Pain Management Drugs Market Research, 2033

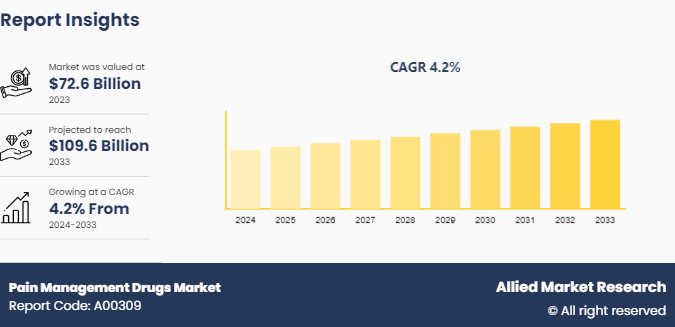

The global pain management drugs market size was valued at $72.6 billion in 2023, and is projected to reach $109.6 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033. The pain management drugs market is driven by aging global population prone to chronic conditions, technological advancements in drug delivery systems and formulations, and regulatory support for innovative pain therapies drives market expansion.

Market Introduction and Definition

The pain management drugs encompasses pharmaceuticals designed to alleviate pain, ranging from mild discomfort to severe agony. These medications target various types of pain, including neuropathic, musculoskeletal, and inflammatory pain. Pain management drugs work through diverse mechanisms, such as inhibiting pain signals in the nervous system, reducing inflammation, or altering brain chemistry to modulate pain perception. These drugs are used for wide range of conditions, including arthritis, postoperative pain, cancer-related pain, and chronic back pain. As the understanding of pain mechanisms evolves, so does the development of novel pain management therapies, aiming to provide effective relief with minimized side effects. Common categories include opioids, nonsteroidal anti-inflammatory drugs (NSAIDs) , acetaminophen, and antidepressants.

Key Takeaways

The pain management drugs market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major pain management drugs industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The global pain management drugs market growth is driven by rise in prevalence of pain-related conditions and advancements in pharmaceutical research and development. Rise in prevalence of chronic diseases such as heart disease, stroke, type II diabetes, and cancer drive the pain management drugs market. In addition, advancements in pharmaceutical research have also fueled market growth. Novel drug formulations and delivery methods offer improved efficacy, safety, and patient convenience. For instance, the development of extended-release formulations ensures prolonged pain relief with reduced dosing frequency, enhancing patient compliance and treatment outcomes. Furthermore, the emergence of non-opioid alternatives addresses concerns about the addictive potential and adverse effects associated with traditional opioid medications further drive the growth during pain management drugs market forecast. These alternatives include NSAIDs, antidepressants, anticonvulsants, and topical analgesics, providing diversified options for pain management across different pain types and patient profiles.

However, the side effects associated with pain management drugs including NSAIDs and opioids, can cause adverse effects such as gastrointestinal bleeding, cardiovascular events, renal impairment, sedation, and respiratory depression, which may limit the market growth. Concerns about these side effects, particularly among vulnerable populations such as the elderly and patients with comorbidities, lead to cautious prescribing practices and patient reluctance to use these medications, thereby hindering the market growth.

On the other hand, advancements in drug delivery systems and formulations present a lucrative pain management drugs market opportunity. The development of novel delivery mechanisms such as transdermal patches, sustained-release formulations, and implantable devices enhances the efficacy and safety of pain management drugs, catering to diverse patient needs and preferences.

Market Segmentation

The pain management drugs market size is segmented into drug class, indication, pain type, and region. On the basis of drug class, the market is categorized into NSAIDs, anesthetics, anticonvulsants, antimigraine agents, antidepressants, opioids, and nonnarcotic analgesics. Opioids are further classified into tramadol, hydrocodone, oxycodone, and others (fentanyl, morphine, meperidine, codeine, and methadone) . On the basis of indication, the market is divided into arthritic pain, neuropathic pain, cancer pain, chronic back pain, postoperative pain, migraine, fibromyalgia, muscle sprain/strain, bone fracture, acute appendicitis, and others. By pain type, the market is classified into chronic pain and acute pain. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Clinical Trials Statistics of Global Pain Management Drugs Market

Statistics encompass various phases of clinical trials, including preclinical studies, Phase I, II, and III trials, and post-marketing surveillance. They provide insights into the effectiveness of pain management drugs in alleviating different types of pain, ranging from acute to chronic conditions. For instance, according to a clinicaltrial.Gov.in 2022, a study was sponsored by Vertex Pharmaceuticals Incorporated to evaluate the efficacy and safety of vx-548 for acute pain after an abdominoplasty. In addition, in 2023, GlaxoSmithKline sponsored a dose-finding study to evaluate the efficacy and safety of gsk3858279 in adults with knee osteoarthritis pain (MARS-17) .

