Paint Packaging Market Research, 2032

The global paint packaging market size was valued at $20.6 billion in 2022, and is projected to reach $30.4 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. Advancements in packaging materials and technologies, and rise in demand for lightweight and durable solutions, are key drivers for the growth of the paint packaging market. Innovative materials such as bio-based plastics, high-strength polymers, and advanced composites enhance durability while reducing weight, catering to both sustainability goals and operational efficiency.

Introduction

The packaging used for the storage and transportation of paints is known as paint packaging. Paints are frequently used to protect and safeguard buildings and structures from outside forces and extreme weather conditions. Packaging reduces product waste, boosts storage productivity, and guarantees the quality of the paint packaging products. Moreover, there are a variety of packaging options available. These include bags, bottles, jerrycans, metal cans, and others. Moreover, sustainable, and eco-friendly packaging options are in great demand as they have minimal environmental impact and are safe to use.

Report key highlighters

- Quantitative information mentioned in the global paint packaging market includes the market numbers in terms of value (USD Million) and volume (Tons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on material, product, and end-use industry. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Berry Global Inc., BWAY Corporation, Dow, Hitech Group, International Paper, KARSHNI PACKS PRIVATE LIMITED, Mold-Tek Packaging Ltd., Mondi, Smurfit Kappa and WestRock Company, hold a large proportion of the paint packaging market.

- This report makes it easier for existing market players and new entrants to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Market Dynamics

The wide usage of paint in the automotive industry boosts the demand for paint packaging products. The rise in demand for vehicles, advancements in coating solutions, and research and development increase the usage of automotive paints which eventually expanded the growth of the paint packaging market. Automotive paints enable metal and aluminum car parts to be more durable so they can withstand harsh conditions like heat, acid, UV rays, and dust particles.

The main purpose of automotive paints are protection and decoration. These coatings are applied in a series of phases to prevent corrosion on the metal. They are frequently utilized in the automotive industry to enhance the visual appeal and functionality of vehicles. The use of automotive paints is expected to expand significantly owing to rise in Original Equipment Manufacturer (OEM) demand.

Many manufacturers are offering their automotive paint solutions leading to the growth of the market. For instance, PPG Industries, Inc. provides a wide range of automotive paints including waterborne and solvent-borne primers, basecoats, clearcoats, powder primers, and scratch resistant ceramic clearcoats. These products are designed to perform within a vehicle's coating layers system, with each layer performing a specific function. In addition, Solvay, a leading chemical manufacturer, also offers its products for the automobile sector.

Addibond is a distinctive line of polymers developed to enhance paint adhesion and adhesive bonding. It offers several advantages when used in corrosion and sterilization treatments, and it is so effective at reducing the carbon footprint of automotive coatings that it earned the Solar Impulse Efficient Solution Label.

The lifespan of a vehicle can be increased by using these beneficial solutions, which improve durability, adhesion, corrosion resistance, water resistance, surface wetting, emulsion polymerization, pigment dispersion, color development, foam management, and others. Owing to these factors, the surge in automotive paint usage stimulated the growth of the paint packaging market tremendously.

The increase in construction of residential and commercial buildings, and surge in infrastructural developments drive the growth of the paint packaging market. Rapid urbanization favored the growth of construction of commercial buildings. The expansion of office spaces and increased demand for new office space and administrative buildings are both contributing to the rise in construction activities.

Any type of structures and buildings can be shielded from the impacts of water and sunlight with paint. Painting wooden structures, such as houses, is common because it stops water from penetrating the wood and causing it to degrade. In addition, the paint helps keep the wood from deteriorating in the blazing sun. To prevent rust, metal buildings and objects of various kinds are painted.

Many manufacturers offer their paint packaging solutions for the construction of residential and commercial structures. For instance, Atrak Shimi Shargh Company offers a wide range of paint metal containers, polyethylene containers (paint bucket) and polyethylene terephthalate (PET) containers with different capacities. These containers are produced from the best raw material and are designed in accordance with market demands. Thus, upsurge in construction activities has paved way for expansion of the paint packaging market.

The fluctuations in the raw material prices restrain the growth of the paint packaging market. The plastic containers, cans, and bottles used for packaging paints are derived from crude oil. There are several factors for the fluctuations of crude oil prices including instability in countries that produce oil, natural disasters that might affect production. The Organization of Petroleum Exporting Countries, or OPEC, is the primary factor affecting changes in oil prices. Oil prices might fluctuate due to production expenses as well.

While it costs less to extract oil in the Middle East, it costs more to do so in Canada's oil sands. Moreover, the metals used for paint packaging are susceptible to price change. Metals require special storage conditions compared to crude oil which affects the overall pricing of metals. Thus, fluctuations in the prices of raw materials hinder the paint packaging market growth.

