Otolaryngology Endoscopy Market Research, 2035

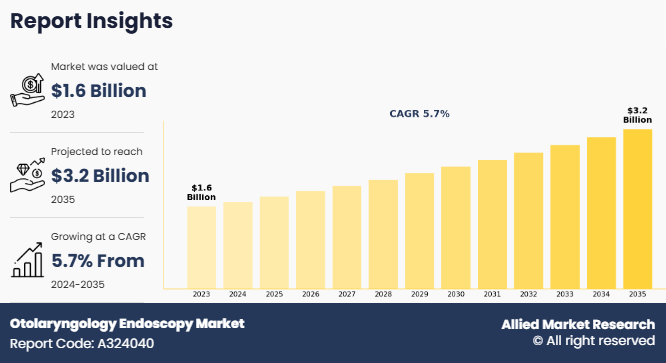

The global otolaryngology endoscopy market size was valued at $1.6 billion in 2023, and is projected to reach $3.2 billion by 2035, growing at a CAGR of 5.7% from 2024 to 2035. The growth of the otolaryngology endoscopy market is driven by rise in prevalence of ENT disorders, increase in adoption of minimally invasive procedures, and technological advancements in endoscopic imaging & navigation systems.

In addition, rise in geriatric population, which is more prone to ENT disorders and improved healthcare infrastructure, especially in emerging markets, fuels demand. For instance, according to the World Health Organization, by 2030, 1 in 6 people in the world are expected to be aged 60 years or over. At this time, the share of the population aged 60 years and over is expected to increase from 1 billion in 2020 to 1.4 billion. Furthermore, rise in the number of outpatient procedures further contributes to otolaryngology endoscopy market growth.

Key Takeaways

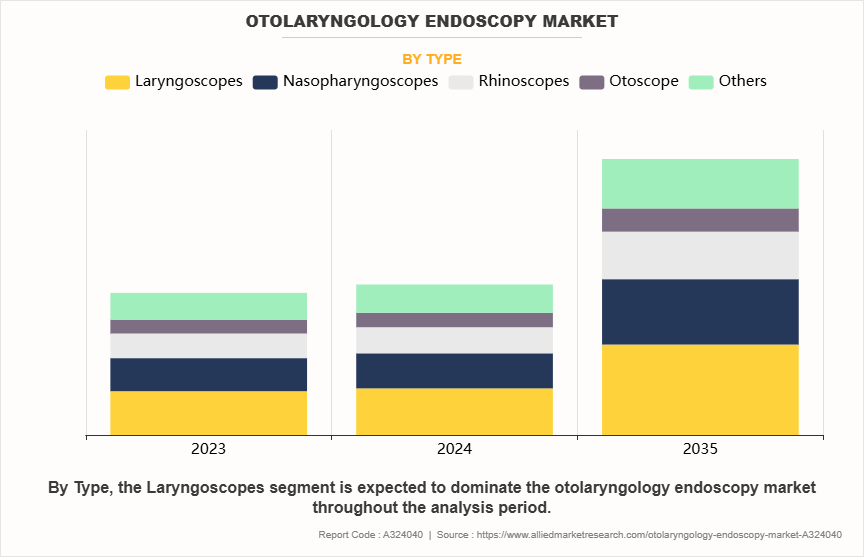

- By type, the Laryngoscopes segment was the largest contributor to the market in 2023 and is also expected to register the highest CAGR during the forecast period.

