Outdoor Payment Terminal (OPT) Market Research, 2032

The global outdoor payment terminal (opt) market was valued at $1.6 billion in 2022, and is projected to reach $4.8 billion by 2032, growing at a CAGR of 11.8% from 2023 to 2032.

Outdoor payment terminal (OPTs) are unattached payment terminal which offer self-service transaction options to customer, through means of contact or contactless payment methods, in a secure and fast manner. For end-user industries that see large number of transactions daily, having a self-service payment terminal enables customers to avail services and conveniently pay without the need of additional staff. Self-service OPT facilitates better security, efficiency, and provide flexibility to transaction processes.

Increasing penetration of smartphones and rise in adoption of cloud-based OPTs and AI integration is boosting the growth of the global market. In addition, growing preference to non-cash transactions is positively impacts growth of the market. However, security issues and privacy concerns and high deployment and maintenance cost is hampering the outdoor payment terminal (OPT) market growth. On the contrary, rising adoption of OPT solutions among SMEs is expected to offer remunerative opportunities for expansion of the outdoor payment terminal (OPT) market during the forecast period.

Segment Review

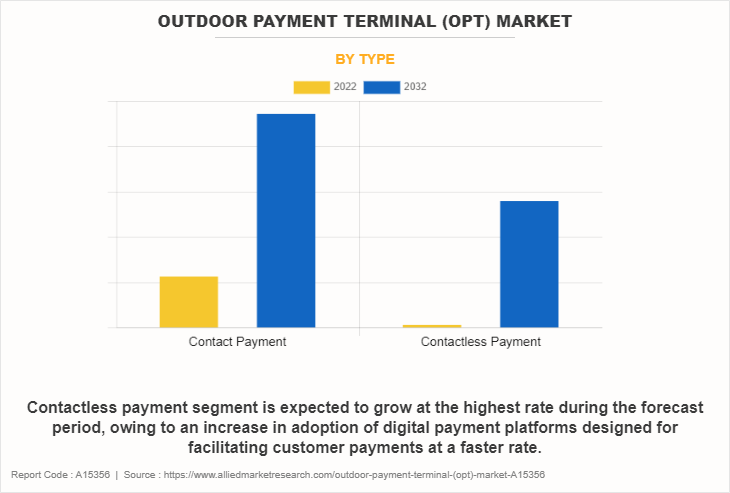

The outdoor payment terminal (OPT) market is segmented on the basis of by type, application, and region. On the basis of type, the market is categorized into contact payment, and contactless payment. On the basis of application, the market is fragmented into refuel, carwash, malls, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of type, the contact payment segment holds the highest outdoor payment terminal (OPT) market size as it provides personalized services, accelerates throughput, and reduces operational costs. However, the contactless payment segment is expected to grow at the highest rate during the forecast period, owing to, increasing global adoption of digital payment platforms designed for facilitating customer payments at a faster rate.

Region wise, the outdoor payment terminal (OPT) market share was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to increasing investments in developing technologically advanced solutions for contactless payments, such as NFCs and RFIDs.. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rise in outdoor payment terminal (OPT) technology investment.

The key players that operate in the outdoor payment terminal (OPT) market are Apple Inc., Capgemini SE, dover fueling solutions, Finastra Group Holdings Limited, Gilbarco Inc, Invenco Group Ltd., Scheidt & Bachmann GmbH, Temenos AG, NCR Corporation, and Verifone, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the outdoor payment terminal (OPT) industry.

Digital Capabilities

The growing use of technologies like AI, IOT, and ML for quicker transactions at gas stations, together with advantages like the ease of comfort provided by OPT, will fuel industry expansion. Groundbreaking technology such as artificial intelligence (AI), internet of things (IoT) and digital platforms will continue to open up completely new possibilities, enabling entirely new approaches to paying. Increasing adoption of contactless or near-field communications (NFC) technology for credit card payment and next gen payment options in RFID and smartphone devices that support mobile-pay applications through digital scanners are expected to revolutionize the payment solutions in coming years. The application of outdoor payment terminal is mostly for fuel retail sites and EV charging stations, however with the adoption of technology the application for adjacent services will derive the future growth. New entrants are partnering with other companies to enhance their offerings and improve customer experience will give major boost to the market. For instance, in March 2020, Invenco partnered with CODAB to run on Invenco Outdoor Payment Terminal (OPTs) and other devices, with each payment terminal talking directly to the pump, payment host and back office system to complete fueling transactions.