The usage of sustainable and eco-friendly packaging solutions is a lucrative opportunity for the paint packaging market. Ecology is negatively impacted in many ways by the plastic used for paint packaging. Plastic contributes to environmental pollution of the land and water. It can harm marine life if it enters our rivers and oceans when it is incorrectly disposed. Plastic production results in the release of greenhouse gases, which contribute to global warming. Climate change poses a major threat to people and wildlife in the future as people continue to generate additional greenhouse gases into the atmosphere.

There is an increase in the desire for sustainable and eco-friendly packaging options owing to rise in public awareness of the environment. Because of this, manufacturers of paint are adopting environment-friendly packaging materials like paper-based goods, recyclable and biodegradable plastics, and other biodegradable materials. For instance, in February 2022, WestRock Company constructed a new corrugated box plant in Longview, Washington, to meet the growing demand from WestRock’s regional customers in the Pacific Northwest. This expansion will increase production of sustainable paint packaging solutions leading to market growth.

Furthermore, in November 2022, Smurfit Kappa acquired Pusa Pack S.L., a bag-in-box packaging plant located in Onda, close to Castellon in the Valencian region. Pusa Pack S.L. specializes in producing flexible large-capacity bags with capacities ranging from 200 to 1500 liters that are used to store and move liquid and semi-liquid goods. This acquisition is projected to boost the growth of the paint packaging market. Thus, the sustainable, biodegradable, and eco-friendly packaging solutions are opportunistic for the paint packaging market.

Segments Overview

The paint packaging market is segmented into material, product, end-use industry, and region. By material, the market is classified into metals, polyethylene, polypropylene, polyethylene terephthalate, and others. By product, the market is segregated into cans and pails, pouches, bottles, and others. By end-use industry, the market is bifurcated into professional and consumer. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

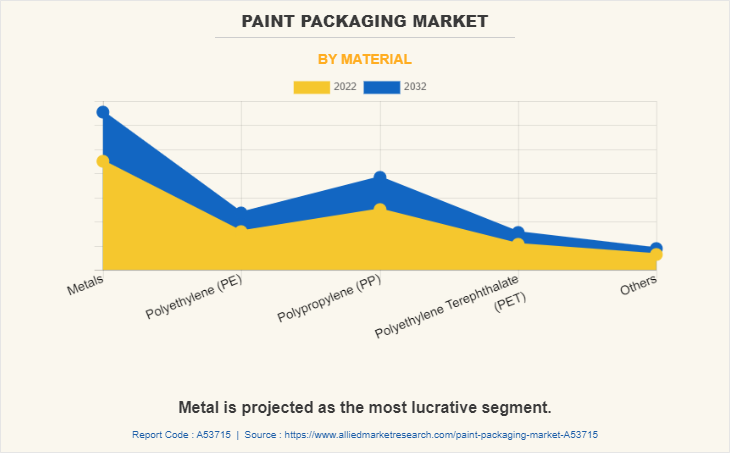

Paint Packaging Market By Material

By material, the market is divided into metals, polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and others. Metal paint packaging is durable and can withstand the rough handling during transportation and storage. It can also protect the paint from external elements, such as light and air, which can cause it to deteriorate.

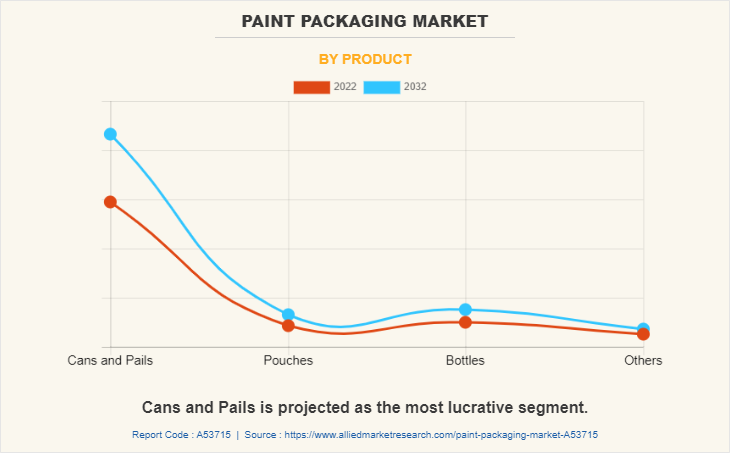

Paint Packaging Market By Product

By product, the market is categorized into cans and pails, pouches, bottles, and others. Cans and pails paint packaging is made of sturdy materials, such as metal or plastic, that can withstand the rigors of transportation and storage, reducing the risk of damage to the product.

