Pancreatic Cancer Diagnostic Market Research, 2035

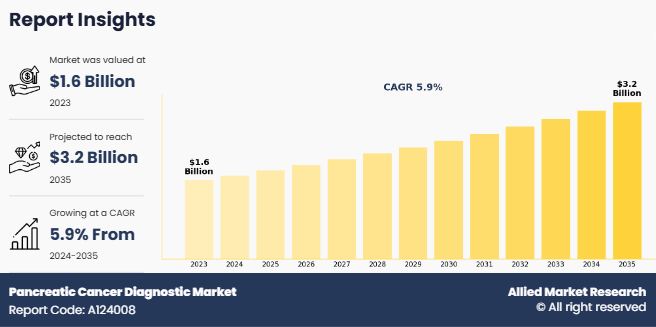

The global pancreatic cancer diagnostic market size was valued at $1.6 billion in 2023, and is projected to reach $3.2 billion by 2035, growing at a CAGR of 5.9% from 2024 to 2035. The growth of the pancreatic cancer diagnostic market is driven by advancements in diagnostic technologies, rise in prevalence of pancreatic cancer, rise in demand for minimally invasive diagnostics, and growing awareness of early screening. For instance, according to the World Cancer Research Fund, there were more than 510,992 new cases of pancreatic cancer in 2022 globally. Thus, rise in incidence of pancreatic cancer has increased the demand for pancreatic cancer diagnostic tools, thus driving the market growth.

Key Takeaways

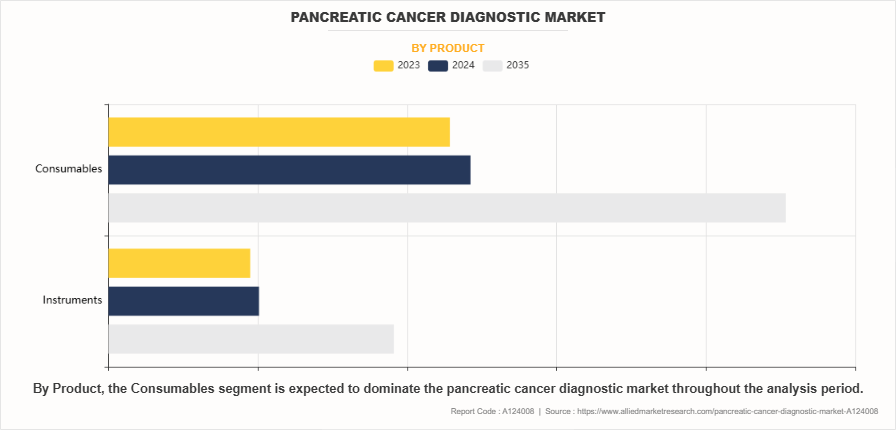

- On the basis of product, the consumables segment dominated the global pancreatic cancer diagnostic market share in 2023. However, the instruments segment is expected to register the highest CAGR during the forecast period.

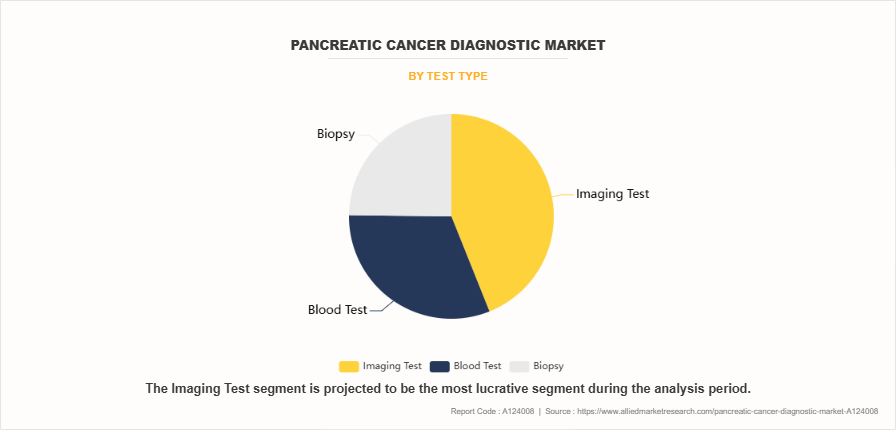

- On the basis of test type, the imaging segment dominated the global market in 2023. However, the blood test segment is anticipated to be the fastest-growing segment during the forecast period.

