Paint Thinner Market Research, 2031

The global paint thinner market was valued at $11.0 billion in 2021, and is projected to reach $16.4 billion by 2031, growing at a CAGR of 4.1% from 2022 to 2031.

Key Market Insights:

- According to an article published by Outlook India in 2021, the factory output (measured in terms of the Index of Industrial Production (IIP)) has registered a growth of 24.2% in March 2021 as compared to 2020. This boosts the demand for paint thinners among industrial machinery & equipment.

- According to a survey conducted by Harvard Business Review in August 2019, consumers (especially millennials) are becoming more linear toward using brands that embrace sustainability. This factor may further augment the growth of the turpentine solvent type paint thinner market.

- According to a data released by the National Investment Promotion and Facilitation Agency of India in April 2021, the automobile sector contributes around 7.1% of the India’s gross domestic product (GDP) and is expected to reach $300 billion by 2026, This may enhance the demand for paint thinners among the growing automobile sector.

- According to a report published by the European Construction Sector Observatory in 2020, the number of enterprises in the broad construction sector increased by 4.4%, from 698,034 in 2010 to 728,420 in 2020. This factor has augmented the growth of the paint thinner market in the construction sector.

- According to an article published by The Economic Times in July 2019, Dubai government imposes a fine of 500 dirham (approx. $132.1) on residents for leaving dirty car. This factor has surged the popularity of 2-butoxyethanol-based paint thinners for paint cleaning purposes in the car care service sectors; thus, fueling the market growth.

Paint thinner is a solvent that is used to liquefy (reduce the viscosity) various paints. Different paint thinners such as polyurethane paint thinners, acetone-based paint thinners, toluene paint thinners, and others are used to enhance the spreadability and finish of paints. Paint thinners are employed for degreasing, cleaning, and in conjunction with paints in various end-use sectors such as building & construction, automotive, mariner, industrial, aerospace, and others.

Growing population base has led to rapid urbanization in both developed and developing economies such as the U.S., China, India, and others. This has increased government spending on building & construction sector to develop various upcoming infrastructure projects. For instance, according to a report published by National Investment Promotion and Facilitation Agency, the infrastructure activities accounted for 13% share of the total foreign direct investment (FDI) inflows in 2021. Furthermore, rapid development of water supply, sanitation, urban transport, schools, and healthcare aid in the growth of the building & construction sector.

Paint thinners are widely used in pipelines, concrete floors, warehouses, hospitals, and others construction sites to break down oil-based paints, primers, and stains. Moreover, paint thinners aid in removal of paint on brushes, rollers, and general cleanup of spills or splatters on wall or other building spaces, which in turn has made customers more linear toward using paint thinners. These factors are anticipated to fuel the demand for paint thinners in the growing building & construction sector. Furthermore, factors such as increase in disposable income, technological upgrades, and spurring rise in original equipment manufacturers (OEMs) have led the automotive & transportation sector to witness a significant growth. For instance, according to a report published by India Brands Equity Foundation, the domestic automobile production increased by a CAGR of 2.36% from 2016-20 with 26.36 million vehicles being manufactured in India in 2020.

Paint thinners have the potential to reduce the optimum viscosity of paints and allow them to easily apply over vehicle surfaces that make it best suited for automotive coating applications. Furthermore, it serves the requirement for high gloss, superior smoothness, and beautiful aesthetics of luxury cars. Moreover, paint thinners are highly preferred for auto refinish, interior coating, and car detailing applications of under hood parts and engine components. Thus, increase in awareness for car care activities such as car polishing, refinishing, and other maintenance & repair-related activities have augmented the growth of the paint thinner market in the automotive & transportation sector. Moreover, rise in young population coupled with increase in number of car enthusiasts may further aid the market growth during the forecast period.

However, the cost involved the formulation of paint thinners is high that results in expensive final product. Furthermore, most of the paint thinners are petroleum-based products that are extracted from crude oil through distillation process. This makes them a highly volatile commodity owing to the fact that prices of crude oil/petroleum are controlled by oil traders, current oil supply, and future supply & demand. In addition, natural and man-made disasters have a great influence on price fluctuations of petroleum-based products. Therefore, increase in the prices of crude oil negatively affects the paint thinner vendors. The pricing of crude oil has a significant impact on the overall price of the component. Moreover, crude oil is traded on community exchange and owing to global economic ups and downs in the market; prices of these materials fluctuate occasionally. Owing to all the aforementioned factors, the rise in prices of crude oil is expected to hamper the growth of the paint thinner market during the forecast period.