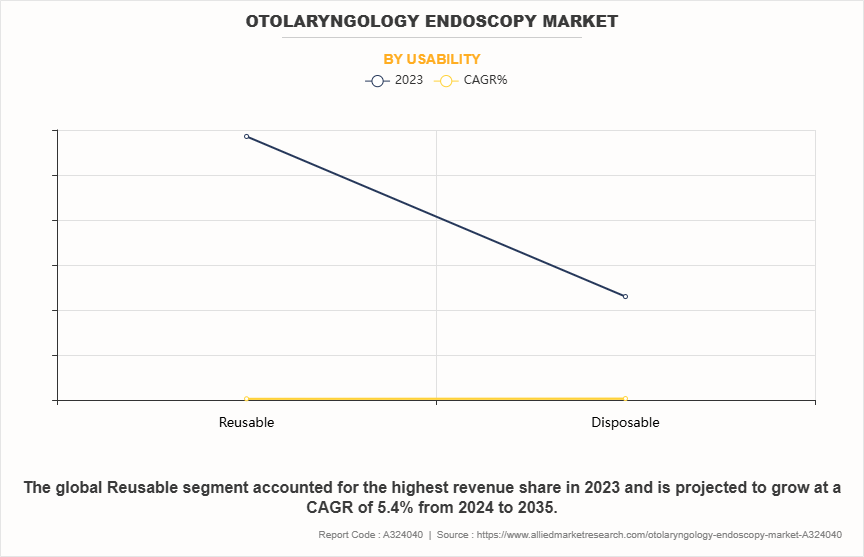

- By usability, the reusable segment was largest contributor to the market in 2023 disposable is expected to register the highest CAGR during the forecast period.

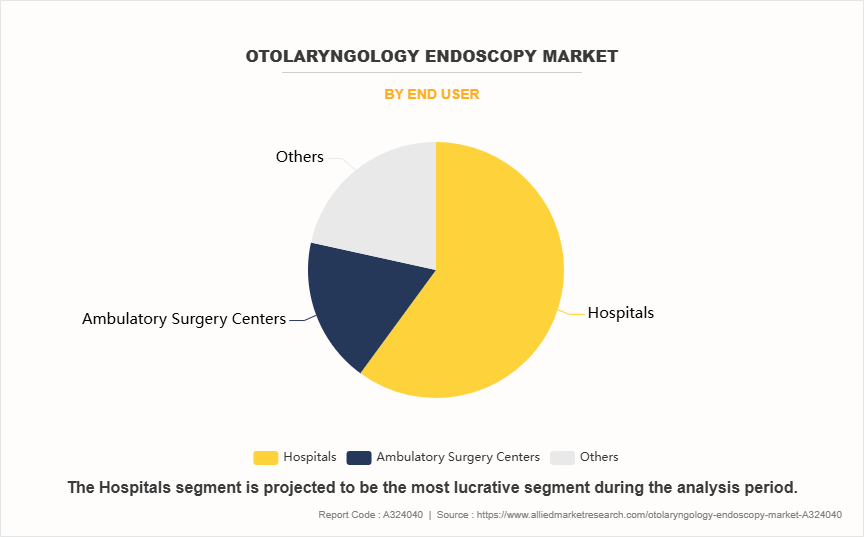

- By end user, the hospitals segment dominated the market in 2023, and the ambulatory surgical centers segment is expected to grow at a highest CAGR during the forecast period.

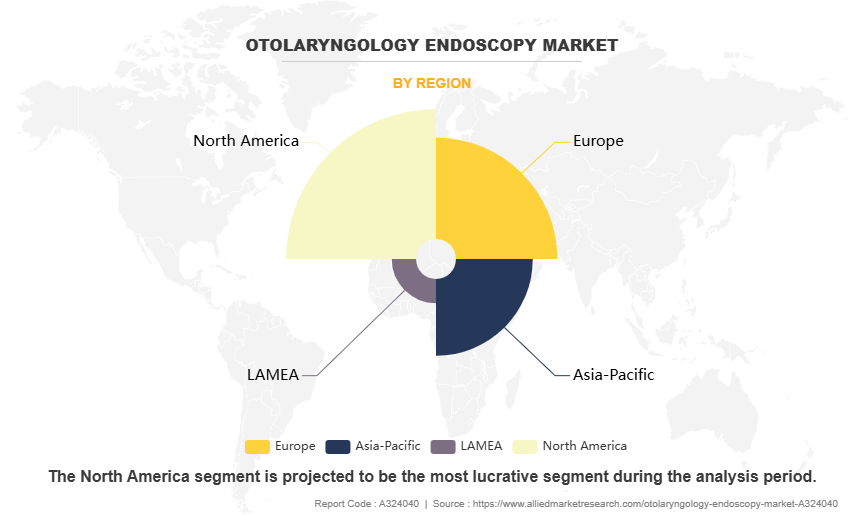

- Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Otolaryngology endoscopy is a minimally invasive diagnostic and therapeutic procedure used to examine the ears, nose, throat, and related structures. This procedure involves the use of an endoscope, a flexible or rigid tube equipped with a camera, to visualize internal areas of the head and neck. It is commonly used in diagnosing conditions such as sinusitis, nasal obstructions, throat cancers, and ear infections. Endoscopy allows precise treatment, such as biopsies, removal of polyps, or drainage of sinuses, with minimal recovery time. It plays a crucial role in enhancing diagnostic accuracy and improving patient outcomes in otolaryngology. It is widely used in outpatient and surgical settings for both diagnostic assessments and guided interventions.