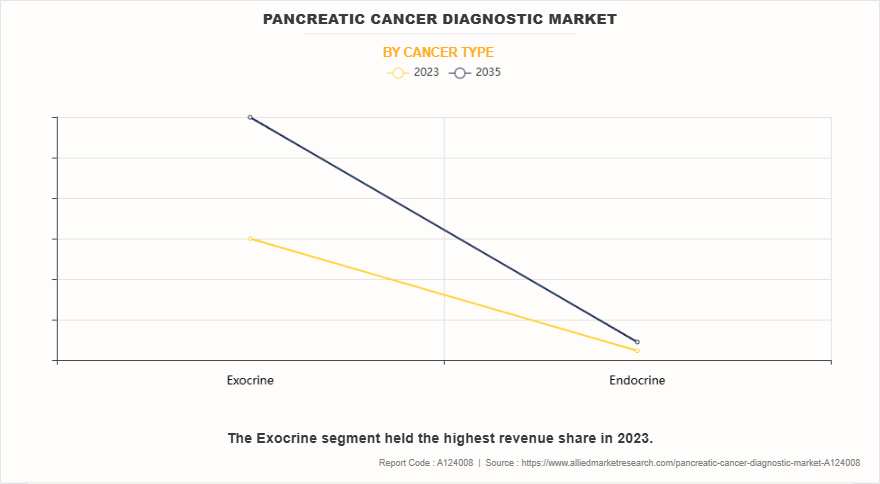

- On the basis of cancer type, the exocrine segment dominated the pancreatic cancer diagnostic market share in terms of revenue in 2023 and is expected to register the highest CAGR during the forecast period.

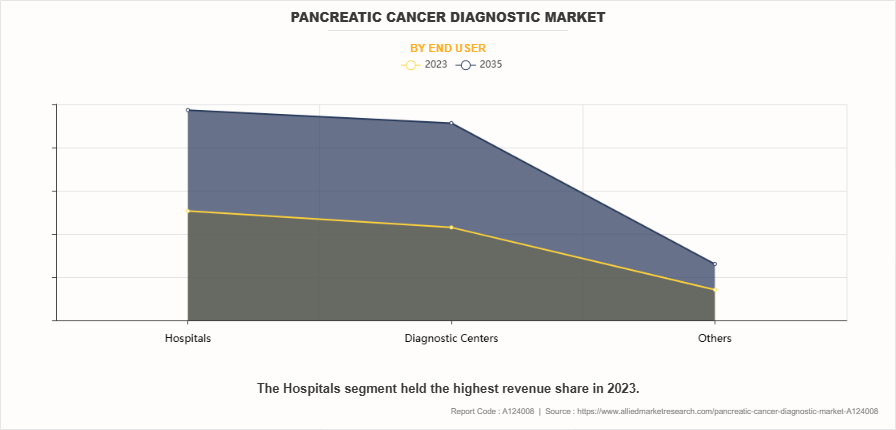

- On the basis of end user type, the hospitals segment dominated the market in terms of revenue in 2023.