Some of Clinical Trials for Pain Mangement Drugs

Sponsor | Year | Phase | Description |

Vertex Pharmaceuticals Incorporated | 2022 | Phase 3 | The purpose of this study is to evaluate the efficacy and safety of VX-548 doses in treating acute pain after an abdominoplasty. |

GlaxoSmithKline | 2023 | Phase 2 | The purpose of this study is to investigate and provide the data necessary to select the optimal effective and safe dose(s) of GSK3858279. |

GlaxoSmithKline | 2023 | Phase 2 | The primary objective of the study is to assess the efficacy of GSK3858279 in participants with diabetic peripheral neuropathic pain who have been unable to sufficiently manage their pain. |

Mayo Clinic | 2023 | Phase 4 | The purpose of this study is to identify a dose of intrathecal hydromorphone (opioid pain medicine) that optimizes pain control but minimizes side effects historically seen with this class of pain medications. |

University of Colorado, Denver | 2023 | Phase 3 | The objectives of this study are to investigate the efficacy of extended cannabis treatment to reduce patient exposure to prescription opioids through its use 1) as a non-opioid analgesic treatment, and 2) as a therapy for reducing high-dose opioid use in patients with chronic spine pain. |

Grünenthal GmbH | 2024 | Phase 3 | This study to evaluate the efficacy and safety of intra-articular injections of RTX-GRT7039 in adult pain associated with osteoarthritis of the Knee |

Source : ClinicalTrials.gov

Regional/Country Market Outlook

In developed regions such as North America and Europe has significant pain management drugs market share owing to healthcare infrastructure and higher awareness of pain management techniques contribute to significant market growth. Rising incidences of chronic diseases, coupled with an aging population, drive the demand for pain management solutions. In addition, increasing adoption of advanced technologies such as minimally invasive procedures and innovative drug delivery systems further fuel market expansion in North America.

In emerging economies such as China, India, and Brazil, rapid urbanization and improving healthcare infrastructure are enhancing access to pain management therapies. However, challenges such as limited healthcare access in rural areas and affordability issues constrain market growth. Nevertheless, increasing healthcare expenditure and government initiatives to improve healthcare services are expected to propel market growth in these regions.

In May 2023, seizure of illicit ketamine by drug enforcement agents has surged throughout the U.S., growing by 349% from 2017 through 2022.

An article published by National Center for Biotechnology and Information (NCBI) in 2022, the weighted 12-month-prevalence of non-opioid analgesics (NOA) abuse was 14.6%, among self-medicated users of these drugs in German population. This high prevalence led to a rise in need for safer and more effective pain management drugs, which drives the market growth.

Industry Trends

In December 2023, FDA announced final approval and implementation of required labeling updates to continue efforts to address the evolving opioid crisis, and to urge health care professionals to take a more patient-centered approach when prescribing opioid analgesic products.

An article published by European Medical Journal in October 2023, stated that a new non-opioid painkiller approved by FDA for use in patients with post-operative pain who are being treated in hospital.

In March 2023, the International Narcotics Control Board (INCB) released its 'Narcotic Drugs 2022' publication, presenting the latest consolidated global data on narcotic drug production and use for medical and scientific purposes, including pain relief. Almost all consumption of opioid analgesics for the treatment of pain is concentrated in developed countries in Europe and North America.

Competitive Landscape

The major players operating in the pain management drugs market include Novartis AG, Eli Lilly & Company, Abbott Laboratories, Endo Health Solutions, Inc., Purdue Pharma L.P., Pfizer, Inc., Viatris Inc., Merck & Co. Inc., Johnson & Johnson, and GlaxoSmithKline Plc. Other players in pain management drugs market includes Allergen Inc., Bayer AG, Bristol-Myers Squibb, Valeant Pharmaceuticals International Inc., Boehringer Ingelheim, Sorrento Therapeutics, WEX Pharmaceuticals, Zynerba Pharmaceuticals and so on.

