Paper Diaper Market Research, 2034

Market Introduction and Definition

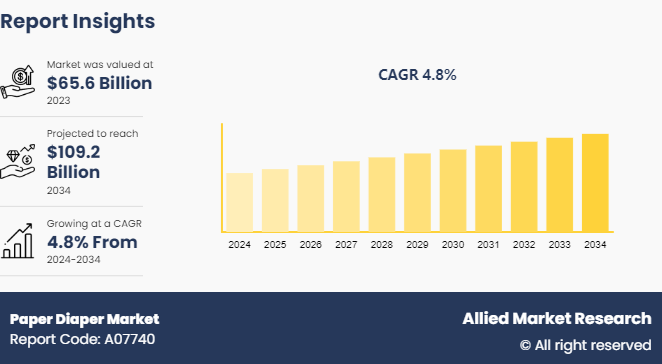

The global paper diaper market size was valued at $65.6 billion in 2023, and is projected to reach $109.2 billion by 2034, growing at a CAGR of 4.8% from 2024 to 2034. A paper diaper is a type of disposable diaper designed primarily from paper-based materials. It features a layered structure that includes a top sheet, absorbent core, and back sheet. The top sheet, made of soft, non-woven paper, is in direct contact with the baby's skin, providing comfort and allowing moisture to pass through to the absorbent core. The core, often composed of fluff pulp and superabsorbent polymers, retains and locks in moisture to keep the skin dry. The back sheet, made from paper or a paper-like material, prevents leaks and keeps the diaper in place. Paper diapers are designed for convenience, which offers high absorbency and easy disposal, though they may not be as eco-friendly as cloth or biodegradable options.

Key Takeaways

The paper diaper market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of paper diaper industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

An increase in birth rates have driven the market demand for paper diapers as it leads to a higher number of infants requiring daily diapering. With more newborns, the need for a consistent and reliable supply of diapers grows significantly. Parents and caregivers seek convenient and hygienic solutions for managing baby care, driving higher consumption of disposable paper diapers. This increased demand also prompts manufacturers to scale up production, innovate in diaper technology, and expand distribution channels to meet the growing needs. In addition, rise in birth rates often correlate with a greater focus on baby products and consumer spending in childcare, further fueling paper diaper market growth. As a result, the paper diaper market has experienced a surge in demand driven by the fundamental need to provide comfort and hygiene for a larger population of infants.

Moreover, technological advancements in absorbent materials significantly boost demand in the paper diaper market by enhancing product performance and consumer satisfaction. Innovations such as the development of superabsorbent polymers (SAPs) and advanced fluff pulp increase the absorbency and leak protection of diapers, ensuring that they can handle higher volumes of moisture while maintaining a thin profile. Improved material technologies also contribute to faster absorption rates and better moisture-locking capabilities, as it reduces the risk of skin irritation and enhances overall comfort for infants. In addition, advancements in breathability and softness of the materials improve the wearability of diapers, aligning with growing consumer preferences for high-quality, premium products. These technological improvements not only differentiate products in a competitive market but also drive consumer preference toward brands offering the latest advancements, thus propelling market growth and expanding paper diaper market share.

However, limited recycling and disposal infrastructure, along with stringent environmental regulations, restrain market demand for paper diapers by raising concerns about environmental impact and increasing operational challenges. The majority of paper diapers are designed for single-use and contribute to significant landfill waste, which creates environmental concerns and pressures on waste management systems. Inadequate recycling facilities further worsen the issue, as most diapers are not effectively recycled and end up in landfills, adding to environmental pollution. Stringent regulations aimed at reducing waste and encouraging sustainable practices compel manufacturers to invest in costly eco-friendly materials and processes. Compliance with these regulations often involves higher production costs and complex logistics, which can lead to increased product prices. Consequently, these factors create barriers to market growth by limiting the appeal of paper diapers among environmentally conscious consumers and by imposing financial and operational burdens on manufacturers.