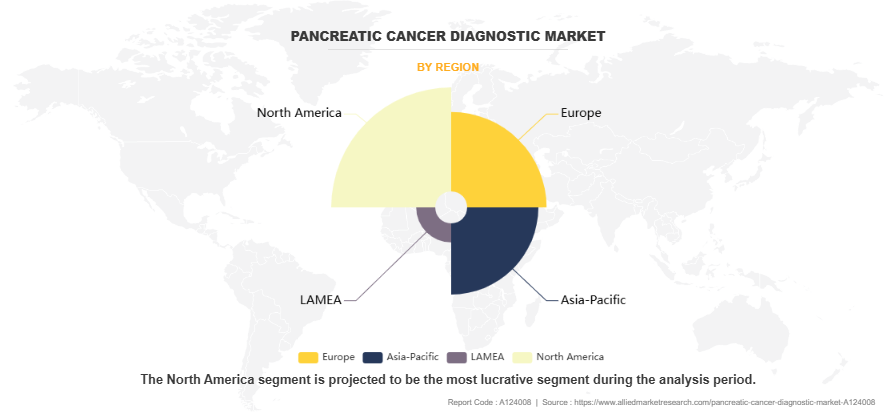

- North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Pancreatic cancer diagnostic refers to a range of medical tests and procedures used to detect and assess pancreatic cancer. This includes imaging techniques such as CT scans, MRIs, and endoscopic ultrasounds, as well as tissue biopsies for histological analysis. Genomic testing, including the identification of genetic mutations like KRAS or BRCA, plays a crucial role in personalizing treatment strategies. Additionally, blood-based biomarkers such as CA 19-9 help in monitoring disease progression. Early detection through these diagnostic methods is vital for improving treatment outcomes and survival rates in patients with pancreatic cancer.

Market Dynamics

The pancreatic cancer diagnostics market growth is experiencing significant growth driven by the rise in global incidence of pancreatic cancer. This increase is partly attributed to an aging population, as pancreatic cancer risk notably increases with age. In addition, the growing prevalence of lifestyle-related risk factors such as smoking, obesity, and diabetes has contributed to higher case numbers, creating an urgent need for effective diagnostic solutions. Furthermore, rise in technological advancements in diagnostic techniques have propels the market growth. The development of more sophisticated imaging technologies, including high-resolution CT scans, MRI, and endoscopic ultrasound, has improved the accuracy and timing of pancreatic cancer detection.

Moreover, the emergence of molecular diagnostic techniques and biomarker testing enhanced the ability to detect pancreatic cancer at earlier stages which further supports the market growth. Healthcare infrastructure improvements and increased healthcare spending in both developed and developing regions have expanded access to advanced diagnostic tools. This expansion is complemented by growing awareness among healthcare providers and patients about the importance of early detection, leading to more frequent screening of high-risk individuals.

Government initiatives and healthcare policies supporting cancer diagnosis and treatment have also played a crucial role in market growth. For instance, in November 2023, ClearNote Health announced that it has signed an agreement to partner with the Pancreatic Cancer Early Detection (PRECEDE) Consortium. The PRECEDE Consortium is an international, multi-institutional collaborative group of experts working to improve early detection for those with a heritable risk for pancreatic cancer, or those with pancreatic cysts, through a novel model of collaboration and data sharing. However, the high cost of advanced diagnostic equipment and tests, which can limit accessibility, particularly in developing regions, thereby limits the market growth.

In addition, the lack of specific symptoms in early-stage pancreatic cancer continues to complicate timely diagnosis which further limits the market growth. On the other hand, the integration of artificial intelligence and machine learning in diagnostic imaging has further enhanced the accuracy and efficiency of pancreatic cancer detection which provides a lucrative pancreatic cancer diagnostic market opportunity. Furthermore, ongoing research efforts and technological innovations are gradually addressing these challenges, suggesting continued market growth. The emphasis on personalized medicine and the development of companion diagnostics for targeted therapies are expected to further expand the pancreatic cancer diagnostic market opportunity, as healthcare providers increasingly rely on precise diagnostic information to guide treatment decisions.