On the contrary, the increasing demand for consumer goods has surged the establishment of industrial manufacturing units in both developed and developing countries such as the U.S., China, India, and others. According to an article published by Outlook India, the factory output (measured in terms of the Index of Industrial Production (IIP)) registered a growth of 24.2% in March 2021 as compared to 2020. Paint thinners are used to reduce the viscosity of paints that make them easy to apply over various surfaces such as floors, roofs, industrial machinery, and others. In addition to this, paint thinners possess excellent anti-rust property that make it best suited for use in cleaning purposes of a wide range of industrial equipment and devices. Thus, the increasing acceptance of paint thinners among the growing industrial sector is anticipated to create lucrative opportunities for the market.

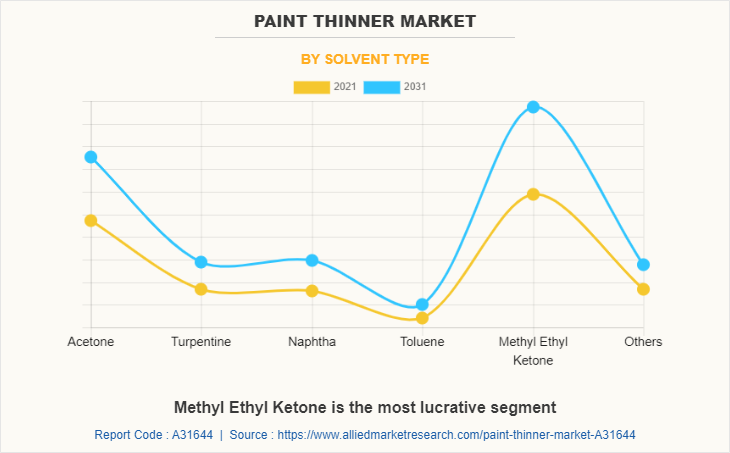

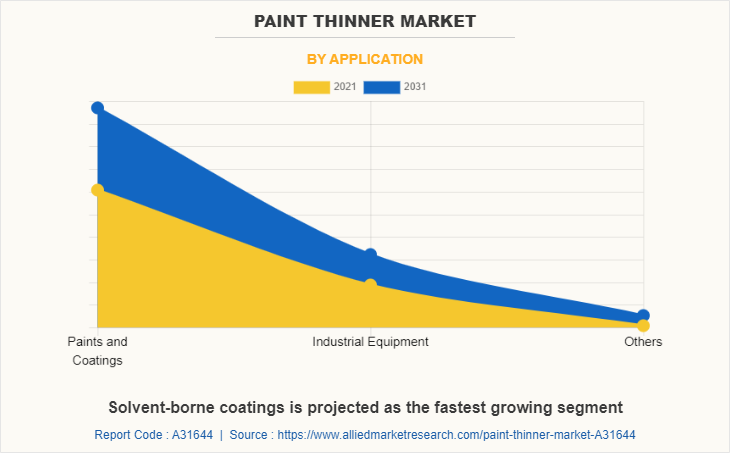

The paint thinner market is segmented into Solvent Type, Application, and region. On the basis of solvent type, the market is categorized into acetone, turpentine, naphtha, toluene, methyl ethyl ketone, and others. By application, it is classified into paints & coatings, industrial equipment, defense, electrical & electronics, building & construction, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By solvent type, the methyl ethyl ketone dominated the global market and is anticipated to grow at a highest CAGR of 4.6% during the forecast period. The increasing demand for consumer goods has surged the establishment of chemical manufacturing units in both developed and developing economies where methyl ethyl ketone-based paint thinners are widely used along with paints for finish coat in steel structures, industrial equipment, and others. This may act as one of the key drivers responsible for the growth of the paint thinner market for methyl ethyl ketone solvent type. In addition to this, increasing government spending on commercial and residential facilities may surge the potential application of methyl ethyl ketone-based paint thinners used for cleaning purposes in the growing architecture sector. According to a report published by the European Construction Sector Observatory in 2020, the number of enterprises in the broad construction sector increased by 4.4%, from 698,034 in 2010 to 728,420 in 2020. This factor has augmented the growth of the paint thinner market for methyl ethyl ketone type in the construction sector.

By application, the paints & coatings segment was the largest revenue generator and is anticipated to grow at a CAGR of 4.3% during the forecast period. This is attributed to the increasing population coupled with rapid urbanization, which in turn have surged the demand for both residential and commercial facilities where a wide range of paint thinners are used in conjunction with paints & coatings to enhance the visual appeal, surface durability, chemical protection and pest protection. This may act as one of the key drivers responsible for the growth of the paint thinner market for paints & coatings applications.

Furthermore, the increasing building & construction activities based on modern theme architecture has surged the potential application of various paints and coatings for use in interior and exterior coating applications where paint thinners are used to reduce the overall viscosity of paints and enhance the paint finishes. This factor may further aid the growth of the paint thinner market for paints & coatings applications during the forecast period.

