orthodontics market share in segmentation by age group. This is attributed to the fact that orthodontic issues, such as misaligned teeth, overcrowding, and bite problems, are often identified during childhood. Early treatment can prevent more severe problems later in life, making orthodontics for children a high-demand service.

Comparative Matrix of Key Segments

Parameters | Brackets | Anchorage Appliances | Ligatures | Archwires |

Market Share | Dominated the market share owing to the fact that brackets are used for wide range of orthodontic issues, including complex cases | Growing rapidly owing to high adoption to treat complex cases and anchorage appliances provides Provide strong and reliable anchorage for orthodontic appliances | Comfortable and less likely to cause irritation. Durable and resistant to staining | High adoption over wide range of orthodontic procedure. Strong and durable, providing consistent force on teeth. |

End User | Orthodontists, general dentists with orthodontic capabilities, dental clinics, and orthodontic treatment centers | Orthodontists, oral surgeons, dental clinics, and orthodontic treatment centers | Orthodontists, and dental clinics | Orthodontists, and dental clinics |

Challenges | Higher initial cost, discomfort and irritation, requires regular adjustments and maintenance | Discomfort, visibility of anchorage appliances and maintenance of oral hygiene | Staining and discoloration over time, need for regular replacement. | Can be less flexible, patient discomfort |

Key Players | 3M, Ormco, Align Technology, ClearCorrect (Straumann), SmileDirectClub, OrthoFx, SureSmile | 3M, American Orthodontics, and Medartis | Ormco, 3M, American Orthodontics, Dentaurum. | 3M, American Orthodontics, Dentaurum, Ormco. |

Regional Dynamics and Competition

North America has emerged as a major revenue generator in the orthodontics market share due to a combination of high awareness of orthodontic treatments, advanced healthcare infrastructure, and strong purchasing power among consumers. The region's emphasis on cosmetic dentistry and the availability of cutting-edge orthodontic technologies contribute to its leading position. However, Asia Pacific is expected to register the highest CAGR in the forecast period owing to increasing disposable incomes, rising dental awareness, and expanding healthcare infrastructure. The growing prevalence of malocclusions and a burgeoning middle-class population in countries like China and India are further driving demand for orthodontic treatments, positioning the region as a rapidly growing market.

By Region

North America was holding a dominant position in 2020 and would continue to maintain the lead over the analysis period.

Some of the major players analyzed in this report are M Company, Align Technology, Inc., American Orthodontics, Envista Holdings Corporation, Dentaurum GmbH & Co. KG, Dentsply Sirona Inc., G&H Orthodontics, Inc. (Altaris Capital Partners, LLC), Henry Schein, Inc., Rocky Mountain Orthodontics, Inc. and T.P. Orthodontics, Inc.

Orthodontics Market News Release

- In January 2024, Henry Schein, Inc. launched Carriere Motion Pro bite corrector1 to treat Class II and Class III anteroposterior dimension occlusion before placing brackets or aligners and reducing the treatment time of orthodontics procedures

- In January 2021, Berkman + Shapiro Orthodontics published an article that stated that the number of American individuals wearing braces at any one point in time is roughly 4 million.

- A survey article published in Dentistry Journal in January 2022 reported that there had been a rise in the number of adult patients seeking teeth-aligning treatment in recent years.

- British Orthodontic Society survey in August 2023 reported a 76% increase in adults seeking tooth-aligning treatment after the pandemic and online working modes.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Orthodontics market analysis from 2022 to 2032 to identify the prevailing Orthodontics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Orthodontics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Orthodontics market trends, key players, market segments, application areas, and market growth strategies.

Orthodontics Market Report Highlights

| Aspects | Details |

| By Age Group |

|

| By Type |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Orthodontics procedures are used to close the wide gaps between the teeth and align the tips of the teeth. The brackets, anchorage appliances, ligatures and archwires are some of the most common type of orthodontics. The brackets segment dominates the market owing to the advancements in brackets and prevalence of oral disorders.

Factors such as increase in prevalence of malocclusion, rise in number of orthodontist, and rise in geriatric population treatment drive the growth of market. In addition, advancement in orthodontics procedures are expected to drive the growth of the orthodontics market.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in prevalence of dental disorders, the presence of key players for manufacturing orthodontics product, and advancement in R&D activities in dental sector, in the region.

However, the high cost of orthodontic product is expected to hamper market growth during the forecast period.

The total market value of Orthodontics market is $2,767.4 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of Orthodontics Market in 2021 was $3,058.5 million

The base year for the report is 2020.

Yes, Orthodontics companies are profiled in the report

The top companies that hold the market share in Orthodontics market are 3M Company, Align Technology, Inc., American Orthodontics, Envista Holdings Corporation, Dentaurum GmbH & Co. KG, Dentsply Sirona Inc., G&H Orthodontics, Inc. (Altaris Capital Partners, LLC), Henry Schein, Inc., Rocky Mountain Orthodontics, Inc. and T.P. Orthodontics, Inc

Asia-Pacific is expected to register highest CAGR of 12.8% from 2021 to 2030, owing to an increase in the number of dentists, rise in healthcare expenditures of patients and high target population

The key trends in the Orthodontics market are by increase in number of geriatric population, rise in awareness about oral health, and surge in demand for orthodontic products

Loading Table Of Content...