Segmental Overview

The pancreatic cancer diagnostic market size is segmented on the basis of product, test type, cancer type, end user, and region. By product, the market is classified into instruments and consumables. By test type, the market is segmented into imaging tests, blood tests and biopsy. By cancer type, the market is classified into exocrine and endocrine. The exocrine segment further categorized into adenocarcinoma, adenosquamous carcinoma, and others. By end user, the market is segmented into hospitals, diagnostic centers, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

The consumables segment dominated the market share in 2023. This was attributed to the need for diagnostic supplies, including test kits, reagents, and other single-use materials essential for various diagnostic procedures. The high consumption rate of these materials, coupled with their mandatory replacement requirements for maintaining testing accuracy, drives the consistent demand for consumables. On the other hand, the instruments segment is anticipated to be the fastest growing segment during the pancreatic cancer diagnostic market forecast period. This is attributed to rapid technological advancements in diagnostic equipment, including next-generation sequencing platforms, advanced imaging systems, and automated diagnostic instruments. In addition, the increase in integration of artificial intelligence and machine learning capabilities into these instruments significantly enhanced their diagnostic accuracy and efficiency which further drives the segment growth.

By Test Type

The imaging segment dominated the market share in 2023. This was attributed to widespread reliance on advanced imaging techniques such as CT scans, MRI, PET scans, and endoscopic ultrasound as the gold standard for pancreatic cancer detection and staging. The superiority of imaging in providing detailed visualization of pancreatic tumors, their size, location, and potential metastasis made it indispensable in the diagnostic process further supports the segment growth. However, the blood test segment is expected to register the highest CAGR during the forecast period. The rapid advancement in blood-based testing, enabling the detection of circulating tumor DNA (ctDNA) and other cancer biomarkers with increased sensitivity and specificity. The minimal-invasive nature of blood tests, combined with their cost-effectiveness and potential for early detection, makes them increasingly attractive to both healthcare providers and patients. In addition, ongoing research into novel blood-based biomarkers and the development of multi-marker panels specifically for pancreatic cancer has enhanced diagnostic accuracy which propels the segment growth.

By Cancer Type

The exocrine segment dominated the market share in 2023 and is expected to register the highest CAGR during the forecast period. This is attributed to a significantly higher prevalence of exocrine pancreatic cancers along with adenocarcinoma being the most common type. The well-established diagnostic protocols for exocrine tumors, coupled with greater awareness among healthcare providers, contributed to increased diagnostic testing thereby drives the segment growth.

By End User

The hospitals segment dominated the market in terms of revenue in 2023. This was attributed to their advanced diagnostic infrastructure and ability to provide comprehensive care. These facilities offer a wide range of diagnostic tools, including imaging technologies, biopsies, and genetic testing, enabling early detection and accurate staging. Additionally, hospitals have access to specialized medical professionals who can manage complex cases and offer personalized treatment plans. The growing number of pancreatic cancer cases and increasing patient reliance on hospitals for diagnosis further contribute to this segment market leadership.

However, the diagnostic centers segment is expected to register the highest CAGR during the forecast period. This is attributed to the increase in demand for specialized testing services, including genetic and molecular diagnostics, that are offered by these centers. Diagnostic labs are becoming more advanced, utilizing cutting-edge technologies like Next-Generation Sequencing (NGS) and liquid biopsies, which provide highly accurate and early detection of pancreatic cancer thereby supporting the segment growth.

By Region

The pancreatic cancer diagnostic market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America region dominated the market in terms of revenue in 2023. The growth in this region is attributed to the advanced healthcare infrastructure and high healthcare spending capacity facilitated widespread adoption of advanced diagnostic technologies. For instance, according to American Medical Association, the health spending in the U.S. increased by 4.1% in 2022 ($4.4 trillion). Rise in healthcare expenditures, there is a corresponding increase in investment in advanced medical technologies which contributes towards the market growth. The presence of major market players and research institutions led to continuous innovation and rapid implementation of new diagnostic tools. Additionally, higher awareness levels about pancreatic cancer and well-established screening programs contributed to increased diagnostic testing rates.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributed to expanding healthcare infrastructure across emerging economies, particularly in China and India, is creating new opportunities for advanced diagnostic services. Rising healthcare expenditure, coupled with growing awareness about pancreatic cancer among both healthcare providers and patients, is driving increased adoption of diagnostic technologies. The region's large population base and improving access to healthcare services, particularly in urban areas, provides a substantial market opportunity.