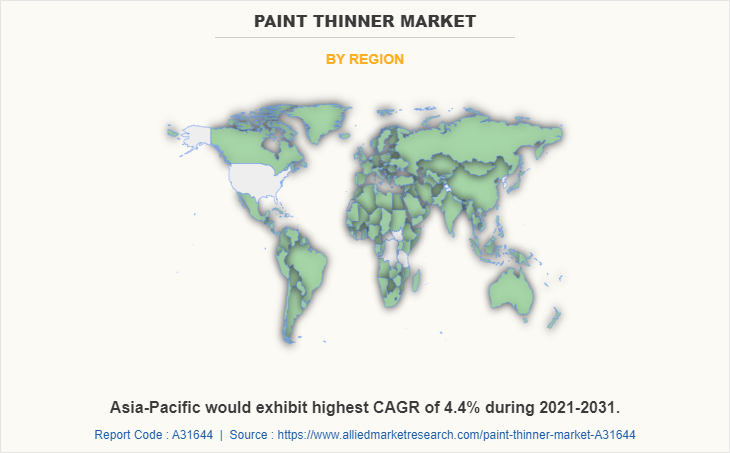

The Asia-Pacific paint thinner market is projected to grow at the highest CAGR of 4.4% during the forecast period and accounted for 48.1% of paint thinner market share in 2021. This is attributed to the rising building & construction, transportation, industrial, and other sectors, which in turn have enhanced the performance of the paint thinner market in Asia-Pacific. China's industrial sector is increasing rapidly which in turn has enhanced the performance of the paint thinner market in the region. According to a report published by the United Nations Statistics Division, China witnessed around 28.7% of the global manufacturing output for consumer goods in 2019.

Moreover, countries such as India and Australia are witnessing a rapid increase in transportation sectors where paint thinner is used with automotive paints as protective coatings to provide structural integrity in transportation equipment and increase their average lifespan. For instance, according to a report published by the Indian Ministry of Commerce and Industry, the transportation sector in India is expected to grow at a CAGR of 5.9% owing to the development of highways, widespread railway networks, aviation ports, and waterway structure. This may enhance the performance of the paint thinner market in Asia-Pacific.

The major companies profiled in this report include Akzo Nobel N.V., Axalta Coating Systems, LLC, Hempel A/S, Jotun, Kansai Paint Co., Ltd., Kwality Paints and Coatings Pvt. Ltd., PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, and Zigma Paints Pvt. Ltd. The global paint thinner market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paint thinner market analysis from 2021 to 2031 to identify the prevailing paint thinner market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the paint thinner market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global paint thinner market trends, key players, market segments, application areas, and market growth strategies.

Paint Thinner Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 16.4 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 260 |

| By Solvent Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | The Sherwin-Williams Company, Hempel A/S, Jotun, Akzo Nobel N.V., PPG Industries, Inc., RPM International Inc., Axalta Coating Systems, LLC, Zigma Paints Pvt. Ltd., Kwality Paints and Coatings Pvt. Ltd., Kansai Paint Co., Ltd. |

Analyst Review

According to CXOs of leading companies, the global paint thinner market is expected to exhibit high growth potential. Paint thinners are used along with a wide range of paints are used in architectural, industrial, automotive, aerospace, and other applications for surface protection, material strengthening, cleaning, degreasing, and corrosion resistance purposes. Transportation and industrial equipment that require high strength, corrosion protection, and degreasing properties can be accomplished with the use of paint thinners.

In addition, paint thinners possess excellent significant properties such as high evaporation/drying rate, less viscous, chemical resistance, and corrosion resistance that make it best suited for automotive coating applications. Paint thinners when applied on automotive surfaces in conjunction with paints, serves as a protective coating in under hood parts and engine components. Furthermore, factors such as flexibility in operation, ease of application, and minimal or no volatile organic compounds (VOCs) levels enhance performance of paint thinners in several end-use industries. CXOs further added that sustained economic growth and development of the construction sector have increased the popularity of paint thinners.

Escalating demand from automotive & transportation sector and robust growth in building & construction sector are the upcoming trends of the paint thinner market.

The global paint thinner market was valued at $11.0 billion in 2021, and is projected to reach $16.4 billion by 2031, growing at a CAGR of 4.1% from 2022 to 2031.

The Asia-Pacific paint thinner market is projected to grow at the highest CAGR of 4.4% during the forecast period and accounted for 48.1% of paint thinner market share in 2021.

The leading application of the paint thinner market is paints & coatings.

The major companies profiled in this report include Akzo Nobel N.V., Axalta Coating Systems, LLC, Hempel A/S, Jotun, Kansai Paint Co., Ltd., Kwality Paints and Coatings Pvt. Ltd., PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, and Zigma Paints Pvt. Ltd.

Loading Table Of Content...