Market Dynamics

The otolaryngology endoscopy market size has experienced significant growth, driven by factors such as increase in prevalence of ear, nose, and throat (ENT) disorders, advancements in endoscopic technologies, and rise in demand for minimally invasive procedures. For instance, according to the World Health Organization (WHO), approximately 466 million people globally suffer from disabling hearing loss, and the incidence of conditions, such as chronic rhinosinusitis (CRS), affects around 11% of the global population. These statistics highlight a growing need for accurate diagnostic and treatment modalities, fueling the demand for otolaryngology endoscopy systems.

One of the key factors driving the otolaryngology endoscopy market growth is the rise in the incidence of ENT-related disorders. The aging population is particularly susceptible to conditions such as hearing loss, voice disorders, and nasal obstructions. As people age, the incidence of chronic conditions such as otitis media, sinusitis, and laryngitis increase, further contributing to the demand for endoscopic procedures. According to the American Academy of Otolaryngology-Head and Neck Surgery (AAO-HNS), about 30 million Americans suffer from chronic sinusitis, a condition often requiring endoscopic intervention for diagnosis and treatment.

Technological advancements in endoscopic systems will play a crucial role in expansion during otolaryngology endoscopy market forecast. The introduction of high-definition (HD) video endoscopy, 3D imaging, and narrow-band imaging (NBI) has significantly improved the precision and efficiency of diagnoses, offering clear, real-time visualization of the ENT structures. For instance, companies such as Olympus and Karl Storz have introduced innovative endoscopic systems with superior imaging quality, compact designs, and ergonomic features that enable surgeons to perform complex procedures with greater ease and accuracy. These technological improvements contribute to higher procedure success rates and better patient outcomes, encouraging their adoption in both diagnostic and therapeutic settings.

In addition, the demand for minimally invasive procedures drives market expansion. Endoscopy offers several advantages over traditional surgical methods, including smaller incisions, reduced risk of infection, faster recovery times, and less postoperative pain. This has resulted in a shift toward endoscopic treatments in both developed and emerging markets. For instance, endoscopic sinus surgery (ESS) has become the standard of care for chronic rhinosinusitis, replacing the need for more invasive procedures. In addition, the ability to perform in-office procedures such as laryngoscopy and nasal endoscopy has helped reduce healthcare costs and improve patient convenience, making endoscopy an increasingly popular choice for both patients and healthcare providers.

However, the market faces several restraints. The high cost of advanced endoscopic equipment remains a significant barrier, particularly in low-resource settings or smaller healthcare facilities. Endoscopic systems require substantial investment, and their maintenance and operational costs are prohibitive. In addition, the lack of skilled professionals proficient in using these advanced systems could limit their widespread adoption. Despite the growing availability of training programs, the need for specialized expertise remains a challenge, especially in regions where healthcare infrastructure is underdeveloped.

The potential regulatory challenges further restrain market growth. The approval process for new endoscopic devices is lengthy and expensive, with stringent regulations governing the safety and effectiveness of these technologies. The market players must comply with the regulations set forth by authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). In some cases, delays in regulatory approvals hinder the speed at which new technologies enter the market, affecting the overall growth rate.

Despite these restraints, the otolaryngology endoscopy market presents numerous opportunities. Increase in demand for outpatient procedures presents a significant growth opportunity. Many endoscopic procedures, such as laryngoscopy and nasal endoscopy, are now performed in outpatient settings, reducing the need for lengthy hospital stays. This is particularly attractive in markets with rise in healthcare costs, where patients and providers seek more cost-effective solutions. The shift to outpatient care is supported by technological innovations such as portable endoscopy systems, which offer mobility and ease of use in various clinical settings.

Moreover, the emerging markets in Asia-Pacific, Latin America, and the Middle East present substantial growth potential for the otolaryngology endoscopy market. Increase in prevalence of ENT disorders in these regions, rise in healthcare investments, and improvements in medical infrastructure are expected to drive demand for advanced diagnostic and treatment tools. For instance, according to World Health Organization, in India, where the number of people suffering from hearing loss is expected to increase to over 63 million by 2030, the demand for ENT procedures is projected to rise significantly. As healthcare access improves, particularly in rural areas, the adoption of endoscopic systems is likely to see a surge.