Key Benefits

The modern OPTs solves the end user-POS machine pain points. New OPTs systems are designed to maximize the service uptime of the terminals, reduce maintenance, and increase the serviceability of the terminals, providing continuous and uninterrupted operation 24/7. These systems also withstand various harsh outdoor environmental climate conditions and fluctuations such as temperature, water and dust resistance, and anti-corrosion. EMV chip technology can store far more information than magnetic stripe credit cards as it allows these credit cards to hold encrypted data and helps to protect against in-store payment fraud. Such benefits fuels the outdoor payment terminal (OPT) market.

Government Initiatives

In the transition to zero-emission, the Government of New Zealand has set federal targets for zero-emission vehicles to reach 35% of annual new vehicle sales by 2025; and 100% by 2050. New Zealand is ideally positioned to gain from electric cars since more than 80% of power is generated from renewable sources, and there is sufficient supply to support broad adoption of EVs. With clean fuel infrastructure policies and competitive tax policies, New Zealand is expected to see rise in fuel stations across the country over the few years in future. Moreover, the government of Canada is making investments to support the transformation towards electrification, including $295 million to the Ford Motor Company of Canada’s $1.8 billion project to build electric vehicles at its Oakville Assembly Complex. Public Services and Procurement Canada (PSPC) and greening government operations will lead to an increase in procurement of electrical fleet vehicles installation of EV Charging Stations This will generate the development of more EV Charging Stations, hence, OPTs at these stations. Such initiatives fuels the growth of the outdoor payment terminal (OPT) Market.

Top Impacting Factors

Increase in Penetration of Smartphones

Rising smartphone penetration and internet usage across countries such as China, India, the U.S., and others owing to the increasing availability of high-end features and high consumer disposable income. Furthermore, due to the rising popularity of smartphones, manufacturers and key market players are increasing their efforts to introduce new and more efficient smartphones at affordable rates. By adding a layer of authentication to payment portals to secure information, users have increased customer trust. Thus, the increasing penetration of smartphones and the internet is driving the growth of the outdoor payment terminal market.

Rise in Adoption of Cloud-based OPTs and AI Integration

Rise in adoption of cloud-based and artificial intelligence (AI) driven the outdoor payment terminal solutions among enterprises and small merchants aids market growth. In addition, AI-based services in system are gaining popularity and increasing across developing countries such as U.S., UK, France, and others. Moreover, several leading players in the market are developing cloud and AI-based OPT systems and software to remain competitive. For instance, in October 2019, Invenco released Invenco-i2, a monthly-payment solution. The new product aimed to retrofit the key dispenser brands known across the United States forecourts. It is also linked with Invenco Cloud Services to enable remote key Injection as well as software upgrades. This factor has led to a surge in demand for cloud based OPTs, thereby fueling the growth of the market.

High Deployment and Maintenance Cost

Implementing OPT software solutions requires substantial investments in terms of hardware, software, and personnel. This is a major deterrent for small and medium-sized banks and financial institutions, thus hindering their adoption of banking software solutions. In addition, in the demand for outdoor payment terminals is the considerable deployment and maintenance cost of this machine. When choosing cutting-edge technology, such as outdoor payment terminals (OTP), debit cards, UPI, and online banking, the cost is a crucial factor. In addition, these terminals are made with high precision along with advanced technologies. Moreover, applications with high security are often expensive. In contrast to online banking and cash-based transactions, PoS Terminal machines have extremely high initial costs as well as ongoing maintenance costs. The high installation cost is the main factor hindering the development of the OPTS market during the projected timeframe. Moreover, to modernize software changes, tech-stack is required, as a result ensuring compatibility of legacy components, while mitigating application to the cloud for data storage leads to compatibility issues and fixing compatibility issues leads to higher cost, thus hindering the market growth.