Furthermore, the rise in demand for premium and high-performance diapers has created significant opportunities in the paper diaper market by encouraging innovation and product differentiation. Manufacturers are motivated to develop advanced features such as superior absorbency, enhanced comfort, and skin-friendly materials to meet the evolving needs of consumers. The shift toward high-quality offerings opens new opportunities for introducing new product lines and expanding market segments, such as hypoallergenic and eco-friendly options. Moreover, the growing preference for premium diapers drives investments in research and development, leading to technological advancements and improved performance. These developments enhance market competitiveness and attract a broader customer base, fueling overall paper diaper market growth.

Value Chain Analysis of Global Paper diaper Market

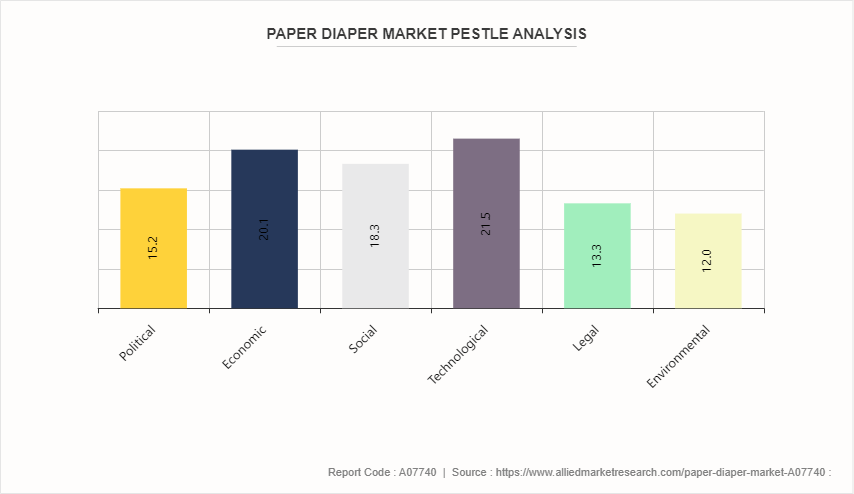

Political:

Regulatory Standards: Governments impose regulations to ensure the safety and quality of paper diapers, including restrictions on harmful chemicals.

Sustainable Practices: Some governments offer incentives for adopting eco-friendly manufacturing practices, impacting paper diaper market dynamics.

Trade Policies: Tariffs and trade agreements affect the cost and availability of raw materials for paper diaper production.

Economic:

Raw Material Prices: Volatility in the cost of materials such as paper and superabsorbent polymers impact paper diaper production costs and pricing.

Economic Growth: Increased disposable income boosts demand for premium paper diapers, enhancing market potential.

Consumer Purchasing Power: Economic conditions influence consumer willingness to spend on high-quality or eco-friendly products.

Social:

Hygiene Awareness: Growing awareness about infant hygiene drives demand for high-performance, convenient paper diaper options.

Birth Rates: Rising birth rates, particularly in emerging markets, increase demand for paper diapers.

Eco-Friendly Preferences: Consumers are increasingly favoring sustainable products, influencing paper diaper market trends.

Technological:

Advancements in Materials: Innovations in absorbent materials improve product performance and comfort.

Biodegradable Options: Development of biodegradable materials meets the growing demand for eco-friendly products.

Enhanced Performance: Technological improvements in manufacturing lead to better functionality and durability.

Legal:

Safety Regulations: Compliance with safety standards ensures product quality and consumer protection.

Intellectual Property: Protection of innovations and technologies through patents affects market competition.

Labor Laws: Regulations regarding worker conditions in manufacturing plants impact production practices.

Environmental:

Waste Management: Increasing concerns about diaper waste led to greater emphasis on recycling and disposal solutions.

Sustainable Materials: Demand for biodegradable and recyclable materials drives market innovation.

Production Impact: Efforts to reduce the environmental footprint of production processes are becoming more critical.