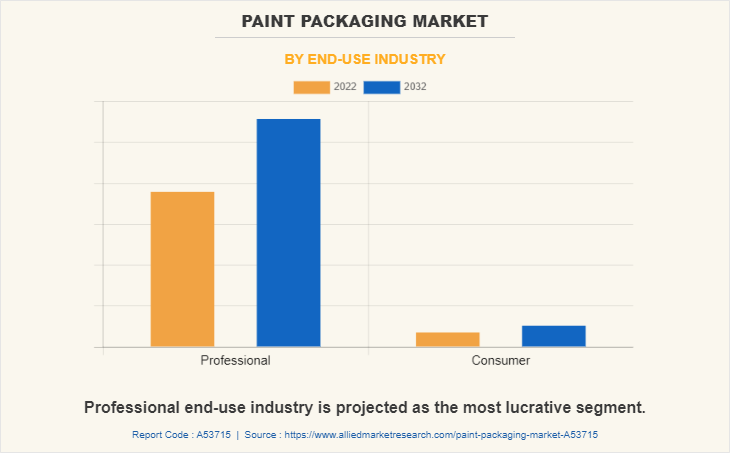

Paint Packaging Market By End-Use Industry

By end-use industry, the market is categorized into professional and consumer. The professional segment is the fastest-growing segment and is expected to continue this trend during the forecast period. The usage of paint packaging in the professional sector has been growing in recent years due to several factors. The growth in the construction and renovation industry has led to an increase in demand for paint, and this has driven the growth of paint packaging in the professional sector.

Paint Packaging Market By Region

By region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific is expected to be the leader in the production of paint packaging, with surge in demand from China and India. With the growth of the construction industry and the increasing demand for consumer goods, the demand for paint and coatings is increasing rapidly in the Asia-Pacific region. This is driving the growth of the paint packaging market as well.

Industry Trends:

- The paint packaging market has witnessed significant shifts, driven by evolving consumer preferences, environmental concerns, and advancements in packaging technologies. One notable trend is the surge in demand for eco-friendly packaging solutions, propelled by government regulations and sustainability goals. For instance, India's Ministry of Environment, Forest and Climate Change (MoEFCC) has been actively promoting the use of biodegradable and recyclable materials. This push has encouraged manufacturers to adopt sustainable packaging practices, such as using recycled plastics and paper-based containers, to align with the country’s environmental policies.

- In parallel, smart packaging technologies have gained traction. Recent advancements include tamper-evident packaging, digital labeling, and RFID-enabled containers, enhancing product security and consumer engagement. The Government of India, through its ‘Digital India’ initiative, has been fostering innovation across various industries, including packaging, by supporting the integration of digital technologies. This has led to the development of interactive and intelligent packaging that enhances brand value and improves customer experience.

- Another trend is the shift towards smaller, more convenient packaging formats to cater to the rising DIY (do-it-yourself) market. With urbanization and the growth of middle-class populations, especially in emerging markets such as India, there is a rise in preference for ready-to-use, portable paint products. According to a recent data from India’s Ministry of Commerce and Industry, the rise in housing projects and home renovations is bolstering demand for such packaging, making it easier for consumers to handle and store paint products.

- In addition, regulatory changes shape the industry. The Bureau of Indian Standards (BIS) recently introduced new guidelines on the labeling of paint products, focusing on transparency and safety. These guidelines emphasize clear communication about the contents, including hazardous chemicals, pushing companies to invest in compliant packaging designs that ensure both safety and adherence to government norms.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paint packaging market analysis from 2022 to 2032 to identify the prevailing paint packaging market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the paint packaging market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global paint packaging market share.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global paint packaging market trends, key players, market segments, application areas, and market growth strategies.

Paint Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 30.4 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 450 |

| By End-Use Industry |

|

| By Material |

|

| By Product |

|

| By Region |

|

| Key Market Players | Mondi, Smurfit Kappa, Berry Global Inc., KARSHNI PACKS PRIVATE LIMITED , Dow, WestRock Company, International Paper, Mold-Tek Packaging Ltd., Hitech Group, BWAY Corporation |

Analyst Review

According to the insights of the CXOs of leading Companies, rapid population growth is one of the primary driving factors propelling the global development industry, which will increase demand for paint packaging. Packing robotization lowers overall packaging costs while also lowering labor expenses and limiting damage during material handling. Some paint manufacturers use packaging robotization to deliver more products in less time. Innovative advancements, for example, printing systems, computerization, astute packaging, mechanical autonomy, and apparatus, is projected to improve packaging and are expected to fuel the growth of the paint packaging market development during the forecast period.

There is a growing demand for eco-friendly and sustainable packaging solutions in the paint packaging industry. This has led to an increase in the use of biodegradable and recyclable materials, as well as the development of packaging designs that minimize waste and environmental impact.

Professional applications are the potential customers of the paint packaging market industry.

Asia-Pacific region will provide more business opportunities for paint packaging market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Berry Global Inc., BWAY Corporation, Dow, Hitech Group, International Paper, KARSHNI PACKS PRIVATE LIMITED, Mold-Tek Packaging Ltd., Mondi, Smurfit Kappa and WestRock Company are the top players in the paint packaging market.

Loading Table Of Content...

Loading Research Methodology...