Palladium Market Overview:

The global palladium market size was valued at $16.3 billion in 2021, and is projected to reach $28.6 billion by 2031, growing at a CAGR of 5.8% from 2022 to 2031.

Key Market Insights

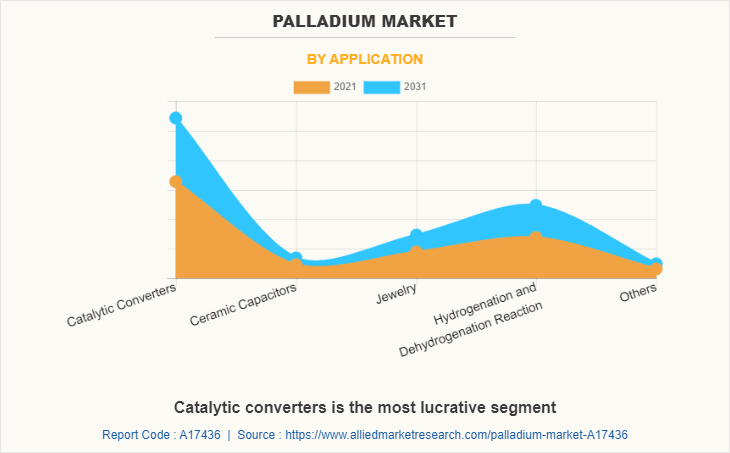

- By Application: In 2021, the catalytic converter segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.9% during the forecast period.

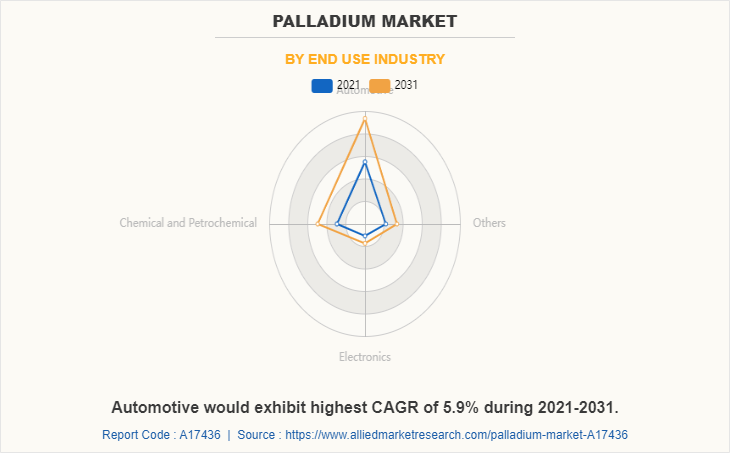

- By End-Use Industry: The automotive segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 5.9% during forecast period.

- By Region: Asia-Pacific held 49.4% of the palladium market share in 2021 and is projected to grow at the highest CAGR of 6.3% during the forecast period.

Market Size & Forecast

- 2031 Projected Market Size: USD 28.6 Billion

- 2021 Market Size: USD 16.3 Billion

- Compound Annual Growth Rate (CAGR) (2021-2031): 5.8%

How to Describe Palladium

Palladium is a ductile malleable silvery-white element of the platinum metal group. It occurs in nickel-bearing ores. It is used in catalytic converters of automotive vehicles for reducing emissions. Furthermore, it is used in jewelry, dentistry, watchmaking, blood sugar test strips, aircraft spark plugs, surgical instruments, and electrical contacts. Moreover, palladium is also used to make professional transverse (concert or classical) flutes.

Market Dynamics

The increase in demand for consumer electronics has surged the popularity of palladium-based multi-layer ceramic (chip) capacitors (MLCC) used to store energy in electronic devices such as broadcasting equipment, mobile telephones, computers, electronic lighting and high voltage circuits. For instance, according to a report published by National Investment Promotion and Facilitation Agency, India’s export of electronic devices is set to increase from $10 billion in 2021 to $120 billion by 2026. This is projected to enhance the demand for palladium in the growing electronics sector; thus fuelling the market growth. Furthermore, the rise in disposable income, surge in population, and increase in urbanization has created a massive demand for regular and advanced electronic devices such as washing machines, smartphones, televisions, computers, and others where palladium-based MLCC is widely used in integrated circuits. For instance, according to data published by International Data Corporation (IDC), the worldwide shipments for smart home devices have reached 801.5 million units in 2020 which is a 4.5% increase over 2019. This may propel the palladium market growth during the forecast period.

However, palladium is extracted commercially as a by-product of nickel and then refined further which requires highly sophisticated machines. These factors together have restrained manufacturers with less investment potential to enter into palladium industry; thus, hampering the market growth.

On the contrary, palladium is used as principal metal in jewelry due to the rise in price of platinum and gold. Furthermore, it is used in dentistry as an alloy of dental amalgam to increase metallic luster and decrease corrosion. Moreover, changes in prospects of investments in palladium have also contributed to the growth of the market. These factors are predicted to create remunerative opportunities for the expansion of the palladium market forecast in the future.