Rising Adoption of OPT Solutions among SMEs

Small businesses are implementing OPT systems to benefit from the host of benefits associated with them. Moreover, effective OPT systems allow business owners to reduce time spent on business administration by offering relevant reports to help speed up decision-making in a timely manner. In addition, the technological capability of wireless OPT systems to interconnect with smartphones or tablets via a mobile card reader is increasing their adoption in several areas. In addition, the low installation cost of mobile point-of-sale systems and their capacity to deliver value-added services for long-term operations are the primary factors attracting the attention of merchants and retailers. Furthermore, public governance systems favor the deployment of the most effective mobile outdoor payment terminal due to their capacity to transmit transparent pricing and money transfer information. As a result of these reasons, the market for outdoor payment terminal is expected to expand throughout the forecast period.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the outdoor payment terminal (OPT) market analysis from 2023 to 2032 to identify the prevailing outdoor payment terminal (OPT) market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the outdoor payment terminal (OPT) market segmentation assists to determine the prevailing outdoor payment terminal (OPT) market demand.

Major countries in each region are mapped according to their revenue contribution to the global outdoor payment terminal (OPT) market forecast.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global outdoor payment terminal (OPT) market trends, key players, market segments, application areas, and market growth strategies.

Outdoor Payment Terminal (OPT) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.8 billion |

| Growth Rate | CAGR of 11.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Capgemini SE, NCR Corporation, Scheidt & Bachmann GmbH, Gilbarco Inc, Verifone, Inc, Finastra Group Holdings Limited, Apple Inc., Dover Fueling Solutions, Invenco Group Ltd., Temenos AG |

Analyst Review

Outdoor payment terminals or OPTS offer quick and secure self-service transaction choices to customers using contactless or contact payment methods. Outdoor payment terminals enable customers to benefit from services and pay effortlessly without the need for additional workers in end-user businesses that see significant daily transaction volumes, such as gas stations.

The global outdoor payment terminals market is expected to register high growth, owing to rise in consumer awareness about security features such as facial recognition and biometric software offered by smartphone-based payments. Thus, the increase in adoption of OPTs owing to their high reliability and low latency networks is one of the most significant factors that drives the growth of the market. With the surge in demand for OPTs, various companies have established alliances to increase their capabilities. For instance, in May 2022, Finastra partnered with Mindtree, a digital transformation and technology services company. Following this partnership, Finastra is expected to integrate its Fusion Payments to Go payments technology into banks across Ireland and the UK to enable them to access Fusion Payments to Go solutions that is operated on Mindtree’s cloud.

In addition, with further growth in investment across the globe and rise in demand for OPT, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in June 2022, Finastra launched an embedded consumer lending solution. With this launch, the company aimed to enable consumers to access conventional regulated lending options at point-of-sale. In addition, this partnership also is projected to offer more options to consumers along with a substitute to the Buy Now Pay Later approach.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, in March 2023, Ingenico acquired Phos. This acquisition helped to allow enterprise customers to equip their sales associates with tablet-type devices for in-aisle payments acceptance

The Outdoor payment terminal (OPT) market is estimated to grow at a CAGR of 11.8% from 2023 to 2032.

The Outdoor payment terminal (OPT) market is projected to reach $4,753.02 million by 2032.

Increasing penetration of smartphones and rise in adoption of cloud-based OPTs and AI integration is boosting the growth of the global outdoor payment terminal (OPT) market. In addition, growing preference to non-cash transactions is positively impacts growth of the outdoor payment terminal (OPT) market. However, security issues and privacy concerns and high deployment and maintenance cost is hampering the outdoor payment terminal (OPT) market growth. On the contrary, rising adoption of OPT solutions among SMEs is expected to offer remunerative opportunities for expansion of the outdoor payment terminal (OPT) market during the forecast period.

The key players profiled in the report include Apple Inc., Capgemini SE, dover fueling solutions, Finastra Group Holdings Limited, Gilbarco Inc, Invenco Group Ltd., Scheidt & Bachmann GmbH, Temenos AG, NCR Corporation, and Verifone, Inc.

The key growth strategies of Outdoor payment terminal (OPT) market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...