Segmental Overview

The otolaryngology endoscopy industry is segmented into type, usability, end user, and region. On the basis of the type, it is divided into laryngoscopes, nasopharyngoscopes, rhinoscopes, otoscope, and others. On the basis of usability, the market is segregated into reusable and disposable. On the basis of end user, the market is categorized into hospitals, ambulatory surgery centers, and others.

Region wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Type

The laryngoscopes segment was the largest contributor to the otolaryngology endoscopy market in 2023 and is also expected to register the highest CAGR during the forecast period. This can be attributed to the increasing prevalence of diseases related to the larynx, such as laryngeal cancer, vocal cord disorders, and other respiratory conditions, which require accurate diagnosis and treatment. Laryngoscopes play a crucial role in both diagnostic and therapeutic procedures for these conditions, making them essential tools in ENT practices.

Furthermore, advancements in laryngoscope technology, including the development of flexible and high-definition models, have enhanced their effectiveness and usability, driving their demand. The rise in minimally invasive surgeries and the growing preference for non-surgical interventions in the treatment of laryngeal diseases further contribute to the increasing adoption of laryngoscopes. In addition, the aging population, who are more prone to voice and swallowing disorders, is another key factor boosting the demand for laryngoscopy procedures. As a result, the laryngoscopes segment is poised for continued growth, both in terms of market share and innovation, making it a key driver in the otolaryngology endoscopy market.

By Usability

The reusable segment dominated the otolaryngology endoscopy market share in 2023 due to its long-term cost-effectiveness, durability, and widespread adoption in healthcare settings. Reusable endoscopes are designed to withstand multiple uses, which makes them a preferred choice for hospitals and clinics with high patient turnover. Their ability to be sterilized and reused across various procedures also aligns with sustainability goals, making them an economically viable option for institutions with budget constraints. Furthermore, reusable devices are typically associated with higher quality and precision, which has solidified their popularity in professional medical settings.

However, the disposable segment is expected to register the highest CAGR during the forecast period. This growth can be attributed to the increasing emphasis on patient safety and infection control. Disposable endoscopes, which are used once and then discarded, significantly reduce the risk of cross-contamination and infection transmission, making them highly attractive in environments where sterility is a critical concern. The growing number of outpatient clinics, smaller healthcare facilities, and mobile healthcare units that may not have the capacity for extensive sterilization processes also supports the demand for disposable devices.

By End User

The hospitals segment dominated the otolaryngology endoscopy market in 2023 due to their comprehensive healthcare infrastructure, advanced diagnostic capabilities, and high patient volumes, which drive the demand for ENT procedures.

However, the ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR during the forecast period. This growth is fueled by the increasing preference for outpatient procedures, cost-effectiveness, shorter recovery times, and the rising adoption of minimally invasive surgeries, which make ASCs an attractive option for both patients and healthcare providers.

By Region

The otolaryngology endoscopy market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America region dominated the otolaryngology endoscopy market share in terms of revenue in 2023. The growth in this region is driven by the presence of advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and increasing awareness about patient safety and recovery. The region also has a significant prevalence of diseases related to the ear, nose, and throat (ENT), such as sinusitis, throat cancer, and sleep apnea, which drive the demand for endoscopic procedures. In addition, the presence of leading manufacturers and favorable reimbursement policies ensures consistent revenue generation.

For instance, according to the American Medical Association, health spending in the U.S. increased by 4.1% in 2022 ($4.4 trillion). The rise in healthcare expenditures is paralleled by increased investments in advanced medical technologies, further fueling the growth of the otolaryngology endoscopy market. The region also benefits from a high number of ENT surgeries and diagnostic procedures, which increases the demand for advanced endoscopic devices. Moreover, government initiatives to improve healthcare standards and invest in cutting-edge technologies are contributing to market growth in North America. The increasing prevalence of ENT-related conditions and the aging population are key factors influencing market expansion in the region.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This growth is attributed to the rapid expansion of healthcare infrastructure, increased investments in medical technologies, and rising healthcare awareness across the region. The growing elderly population and the increasing prevalence of chronic ENT diseases are contributing to the demand for advanced otolaryngology endoscopy solutions. As the region witnesses a rise in the number of surgeries and critical care cases, the need for efficient diagnostic and treatment options, such as endoscopes, is expected to grow significantly. Increasing awareness of otolaryngology procedures, economic development in emerging economies, and government initiatives to improve healthcare accessibility are also driving the adoption of advanced endoscopic devices. In addition, improvements in healthcare access in countries like China and India further contribute to the growth of the otolaryngology endoscopy market in the region.