Palladium Market Segments Review:

The palladium industry is segmented into Application and End-Use Industry, and region. By application, it is fragmented into catalytic converter, ceramic capacitors, jewelry, hydrogenation/dehydrogenation reactions, and others. By end use industry, it is classified into automotive, chemical and petrochemical, electronics, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The Asia-Pacific palladium market size is projected to grow at the highest CAGR of 6.3% during the forecast period and accounted for 49.4% of palladium market share in 2021. This is attributed to rise in China's electronic sector which has forced the palladium manufacturers to produce more efficient MLCC used in various consumer electronic products. Furthermore, countries such as Japan and Taiwan have a large electronics industry base and consumer electronics appliances industry which in turn has enhanced the performance of palladium market in the Asia-Pacific region.

In 2021, the catalytic converter segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.9% during the forecast period. This is attributed to the increase in transportation activities which in turn has led the automotive sector in both developed and developing economies to witness a significant growth where palladium is widely used in catalytic converter of cars, trucks, and other vehicles for reducing vehicle emission. Furthermore, the increasing regulatory norms put forward by several government agencies such as the Environmental Protection Agency (EPA), Central Pollution Control Board (CPCB), and others for reducing the vehicle emissions may propel the demand for palladium-based catalytic converters.

By end use industry, the automotive segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 5.9% during forecast period. This is attributed to increase in disposable income and rise in original equipment manufacturers (OEMs) which in turn leads the automotive industry to witness a significant growth where palladium is widely employed in catalytic converters of cars, trucks, and other vehicle for emission reduction purposes.

Which are the Leading Companies in Palladium

The major companies profiled in this report include Alfa Aesar, China North Industries Corp (NORINCO), Indian Platinum Pvt. Ltd, Manilal Maganlal & Company, Norilsk Nickel, Northam Platinum Limited, Otto Chemie Pvt. Ltd., Platinum Group Metals Ltd, Sibanye-Stillwater, Southern Palladium Limited, Vale, and Vineeth Precious Catalysts Pvt. Ltd.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the palladium market analysis from 2021 to 2031 to identify the prevailing palladium market opportunities.

- The palladium market report is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the palladium market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global palladium market trends, key players, market segments, application areas, and market growth strategies.

Palladium Market Report Highlights

| Aspects | Details |

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Alfa Aesar, Norilsk Nickel, Sibanye-Stillwater, Northam Platinum Holdings Limited, Southern Palladium Limited, Platinum Group Metals Ltd, Impala Platinum Holdings Limited, Platinum Group Metals Ltd., First Quantum Minerals Ltd., Manilal Maganlal & Company, Vale S.A., Thermo Fisher Scientific Inc., Otto Chemie Pvt. Ltd., Indian Platinum Pvt.Ltd, NORINCO, Anglo American plc, Vineeth Precious Catalysts Pvt. Ltd. |

Analyst Review

According to CXOs of leading companies, the global palladium market is expected to exhibit high growth potential during the forecast period. The drastic rise in the adoption rate of smartphones, tablets, and the introduction of highly advanced consumer electronic devices have surged the growth of the palladium market. In addition, the increase in the trend for fuel cells and advanced battery systems where palladium-based capacitors play a significant role in power supply applications is expected to positively impact the growth of the market. According to some CXOs, there is an increase in the demand for palladium-based catalytic converters, due to the considerable growth in the automotive industry. This is expected to open new growth opportunities for the market. Emergence of modern aircraft with advanced avionics where palladium is used as multi-layer ceramic (chip) capacitors (MLCC) for manufacturing various electronic components is projected to widen the growth trajectory of this market. As there is a rise in the adoption rate of consumer electronics devices, the assessment period from 2021 to 2031 is anticipated to be a transformational phase for the growth of the market.

The Asia-Pacific palladium market size is projected to grow at the highest CAGR of 6.3% during the forecast period and accounted for the largest share in 2021.

The catalytic converter segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.9% during the forecast period.

Furthermore, it is used in dentistry as an alloy of dental amalgam to increase metallic lustre and decrease corrosion. Moreover, changes in prospects of investments in palladium have also contributed to the growth of the market.

The global palladium market is projected to reach $28.6 billion by 2031, growing at a CAGR of 5.8% from 2022 to 2030.

The major companies profiled in this report include Alfa Aesar, China North Industries Corp (NORINCO), Indian Platinum Pvt. Ltd, Manilal Maganlal & Company, Norilsk Nickel, Northam Platinum Limited, Otto Chemie Pvt. Ltd., Platinum Group Metals Ltd, Sibanye-Stillwater, Southern Palladium Limited, Vale, and Vineeth Precious Catalysts Pvt. Ltd.

Loading Table Of Content...