Market Segmentation

The paper diaper market is segmented into product type, application, distribution channel, and region. On the basis of product type, the market is categorized into baby diaper and adult diaper. As per application, the market is classified into household and healthcare facilities. According to distribution channel, it is fragmented into supermarkets/hypermarkets, B2B, specialty stores, pharmacies, online sales channel, and others. Region wise, the paper diaper market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. paper diaper market has highlighted strong growth prospects driven by increase in demand for premium, eco-friendly products and technological advancements in diaper materials and designs. The market benefits from a rise in awareness of hygiene and an expanding elderly population requiring incontinence products. However, it faces significant challenges, including environmental concerns over diaper disposal and the need for sustainable solutions. In addition, declining birth rates in the U.S. pose a challenge to market growth, prompting companies to diversify their product lines and target broader demographics. According to an analysis of 2023 birth certificate data published by the Centers for Disease Control and Prevention, the U.S. birth rate reached a new record low. The decline marked the end of the COVID-19 pandemic-related baby boom, with 3, 591, 328 births in 2023, down by 2% from 3, 667, 758 in 2022, aligning with pre-pandemic annual declines averaging around 2%. Furthermore, the competitive landscape, with major players such as Procter & Gamble and Kimberly-Clark, necessitates continuous innovation and adaptation to changing consumer preferences.

In the Asia-Pacific paper diaper market, growth opportunities arise from increasing urbanization and awareness of hygiene, particularly in rapidly developing countries such as China and India. The demand for innovative, eco-friendly products presents new market growth opportunities for manufacturers to introduce biodegradable and sustainable diaper options such as paper diapers. Moreover, the expanding e-commerce sector offers wider distribution channels, enhancing accessibility and convenience for consumers. In addition, government initiatives focusing on child health and hygiene are supporting market expansion by promoting better childcare practices, thus driving paper diaper market demand. These factors create a productive environment for companies to invest in research and development, diversify product lines, and capture a larger share of the paper diaper market.

Industry Trends:

Expansion in emerging economies has significantly influenced the global paper diaper market by driving increased demand and fostering market growth. As disposable incomes rise and urbanization increases in regions such as Asia-Pacific and Latin America, the need for convenient and hygienic baby care products, such as paper diapers, has surged simultaneously. Manufacturers have responded by targeting these regions with tailored marketing strategies, affordable product lines, and localized distribution channels. The expansion has led to increased market penetration and competition, encouraging innovation and improved product offerings. Thus, emerging economies have become key growth drivers, thereby shaping market trends and influencing global strategies in the paper diaper industry.

Competitive Landscape

The major players operating in the paper diaper market include Procter & Gamble, Kimberly-Clark, Unicharm, Essity, Ontex, Kao Corporation, First Quality Enterprises, Domtar, Hengan International, and Daio Paper Corporation.

Other players in the paper diaper market include Medline Industries, Attends Healthcare Products, Drylock Technologies, Abena, Principle Business Enterprises, Chiaus, Vinda International, Evergreen Hygiene Products, Fippi, Hayat Kimya, and so on.

Recent Key Strategies and Developments

In May 2024, First Quality Baby Products announced a $418 million investment to expand its Macon, Georgia facility. The expansion will increase manufacturing capacity for baby paper diapers and training pants by 50%, creating 600 new jobs.

In June 2023, Dyper launched a newly designed diaper with fully recyclable kraft paper packaging, which is manufactured in North America? to strengthen its foothold in the paper diaper business.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paper diaper market analysis from 2024 to 2034 to identify the prevailing paper diaper market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the paper diaper market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global paper diaper market trends, key players, market segments, application areas, and market growth strategies.

Paper Diaper Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 109.2 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 209 |

| By Product Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | DOMTAR CORPORATION, First Quality Enterprises, Daio Paper Corporation, kimberly-clark, Ontex, Procter & Gamble, Unicharm Corporation, Hengan International, Essity, Kao Corporation |

Emerging trends include eco-friendly materials, biodegradable options, smart diapers, improved absorption technology, and increased demand in developing regions.

The leading application of the paper diaper market is infant care, driven by the high demand for comfort and convenience for babies.

By region, Asia-Pacific held the highest market share in terms of revenue in 2023.

The global paper diaper market was valued at $65.6 billion in 2023.

The major players operating in the paper diaper market include Procter & Gamble, Kimberly-Clark, Unicharm, Essity, Ontex, Kao Corporation, First Quality Enterprises, Domtar, Hengan International, and Daio Paper Corporation.

Loading Table Of Content...