Competition Analysis

Major key players that operate in the global otolaryngology endoscopy market are Ambu A/S, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, Olympus Corporation, BSEDATA, Optim LLC, Pioneer Healthcare Technologies, Ottomed Endoscopy, HOYA Corporation, and American Diagnostic Corporation. The key players operating in the market have adopted product launch and partnership as their key strategies to expand their product portfolio.

Recent Developments in the Otolaryngology Endoscopy Industry

- In September 2023, Olympus Corporation launched Vathin E SteriScope single-use flexible video rhinolaryngoscope for use in diagnostic and therapeutic otorhinolaryngological procedures.

- In July 2020, Optim partnered with MedShare of Decatur, GA to donate the companies ENTity Nasopharyngoscopes to under-served communities around the globe.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the otolaryngology endoscopy market analysis from 2023 to 2035 to identify the prevailing otolaryngology endoscopy market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the otolaryngology endoscopy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global otolaryngology endoscopy market trends, key players, market segments, application areas, and market growth strategies.

Otolaryngology Endoscopy Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 3.2 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2023 - 2035 |

| Report Pages | 290 |

| By Type |

|

| By Usability |

|

| By End User |

|

| By Region |

|

| Key Market Players | Fujifilm Holdings Corporation, Ambu A/S, Pioneer Healthcare Technologies, American Diagnostic Corporation., BESDATA, HOYA Corporation., OPTIM LLC, Ottomed Endoscopy, KARL STORZ SE & Co. KG, Olympus Corporation |

Analyst Review

The Otolaryngology endoscopy market has expanded due to increase in prevalence of ENT disorders and rise in awareness about early diagnosis & minimally invasive surgical techniques. Advancements in endoscopic technologies, such as high-definition imaging and narrow-band imaging, further drive the adoption of endoscopy systems and contribute to market growth.

The government initiatives to improve access to ENT healthcare services and promote awareness about hearing and sinus-related disorders fuel market growth. In addition, growing medical tourism and increased investments in private healthcare in the developing regions, such as Asia-Pacific, foster market expansion.

North America generated the largest revenue in 2023, owing to its advanced healthcare infrastructure, high adoption of cutting-edge endoscopic technologies, and increase in number of ENT procedures driven by a growing geriatric population. The presence of key market players and continuous technological innovations in endoscopy systems further solidified the region's leading market position. However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period owing to rise in prevalence of ENT disorders, increased adoption of advanced endoscopic devices, and significant investments in expanding healthcare infrastructure.

The top companies holding market share in the otolaryngology endoscopy market include Karl Storz, Olympus Corporation, Medtronic, Stryker, driven by their advanced product offerings, strong distribution networks, and continuous innovations in endoscopic technology.

The otolaryngology endoscopy market was valued at $1,631.02 million in 2023 and is estimated to reach $3,167.36 million by 2035, exhibiting a CAGR of 5.7% from 2024 to 2035.

North America is the largest regional market for otolaryngology endoscopy, driven by advanced healthcare infrastructure, high adoption of innovative endoscopic technologies, a growing geriatric population, and favorable reimbursement policies for ENT procedures.

The leading application of the otolaryngology endoscopy market is diagnosis and treatment of chronic sinusitis, driven by the high prevalence of sinus-related disorders and the growing adoption of minimally invasive endoscopic sinus surgeries (ESS) for improved patient outcomes.

Upcoming trends in the global otolaryngology endoscopy market include the increasing adoption of AI-powered image analysis for enhanced diagnostics, the rise of single-use disposable endoscopes for infection control, and advancements in 4K and 3D imaging technologies for improved visualization. Additionally, the integration of robotic-assisted endoscopy and the expansion of outpatient ENT procedures in ambulatory surgical centers are shaping market growth.

Loading Table Of Content...

Loading Research Methodology...