Recent Key Strategies and Developments in Pain Management Drugs Industry

In January 2024, Vertex Pharmaceuticals Incorporated announced positive results from its Phase 3 program for the selective NaV1.8 inhibitor, VX-548, in the treatment of moderate-to-severe acute pain. The Phase 3 program included two randomized, double-blind, placebo-controlled, pivotal trials, one following abdominoplasty surgery and one following bunionectomy surgery, as well as a single arm safety and effectiveness study which enrolled patients with a broad range of surgical and non-surgical pain conditions.

In May 2021, Allay Therapeutics, a clinical-stage biotechnology company pioneering ultra-sustained analgesic products to transform post-surgical pain management and recuperation announced the first-ever clinical data showing non-opioid pain relief lasting two weeks after a single administration.

In March 2020, GlaxoSmithKline announced that the U.S. Food and Drug Administration (FDA) approved Advil Dual Action with Acetaminophen as an over-the-counter (OTC) product for pain relief. The exclusive formula is now the first FDA-approved OTC combination of ibuprofen and acetaminophen in the U.S. and will be available over-the-counter nationwide in 2020.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centers (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pain management drugs market analysis from 2024 to 2033 to identify the prevailing pain management drugs market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the pain management drugs market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global pain management drugs market trends, key players, market segments, application areas, and market growth strategies.

Pain Management Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 109.6 Billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Drug Class |

|

| By Indication |

|

| By Pain Type |

|

| By Region |

|

| Key Market Players | Pfizer, Inc., Endo Health Solutions, Inc., Novartis AG, Abbott Laboratories, GlaxoSmithKline Plc, Merck & Co. Inc., Purdue Pharma L.P., Johnson & Johnson, Viatris Inc., Eli Lilly & Company |

Analyst Review

Pain management drugs are medications that are used to relive pain. Over the recent years, the demand for pain management drugs is increasing rapidly. Pain can be caused due to various reasons such as chronic diseases, cancer, and surgeries. Rise in use of nonsteroidal anti-inflammatory drugs and opioids for the treatment of various pain conditions is a major driver of the pain management market. Thus, these segments are the largest contributors towards the market growth. Presence of large geriatric population base, rise in global prevalence of cancer, and availability of pipeline drugs that pose to be promising treatment options for patients with chronic diseases further contribute towards the growth of the market. However, patent expiration of the major best-seller drugs such as pregabalin and duloxetine by Pfizer and Eli Lilly & Co., respectively, and availability of alternative therapies such as acupuncture, massage, and medical devices hamper the market growth.

The employment of pain management drugs is highest in North America, owing of increase in adoption of these drugs, high prevalence of chronic diseases, and increase in disposable income among customers. In addition, the presence of a large geriatric population and favorable regulatory & healthcare reforms such as the U.S. Patient Protection and Affordable Care Act of 2010 supplement the market growth. Although the use of pain management drugs in Asia-Pacific and LAMEA is low, the adoption rate is expected to increase owing to rise in disposable income and surge in incidence of chronic disease. China and India are the potential markets in Asia-Pacific. Moreover, increase in R&D investment, upsurge in healthcare expenditure, and rise in government funding & initiatives propel the market growth in Asia-Pacific.

The total value of pain management drugs market was $72.6 billion in 2023.

The forecast period for pain management drugs market is 2024 to 2033.

The market value of pain management drugs market in 2033 is $109.6 billion.

The driving factors for the pain management drugs market include the increasing prevalence of chronic pain conditions such as arthritis and back pain, rising geriatric population prone to pain-related disorders, advancements in drug delivery techniques enhancing efficacy and patient compliance, and expanding awareness and acceptance of multimodal approaches to pain management.

The base year calculated is 2023 in the report.

Pain management drugs include analgesics, NSAIDs, opioids, and adjuvant medications like antidepressants and anticonvulsants. They work by targeting pain pathways to reduce or alleviate pain sensations.

Opioids segment holds the maximum market share.

Loading Table Of Content...