Competition Analysis

Key players such as ClearNote Health and Toray Industries, Inc., have adopted product approval, agreement, and collaboration as key developmental strategies to improve the product portfolio of the pancreatic cancer diagnostic industry. For instance, In November 2023, ClearNote Health announced it has signed an agreement to partner with the Pancreatic Cancer Early Detection (PRECEDE) Consortium. The PRECEDE Consortium is an international, multi-institutional collaborative group of experts working to improve early detection for those with a heritable risk for pancreatic cancer, or those with pancreatic cysts, through a novel model of collaboration and data sharing.

Recent Developments in Pancreatic Cancer Diagnostic Industry

- In February 2024, FUJIFILM India, a pioneer in diagnostic imaging and information systems, has launched the groundbreaking ALOKA ARIETTA 850 Diagnostic Ultrasound System in India with its first-ever installation at Fortis Hospital in Bengaluru, Karnataka, the state leading healthcare services provider. Representing a remarkable advancement in endoscopic technologies, the high-tech ultrasound system aims to enhance diagnostic precision and image clarity for gastrointestinal diseases in the region.

- In October 2024, Toray Industries, Inc., announced that it concluded a collaborative agreement (with the University of Tsukuba. They have since launched the Special Joint Research Project on Healthy Longevity and Patient Quality of Life at a new university unit. This five-year initiative will integrate Torays drug discovery and medical technology with the university expertise, infrastructure, and network to address the challenges of an aging society by improving the quality of life for the elderly and patients with progressive diseases.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pancreatic cancer diagnostic market analysis from 2023 to 2035 to identify the prevailing pancreatic cancer diagnostic market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pancreatic cancer diagnostic market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pancreatic cancer diagnostic market trends, key players, market segments, application areas, and market growth strategies.

Pancreatic Cancer Diagnostic Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 3.2 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2023 - 2035 |

| Report Pages | 368 |

| By Product |

|

| By Test Type |

|

| By Cancer Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Thermo Fisher Scientific Inc., Siemens, Myriad Genetics, Inc., F. Hoffmann-La Roche Ltd., Qiagen N.V., Prestige Biopharma Ltd., Fujifilm Holdings Corporation, ClearNote Health, Randox Laboratories Ltd., Toray Industries, Inc. |

Analyst Review

This section provides various opinions of top-level of the pancreatic cancer diagnostic market. The increase in demand for pancreatic cancer diagnostic and rise in awareness about the importance of early diagnosis and treatment are expected to create profitable opportunities for the expansion of the market. However, high cost of diagnostic tests hinders the market growth.

In addition, surge in prevalence of pancreatic cancer and rise in awareness regarding the potential benefits of advanced pancreatic cancer diagnostic led to increase in demand for pancreatic cancer diagnostic across the globe, which is expected to fuel the market growth during the forecast period. In addition, surge in demand for early disease diagnosis, rise in geriatric population, and increase in healthcare expenditure drive the growth of the market.

Furthermore, North America is expected to witness the largest growth, in terms of revenue, owing to rise in prevalence of pancreatic cancer, increase in diagnostic tests, and easy availability of pancreatic cancer diagnostic. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to rise in technological advancement, development of healthcare settings, and surge in prevalence of pancreatic cancer.

The total market value of pancreatic cancer diagnostic market was $1.6 billion in 2023.

The forecast period for pancreatic cancer diagnostic market is 2024 to 2035.

The market value of pancreatic cancer diagnostic market is projected to reach $3.2 billion by 2035.

The pancreatic cancer diagnostic market is driven by the rising incidence of pancreatic cancer, increasing demand for early detection methods, and advancements in biomarker-based and molecular diagnostics. The integration of AI in imaging and liquid biopsy technologies is enhancing diagnostic accuracy and efficiency.

The pancreatic cancer diagnostic market refers to the industry involved in developing, manufacturing, and distributing technologies and tests used to detect pancreatic cancer. This includes imaging techniques, biomarker-based tests, genetic screening, and advanced molecular diagnostics.

Loading Table Of Content...

Loading Research Methodology...